Intro

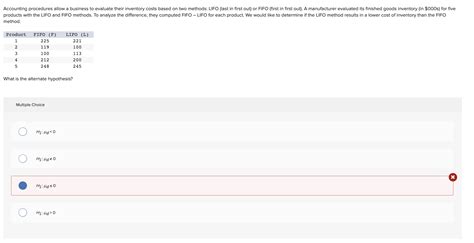

Discover 5 ways LIFO FIFO methods impact inventory management, including cost calculation, stock valuation, and warehouse organization, to optimize logistics and supply chain operations.

The world of inventory management is a complex and nuanced one, with various methods and techniques used to track and manage stock levels. Two of the most popular methods are LIFO (Last In, First Out) and FIFO (First In, First Out), each with its own advantages and disadvantages. In this article, we will delve into the world of LIFO and FIFO, exploring the 5 ways in which they differ and how they can be used to optimize inventory management.

The importance of effective inventory management cannot be overstated. With the rise of e-commerce and global supply chains, businesses must be able to manage their stock levels with precision and accuracy. This is where LIFO and FIFO come in, providing two distinct approaches to inventory management. By understanding the differences between these two methods, businesses can make informed decisions about which approach to use and how to optimize their inventory management systems.

In recent years, the use of LIFO and FIFO has become increasingly popular, with many businesses adopting one or both of these methods to manage their inventory. However, despite their popularity, there is still a great deal of confusion about how these methods work and how they differ. This article aims to provide a comprehensive overview of LIFO and FIFO, exploring the 5 key ways in which they differ and how they can be used to optimize inventory management.

Introduction to LIFO and FIFO

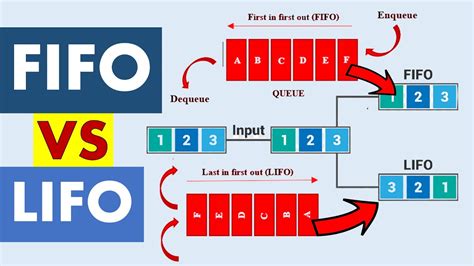

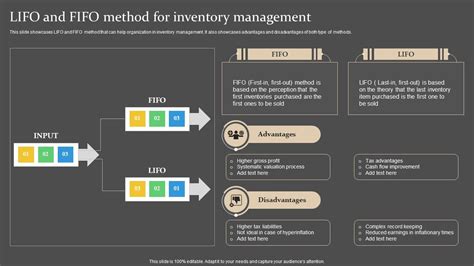

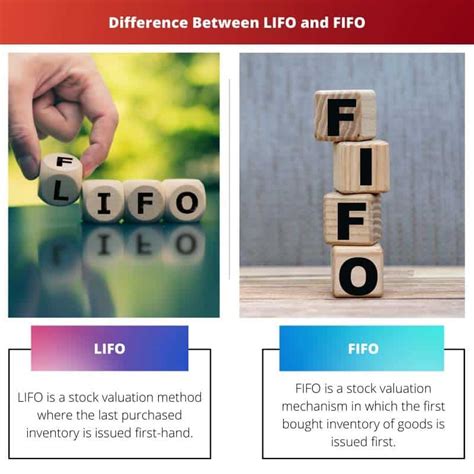

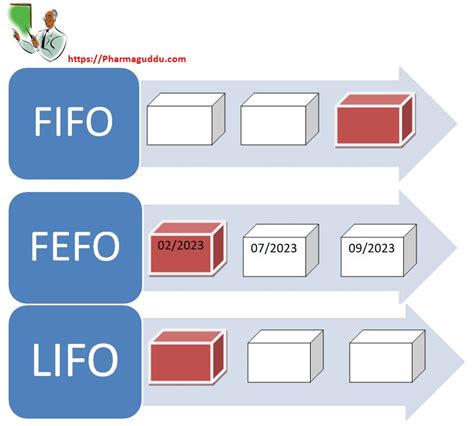

LIFO and FIFO are two inventory management methods used to track and manage stock levels. LIFO assumes that the most recently acquired items are the first ones to be sold or used, while FIFO assumes that the oldest items in inventory are the first ones to be sold or used. These two methods have different implications for inventory valuation, tax calculations, and inventory management.

Key Differences Between LIFO and FIFO

The main difference between LIFO and FIFO lies in the assumption about which items are sold or used first. LIFO assumes that the most recently acquired items are the first ones to be sold or used, while FIFO assumes that the oldest items in inventory are the first ones to be sold or used. This difference has significant implications for inventory valuation, tax calculations, and inventory management.Advantages and Disadvantages of LIFO

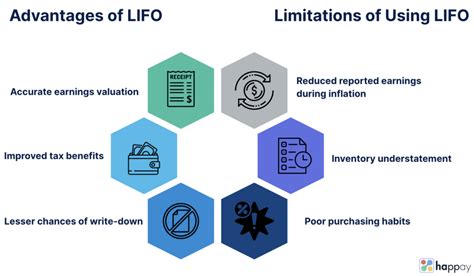

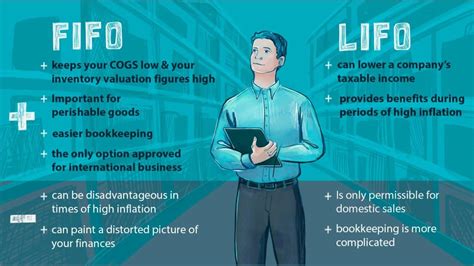

LIFO has several advantages, including the ability to match current costs with current revenues, which can provide a more accurate picture of a company's financial performance. Additionally, LIFO can help to reduce taxes by assuming that the most recently acquired items are the first ones to be sold or used, which can result in lower inventory valuations. However, LIFO also has some disadvantages, including the potential for inventory to become obsolete or spoiled if it is not sold or used in a timely manner.

