Intro

Track vehicle mileage with a printable mileage form template, featuring log sheets, expense trackers, and trip records, ideal for business, personal, or tax purposes, including odometer readings and fuel efficiency calculations.

The importance of tracking mileage cannot be overstated, especially for individuals who use their personal vehicles for business purposes. Keeping accurate records of mileage can help individuals and businesses reap significant tax benefits, as well as ensure reimbursement for expenses incurred while on the road. One effective way to track mileage is by using mileage forms, which provide a structured and organized approach to recording and calculating mileage expenses. In this article, we will delve into the world of mileage forms, exploring their benefits, how they work, and providing a comprehensive guide on how to use them effectively.

For many individuals and businesses, manually tracking mileage can be a time-consuming and tedious process, prone to errors and inaccuracies. Mileage forms offer a simple and efficient solution to this problem, providing a standardized template for recording mileage expenses. By using mileage forms, individuals and businesses can ensure that they are taking advantage of all the tax deductions and reimbursements they are eligible for, which can result in significant cost savings. Furthermore, mileage forms can also help to streamline the process of tracking and calculating mileage expenses, making it easier to manage and analyze data.

The use of mileage forms is not limited to businesses and individuals who use their vehicles for work purposes. Anyone who drives regularly, whether for personal or professional reasons, can benefit from using mileage forms to track their expenses. For example, individuals who volunteer or participate in charitable activities may be eligible for tax deductions on their mileage expenses. By using mileage forms, these individuals can ensure that they are accurately tracking and recording their mileage expenses, making it easier to claim deductions and reimbursements.

