Intro

Discover Ny Restaurant Sales Tax rates, exemptions, and filing requirements, including food sales tax, dining tax, and hospitality industry regulations.

The New York restaurant industry is a thriving sector, with thousands of establishments serving a diverse range of cuisines to locals and tourists alike. However, running a restaurant in New York comes with its own set of challenges, including navigating the complex sales tax landscape. In this article, we will delve into the world of New York restaurant sales tax, exploring the key concepts, rules, and regulations that restaurateurs need to know.

New York state imposes a sales tax on most goods and services, including food and beverages sold in restaurants. The sales tax rate in New York varies depending on the location, with a statewide rate of 4% and additional local rates ranging from 0.5% to 4.5%. For example, in New York City, the combined state and local sales tax rate is 8.875%. This means that restaurants in the city must collect and remit sales tax on all eligible sales, which can be a significant burden for small businesses.

Understanding the sales tax rules and regulations is crucial for New York restaurants to avoid penalties, fines, and even audits. The New York State Department of Taxation and Finance (DTF) is responsible for administering the sales tax program, and it provides guidance and resources for businesses to comply with the law. One of the key concepts that restaurants need to grasp is the idea of taxable and exempt sales. Generally, sales of food and beverages for on-premise consumption are subject to sales tax, while sales of food and beverages for off-premise consumption, such as take-out or delivery, are exempt.

New York Restaurant Sales Tax Rates

The sales tax rates in New York vary depending on the location, as mentioned earlier. The statewide rate is 4%, and local rates range from 0.5% to 4.5%. Some of the major cities in New York have the following combined state and local sales tax rates: New York City (8.875%), Buffalo (8.75%), Rochester (8%), and Albany (8%). Restaurants need to be aware of the sales tax rate in their specific location to ensure they are collecting and remitting the correct amount of sales tax.

Taxable and Exempt Sales

As mentioned earlier, sales of food and beverages for on-premise consumption are generally subject to sales tax, while sales of food and beverages for off-premise consumption are exempt. However, there are some exceptions and nuances to this rule. For example, sales of food and beverages from vending machines are exempt from sales tax, regardless of whether they are consumed on or off the premises. Additionally, sales of certain types of food, such as groceries and snacks, may be exempt from sales tax if they are sold for off-premise consumption.

Food and Beverage Sales Tax

The sales tax on food and beverages in New York can be complex, with different rates and rules applying to different types of sales. For example, sales of alcoholic beverages are subject to a higher sales tax rate than sales of non-alcoholic beverages. Additionally, some types of food, such as candy and soda, may be subject to a higher sales tax rate than other types of food. Restaurants need to be aware of these different rates and rules to ensure they are collecting and remitting the correct amount of sales tax.

Restaurant Sales Tax Exemptions

There are some exemptions from sales tax that apply to restaurants in New York. For example, sales of food and beverages to certain types of organizations, such as non-profit groups and government agencies, may be exempt from sales tax. Additionally, sales of certain types of food, such as groceries and snacks, may be exempt from sales tax if they are sold for off-premise consumption. Restaurants need to be aware of these exemptions to ensure they are not collecting sales tax on exempt sales.

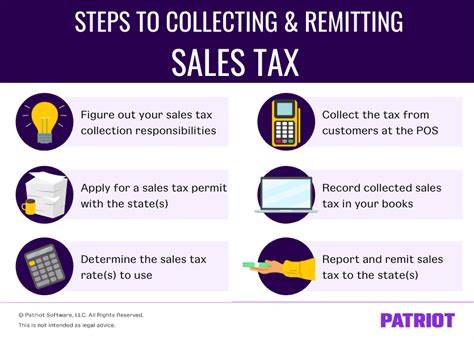

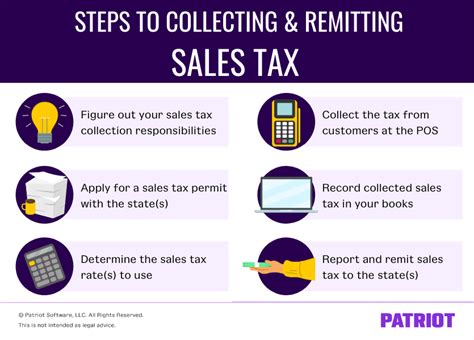

Collecting and Remitting Sales Tax

Restaurants in New York are required to collect and remit sales tax on all eligible sales. This includes collecting sales tax from customers and remitting it to the state on a regular basis. Restaurants can use a variety of methods to collect and remit sales tax, including cash registers and point-of-sale systems. They must also keep accurate records of all sales and sales tax collected, in case of an audit.

