Intro

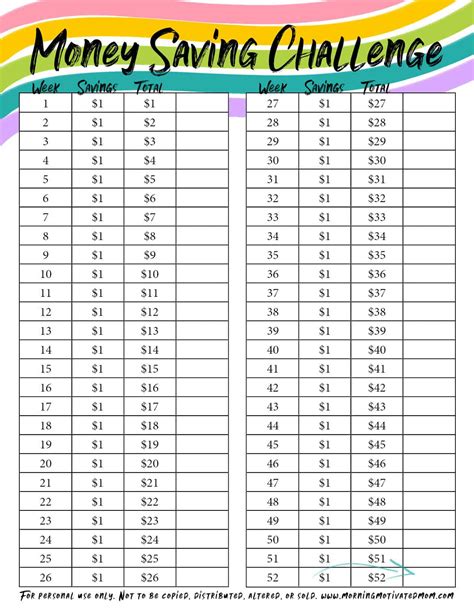

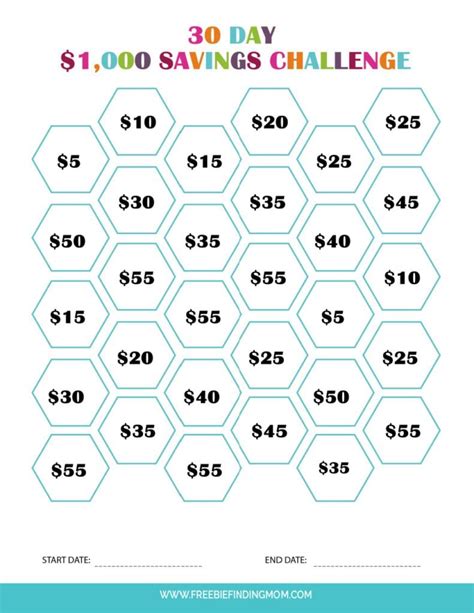

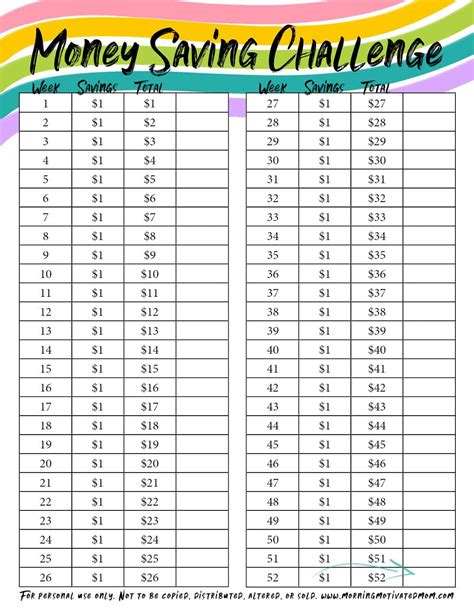

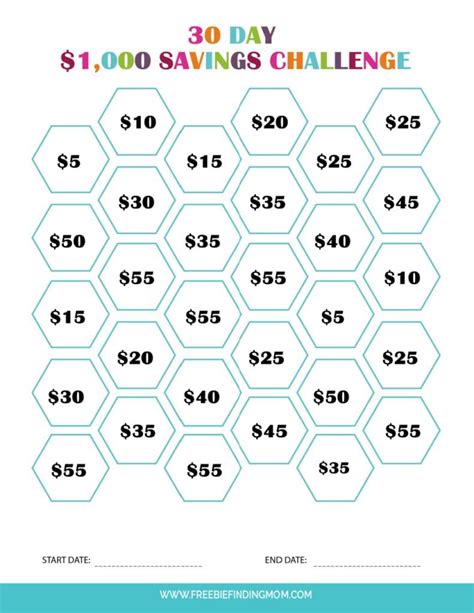

Boost savings with a Money Challenge Printable Sheet, featuring budgeting templates, financial trackers, and expense managers to help manage finances effectively.

The concept of a money challenge has gained significant traction in recent years, as individuals seek to manage their finances more effectively and achieve their financial goals. A money challenge printable sheet is a valuable tool that can help individuals track their expenses, create a budget, and develop healthy financial habits. In this article, we will delve into the importance of a money challenge, the benefits of using a printable sheet, and provide guidance on how to use this tool to achieve financial success.

The money challenge is a simple yet effective way to manage one's finances, as it encourages individuals to set financial goals, track their expenses, and make conscious decisions about their spending habits. By using a money challenge printable sheet, individuals can take control of their finances, reduce debt, and build wealth over time. The sheet provides a clear and concise way to track income and expenses, making it easier to identify areas where adjustments can be made to achieve financial stability.

