Intro

Boost accounting efficiency with 5 ledger accounting tips, including journal entry management, financial statement analysis, and account reconciliation, to ensure accurate bookkeeping and compliant financial reporting.

Ledger accounting is a crucial aspect of financial management for businesses and individuals alike. It involves the systematic recording of financial transactions in a ledger, which helps in tracking income, expenses, assets, and liabilities. The accuracy and efficiency of ledger accounting are vital for making informed financial decisions, preparing tax returns, and ensuring compliance with regulatory requirements. In this article, we will delve into the importance of ledger accounting and provide valuable tips to enhance your financial management skills.

Effective ledger accounting is the backbone of a company's financial health. It provides a clear picture of the financial position, helping businesses to identify areas of improvement, manage cash flow, and make strategic decisions. Moreover, accurate and up-to-date ledger accounting helps in detecting and preventing financial fraud, ensuring that all transactions are legitimate and properly documented. With the advent of digital accounting tools, managing ledgers has become more efficient and less prone to errors, but the fundamental principles of ledger accounting remain unchanged.

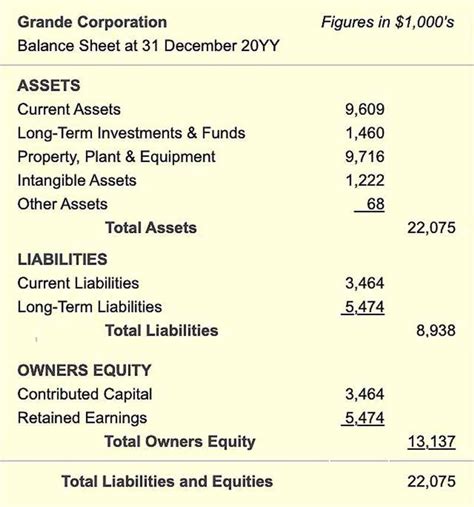

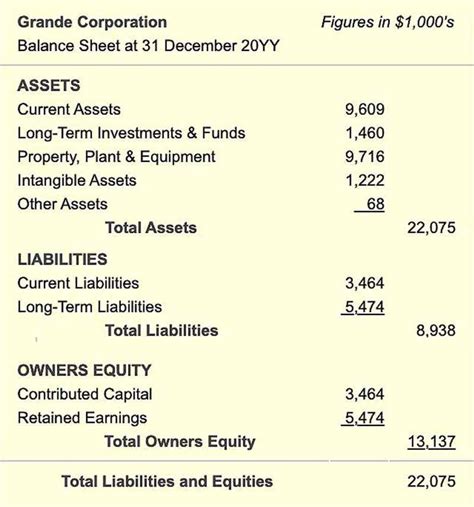

The benefits of proper ledger accounting extend beyond financial management. It also plays a critical role in maintaining transparency and accountability within an organization. By ensuring that all financial transactions are recorded and reported accurately, businesses can build trust with their stakeholders, including investors, customers, and regulatory bodies. Furthermore, well-maintained ledgers facilitate the preparation of financial statements, such as balance sheets and income statements, which are essential for evaluating a company's performance and making future projections.

