Intro

Create a clear picture of your finances with a Personal Financial Statement Printable, featuring income, expenses, assets, and liabilities, to track budget, manage debt, and build wealth effectively.

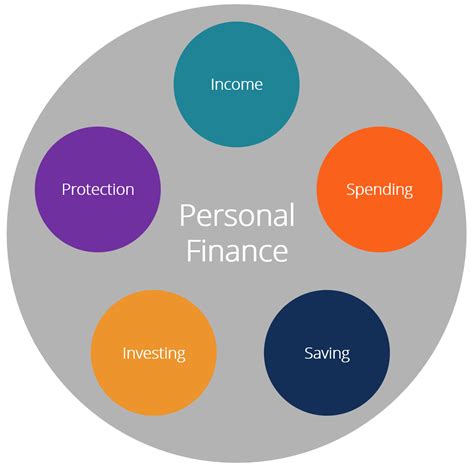

Creating a personal financial statement is a crucial step in managing one's finances effectively. It provides a clear picture of an individual's financial situation, including their assets, liabilities, income, and expenses. With this information, individuals can make informed decisions about their financial goals and develop strategies to achieve them. In today's fast-paced world, having a personal financial statement printable can be a valuable tool for anyone looking to take control of their finances.

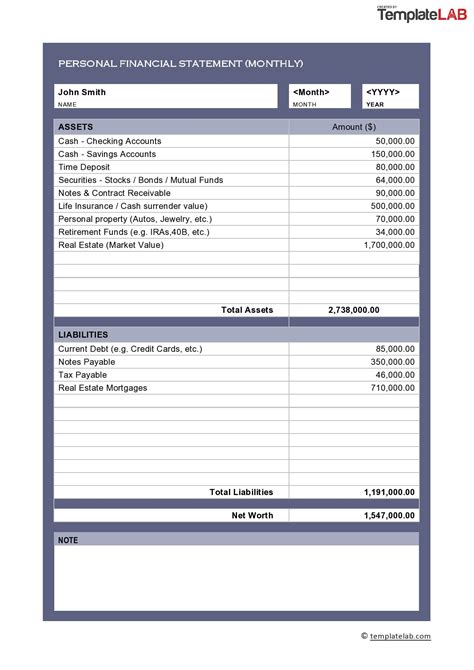

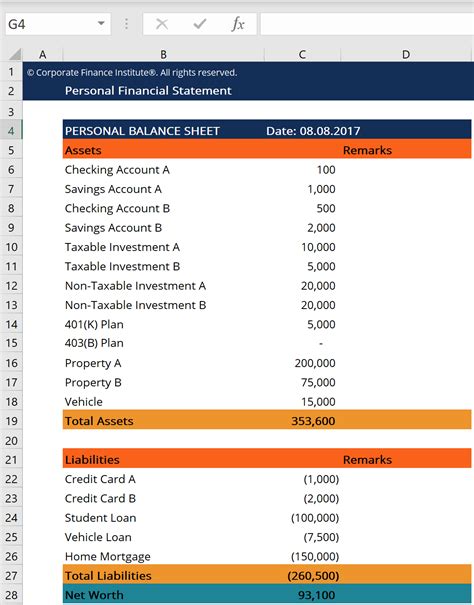

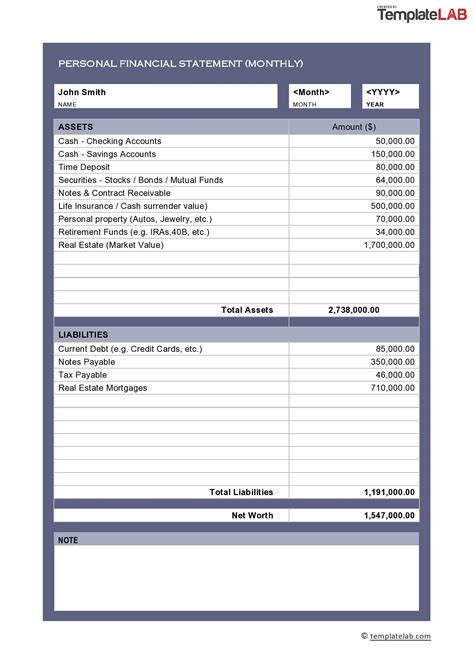

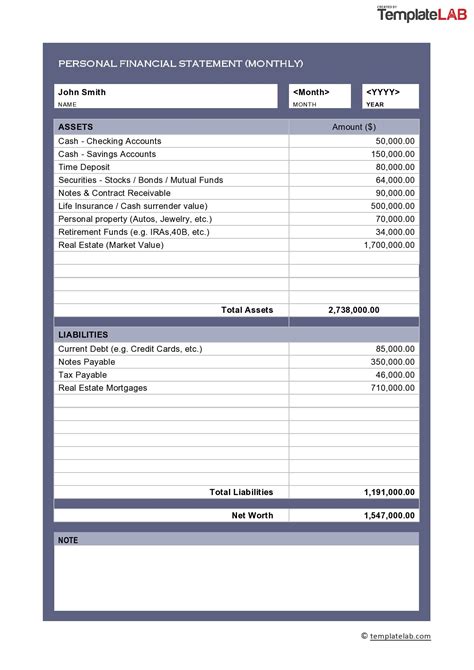

A personal financial statement is a document that outlines an individual's financial position at a specific point in time. It typically includes information about their assets, such as cash, investments, and property, as well as their liabilities, such as debts and loans. By comparing their assets to their liabilities, individuals can determine their net worth, which is a key indicator of their overall financial health. Having a personal financial statement printable can help individuals to easily update and track their financial situation over time.

