Intro

Boost business with 5 tips on merchant services, including payment processing, credit card transactions, and online payment solutions, to enhance customer experience and increase sales through secure and reliable merchant account management.

The world of merchant services can be complex and overwhelming, especially for small business owners or those who are new to the industry. With so many options and providers available, it can be difficult to know where to start or how to choose the best services for your business. However, with the right knowledge and guidance, you can navigate the world of merchant services with confidence and find the solutions that best meet your needs.

In today's fast-paced and technology-driven world, having a reliable and efficient payment processing system is crucial for any business. Whether you're a brick-and-mortar store, an online retailer, or a mobile business, you need to be able to accept payments quickly and securely. This is where merchant services come in – providing businesses with the tools and solutions they need to process transactions, manage their finances, and grow their operations.

As a business owner, it's essential to understand the importance of merchant services and how they can impact your bottom line. From credit card processing and payment gateways to point-of-sale systems and online invoicing, there are many different aspects to consider when it comes to merchant services. In this article, we'll explore five tips for choosing the right merchant services for your business, as well as provide an overview of the industry and its key players.

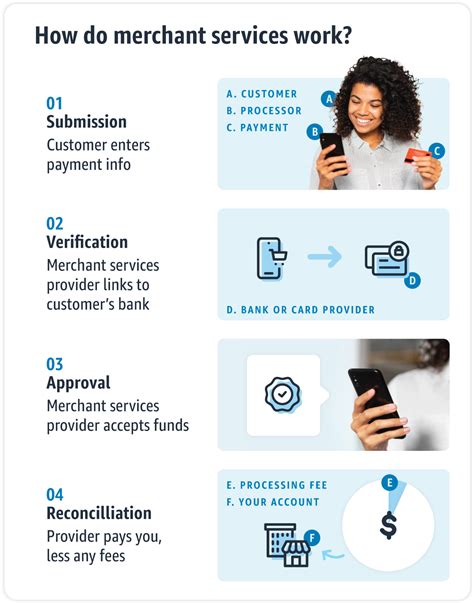

Understanding Merchant Services

Key Players in the Merchant Services Industry

The merchant services industry is made up of a variety of key players, including banks, payment processors, and independent sales organizations (ISOs). Each of these players has a different role to play in the payment processing ecosystem, and understanding their relationships and responsibilities is crucial for businesses.Tips for Choosing the Right Merchant Services

- Understand Your Fees: One of the most important things to consider when choosing a merchant services provider is the fees associated with their services. This can include everything from transaction fees and monthly minimums to equipment rental fees and cancellation fees. Make sure you understand all of the fees associated with a provider's services before signing up.

- Consider Your Payment Options: Different businesses have different payment needs, and it's essential to choose a merchant services provider that can meet yours. Consider the types of payments you need to accept, such as credit cards, debit cards, and mobile payments, and make sure your provider offers the necessary tools and solutions.

- Evaluate the Security and Compliance: Security and compliance are critical components of any merchant services provider. Make sure your provider is compliant with industry standards, such as PCI-DSS, and offers robust security features, such as encryption and tokenization.

- Look for Scalability and Flexibility: As your business grows and evolves, your merchant services needs may change. Choose a provider that offers scalable and flexible solutions, such as cloud-based payment processing and mobile payments.

- Check the Customer Support: Finally, consider the level of customer support offered by a merchant services provider. Look for providers that offer 24/7 support, online resources, and dedicated account management.

Additional Considerations

In addition to these tips, there are several other factors to consider when choosing a merchant services provider. These can include the provider's reputation and reviews, their experience working with businesses like yours, and their ability to integrate with your existing systems and software.Common Merchant Services Solutions

- Credit card processing: This involves the ability to accept credit card payments, either in-person or online.

- Payment gateways: These are online platforms that enable businesses to accept payments through their website or mobile app.

- Point-of-sale systems: These are the systems used to process transactions in-person, such as cash registers and credit card terminals.

- Online invoicing: This involves the ability to create and send invoices to customers online, and to accept payments through those invoices.

Benefits of Merchant Services

The benefits of merchant services are numerous, and can include everything from increased efficiency and productivity to improved customer satisfaction and loyalty. By choosing the right merchant services provider and solutions, businesses can streamline their payment processing, reduce their costs, and improve their bottom line.Real-World Examples of Merchant Services in Action

- A small coffee shop uses a point-of-sale system to process transactions and manage their inventory.

- An online retailer uses a payment gateway to accept payments through their website.

- A mobile business uses a mobile payment processing solution to accept payments on-the-go.

Future of Merchant Services

The future of merchant services is exciting, with new technologies and innovations emerging all the time. Some of the trends that are expected to shape the industry in the coming years include the growth of mobile payments, the increasing importance of security and compliance, and the rise of cloud-based payment processing.Merchant Services Image Gallery

What is merchant services?

+Merchant services refer to the financial services and products that are designed to help businesses manage their transactions, process payments, and manage their finances.

What are the benefits of merchant services?

+The benefits of merchant services include increased efficiency and productivity, improved customer satisfaction and loyalty, and reduced costs.

How do I choose the right merchant services provider?

+To choose the right merchant services provider, consider factors such as fees, payment options, security and compliance, scalability and flexibility, and customer support.

What is the future of merchant services?

+The future of merchant services is expected to be shaped by trends such as the growth of mobile payments, the increasing importance of security and compliance, and the rise of cloud-based payment processing.

How can I get started with merchant services?

+To get started with merchant services, research and compare different providers, consider your business needs and goals, and reach out to a provider to learn more about their services and solutions.

We hope this article has provided you with a comprehensive understanding of merchant services and how they can benefit your business. By choosing the right merchant services provider and solutions, you can streamline your payment processing, reduce your costs, and improve your bottom line. If you have any further questions or would like to learn more about merchant services, please don't hesitate to reach out. Share this article with your friends and colleagues, and let's get the conversation started about the importance of merchant services for businesses.