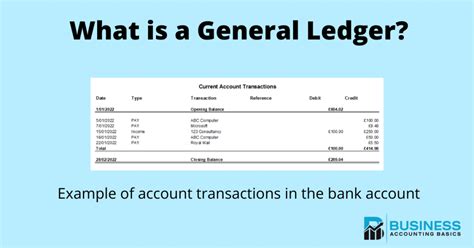

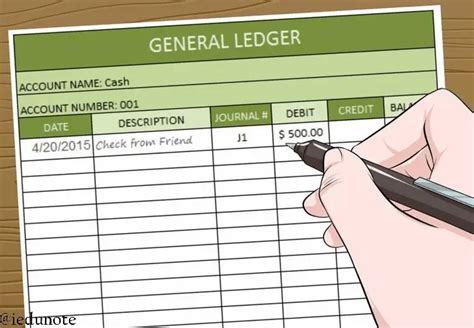

Understanding Ledger Accounting Basics

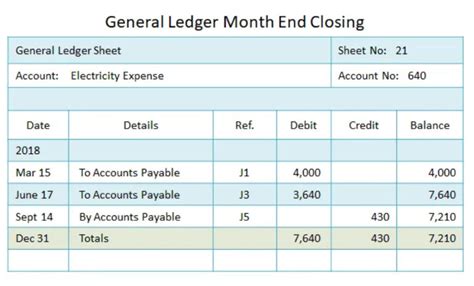

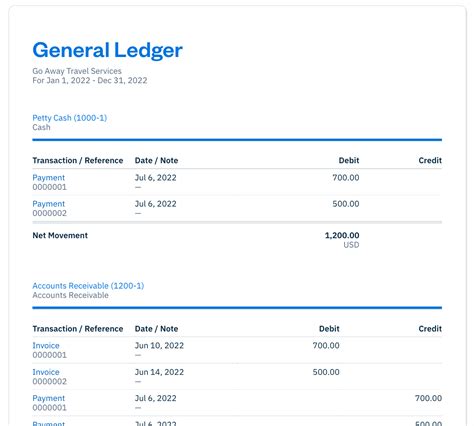

To master ledger accounting, it is essential to understand its basics. This includes familiarizing yourself with the different types of ledgers, such as general ledgers, subsidiary ledgers, and special journals. Each type of ledger serves a specific purpose and is used to record different kinds of transactions. For instance, a general ledger is used to record all financial transactions of a business, while a subsidiary ledger, like an accounts payable ledger, is used to record transactions related to a specific account.

Types of Ledger Accounts

Ledger accounts can be broadly classified into five categories: assets, liabilities, equity, revenues, and expenses. Understanding the nature and characteristics of each type of account is crucial for accurate ledger accounting. Assets are resources owned by a business, such as cash, inventory, and property. Liabilities are debts or obligations that a business owes to others, like accounts payable and loans. Equity represents the ownership interest in a business and can include common stock and retained earnings. Revenues are the incomes earned by a business from its operations, while expenses are the costs incurred to generate those revenues.Implementing Effective Ledger Accounting Practices

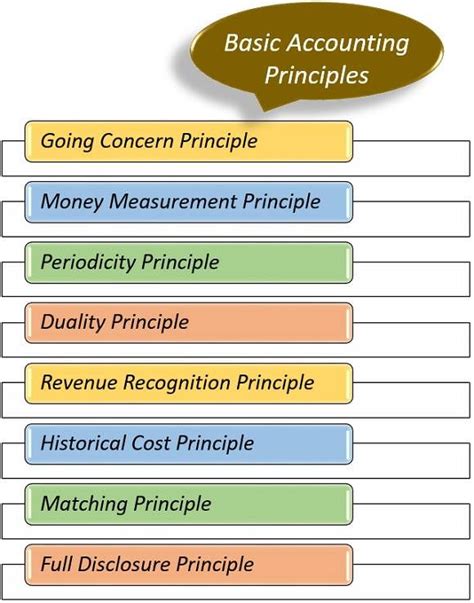

Effective ledger accounting practices are essential for maintaining accurate and reliable financial records. This includes regularly reviewing and reconciling ledger accounts to ensure that they are up-to-date and free from errors. It is also important to implement a robust system of internal controls to prevent and detect financial misstatements and fraud. Additionally, businesses should adopt a consistent accounting methodology and ensure that all financial transactions are recorded in accordance with generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS).

Benefits of Digital Ledger Accounting

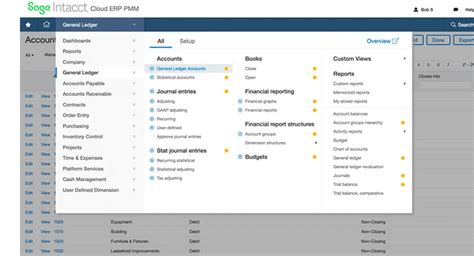

The advent of digital ledger accounting has revolutionized the way businesses manage their financial records. Digital accounting tools offer numerous benefits, including increased efficiency, reduced errors, and enhanced security. They also provide real-time access to financial information, enabling businesses to make timely and informed decisions. Furthermore, digital ledger accounting systems can automate many tasks, such as data entry and reconciliations, freeing up staff to focus on more strategic and value-added activities.Common Challenges in Ledger Accounting

Despite its importance, ledger accounting can be challenging, especially for small businesses or those with limited accounting expertise. Common challenges include ensuring the accuracy and completeness of financial records, managing cash flow, and complying with regulatory requirements. Businesses may also face difficulties in implementing and maintaining effective internal controls, which can increase the risk of financial misstatements and fraud.

