Intro

Discover smart investing strategies for small businesses, including startup funding, venture capital, and entrepreneurship opportunities, to maximize returns and support innovative ventures.

Investing in small businesses can be a highly rewarding and profitable venture, offering a unique opportunity to support entrepreneurship and innovation while generating returns on investment. Small businesses are the backbone of many economies, driving job creation, economic growth, and community development. By investing in small businesses, individuals can contribute to the success of these enterprises, fostering a more diverse and resilient economy. In this article, we will delve into the world of small business investing, exploring the benefits, challenges, and strategies for success.

The importance of small businesses cannot be overstated. They account for a significant proportion of employment opportunities, with many small businesses serving as incubators for new ideas and talent. Moreover, small businesses often have a profound impact on local communities, providing essential goods and services, and contributing to the unique character of neighborhoods and towns. By investing in small businesses, individuals can help to preserve and strengthen these community assets, promoting economic vitality and social cohesion.

As the global economy continues to evolve, small businesses are playing an increasingly critical role in driving innovation and growth. With the rise of digital technologies, small businesses can now access global markets, connect with customers, and compete with larger corporations on a more level playing field. This has created new opportunities for small business investors, who can now support a wide range of enterprises, from tech startups to sustainable agriculture projects. Whether you are a seasoned investor or just starting to explore the world of small business investing, there has never been a more exciting time to get involved.

Benefits Of Investing In Small Businesses

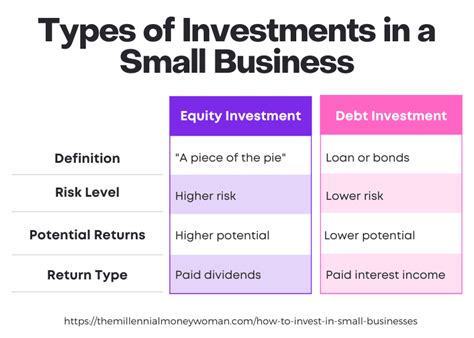

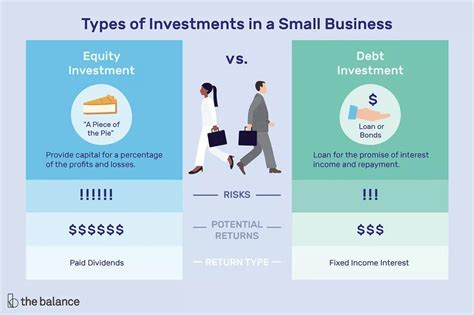

Types Of Small Business Investments

There are many different types of small business investments, each with its own unique characteristics and requirements. Some of the most common types of small business investments include: * Equity investments: This involves investing in a small business in exchange for ownership shares, providing a potential long-term return on investment. * Debt investments: This involves lending money to a small business, with the expectation of regular interest payments and the eventual repayment of the principal amount. * Venture capital: This involves investing in early-stage businesses with high growth potential, often in exchange for equity shares. * Crowdfunding: This involves investing in a small business through a crowdfunding platform, which allows multiple individuals to contribute small amounts of money to support a project or enterprise.Challenges Of Investing In Small Businesses

Strategies For Successful Small Business Investing

To succeed in small business investing, it is essential to develop a clear strategy and approach. Some of the key strategies for successful small business investing include: * Conducting thorough due diligence: This involves researching the small business, its management team, and its financial performance to assess the potential risks and returns. * Diversifying your portfolio: This involves spreading your investments across a range of small businesses and asset classes to minimize risk and maximize returns. * Building relationships: This involves developing strong relationships with the small business owners and management teams, providing support and guidance to help them succeed. * Monitoring performance: This involves regularly monitoring the performance of your small business investments, adjusting your strategy as needed to optimize returns and minimize risk.Best Practices For Small Business Investing

Common Mistakes To Avoid In Small Business Investing

When investing in small businesses, there are several common mistakes to avoid. Some of the key pitfalls to watch out for include: * Lack of due diligence: Failing to conduct thorough research on the small business, its management team, and its financial performance. * Insufficient diversification: Failing to spread your investments across a range of small businesses and asset classes, increasing the risk of financial loss. * Poor communication: Failing to build strong relationships with the small business owners and management teams, leading to misunderstandings and conflicts. * Inadequate monitoring: Failing to regularly monitor the performance of your small business investments, adjusting your strategy as needed to optimize returns and minimize risk.Small Business Investing Platforms

Small Business Investing Resources

For individuals looking to invest in small businesses, there are a range of resources available to provide guidance and support. Some of the most useful small business investing resources include: * Online forums and communities: These platforms provide a space for investors to connect, share knowledge, and learn from each other's experiences. * Investment blogs and websites: These resources offer news, analysis, and insights on small business investing, helping investors to stay informed and up-to-date. * Professional associations: These organizations provide training, networking opportunities, and advocacy for small business investors, helping to promote the industry and support its growth. * Government agencies: These agencies often provide funding, resources, and support for small businesses, helping to promote entrepreneurship and economic development.Small Business Investing Tips

Small Business Investing For Beginners

For individuals new to small business investing, it can be challenging to know where to start. Some of the most important things to keep in mind for small business investing beginners include: * Start small: This involves beginning with a small investment and gradually increasing your portfolio over time. * Conduct thorough research: This involves learning about the small business, its management team, and its financial performance to assess the potential risks and returns. * Seek guidance: This involves working with a financial advisor or investment professional to develop a clear investment strategy and provide ongoing support. * Be patient: This involves taking a long-term approach to small business investing, recognizing that returns may take time to materialize.Small Business Investing Image Gallery

What are the benefits of investing in small businesses?

+The benefits of investing in small businesses include diversification, job creation, innovation, and community engagement. Small businesses can provide a unique opportunity for investors to support entrepreneurship and innovation while generating returns on investment.

What are the challenges of investing in small businesses?

+The challenges of investing in small businesses include risk, due diligence, cash flow, and scalability. Small businesses can be risky, and investors must conduct thorough due diligence to assess the potential risks and returns. Additionally, small businesses may experience cash flow difficulties, and investors must be patient and flexible to navigate these challenges.

How can I get started with small business investing?

+To get started with small business investing, it is essential to develop a clear investment strategy, conduct thorough due diligence, and build a diverse portfolio. Investors should also seek guidance from financial advisors or investment professionals and be patient and flexible when navigating the challenges of small business investing.

What are the best small business investing platforms?

+The best small business investing platforms include crowdfunding platforms, peer-to-peer lending platforms, venture capital platforms, and equity crowdfunding platforms. These platforms provide a range of investment opportunities, from debt and equity investments to crowdfunding and venture capital.

How can I minimize risk when investing in small businesses?

+To minimize risk when investing in small businesses, it is essential to conduct thorough due diligence, build a diverse portfolio, and seek guidance from financial advisors or investment professionals. Investors should also be patient and flexible when navigating the challenges of small business investing and be prepared to adapt to changing market conditions.

In conclusion, investing in small businesses can be a highly rewarding and profitable venture, offering a unique opportunity to support entrepreneurship and innovation while generating returns on investment. By understanding the benefits, challenges, and strategies for success, individuals can make informed investment decisions and contribute to the growth and development of small businesses. Whether you are a seasoned investor or just starting to explore the world of small business investing, there has never been a more exciting time to get involved. We invite you to share your thoughts and experiences with small business investing in the comments below and to explore the many resources and opportunities available to support your investment journey.