Advantages of FIFO

FIFO has several advantages, including the ability to provide a more accurate picture of a company's inventory levels and the potential for reduced waste and obsolescence. Additionally, FIFO can help to improve cash flow by assuming that the oldest items in inventory are the first ones to be sold or used, which can result in higher inventory valuations.5 Ways LIFO and FIFO Differ

The 5 ways in which LIFO and FIFO differ are:

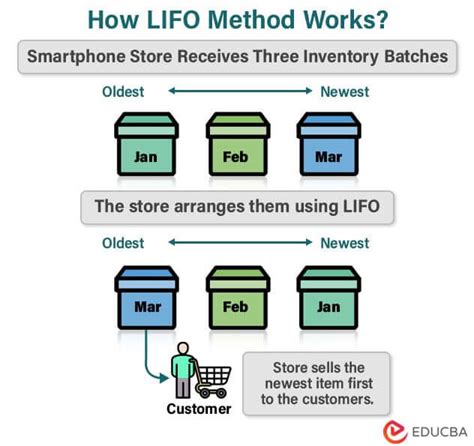

- Assumption about which items are sold or used first: LIFO assumes that the most recently acquired items are the first ones to be sold or used, while FIFO assumes that the oldest items in inventory are the first ones to be sold or used.

- Inventory valuation: LIFO can result in lower inventory valuations, while FIFO can result in higher inventory valuations.

- Tax calculations: LIFO can help to reduce taxes by assuming that the most recently acquired items are the first ones to be sold or used, while FIFO can result in higher taxes by assuming that the oldest items in inventory are the first ones to be sold or used.

- Inventory management: LIFO can result in inventory becoming obsolete or spoiled if it is not sold or used in a timely manner, while FIFO can help to reduce waste and obsolescence by assuming that the oldest items in inventory are the first ones to be sold or used.

- Cash flow: LIFO can result in lower cash flow by assuming that the most recently acquired items are the first ones to be sold or used, while FIFO can help to improve cash flow by assuming that the oldest items in inventory are the first ones to be sold or used.

Examples of LIFO and FIFO in Practice

Examples of LIFO and FIFO in practice include: * A retail store that uses LIFO to manage its inventory of clothing, assuming that the most recently acquired items are the first ones to be sold. * A manufacturer that uses FIFO to manage its inventory of raw materials, assuming that the oldest items in inventory are the first ones to be used. * A wholesaler that uses LIFO to manage its inventory of electronics, assuming that the most recently acquired items are the first ones to be sold.Best Practices for Implementing LIFO and FIFO

Best practices for implementing LIFO and FIFO include:

- Regularly reviewing and updating inventory management systems to ensure that they are accurate and effective.

- Providing training to employees on the use of LIFO and FIFO, including how to track and manage inventory levels.

- Monitoring inventory levels and adjusting LIFO and FIFO methods as needed to ensure that inventory is being managed effectively.

- Using technology, such as inventory management software, to track and manage inventory levels.

Common Mistakes to Avoid When Implementing LIFO and FIFO

Common mistakes to avoid when implementing LIFO and FIFO include: * Failing to regularly review and update inventory management systems, which can result in inaccurate or ineffective inventory management. * Failing to provide training to employees on the use of LIFO and FIFO, which can result in confusion or errors. * Failing to monitor inventory levels and adjust LIFO and FIFO methods as needed, which can result in inventory becoming obsolete or spoiled.Gallery of LIFO and FIFO Images

LIFO and FIFO Image Gallery

Frequently Asked Questions

What is the main difference between LIFO and FIFO?

+The main difference between LIFO and FIFO lies in the assumption about which items are sold or used first. LIFO assumes that the most recently acquired items are the first ones to be sold or used, while FIFO assumes that the oldest items in inventory are the first ones to be sold or used.

What are the advantages of using LIFO?

+LIFO has several advantages, including the ability to match current costs with current revenues, which can provide a more accurate picture of a company's financial performance. Additionally, LIFO can help to reduce taxes by assuming that the most recently acquired items are the first ones to be sold or used, which can result in lower inventory valuations.

What are the disadvantages of using FIFO?

+FIFO has several disadvantages, including the potential for higher taxes by assuming that the oldest items in inventory are the first ones to be sold or used, which can result in higher inventory valuations. Additionally, FIFO can result in lower cash flow by assuming that the oldest items in inventory are the first ones to be sold or used.

How do I implement LIFO and FIFO in my business?

+Best practices for implementing LIFO and FIFO include regularly reviewing and updating inventory management systems, providing training to employees on the use of LIFO and FIFO, and monitoring inventory levels and adjusting LIFO and FIFO methods as needed.

What are some common mistakes to avoid when implementing LIFO and FIFO?

+Common mistakes to avoid when implementing LIFO and FIFO include failing to regularly review and update inventory management systems, failing to provide training to employees on the use of LIFO and FIFO, and failing to monitor inventory levels and adjust LIFO and FIFO methods as needed.

In conclusion, LIFO and FIFO are two inventory management methods that differ in their assumptions about which items are sold or used first. By understanding the advantages and disadvantages of each method, businesses can make informed decisions about which approach to use and how to optimize their inventory management systems. Whether you are a small business owner or a large corporation, using LIFO and FIFO effectively can help you to improve your bottom line and stay competitive in today's fast-paced business environment. We encourage you to share your thoughts and experiences with LIFO and FIFO in the comments below, and to share this article with others who may be interested in learning more about these important inventory management methods.