Intro

Boost sales with 5 tips for merchant credit, including payment processing, credit card solutions, and online transactions, to enhance customer experience and merchant services.

The world of merchant credit can be complex and overwhelming, especially for small business owners or entrepreneurs who are just starting out. However, understanding the basics of merchant credit and how it works can be a game-changer for businesses looking to expand their operations, improve their cash flow, and increase their overall financial stability. In this article, we will delve into the world of merchant credit, exploring its importance, benefits, and key considerations for businesses.

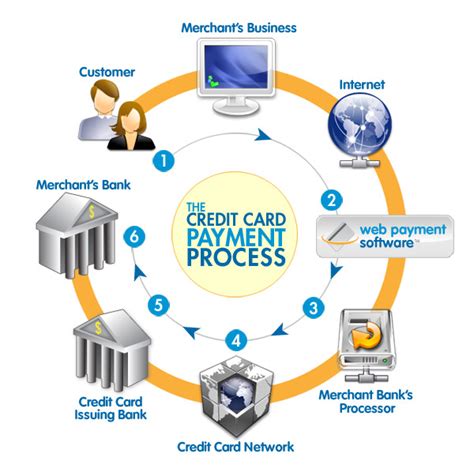

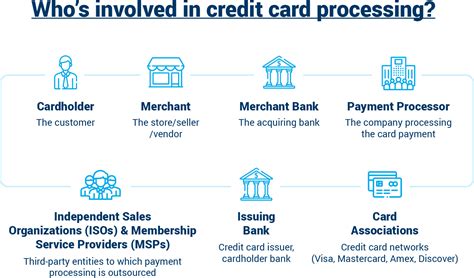

Merchant credit refers to the credit extended to businesses by merchant banks, financial institutions, or other lenders to facilitate transactions, manage cash flow, and finance business operations. It is an essential tool for businesses of all sizes, as it enables them to purchase goods and services, pay employees, and invest in growth initiatives. With the right merchant credit strategy, businesses can optimize their financial performance, reduce costs, and improve their competitiveness in the market.

The importance of merchant credit cannot be overstated. It provides businesses with the necessary funds to operate, grow, and respond to changing market conditions. Without access to merchant credit, businesses may struggle to survive, let alone thrive. In fact, studies have shown that businesses with access to credit are more likely to experience rapid growth, create jobs, and contribute to economic development. In contrast, businesses without access to credit may be forced to rely on personal savings, loans from friends and family, or other informal sources of funding, which can be unreliable and unsustainable.

Understanding Merchant Credit

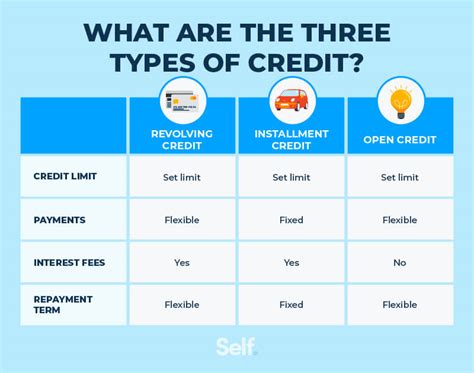

To make informed decisions about merchant credit, businesses need to understand the different types of credit available, including revolving credit, term loans, and lines of credit. Each type of credit has its own advantages and disadvantages, and businesses must carefully evaluate their options to determine which one best meets their needs. For example, revolving credit provides businesses with a flexible credit limit that can be used and reused as needed, while term loans offer a fixed amount of credit that must be repaid over a specified period.

Benefits of Merchant Credit

The benefits of merchant credit are numerous and well-documented. Some of the most significant advantages include: * Improved cash flow: Merchant credit provides businesses with the necessary funds to manage their cash flow, pay bills, and invest in growth initiatives. * Increased financial flexibility: With access to merchant credit, businesses can respond quickly to changing market conditions, take advantage of new opportunities, and mitigate risks. * Enhanced competitiveness: Businesses with access to merchant credit can invest in new technologies, hire skilled employees, and develop innovative products and services, giving them a competitive edge in the market. * Better risk management: Merchant credit can help businesses manage risk by providing a safety net in case of unexpected expenses or revenue shortfalls.Types of Merchant Credit

There are several types of merchant credit available to businesses, each with its own unique characteristics and advantages. Some of the most common types of merchant credit include:

- Revolving credit: This type of credit provides businesses with a flexible credit limit that can be used and reused as needed.