Audits and Penalties

The New York State Department of Taxation and Finance (DTF) conducts regular audits of restaurants to ensure they are complying with the sales tax law. If a restaurant is found to be non-compliant, it may be subject to penalties and fines. These can include fines, interest, and even the loss of a business license. Restaurants need to be aware of the risks of non-compliance and take steps to ensure they are collecting and remitting sales tax correctly.

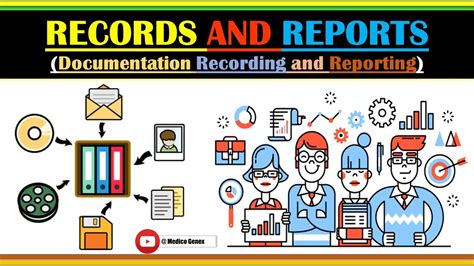

Record Keeping and Reporting

Restaurants in New York are required to keep accurate records of all sales and sales tax collected. This includes records of all sales, including exempt sales, as well as records of all sales tax collected and remitted. Restaurants must also file regular sales tax returns with the state, which includes reporting all sales and sales tax collected. Accurate record keeping and reporting are essential to ensuring compliance with the sales tax law and avoiding penalties and fines.

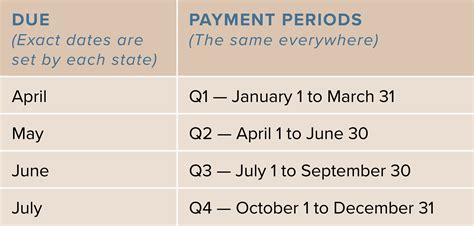

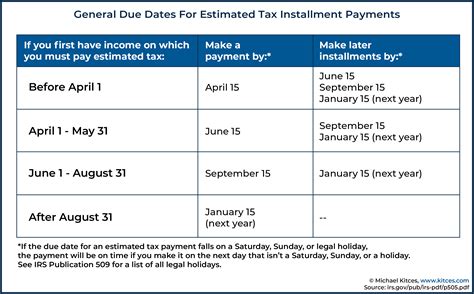

Sales Tax Returns and Payments

Restaurants in New York must file regular sales tax returns with the state, which includes reporting all sales and sales tax collected. The frequency of these returns depends on the amount of sales tax collected, with most restaurants required to file monthly or quarterly returns. Restaurants must also make timely payments of all sales tax due, which can be done online or by mail. Failure to file returns or make payments on time can result in penalties and fines.

New York Restaurant Sales Tax Resources

The New York State Department of Taxation and Finance (DTF) provides a range of resources to help restaurants comply with the sales tax law. These include guidance documents, webinars, and online tutorials, as well as a dedicated hotline for sales tax questions. Restaurants can also consult with a tax professional or accountant to ensure they are meeting all their sales tax obligations.

Gallery of New York Restaurant Sales Tax

New York Restaurant Sales Tax Image Gallery

What is the sales tax rate in New York City?

+The combined state and local sales tax rate in New York City is 8.875%.

Are sales of food and beverages for off-premise consumption exempt from sales tax?

+Yes, sales of food and beverages for off-premise consumption are generally exempt from sales tax.

How often do restaurants need to file sales tax returns in New York?

+Restaurants in New York need to file sales tax returns on a monthly or quarterly basis, depending on the amount of sales tax collected.

What are the penalties for non-compliance with the sales tax law in New York?

+The penalties for non-compliance with the sales tax law in New York can include fines, interest, and even the loss of a business license.

Where can restaurants find resources and guidance on the sales tax law in New York?

+Restaurants can find resources and guidance on the sales tax law in New York on the New York State Department of Taxation and Finance (DTF) website, or by consulting with a tax professional or accountant.

In conclusion, navigating the complex world of New York restaurant sales tax can be challenging, but with the right guidance and resources, restaurants can ensure they are complying with the law and avoiding penalties and fines. By understanding the sales tax rates, taxable and exempt sales, and record keeping and reporting requirements, restaurants can stay on top of their sales tax obligations and focus on what they do best – providing great food and service to their customers. If you have any questions or concerns about New York restaurant sales tax, don't hesitate to reach out to a tax professional or accountant for guidance. Share this article with your friends and colleagues to help them stay informed about the latest developments in New York restaurant sales tax.