Intro

Discover smart strategies for investing in small business, including entrepreneurship, venture capital, and startup funding, to drive growth and profitability.

Investing in small businesses can be a lucrative venture, offering a unique opportunity to support local economies and innovative entrepreneurs. Small businesses are the backbone of many economies, providing essential goods and services, creating jobs, and driving growth. However, they often face significant challenges in accessing capital, which can hinder their ability to expand and succeed. By investing in small businesses, individuals can help bridge this funding gap, while also potentially earning attractive returns on their investment.

The importance of small businesses cannot be overstated. They account for a significant proportion of employment opportunities, with many small businesses serving as incubators for new ideas and talent. Moreover, small businesses are often more agile and adaptable than their larger counterparts, allowing them to respond quickly to changing market conditions and consumer needs. By investing in small businesses, individuals can help foster a more dynamic and resilient economy, which can have far-reaching benefits for communities and society as a whole.

For those considering investing in small businesses, there are several factors to take into account. It is essential to conduct thorough research and due diligence on any potential investment opportunity, assessing the business's financial health, management team, and growth prospects. Investors should also consider their own risk tolerance and investment goals, as well as the potential returns on investment. With careful planning and a well-informed approach, investing in small businesses can be a rewarding and profitable experience.

Benefits Of Investing In Small Businesses

Investing in small businesses offers a range of benefits, from financial returns to social impact. Some of the key advantages of investing in small businesses include:

- Diversification: Investing in small businesses can provide a unique opportunity to diversify a portfolio, reducing reliance on larger, more established companies.

- Growth potential: Small businesses often have significant growth potential, as they are able to respond quickly to changing market conditions and consumer needs.

- Job creation: By investing in small businesses, individuals can help create jobs and stimulate local economies.

- Innovation: Small businesses are often at the forefront of innovation, developing new products and services that can disrupt traditional markets and create new opportunities.

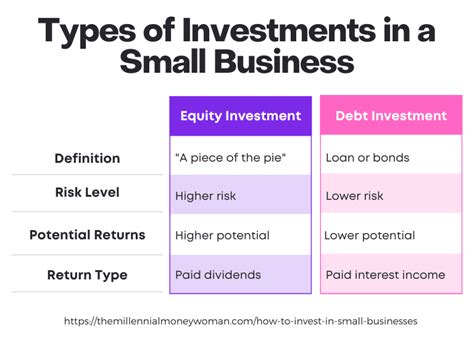

Types Of Small Business Investments

There are several types of small business investments, each with its own unique characteristics and benefits. Some of the most common types of small business investments include: * Equity investments: This involves investing in a small business in exchange for equity, or ownership, in the company. * Debt investments: This involves lending money to a small business, with the expectation of earning interest on the investment. * Hybrid investments: This involves combining elements of equity and debt investments, such as investing in a small business through a convertible note.How To Invest In Small Businesses

Investing in small businesses requires a thoughtful and informed approach. Some of the key steps to consider include:

- Research and due diligence: Conduct thorough research on any potential investment opportunity, assessing the business's financial health, management team, and growth prospects.

- Evaluate investment options: Consider the different types of small business investments, including equity, debt, and hybrid investments.

- Assess risk and return: Evaluate the potential risks and returns on investment, considering factors such as the business's financial health, market conditions, and competitive landscape.

- Develop an investment strategy: Create a clear investment strategy, outlining goals, risk tolerance, and expectations for returns on investment.

Small Business Investment Options

There are several small business investment options to consider, each with its own unique characteristics and benefits. Some of the most common small business investment options include: * Crowdfunding: This involves investing in a small business through a crowdfunding platform, which allows multiple investors to pool their resources and support a single business. * Venture capital: This involves investing in a small business through a venture capital firm, which provides funding and support to early-stage companies. * Angel investing: This involves investing in a small business through an angel investor, who provides funding and guidance to early-stage companies.Challenges Of Investing In Small Businesses

Investing in small businesses can be challenging, with several factors to consider. Some of the key challenges of investing in small businesses include:

- Risk: Investing in small businesses can be risky, as these companies often face significant challenges in accessing capital and achieving scale.

- Due diligence: Conducting thorough research and due diligence on a small business can be time-consuming and resource-intensive.

- Regulation: Small businesses are often subject to complex and evolving regulations, which can create uncertainty and risk for investors.

- Scalability: Small businesses may struggle to achieve scale, which can limit their growth potential and returns on investment.

