Intro

Boost savings with the 5 Ways Penny Challenge, a fun savings strategy using penny jars, coin banks, and budgeting tips to promote financial discipline and wealth accumulation.

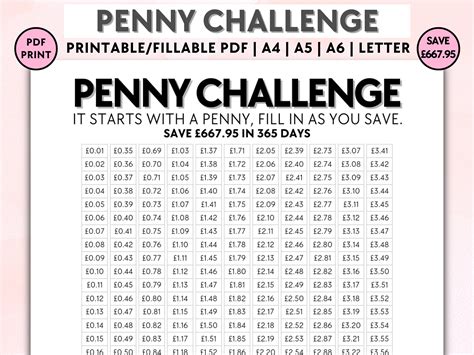

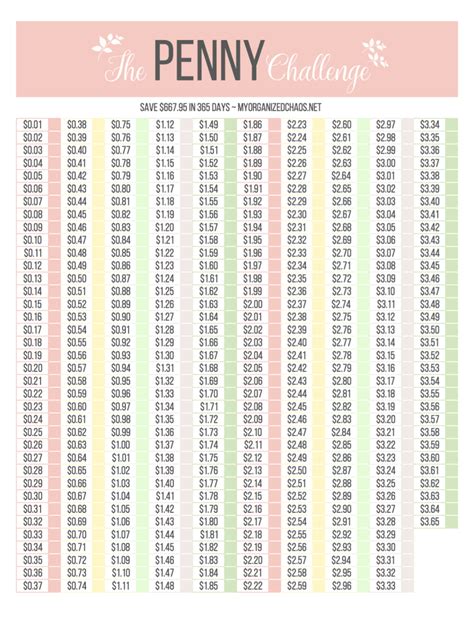

The concept of saving money has been around for centuries, and one of the most intriguing methods is the penny challenge. This challenge has gained popularity in recent years due to its simplicity and potential to yield significant savings over time. The idea is to save a small amount of money each day, starting with just one penny on the first day and increasing the amount by one penny each subsequent day. For instance, on the second day, you would save two pennies, on the third day, three pennies, and so on. By the end of the year, the total savings can be substantial. In this article, we will explore five ways to approach the penny challenge, providing a comprehensive guide on how to get started and make the most out of this savings strategy.

Understanding the Penny Challenge

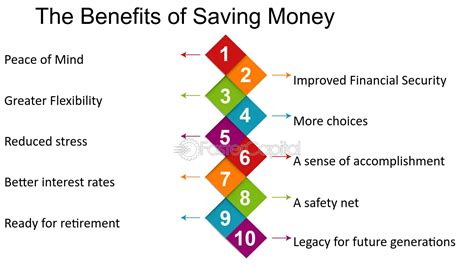

Benefits of the Penny Challenge

Adapting the Penny Challenge

The traditional penny challenge can be adapted in various ways to suit different financial situations and goals. For example, instead of saving pennies, one could save dollars or even larger amounts, depending on their income and expenses. Another approach is to start the challenge at a different time of the year or to extend it beyond a single year, creating a long-term savings plan. The key is to find a version of the challenge that is both challenging and achievable, ensuring that the savings habit is maintained over time.5 Ways to Approach the Penny Challenge

Implementing the Penny Challenge

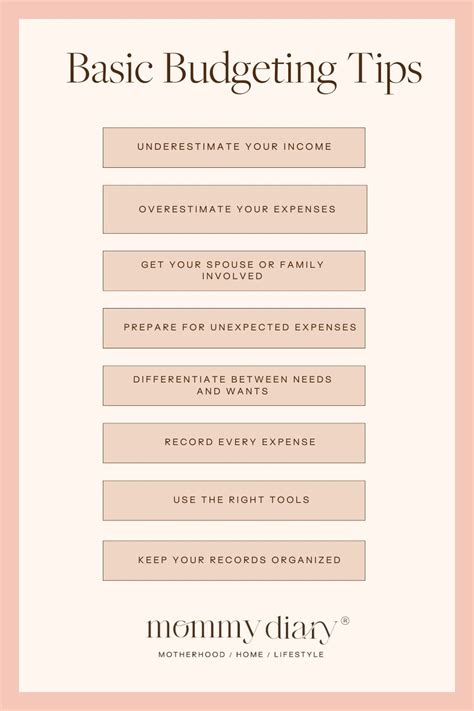

Implementing the penny challenge requires a few simple steps: - Decide on the version of the challenge you want to undertake. - Set up a savings account or a jar where you will keep your savings. - Create a schedule or set reminders to ensure you make your daily savings. - Consider automating your savings through digital banking to make the process smoother.Tips for Success

Overcoming Challenges

One of the main challenges of the penny challenge is maintaining the habit of saving daily. Life events, financial emergencies, or simply forgetting can interrupt the savings routine. To overcome these challenges, it's crucial to have a contingency plan, such as setting aside a small buffer for emergencies or finding ways to remind yourself to make your daily savings.Conclusion and Next Steps

Penny Challenge Image Gallery

What is the Penny Challenge?

+The Penny Challenge is a savings plan where you save an amount equal to the day's number in pennies, starting from January 1st.

How much can I save with the Penny Challenge?

+By the end of the year, you can save approximately $667.95 with the traditional penny challenge.

Can I adapt the Penny Challenge to fit my financial situation?

+Yes, the Penny Challenge can be adapted by changing the currency, starting amount, or duration to suit your financial goals and situation.

We hope this comprehensive guide to the penny challenge has inspired you to start your savings journey. Whether you decide to follow the traditional approach or one of the adapted versions, the key to success lies in consistency and patience. Share your experiences with the penny challenge in the comments below, and don't forget to share this article with friends and family who might benefit from this innovative savings strategy. Together, let's make saving easier and more accessible for everyone.