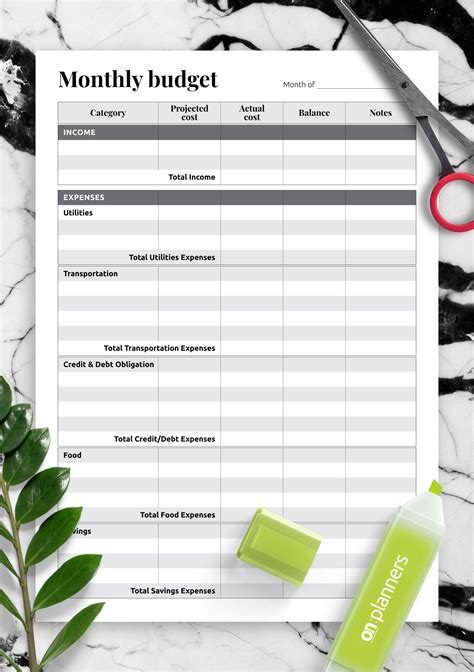

A money challenge printable sheet is a versatile tool that can be used by anyone, regardless of their financial situation. Whether you are looking to pay off debt, build an emergency fund, or save for a long-term goal, this sheet can help you stay on track and motivated. The sheet typically includes columns for tracking income, fixed expenses, variable expenses, and savings, making it easy to see where your money is going and where you can make adjustments to achieve your financial goals.

Benefits of Using a Money Challenge Printable Sheet

The benefits of using a money challenge printable sheet are numerous. Firstly, it helps individuals develop a clear understanding of their financial situation, including their income, expenses, and savings. This information is essential for creating a budget and making informed financial decisions. Secondly, the sheet provides a visual representation of one's finances, making it easier to identify areas where adjustments can be made to achieve financial stability. Finally, the sheet serves as a motivational tool, encouraging individuals to stay on track and work towards their financial goals.

Some of the key benefits of using a money challenge printable sheet include:

- Improved financial awareness and understanding

- Enhanced budgeting and expense tracking

- Increased motivation and accountability

- Better decision-making and financial planning

- Reduced debt and improved credit scores

- Increased savings and wealth-building

How to Use a Money Challenge Printable Sheet

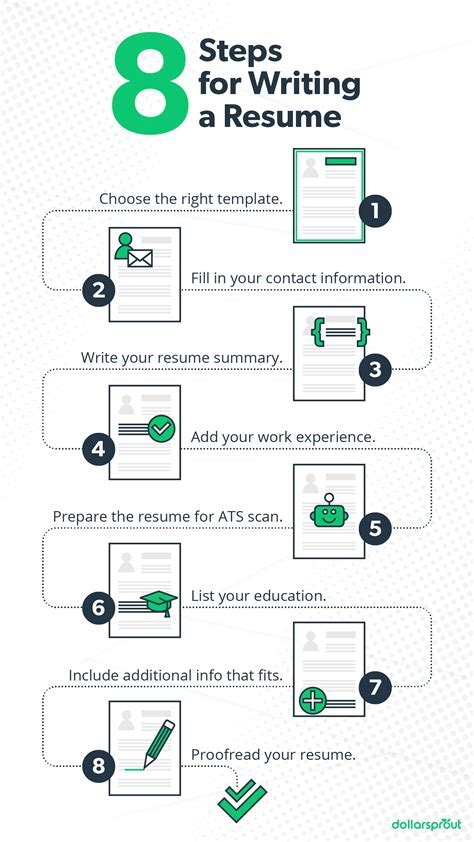

To get the most out of a money challenge printable sheet, it is essential to use it consistently and accurately. Here are some steps to follow: 1. Start by tracking your income and expenses for a month to get a clear understanding of your financial situation. 2. Use the sheet to categorize your expenses into fixed and variable expenses, such as rent, utilities, and groceries. 3. Set financial goals, such as paying off debt or building an emergency fund, and use the sheet to track your progress. 4. Review your sheet regularly to identify areas where adjustments can be made to achieve your financial goals. 5. Make adjustments to your budget and spending habits as needed to stay on track.Types of Money Challenge Printable Sheets

There are several types of money challenge printable sheets available, each with its own unique features and benefits. Some common types include:

- Budgeting sheets: These sheets provide a detailed breakdown of income and expenses, making it easy to create a budget and track spending.

- Expense tracking sheets: These sheets allow individuals to track their expenses over time, identifying areas where adjustments can be made to reduce spending.

- Savings sheets: These sheets help individuals track their savings progress, making it easier to reach long-term financial goals.

- Debt repayment sheets: These sheets provide a clear plan for paying off debt, including the amount owed, interest rates, and payment schedules.

Customizing Your Money Challenge Printable Sheet

To get the most out of a money challenge printable sheet, it is essential to customize it to meet your individual needs and financial goals. Here are some tips for customizing your sheet: * Add columns or rows as needed to track specific expenses or income sources. * Use different colors or highlighting to categorize expenses and income. * Set reminders and deadlines for bill payments and financial tasks. * Review and update your sheet regularly to reflect changes in your financial situation.Money Challenge Printable Sheet Templates

There are many money challenge printable sheet templates available online, each with its own unique features and benefits. Some popular templates include:

- The 50/30/20 budgeting template: This template allocates 50% of income towards fixed expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment.

- The envelope system template: This template uses envelopes to categorize expenses, making it easy to track spending and stay within budget.

- The zero-based budgeting template: This template requires individuals to account for every dollar of income, making it easier to identify areas where adjustments can be made to achieve financial stability.

