Intro

Master PCI compliance with our certification guide, covering security standards, vulnerability scans, and penetration testing to ensure data protection and payment card industry compliance.

The importance of PCI compliance certification cannot be overstated, especially for businesses that handle credit card information. As technology advances and online transactions become more prevalent, the risk of data breaches and cyber attacks increases. This is where PCI compliance comes into play, providing a set of standards and guidelines to ensure that businesses are handling sensitive information securely. In this article, we will delve into the world of PCI compliance certification, exploring its benefits, requirements, and steps to achieve certification.

PCI compliance is not just a necessity for businesses, but also a requirement for any organization that stores, processes, or transmits credit card information. The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to ensure that businesses are protecting sensitive information and preventing data breaches. By achieving PCI compliance certification, businesses can demonstrate their commitment to security and protect their customers' sensitive information.

The benefits of PCI compliance certification are numerous, ranging from improved security and reduced risk of data breaches to increased customer trust and loyalty. Businesses that achieve PCI compliance certification can also avoid costly fines and penalties associated with non-compliance. Moreover, PCI compliance certification can help businesses to improve their reputation and gain a competitive edge in the market. With the increasing demand for online transactions and digital payments, PCI compliance certification has become a essential requirement for businesses to operate securely and efficiently.

Introduction to PCI Compliance Certification

PCI compliance certification is a process that involves assessing and validating an organization's security controls and processes to ensure that they meet the requirements of the PCI DSS. The certification process typically involves a series of steps, including a self-assessment questionnaire, vulnerability scans, and an on-site assessment. The goal of the certification process is to ensure that businesses are implementing and maintaining effective security controls to protect sensitive information.

Benefits of PCI Compliance Certification

The benefits of PCI compliance certification are numerous and can have a significant impact on a business's operations and reputation. Some of the key benefits include: * Improved security and reduced risk of data breaches * Increased customer trust and loyalty * Avoidance of costly fines and penalties associated with non-compliance * Improved reputation and competitive edge in the market * Compliance with regulatory requirements and industry standards * Protection of sensitive information and prevention of identity theftRequirements for PCI Compliance Certification

To achieve PCI compliance certification, businesses must meet the requirements of the PCI DSS. The requirements are divided into six categories, including:

- Install and maintain a firewall to protect cardholder data

- Use secure passwords and authentication procedures

- Protect stored cardholder data

- Encrypt cardholder data when transmitted across public networks

- Use and regularly update antivirus software

- Restrict access to cardholder data on a need-to-know basis

- Monitor and analyze security logs and network activity

- Conduct regular security audits and penetration testing

Steps to Achieve PCI Compliance Certification

Achieving PCI compliance certification involves several steps, including: 1. Determine the scope of the assessment: Identify the systems and processes that handle credit card information and determine the scope of the assessment. 2. Complete a self-assessment questionnaire: Fill out a self-assessment questionnaire to identify areas of non-compliance and prioritize remediation efforts. 3. Conduct vulnerability scans: Conduct vulnerability scans to identify potential security threats and weaknesses. 4. Perform an on-site assessment: Perform an on-site assessment to validate the security controls and processes. 5. Remediate identified issues: Remediate identified issues and implement corrective actions to address non-compliance. 6. Maintain compliance: Maintain compliance by regularly reviewing and updating security controls and processes.PCI Compliance Certification Levels

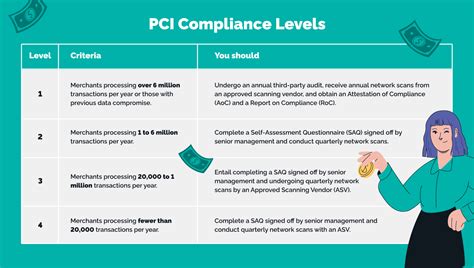

PCI compliance certification levels are determined by the type and volume of credit card transactions. There are four levels of PCI compliance certification, including:

- Level 1: Businesses that process over 6 million credit card transactions per year

- Level 2: Businesses that process between 1 million and 6 million credit card transactions per year

- Level 3: Businesses that process between 20,000 and 1 million credit card transactions per year

- Level 4: Businesses that process fewer than 20,000 credit card transactions per year

PCI Compliance Certification Process

The PCI compliance certification process typically involves the following steps: 1. Pre-assessment: Conduct a pre-assessment to identify areas of non-compliance and prioritize remediation efforts. 2. On-site assessment: Perform an on-site assessment to validate the security controls and processes. 3. Remediation: Remediate identified issues and implement corrective actions to address non-compliance. 4. Report on compliance: Provide a report on compliance to the acquiring bank or payment processor. 5. Maintenance: Maintain compliance by regularly reviewing and updating security controls and processes.Cost of PCI Compliance Certification

The cost of PCI compliance certification can vary depending on the size and complexity of the business. The costs associated with PCI compliance certification include:

- Assessment and audit costs: The cost of hiring a qualified security assessor to conduct the on-site assessment and audit.

- Remediation costs: The cost of implementing corrective actions to address non-compliance.

- Maintenance costs: The cost of regularly reviewing and updating security controls and processes.

- Penalties and fines: The cost of non-compliance, including penalties and fines associated with data breaches and non-compliance.

Best Practices for PCI Compliance Certification

To achieve and maintain PCI compliance certification, businesses should follow best practices, including: * Implementing and maintaining effective security controls and processes * Regularly reviewing and updating security controls and processes * Conducting regular security audits and penetration testing * Providing security awareness training to employees * Monitoring and analyzing security logs and network activityCommon Challenges in Achieving PCI Compliance Certification

Achieving PCI compliance certification can be challenging, especially for small and medium-sized businesses. Some common challenges include:

- Lack of resources and budget

- Limited expertise and knowledge

- Complexity of the PCI DSS requirements

- Difficulty in implementing and maintaining effective security controls and processes

- Limited visibility and control over third-party vendors and service providers

Solutions to Common Challenges

To overcome common challenges, businesses can: * Hire a qualified security assessor to conduct the on-site assessment and audit * Implement a security information and event management (SIEM) system to monitor and analyze security logs and network activity * Provide security awareness training to employees * Implement a vulnerability management program to identify and remediate potential security threats and weaknesses * Regularly review and update security controls and processesPCI Compliance Image Gallery

What is PCI compliance certification?

+PCI compliance certification is a process that involves assessing and validating an organization's security controls and processes to ensure that they meet the requirements of the PCI DSS.

Why is PCI compliance certification important?

+PCI compliance certification is important because it helps to protect sensitive information and prevent data breaches. It also helps businesses to avoid costly fines and penalties associated with non-compliance.

How do I achieve PCI compliance certification?

+To achieve PCI compliance certification, businesses must meet the requirements of the PCI DSS. This involves completing a self-assessment questionnaire, conducting vulnerability scans, and performing an on-site assessment.

What are the benefits of PCI compliance certification?

+The benefits of PCI compliance certification include improved security, increased customer trust and loyalty, avoidance of costly fines and penalties, and compliance with regulatory requirements and industry standards.

How much does PCI compliance certification cost?

+The cost of PCI compliance certification can vary depending on the size and complexity of the business. The costs associated with PCI compliance certification include assessment and audit costs, remediation costs, maintenance costs, and penalties and fines.

In