Intro

Discover 5 ways to breakeven, including cost reduction, revenue growth, and investment strategies, to achieve financial stability and maximize profits with break-even analysis.

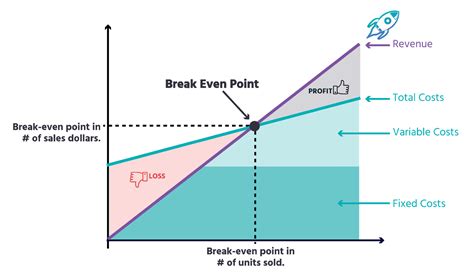

The concept of breaking even is a crucial milestone for any business or individual looking to turn a profit. It's the point at which the total revenue equals the total fixed and variable costs, resulting in neither profit nor loss. Reaching this point is essential, as it indicates that the business or project is financially sustainable and can continue to operate without incurring further losses. In this article, we will explore five ways to breakeven, providing insights and strategies for achieving this critical goal.

Breaking even is not just a financial concept; it's also a psychological milestone. It gives entrepreneurs and business owners the confidence to continue investing in their ventures, knowing that they can cover their costs. Moreover, breakeven analysis helps companies to identify areas where they can improve efficiency, reduce costs, and increase revenue. By understanding the breakeven point, businesses can make informed decisions about pricing, production, and investment, ultimately leading to increased profitability.

The importance of breaking even cannot be overstated. It's a key performance indicator (KPI) that helps businesses to evaluate their financial health and make adjustments as needed. By monitoring their progress towards the breakeven point, companies can identify potential issues before they become major problems. This allows them to take corrective action, such as reducing costs, increasing prices, or improving operational efficiency. In addition, breakeven analysis helps businesses to determine the viability of new projects or products, ensuring that they are allocating resources effectively.