Mileage Forms Benefits

How Mileage Forms Work

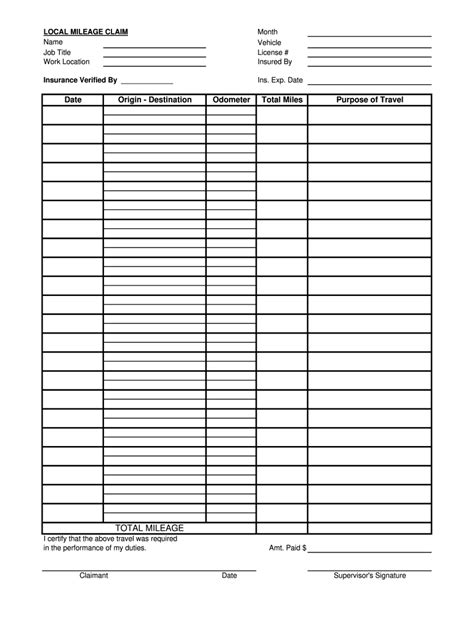

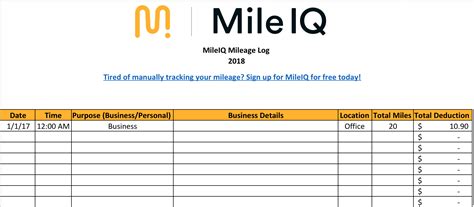

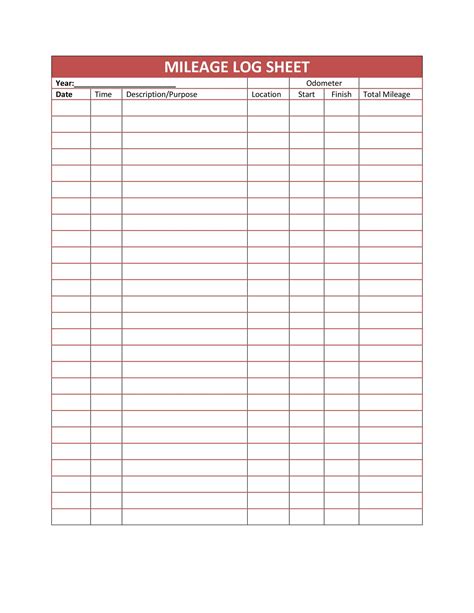

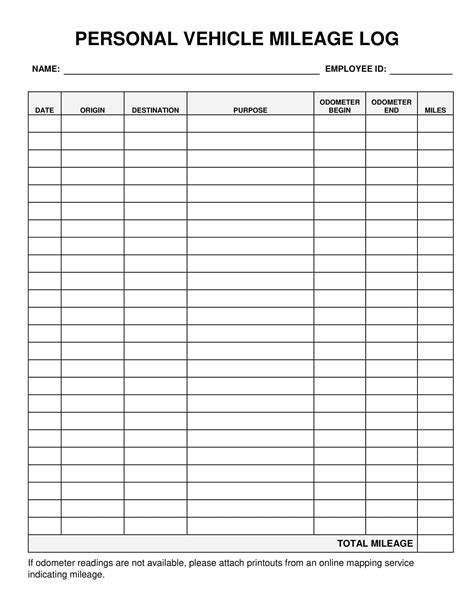

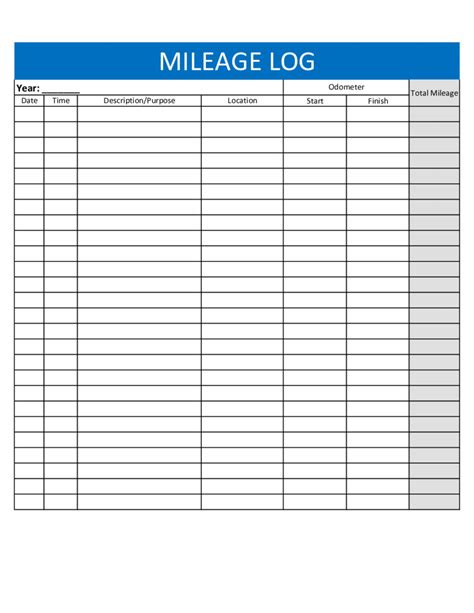

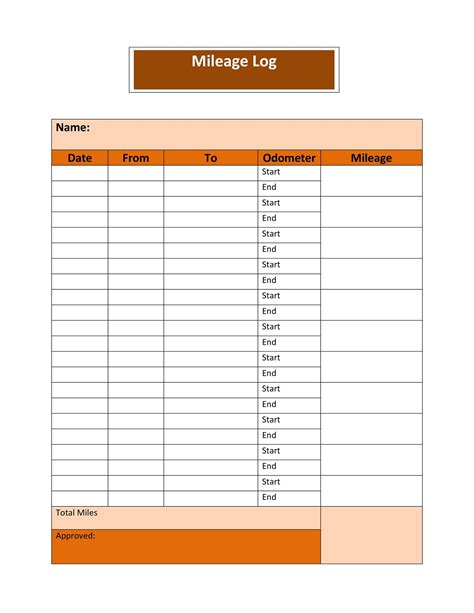

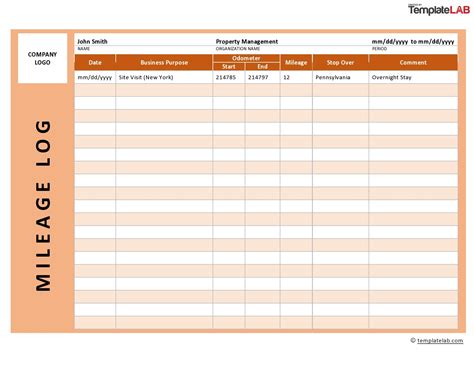

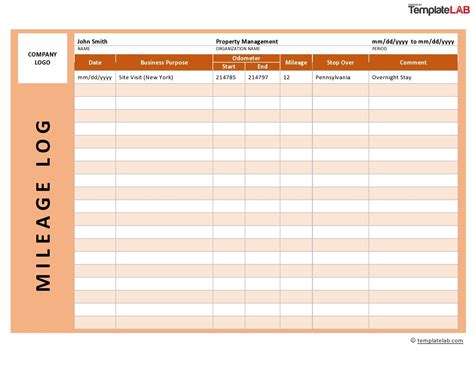

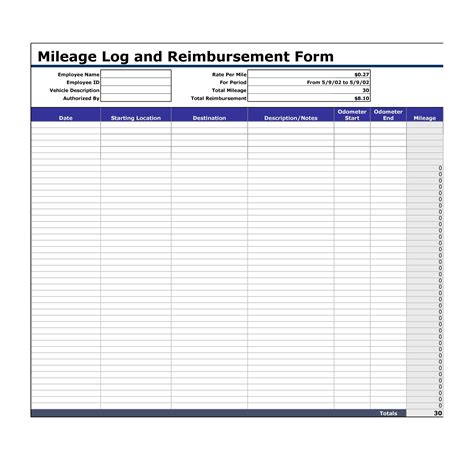

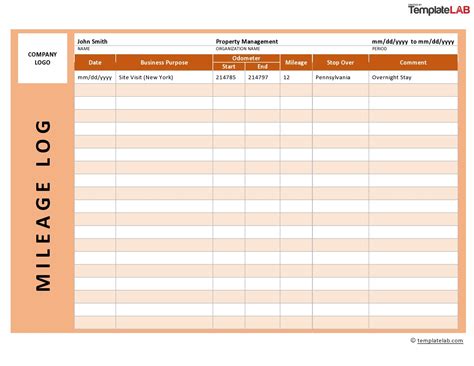

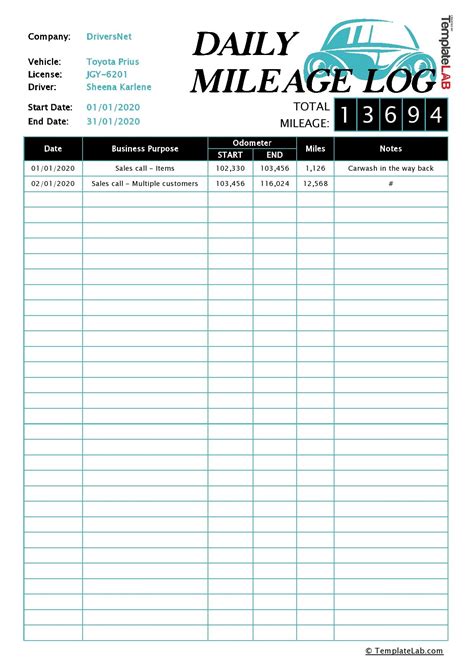

Mileage forms typically consist of a standardized template that includes fields for recording various pieces of information, such as: * Date and time of trip * Starting and ending odometer readings * Total miles driven * Purpose of trip (business, personal, etc.) * Expenses incurred (fuel, tolls, etc.)By filling out these fields for each trip, individuals and businesses can create a comprehensive and accurate record of their mileage expenses. This information can then be used to calculate and claim tax deductions and reimbursements, as well as to analyze and understand mileage expenses.

Types of Mileage Forms

Creating a Mileage Form

Creating a mileage form is a relatively simple process that can be tailored to meet the specific needs and requirements of different individuals and businesses. Some steps to follow when creating a mileage form include: * Determine the type of mileage form needed (daily, weekly, monthly, etc.) * Identify the fields and information that need to be included (date, time, starting and ending odometer readings, etc.) * Design the form to be easy to use and understand * Test the form to ensure it is accurate and effectiveUsing Mileage Forms Effectively

Mileage Form Templates

There are many mileage form templates available, both online and offline. Some popular options include: * Microsoft Excel templates: These templates can be downloaded and customized to meet the specific needs and requirements of different individuals and businesses. * Google Sheets templates: These templates can be accessed and edited online, making it easy to collaborate and share mileage data. * Printable mileage logs: These templates can be printed and filled out by hand, providing a simple and low-tech solution for tracking mileage expenses.Printable Mileage Forms

Free Mileage Forms

There are many free mileage forms available online, offering a cost-effective solution for individuals and businesses who need to track mileage expenses. Some popular options include: * IRS mileage log: This form is provided by the Internal Revenue Service and can be used to track mileage expenses for tax purposes. * Mileage log template: This template can be downloaded and customized to meet the specific needs and requirements of different individuals and businesses. * Online mileage tracker: This tool can be used to track mileage expenses online, providing a convenient and accessible solution for individuals and businesses who need to track mileage expenses.Mileage Forms for Business

