Intro

Calculate COGS easily with expert tips and formulas, optimizing inventory costs, and improving profitability through accurate cost of goods sold calculations and accounting methods.

Calculating the Cost of Goods Sold (COGS) is a crucial step for businesses to determine their profitability and make informed decisions. COGS represents the direct costs associated with producing and selling a company's products or services. In this article, we will delve into the importance of COGS, its calculation, and provide tips on how to calculate it easily.

The COGS is a key component of a company's financial statements, as it directly affects the gross profit and net income. A lower COGS indicates higher profitability, while a higher COGS can erode a company's margins. Therefore, it is essential for businesses to accurately calculate their COGS to ensure they are making informed decisions about pricing, production, and inventory management.

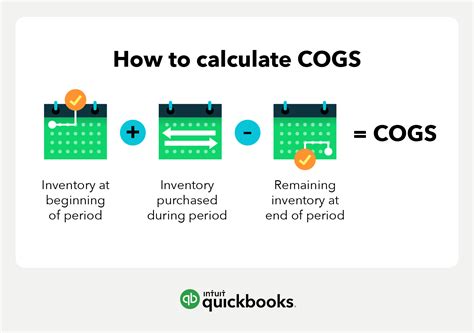

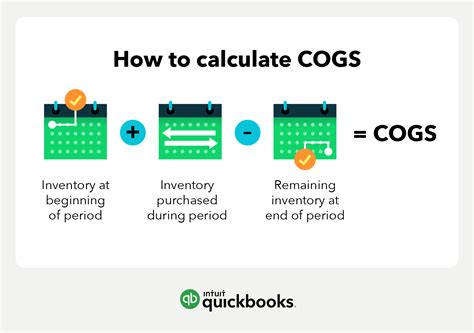

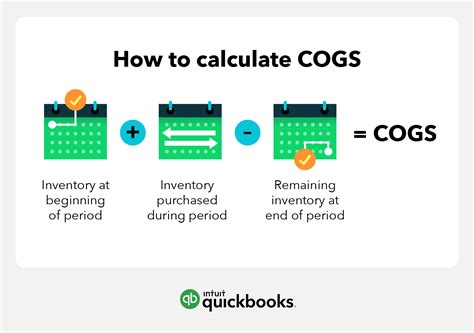

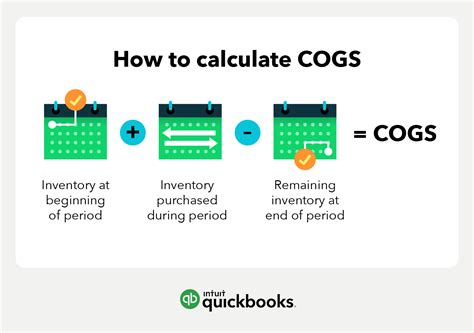

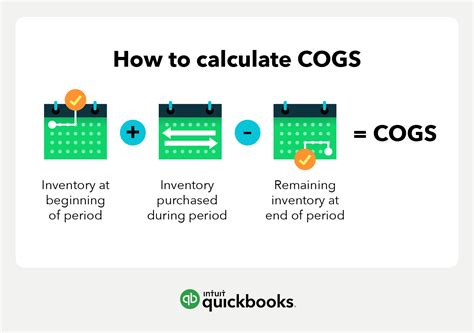

To calculate COGS, businesses need to consider the direct costs associated with producing and selling their products or services. These costs include the cost of materials, labor, and overhead. The COGS formula is: COGS = Beginning Inventory + Purchases - Ending Inventory. This formula takes into account the inventory levels at the beginning and end of the period, as well as the purchases made during the period.

Understanding COGS Calculation

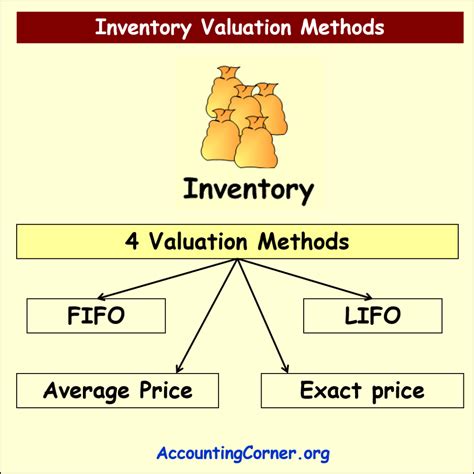

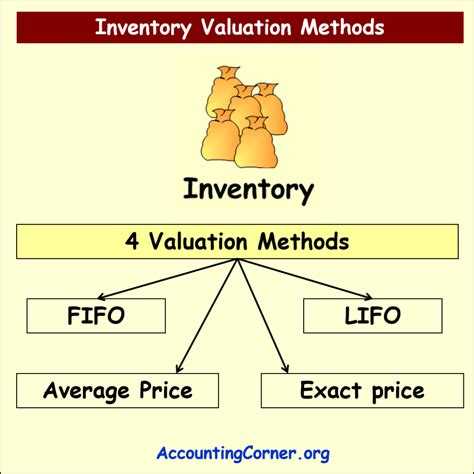

Calculating COGS involves several steps, including determining the beginning and ending inventory levels, calculating the purchases made during the period, and applying the COGS formula. Businesses can use various methods to calculate COGS, including the First-In-First-Out (FIFO) method, the Last-In-First-Out (LIFO) method, and the Weighted Average Cost (WAC) method. Each method has its advantages and disadvantages, and businesses should choose the method that best suits their needs.