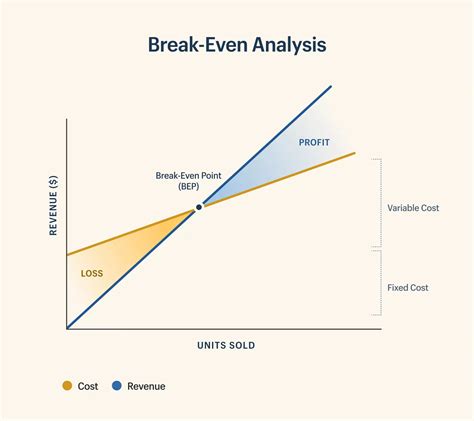

Understanding Breakeven Analysis

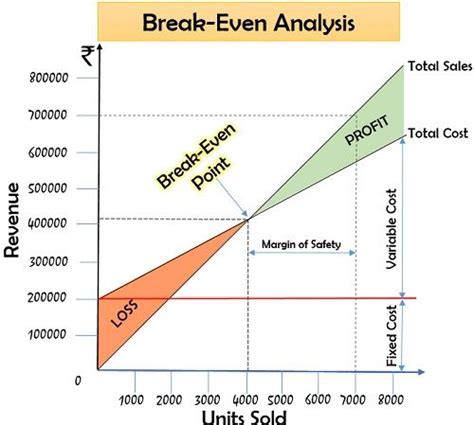

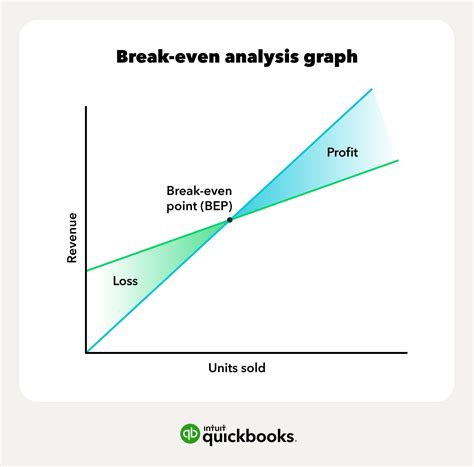

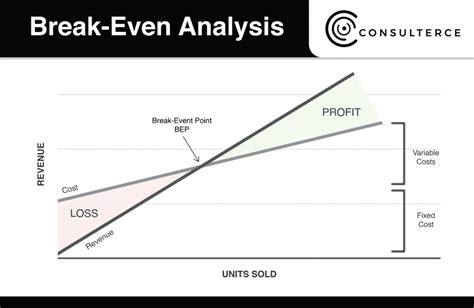

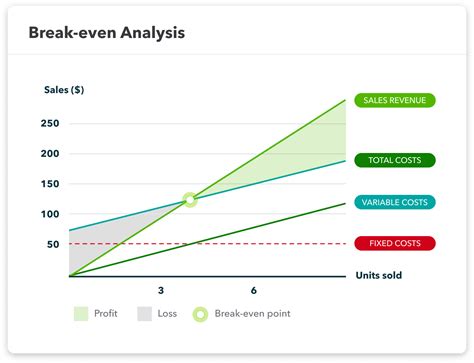

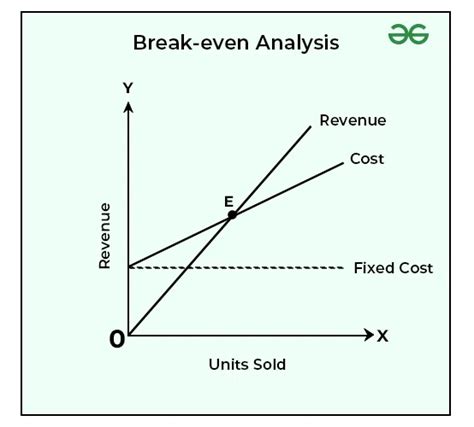

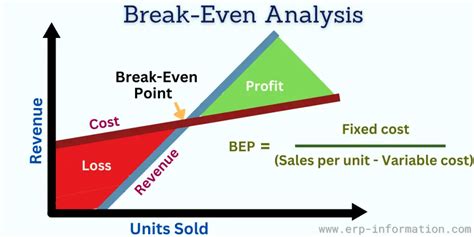

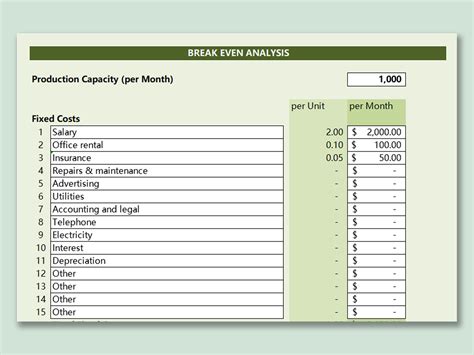

Breakeven analysis is a financial calculation that determines the point at which a business or project will break even. It's based on the relationship between fixed costs, variable costs, and revenue. Fixed costs are expenses that remain the same even if the business produces more or less, such as rent, salaries, and insurance. Variable costs, on the other hand, are expenses that change in proportion to the level of production, such as raw materials, labor, and marketing. By understanding these costs and how they relate to revenue, businesses can calculate their breakeven point and make informed decisions about pricing, production, and investment.

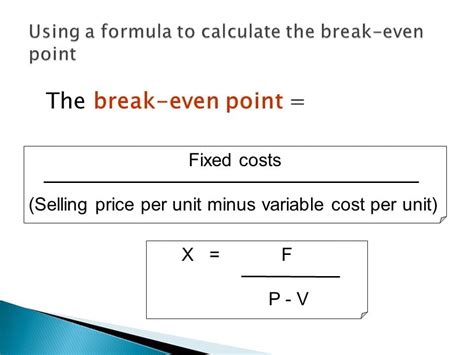

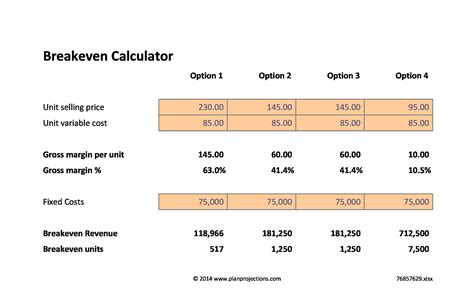

To calculate the breakeven point, businesses can use the following formula: Breakeven Point = Fixed Costs / (Selling Price - Variable Costs). This formula provides a clear indication of the number of units that need to be sold in order to break even. By analyzing this data, companies can identify areas where they can improve efficiency, reduce costs, and increase revenue. For example, if a business has high fixed costs, it may need to focus on increasing sales volume to reach the breakeven point. On the other hand, if a company has high variable costs, it may need to focus on reducing these costs through process improvements or outsourcing.