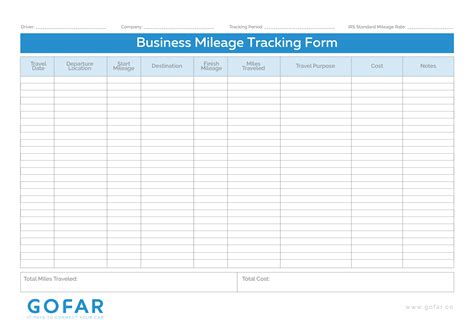

Business Mileage Log

A business mileage log is a type of mileage form that is specifically designed for businesses. This log typically includes fields for recording various pieces of information, such as: * Date and time of trip * Starting and ending odometer readings * Total miles driven * Purpose of trip (business, personal, etc.) * Expenses incurred (fuel, tolls, etc.)By using a business mileage log, businesses can create a comprehensive and accurate record of their mileage expenses, making it easier to calculate and claim tax deductions and reimbursements.

Mileage Forms for Personal Use

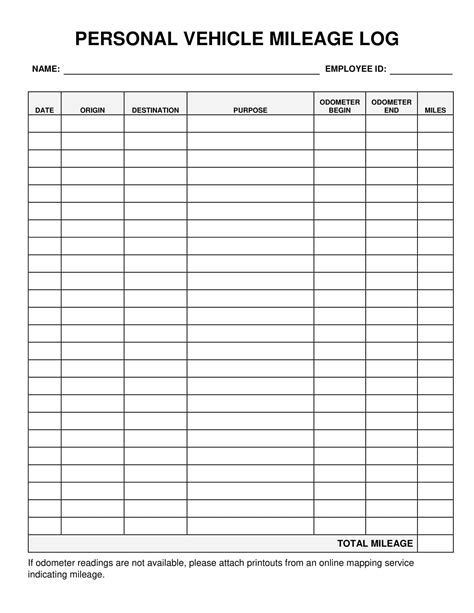

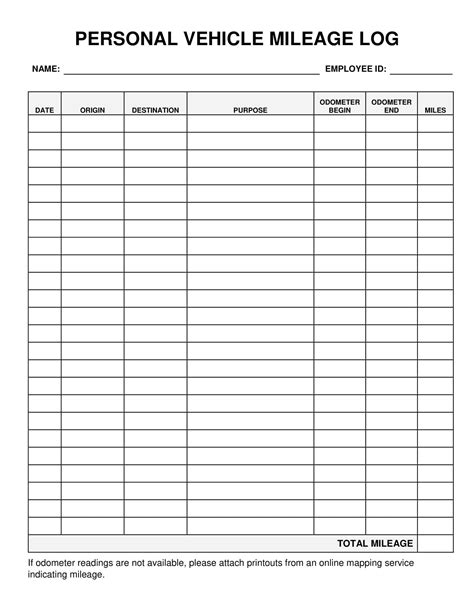

Personal Mileage Log

A personal mileage log is a type of mileage form that is specifically designed for personal use. This log typically includes fields for recording various pieces of information, such as: * Date and time of trip * Starting and ending odometer readings * Total miles driven * Purpose of trip (personal, business, etc.) * Expenses incurred (fuel, tolls, etc.)By using a personal mileage log, individuals can create a comprehensive and accurate record of their mileage expenses, making it easier to calculate and claim tax deductions and reimbursements.

Mileage Forms Gallery

What is a mileage form?

+A mileage form is a document used to track and record mileage expenses, typically including fields for date, time, starting and ending odometer readings, total miles driven, and purpose of trip.

Why is it important to use a mileage form?

+Using a mileage form is important because it helps individuals and businesses accurately track and record mileage expenses, making it easier to calculate and claim tax deductions and reimbursements.

What types of mileage forms are available?

+There are several types of mileage forms available, including daily, weekly, and monthly mileage logs, as well as business and personal mileage logs.

Can I create my own mileage form?

+Yes, you can create your own mileage form using a spreadsheet or word processing program, or by downloading a template from the internet.

Are mileage forms available online?

+Yes, there are many mileage forms available online, including free templates and downloadable forms.

In

Final Thoughts