COGS Calculation Methods

The FIFO method assumes that the oldest inventory items are sold first, while the LIFO method assumes that the most recent inventory items are sold first. The WAC method calculates the average cost of all inventory items, regardless of when they were purchased. Businesses should consider their inventory management practices and choose the method that most accurately reflects their operations.Importance of Accurate COGS Calculation

Accurate COGS calculation is crucial for businesses to make informed decisions about pricing, production, and inventory management. A incorrect COGS calculation can lead to incorrect financial statements, which can have serious consequences, including misinformed business decisions, incorrect tax payments, and damaged credibility with investors and stakeholders.

Consequences of Inaccurate COGS Calculation

Inaccurate COGS calculation can have significant consequences, including: * Misinformed business decisions: Incorrect COGS calculation can lead to incorrect financial statements, which can misinform business decisions about pricing, production, and inventory management. * Incorrect tax payments: Incorrect COGS calculation can lead to incorrect tax payments, which can result in penalties and fines. * Damaged credibility: Incorrect COGS calculation can damage a company's credibility with investors and stakeholders, which can affect their ability to raise capital and attract investors.Tips for Easy COGS Calculation

To calculate COGS easily, businesses can follow these tips:

- Use accounting software: Accounting software can automate the COGS calculation process, reducing the risk of errors and saving time.

- Implement a perpetual inventory system: A perpetual inventory system can provide real-time inventory levels, making it easier to calculate COGS.

- Use a consistent accounting method: Consistently using the same accounting method can simplify the COGS calculation process and reduce errors.

Benefits of Easy COGS Calculation

Easy COGS calculation can have several benefits, including: * Improved accuracy: Easy COGS calculation can improve the accuracy of financial statements, reducing the risk of errors and misinformed business decisions. * Increased efficiency: Easy COGS calculation can save time and reduce the workload, allowing businesses to focus on other important tasks. * Better decision-making: Easy COGS calculation can provide businesses with accurate and timely information, enabling them to make informed decisions about pricing, production, and inventory management.Common COGS Calculation Mistakes

Common COGS calculation mistakes include:

- Incorrect inventory valuation: Incorrect inventory valuation can lead to incorrect COGS calculation, which can affect financial statements and business decisions.

- Failure to account for inventory adjustments: Failure to account for inventory adjustments, such as inventory write-offs and inventory transfers, can lead to incorrect COGS calculation.

- Inconsistent accounting methods: Inconsistent accounting methods can lead to incorrect COGS calculation and make it difficult to compare financial statements.

How to Avoid COGS Calculation Mistakes

To avoid COGS calculation mistakes, businesses can: * Implement a robust inventory management system: A robust inventory management system can provide accurate and timely inventory information, reducing the risk of errors. * Use accounting software: Accounting software can automate the COGS calculation process, reducing the risk of errors and saving time. * Regularly review and reconcile financial statements: Regularly reviewing and reconciling financial statements can help identify and correct errors, ensuring accurate COGS calculation.COGS Calculation Best Practices

COGS calculation best practices include:

- Using a consistent accounting method: Consistently using the same accounting method can simplify the COGS calculation process and reduce errors.

- Implementing a perpetual inventory system: A perpetual inventory system can provide real-time inventory levels, making it easier to calculate COGS.

- Regularly reviewing and reconciling financial statements: Regularly reviewing and reconciling financial statements can help identify and correct errors, ensuring accurate COGS calculation.

Benefits of COGS Calculation Best Practices

The benefits of COGS calculation best practices include: * Improved accuracy: COGS calculation best practices can improve the accuracy of financial statements, reducing the risk of errors and misinformed business decisions. * Increased efficiency: COGS calculation best practices can save time and reduce the workload, allowing businesses to focus on other important tasks. * Better decision-making: COGS calculation best practices can provide businesses with accurate and timely information, enabling them to make informed decisions about pricing, production, and inventory management.COGS Image Gallery

What is COGS and why is it important?

+COGS stands for Cost of Goods Sold, which represents the direct costs associated with producing and selling a company's products or services. It is important because it directly affects the gross profit and net income of a company.

How do I calculate COGS?

+COGS can be calculated using the formula: COGS = Beginning Inventory + Purchases - Ending Inventory. This formula takes into account the inventory levels at the beginning and end of the period, as well as the purchases made during the period.

What are the common mistakes to avoid when calculating COGS?

+Common mistakes to avoid when calculating COGS include incorrect inventory valuation, failure to account for inventory adjustments, and inconsistent accounting methods. To avoid these mistakes, businesses should implement a robust inventory management system, use accounting software, and regularly review and reconcile financial statements.

In conclusion, calculating COGS is a crucial step for businesses to determine their profitability and make informed decisions. By following the tips and best practices outlined in this article, businesses can easily calculate their COGS and avoid common mistakes. We invite you to share your thoughts and experiences on COGS calculation in the comments below. Additionally, if you found this article helpful, please share it with your network to help others improve their COGS calculation skills.