5 Ways to Breakeven

There are several strategies that businesses can use to reach the breakeven point. Here are five ways to breakeven:

- Increase Revenue: One of the most effective ways to breakeven is to increase revenue. This can be achieved by increasing sales volume, raising prices, or expanding into new markets. By generating more revenue, businesses can cover their fixed and variable costs, ultimately reaching the breakeven point.

- Reduce Fixed Costs: Fixed costs can be a significant burden for businesses, especially those with high overhead expenses. By reducing fixed costs, companies can lower their breakeven point, making it easier to reach. This can be achieved by renegotiating leases, reducing staff, or outsourcing non-core functions.

- Improve Operational Efficiency: Improving operational efficiency can help businesses to reduce variable costs and increase productivity. By streamlining processes, reducing waste, and improving supply chain management, companies can lower their costs and increase revenue.

- Increase Pricing: Increasing prices can be a effective way to breakeven, especially for businesses with high variable costs. By raising prices, companies can increase revenue and cover their costs, ultimately reaching the breakeven point.

- Reduce Variable Costs: Reducing variable costs can help businesses to lower their breakeven point and increase profitability. By improving supply chain management, reducing waste, and improving process efficiency, companies can lower their variable costs and increase revenue.

Benefits of Breakeven Analysis

Breakeven analysis provides several benefits for businesses, including:

- Improved Financial Management: Breakeven analysis helps businesses to understand their financial situation and make informed decisions about pricing, production, and investment.

- Increased Profitability: By identifying areas where costs can be reduced and revenue can be increased, businesses can improve their profitability and reach the breakeven point more quickly.

- Better Decision Making: Breakeven analysis provides businesses with a clear understanding of their financial situation, enabling them to make better decisions about investments, pricing, and production.

- Reduced Risk: By understanding the breakeven point, businesses can reduce their risk and avoid making decisions that could lead to financial losses.

Common Mistakes to Avoid

When conducting breakeven analysis, there are several common mistakes to avoid, including:

- Failing to Account for All Costs: Businesses should ensure that they account for all costs, including fixed and variable costs, when conducting breakeven analysis.

- Overestimating Revenue: Businesses should avoid overestimating revenue, as this can lead to inaccurate breakeven calculations and poor decision making.

- Failing to Monitor Progress: Businesses should regularly monitor their progress towards the breakeven point, making adjustments as needed to ensure that they reach their goal.

Real-World Examples

Breakeven analysis is used by businesses in a variety of industries, including:

- Retail: Retailers use breakeven analysis to determine the optimal price for their products and to identify areas where they can reduce costs.

- Manufacturing: Manufacturers use breakeven analysis to determine the optimal production level and to identify areas where they can improve efficiency.

- Service: Service-based businesses use breakeven analysis to determine the optimal pricing for their services and to identify areas where they can reduce costs.

Gallery of Breakeven Analysis

Breakeven Analysis Image Gallery

What is breakeven analysis?

+Breakeven analysis is a financial calculation that determines the point at which a business or project will break even. It's based on the relationship between fixed costs, variable costs, and revenue.

Why is breakeven analysis important?

+Breakeven analysis is important because it helps businesses to understand their financial situation and make informed decisions about pricing, production, and investment. It also helps to identify areas where costs can be reduced and revenue can be increased.

How do I calculate the breakeven point?

+The breakeven point can be calculated using the formula: Breakeven Point = Fixed Costs / (Selling Price - Variable Costs). This formula provides a clear indication of the number of units that need to be sold in order to break even.

In conclusion, breakeven analysis is a powerful tool that can help businesses to understand their financial situation and make informed decisions about pricing, production, and investment. By following the five ways to breakeven outlined in this article, businesses can improve their financial management, increase profitability, and reduce risk. We encourage readers to share their experiences with breakeven analysis and provide feedback on this article. If you have any questions or need further clarification on any of the points discussed, please don't hesitate to comment below. Additionally, we invite you to share this article with your network and explore other related topics on our website.