Overcoming The Challenges Of Investing In Small Businesses

Despite the challenges of investing in small businesses, there are several strategies that can help overcome these obstacles. Some of the key strategies include: * Diversification: Investing in a diversified portfolio of small businesses can help reduce risk and increase potential returns. * Research and due diligence: Conducting thorough research and due diligence on a small business can help identify potential risks and opportunities. * Partnering with experienced investors: Partnering with experienced investors, such as venture capital firms or angel investors, can provide access to expertise and resources. * Focusing on high-growth industries: Focusing on high-growth industries, such as technology or healthcare, can increase the potential for returns on investment.Best Practices For Investing In Small Businesses

Investing in small businesses requires a thoughtful and informed approach. Some of the best practices for investing in small businesses include:

- Conducting thorough research and due diligence: This involves assessing the business's financial health, management team, and growth prospects.

- Evaluating investment options: This involves considering the different types of small business investments, including equity, debt, and hybrid investments.

- Assessing risk and return: This involves evaluating the potential risks and returns on investment, considering factors such as the business's financial health, market conditions, and competitive landscape.

- Developing an investment strategy: This involves creating a clear investment strategy, outlining goals, risk tolerance, and expectations for returns on investment.

Investing In Small Businesses For Social Impact

Investing in small businesses can have a significant social impact, from creating jobs and stimulating local economies to supporting innovative entrepreneurs and fostering a more dynamic and resilient economy. Some of the key ways that investing in small businesses can have a social impact include: * Job creation: By investing in small businesses, individuals can help create jobs and stimulate local economies. * Innovation: Small businesses are often at the forefront of innovation, developing new products and services that can disrupt traditional markets and create new opportunities. * Community development: Investing in small businesses can help support community development, by providing essential goods and services and fostering a sense of community and social connection.Investing In Small Businesses For Financial Returns

Investing in small businesses can provide attractive financial returns, from dividends and interest payments to capital gains and exit opportunities. Some of the key ways that investing in small businesses can provide financial returns include:

- Dividends: Investing in a small business can provide a regular stream of dividend payments, which can help generate income and support financial goals.

- Interest payments: Investing in a small business through a debt investment can provide a regular stream of interest payments, which can help generate income and support financial goals.

- Capital gains: Investing in a small business can provide an opportunity for capital gains, if the business is sold or goes public.

- Exit opportunities: Investing in a small business can provide an opportunity for exit, if the business is sold or merged with another company.

Investing In Small Businesses Through Crowdfunding

Crowdfunding is a popular way to invest in small businesses, allowing multiple investors to pool their resources and support a single business. Some of the key benefits of investing in small businesses through crowdfunding include: * Access to a diverse range of investment opportunities: Crowdfunding platforms provide access to a diverse range of investment opportunities, from early-stage startups to established small businesses. * Lower minimum investment amounts: Crowdfunding platforms often have lower minimum investment amounts, making it easier for individuals to invest in small businesses. * Opportunity to support innovative entrepreneurs: Crowdfunding provides an opportunity to support innovative entrepreneurs and small businesses, which can help foster a more dynamic and resilient economy.Small Business Investment Gallery

What are the benefits of investing in small businesses?

+The benefits of investing in small businesses include diversification, growth potential, job creation, and innovation. Small businesses often have significant growth potential, as they are able to respond quickly to changing market conditions and consumer needs.

How do I invest in a small business?

+There are several ways to invest in a small business, including equity investments, debt investments, and hybrid investments. It is essential to conduct thorough research and due diligence on any potential investment opportunity, assessing the business's financial health, management team, and growth prospects.

What are the risks of investing in small businesses?

+The risks of investing in small businesses include risk, due diligence, regulation, and scalability. Small businesses often face significant challenges in accessing capital and achieving scale, which can limit their growth potential and returns on investment.

How can I mitigate the risks of investing in small businesses?

+There are several strategies that can help mitigate the risks of investing in small businesses, including diversification, research and due diligence, partnering with experienced investors, and focusing on high-growth industries. It is essential to conduct thorough research and due diligence on any potential investment opportunity, assessing the business's financial health, management team, and growth prospects.

What are the best practices for investing in small businesses?

+The best practices for investing in small businesses include conducting thorough research and due diligence, evaluating investment options, assessing risk and return, and developing an investment strategy. It is essential to create a clear investment strategy, outlining goals, risk tolerance, and expectations for returns on investment.

In conclusion, investing in small businesses can be a lucrative venture, offering a unique opportunity to support local economies and innovative entrepreneurs. By conducting thorough research and due diligence, evaluating investment options, and assessing risk and return, individuals can make informed investment decisions and potentially earn attractive returns on their investment. Whether you are a seasoned investor or just starting out, investing in small businesses can be a rewarding and profitable experience. We invite you to share your thoughts and experiences on investing in small businesses, and to explore the many resources and opportunities available to support small business growth and development.