Intro

Discover top payment gateway providers for secure transactions, offering seamless online payment processing, merchant services, and e-commerce solutions with reliable payment processing, fraud protection, and mobile payments.

The world of e-commerce has experienced tremendous growth over the past decade, with more businesses than ever before turning to online platforms to sell their products and services. One crucial aspect of any e-commerce website is the payment gateway, which enables customers to make secure and convenient transactions. With so many payment gateway providers available, it can be challenging for businesses to choose the right one for their needs. In this article, we will explore the importance of payment gateways, the benefits they offer, and some of the best payment gateway providers available.

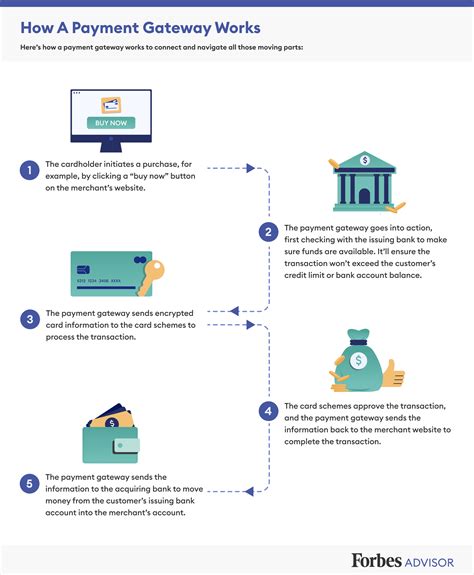

Payment gateways play a vital role in the e-commerce ecosystem, acting as a bridge between the customer's payment method and the merchant's bank account. They facilitate the transfer of funds, ensuring that transactions are secure, reliable, and efficient. A good payment gateway provider should offer a range of features, including support for multiple payment methods, robust security measures, and competitive pricing. With the rise of mobile commerce and online shopping, the demand for payment gateways has never been higher, and businesses are looking for providers that can meet their evolving needs.

The benefits of using a payment gateway are numerous, from increased conversions and improved customer satisfaction to reduced fraud and lower transaction costs. By offering a seamless and secure payment experience, businesses can build trust with their customers and encourage repeat sales. Moreover, payment gateways can provide valuable insights into customer behavior and spending habits, helping businesses to optimize their marketing strategies and improve their overall performance. With so many payment gateway providers available, it is essential to choose a provider that aligns with your business goals and offers the features and support you need to succeed.

What is a Payment Gateway?

Key Features of a Payment Gateway

Some of the key features of a payment gateway include: * Support for multiple payment methods, such as credit cards, debit cards, and bank transfers * Robust security measures, such as encryption and tokenization, to protect sensitive customer data * Competitive pricing, with transparent fees and no hidden charges * Easy integration with e-commerce platforms and shopping carts * Real-time reporting and analytics to help businesses track their sales and customer behavior * Multi-currency support, allowing businesses to accept payments from customers around the worldBenefits of Using a Payment Gateway

Advantages of Payment Gateways

Some of the advantages of payment gateways include: * Increased conversions, as customers are more likely to complete a purchase if the payment process is easy and secure * Improved customer satisfaction, as payment gateways provide a seamless and convenient payment experience * Reduced fraud, as payment gateways offer robust security measures to protect sensitive customer data * Lower transaction costs, as payment gateways can negotiate better rates with banks and other financial institutions * Valuable insights into customer behavior and spending habits, helping businesses to optimize their marketing strategies and improve their overall performanceBest Payment Gateway Providers

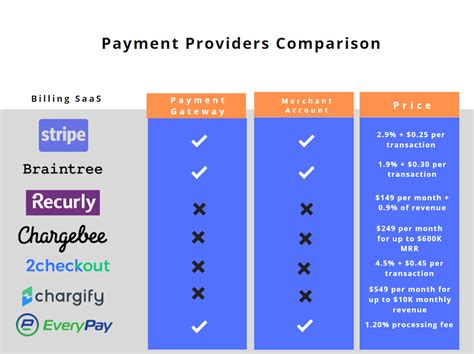

Payment Gateway Providers Comparison

Here is a comparison of some of the best payment gateway providers: * PayPal: 2.9% + $0.30 per transaction, with support for multiple payment methods and robust security measures * Stripe: 2.9% + $0.30 per transaction, with support for multiple payment methods and flexible pricing plans * Square: 2.9% + $0.30 per transaction, with support for multiple payment methods and robust security measures * Authorize.net: 2.9% + $0.30 per transaction, with support for multiple payment methods and competitive pricing * Braintree: 2.9% + $0.30 per transaction, with support for multiple payment methods and robust security measuresHow to Choose a Payment Gateway Provider

Payment Gateway Provider Selection Criteria

Here are some criteria to consider when selecting a payment gateway provider: * Fees and pricing plans, including transaction fees and monthly fees * Support for multiple payment methods, including credit cards, debit cards, and bank transfers * Security measures, including encryption and tokenization * Integration options, including support for e-commerce platforms and shopping carts * Customer support, including phone, email, and live chat support * Reputation, including reviews and ratings from other customersPayment Gateway Image Gallery

What is a payment gateway?

+A payment gateway is a technology that enables businesses to accept online payments from their customers. It acts as an intermediary between the customer's payment method and the merchant's bank account.

What are the benefits of using a payment gateway?

+The benefits of using a payment gateway include increased conversions, improved customer satisfaction, reduced fraud, and lower transaction costs. Payment gateways also provide valuable insights into customer behavior and spending habits.

How do I choose a payment gateway provider?

+When choosing a payment gateway provider, consider the fees and pricing plans, support for multiple payment methods, security measures, integration options, customer support, and reputation. Read reviews and check the reputation of the provider to ensure you choose a reliable and trustworthy provider.

What are the best payment gateway providers?

+Some of the best payment gateway providers include PayPal, Stripe, Square, Authorize.net, and Braintree. Each provider offers a range of features and support for multiple payment methods, so it's essential to compare their fees, features, and reputation to choose the best provider for your business.

How do I integrate a payment gateway with my e-commerce platform?

+Most payment gateways offer easy integration with popular e-commerce platforms, such as Shopify, WooCommerce, and Magento. You can typically integrate a payment gateway by installing a plugin or module, or by using an API to connect your platform to the payment gateway.

In conclusion, choosing the right payment gateway provider is crucial for businesses that want to succeed in the world of e-commerce. By considering the fees, features, and reputation of different providers, businesses can choose a payment gateway that meets their needs and helps them to achieve their goals. Whether you're a small startup or a large enterprise, there's a payment gateway provider out there that can help you to accept online payments, reduce fraud, and improve customer satisfaction. We hope this article has provided you with valuable insights and information to help you make an informed decision when choosing a payment gateway provider. If you have any further questions or comments, please don't hesitate to reach out. Share this article with your friends and colleagues, and help them to choose the best payment gateway provider for their business needs.