Intro

Manage your finances effectively with Ledger Balance Account Management, utilizing account reconciliation, transaction tracking, and balance monitoring to optimize financial reporting and analysis.

The concept of ledger balance account management is crucial for businesses and individuals alike, as it enables them to keep track of their financial transactions, manage their accounts, and make informed decisions about their financial resources. Effective ledger balance account management is essential for maintaining accurate financial records, ensuring compliance with accounting standards, and making strategic business decisions. In this article, we will delve into the world of ledger balance account management, exploring its importance, benefits, and best practices.

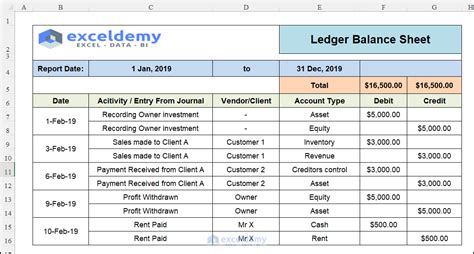

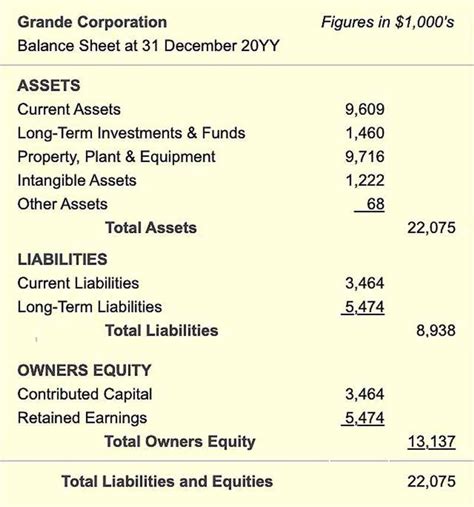

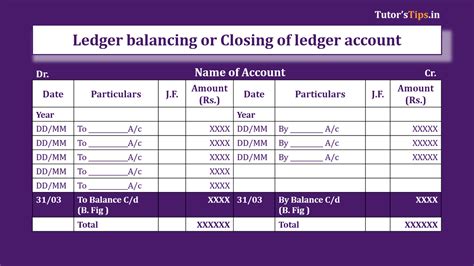

A ledger balance account is a type of account that provides a comprehensive picture of a company's or individual's financial situation. It is a centralized account that records all financial transactions, including income, expenses, assets, liabilities, and equity. The ledger balance account is used to prepare financial statements, such as balance sheets and income statements, which are essential for making business decisions and evaluating financial performance. By managing ledger balance accounts effectively, businesses and individuals can ensure that their financial records are accurate, up-to-date, and compliant with accounting standards.

The importance of ledger balance account management cannot be overstated. It enables businesses and individuals to track their financial transactions, identify trends and patterns, and make informed decisions about their financial resources. Effective ledger balance account management also helps to prevent errors, discrepancies, and fraud, which can have serious consequences for businesses and individuals. Moreover, it enables businesses to evaluate their financial performance, identify areas for improvement, and make strategic decisions about investments, funding, and resource allocation.

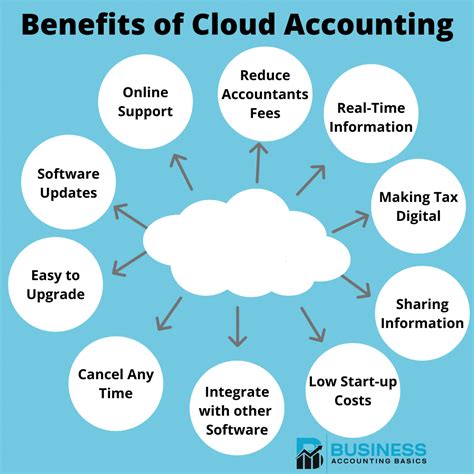

Benefits of Ledger Balance Account Management

Key Components of Ledger Balance Account Management

Effective ledger balance account management involves several key components, including: * Accurate and timely recording of financial transactions * Regular reconciliation of accounts * Maintenance of accurate and up-to-date financial records * Preparation of financial statements and reports * Analysis and interpretation of financial data * Identification and mitigation of financial risksBest Practices for Ledger Balance Account Management

Common Challenges in Ledger Balance Account Management

Despite its importance, ledger balance account management can be challenging, especially for small businesses or individuals with limited accounting experience. Some common challenges include: * Inaccurate or incomplete financial records * Insufficient accounting knowledge or skills * Limited resources or budget * Complexity of accounting standards and regulations * Risk of errors, discrepancies, or fraudTechnological Solutions for Ledger Balance Account Management

Future of Ledger Balance Account Management

The future of ledger balance account management is likely to be shaped by technological advancements, changing accounting standards, and evolving business needs. Some potential trends and developments include: * Increased use of AI and ML in accounting and finance * Greater adoption of cloud-based accounting platforms * More emphasis on real-time financial reporting and analysis * Growing importance of cybersecurity and data protection in accountingConclusion and Recommendations

Gallery of Ledger Balance Account Management

Ledger Balance Account Management Image Gallery

What is ledger balance account management?

+Ledger balance account management refers to the process of managing and maintaining accurate and up-to-date financial records, including income, expenses, assets, liabilities, and equity.

Why is ledger balance account management important?

+Ledger balance account management is important because it enables businesses and individuals to track their financial transactions, identify trends and patterns, and make informed decisions about their financial resources.

What are the benefits of ledger balance account management?

+The benefits of ledger balance account management include improved financial accuracy and transparency, enhanced financial decision-making and planning, increased efficiency and productivity, and better cash flow management and forecasting.

How can I improve my ledger balance account management skills?

+You can improve your ledger balance account management skills by taking accounting courses, attending workshops and seminars, and seeking guidance from experienced accounting professionals.

What are the common challenges in ledger balance account management?

+Common challenges in ledger balance account management include inaccurate or incomplete financial records, insufficient accounting knowledge or skills, limited resources or budget, complexity of accounting standards and regulations, and risk of errors, discrepancies, or fraud.

We hope this article has provided you with valuable insights and information about ledger balance account management. If you have any further questions or would like to share your experiences, please feel free to comment below. Additionally, if you found this article helpful, please share it with your friends and colleagues who may benefit from it.