Strategies for Overcoming Ledger Accounting Challenges

To overcome the challenges in ledger accounting, businesses should adopt a proactive and strategic approach. This includes investing in digital accounting tools, providing regular training to accounting staff, and engaging external auditors to review financial records. Additionally, businesses should establish clear policies and procedures for ledger accounting, ensure that all financial transactions are properly authorized and documented, and regularly review and update their accounting systems to ensure they remain effective and efficient.Best Practices for Ledger Accounting

Adopting best practices for ledger accounting is essential for maintaining accurate and reliable financial records. This includes ensuring that all financial transactions are recorded promptly and accurately, using proper accounting classifications and descriptions, and regularly reviewing and reconciling ledger accounts. Businesses should also maintain a robust system of internal controls, ensure that all financial records are properly secured and backed up, and comply with all relevant regulatory requirements.

Importance of Ledger Accounting in Financial Analysis

Ledger accounting plays a critical role in financial analysis, as it provides the raw data used to prepare financial statements and conduct financial ratio analysis. Accurate and up-to-date ledger accounting enables businesses to assess their financial performance, identify trends and patterns, and make informed decisions about future investments and funding requirements. Furthermore, ledger accounting is essential for conducting break-even analysis, cash flow forecasting, and sensitivity analysis, which are critical tools for strategic planning and risk management.Future of Ledger Accounting

The future of ledger accounting is likely to be shaped by technological advancements, changing regulatory requirements, and evolving business needs. As digital accounting tools become more sophisticated, businesses can expect to see increased automation, improved accuracy, and enhanced security. Additionally, the use of artificial intelligence, blockchain, and cloud computing is likely to transform the way ledger accounting is performed, making it more efficient, transparent, and accessible.

Emerging Trends in Ledger Accounting

Emerging trends in ledger accounting include the adoption of cloud-based accounting systems, the use of machine learning algorithms for automated data entry and reconciliations, and the integration of blockchain technology for enhanced security and transparency. Businesses are also increasingly using big data analytics to gain insights into their financial performance and make data-driven decisions. Furthermore, there is a growing emphasis on sustainability and environmental, social, and governance (ESG) reporting, which requires businesses to adopt more comprehensive and integrated approaches to ledger accounting.Ledger Accounting Image Gallery

What is the primary purpose of ledger accounting?

+The primary purpose of ledger accounting is to record and classify all financial transactions of a business in a systematic and organized manner, providing a clear picture of its financial position and performance.

What are the benefits of digital ledger accounting?

+The benefits of digital ledger accounting include increased efficiency, reduced errors, enhanced security, and real-time access to financial information, enabling businesses to make timely and informed decisions.

How can businesses overcome common challenges in ledger accounting?

+Businesses can overcome common challenges in ledger accounting by adopting a proactive and strategic approach, investing in digital accounting tools, providing regular training to accounting staff, and engaging external auditors to review financial records.

What is the importance of ledger accounting in financial analysis?

+Ledger accounting plays a critical role in financial analysis, as it provides the raw data used to prepare financial statements and conduct financial ratio analysis, enabling businesses to assess their financial performance, identify trends and patterns, and make informed decisions about future investments and funding requirements.

What are the emerging trends in ledger accounting?

+Emerging trends in ledger accounting include the adoption of cloud-based accounting systems, the use of machine learning algorithms for automated data entry and reconciliations, and the integration of blockchain technology for enhanced security and transparency.

In conclusion, ledger accounting is a vital component of financial management, providing businesses with a systematic and organized approach to recording and classifying financial transactions. By adopting best practices, overcoming common challenges, and embracing emerging trends, businesses can ensure accurate and reliable financial records, make informed decisions, and drive long-term success. We invite you to share your thoughts and experiences with ledger accounting, ask questions, and explore how you can improve your financial management skills.