- Term loans: This type of credit offers a fixed amount of credit that must be repaid over a specified period.

- Lines of credit: This type of credit provides businesses with a fixed amount of credit that can be drawn upon as needed.

- Invoice financing: This type of credit allows businesses to borrow against outstanding invoices, providing them with immediate access to cash.

- Merchant cash advances: This type of credit provides businesses with a lump sum of cash in exchange for a percentage of their future sales.

Key Considerations for Businesses

When evaluating merchant credit options, businesses must consider several key factors, including: * Interest rates: The interest rate charged on the credit can significantly impact the overall cost of borrowing. * Fees: Many merchant credit products come with fees, such as origination fees, late payment fees, and maintenance fees. * Repayment terms: The repayment terms, including the length of the repayment period and the frequency of payments, can impact the business's cash flow and financial stability. * Collateral requirements: Some merchant credit products require collateral, such as property or equipment, to secure the loan.Best Practices for Managing Merchant Credit

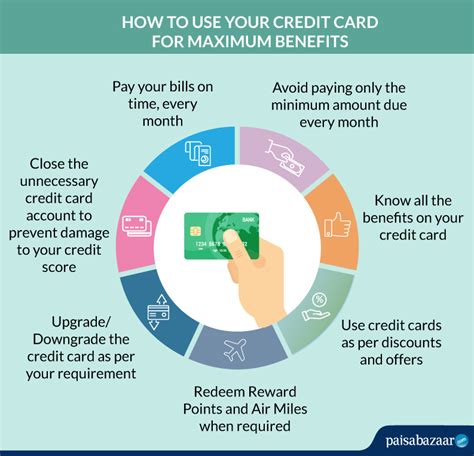

To get the most out of merchant credit, businesses must manage it effectively. Some best practices for managing merchant credit include:

- Monitoring credit utilization: Businesses should keep track of their credit utilization ratio to ensure they are not over-extending themselves.

- Making timely payments: Late payments can damage a business's credit score and increase the cost of borrowing.

- Avoiding unnecessary credit: Businesses should only borrow what they need, as unnecessary credit can increase costs and reduce financial flexibility.

- Reviewing credit agreements: Businesses should carefully review credit agreements to ensure they understand the terms and conditions.

Common Mistakes to Avoid

When using merchant credit, businesses must avoid common mistakes that can increase costs, reduce financial flexibility, and damage their credit score. Some common mistakes to avoid include: * Over-borrowing: Borrowing too much credit can lead to debt overload, reduced financial flexibility, and increased costs. * Missing payments: Late payments can damage a business's credit score, increase the cost of borrowing, and lead to penalties and fees. * Ignoring credit agreements: Failing to review credit agreements can lead to misunderstandings, disputes, and financial losses.Conclusion and Next Steps

In conclusion, merchant credit is a powerful tool that can help businesses optimize their financial performance, reduce costs, and improve their competitiveness. By understanding the different types of merchant credit, evaluating options carefully, and managing credit effectively, businesses can unlock the full potential of merchant credit and achieve their goals.

To take the next step, businesses should:

- Evaluate their current financial situation and identify areas for improvement.

- Research and compare different merchant credit options to find the best fit for their needs.

- Develop a comprehensive financial plan that incorporates merchant credit and other financing strategies.

- Monitor their credit utilization and make adjustments as needed to ensure they are getting the most out of their merchant credit.

Merchant Credit Image Gallery

What is merchant credit and how does it work?

+Merchant credit refers to the credit extended to businesses by merchant banks, financial institutions, or other lenders to facilitate transactions, manage cash flow, and finance business operations. It works by providing businesses with a line of credit that can be used to purchase goods and services, pay employees, and invest in growth initiatives.

What are the benefits of using merchant credit?

+The benefits of using merchant credit include improved cash flow, increased financial flexibility, enhanced competitiveness, and better risk management. Merchant credit can also provide businesses with access to funds that might not be available through other means, such as loans or investments.

How do I apply for merchant credit?

+To apply for merchant credit, businesses should research and compare different credit options, evaluate their financial situation, and prepare a comprehensive financial plan. They should also gather required documents, such as financial statements and tax returns, and submit an application to a merchant bank or financial institution.

We hope this article has provided you with a comprehensive understanding of merchant credit and its importance for businesses. If you have any further questions or would like to share your experiences with merchant credit, please leave a comment below. You can also share this article with others who may benefit from this information. Thank you for reading!