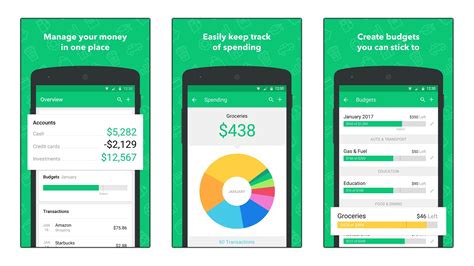

Using a Money Challenge Printable Sheet with Other Financial Tools

A money challenge printable sheet can be used in conjunction with other financial tools, such as budgeting apps and spreadsheets, to enhance financial management and planning. Here are some tips for using a money challenge printable sheet with other financial tools: * Use a budgeting app to track expenses and income, and then transfer the data to your printable sheet for review and analysis. * Use a spreadsheet to create a detailed budget and financial plan, and then use your printable sheet to track progress and make adjustments. * Use a savings app to track progress towards long-term financial goals, and then use your printable sheet to review and adjust your budget and spending habits.Common Mistakes to Avoid When Using a Money Challenge Printable Sheet

While a money challenge printable sheet can be a valuable tool for managing finances, there are some common mistakes to avoid when using this tool. Here are some tips for avoiding common mistakes:

- Failing to track expenses accurately: It is essential to track expenses accurately and consistently to get a clear understanding of your financial situation.

- Not reviewing and updating the sheet regularly: It is essential to review and update your sheet regularly to reflect changes in your financial situation and to stay on track with your financial goals.

- Not being realistic about financial goals: It is essential to set realistic financial goals and to be patient and persistent when working towards them.

Overcoming Challenges When Using a Money Challenge Printable Sheet

While a money challenge printable sheet can be a valuable tool for managing finances, there may be challenges to overcome when using this tool. Here are some tips for overcoming common challenges: * Stay motivated and engaged by setting realistic financial goals and tracking progress. * Use reminders and deadlines to stay on track with bill payments and financial tasks. * Review and update your sheet regularly to reflect changes in your financial situation and to stay on track with your financial goals.Conclusion and Next Steps

In conclusion, a money challenge printable sheet is a valuable tool for managing finances and achieving financial success. By using this tool consistently and accurately, individuals can develop a clear understanding of their financial situation, create a budget, and make informed financial decisions. To get the most out of a money challenge printable sheet, it is essential to customize it to meet your individual needs and financial goals, and to use it in conjunction with other financial tools.

Next steps:

- Download a money challenge printable sheet template and start tracking your income and expenses.

- Review and update your sheet regularly to reflect changes in your financial situation and to stay on track with your financial goals.

- Use reminders and deadlines to stay on track with bill payments and financial tasks.

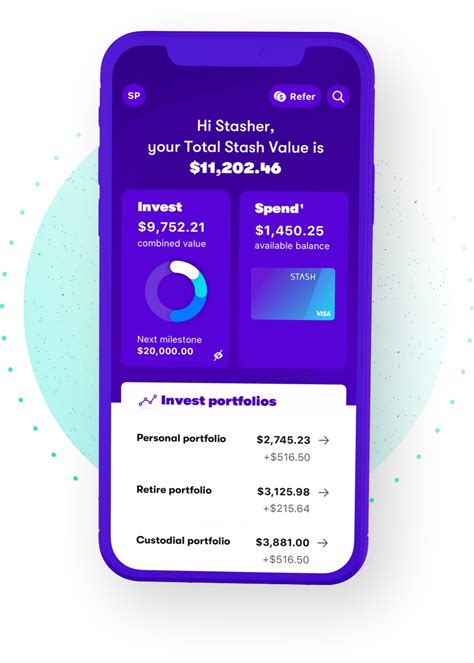

Money Challenge Image Gallery

What is a money challenge printable sheet?

+A money challenge printable sheet is a tool used to track income and expenses, create a budget, and make informed financial decisions.

How do I use a money challenge printable sheet?

+To use a money challenge printable sheet, start by tracking your income and expenses for a month, then use the sheet to categorize your expenses and create a budget.

What are the benefits of using a money challenge printable sheet?

+The benefits of using a money challenge printable sheet include improved financial awareness, enhanced budgeting and expense tracking, and increased motivation and accountability.

Can I customize my money challenge printable sheet?

+Yes, you can customize your money challenge printable sheet to meet your individual needs and financial goals by adding columns or rows as needed and using different colors or highlighting to categorize expenses and income.

What other financial tools can I use with a money challenge printable sheet?

+You can use a money challenge printable sheet with other financial tools, such as budgeting apps and spreadsheets, to enhance financial management and planning.

We hope this article has provided you with a comprehensive understanding of the benefits and uses of a money challenge printable sheet. By using this tool consistently and accurately, you can develop a clear understanding of your financial situation, create a budget, and make informed financial decisions. Remember to customize your sheet to meet your individual needs and financial goals, and to use it in conjunction with other financial tools to enhance financial management and planning. If you have any further questions or comments, please do not hesitate to reach out. Share this article with your friends and family to help them achieve financial success.