The importance of having a personal financial statement cannot be overstated. It helps individuals to identify areas where they can improve their financial management, such as reducing expenses or increasing income. It also enables them to set realistic financial goals and develop a plan to achieve them. Whether it's saving for a down payment on a house, paying off debt, or building up an emergency fund, a personal financial statement provides the necessary information to make informed decisions.

Benefits of a Personal Financial Statement

There are numerous benefits to creating a personal financial statement. Some of the most significant advantages include:

- Improved financial awareness: A personal financial statement provides a clear picture of an individual's financial situation, helping them to understand their strengths and weaknesses.

- Enhanced financial planning: By identifying areas for improvement, individuals can develop a plan to achieve their financial goals.

- Increased financial discipline: A personal financial statement helps individuals to track their income and expenses, making it easier to stick to a budget and avoid unnecessary spending.

- Better investment decisions: With a clear understanding of their financial situation, individuals can make informed decisions about investments and other financial opportunities.

Components of a Personal Financial Statement

A personal financial statement typically includes several key components, including:- Assets: This section lists all of an individual's assets, such as cash, investments, and property.

- Liabilities: This section lists all of an individual's liabilities, such as debts and loans.

- Income: This section lists all of an individual's income sources, such as their salary, investments, and any other sources of income.

- Expenses: This section lists all of an individual's expenses, such as rent, utilities, and other living expenses.

How to Create a Personal Financial Statement

Creating a personal financial statement is a relatively straightforward process. Here are the steps to follow:

- Gather all financial documents: This includes bank statements, investment accounts, loan documents, and any other relevant financial information.

- List all assets: This includes cash, investments, property, and any other assets.

- List all liabilities: This includes debts, loans, and any other liabilities.

- Calculate net worth: This is done by subtracting total liabilities from total assets.

- List all income sources: This includes salary, investments, and any other sources of income.

- List all expenses: This includes rent, utilities, and any other living expenses.

- Review and update: Regularly review and update the personal financial statement to ensure it remains accurate and relevant.

Tips for Creating a Personal Financial Statement

Here are some tips to keep in mind when creating a personal financial statement:- Be accurate: Ensure all information is accurate and up-to-date.

- Be comprehensive: Include all relevant financial information.

- Review regularly: Regularly review and update the personal financial statement to ensure it remains relevant.

- Seek professional advice: If necessary, seek the advice of a financial advisor or accountant.

Personal Financial Statement Printable Templates

There are many personal financial statement printable templates available online. These templates can be downloaded and used to create a personal financial statement. Some popular templates include:

- Microsoft Excel templates: These templates provide a comprehensive and customizable way to create a personal financial statement.

- Google Sheets templates: These templates provide a free and customizable way to create a personal financial statement.

- PDF templates: These templates provide a simple and easy-to-use way to create a personal financial statement.

Advantages of Using a Personal Financial Statement Printable Template

There are several advantages to using a personal financial statement printable template, including:- Convenience: Templates are easy to use and provide a convenient way to create a personal financial statement.

- Customization: Templates can be customized to meet individual needs and preferences.

- Accuracy: Templates provide a comprehensive and accurate way to create a personal financial statement.

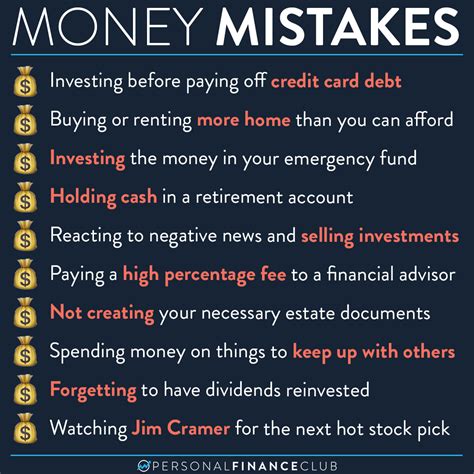

Common Mistakes to Avoid When Creating a Personal Financial Statement

There are several common mistakes to avoid when creating a personal financial statement, including:

- Inaccurate information: Ensure all information is accurate and up-to-date.

- Incomplete information: Ensure all relevant financial information is included.

- Failure to review and update: Regularly review and update the personal financial statement to ensure it remains relevant.

Best Practices for Creating a Personal Financial Statement

Here are some best practices to keep in mind when creating a personal financial statement:- Use a template: Templates provide a comprehensive and customizable way to create a personal financial statement.

- Seek professional advice: If necessary, seek the advice of a financial advisor or accountant.

- Review regularly: Regularly review and update the personal financial statement to ensure it remains relevant.

Conclusion and Next Steps

Creating a personal financial statement is an important step in managing one's finances effectively. By following the steps outlined in this article and using a personal financial statement printable template, individuals can create a comprehensive and accurate personal financial statement. Remember to review and update the statement regularly to ensure it remains relevant. With a personal financial statement, individuals can make informed decisions about their financial goals and develop strategies to achieve them.

Personal Financial Statement Image Gallery

What is a personal financial statement?

+A personal financial statement is a document that outlines an individual's financial position at a specific point in time.

Why is a personal financial statement important?

+A personal financial statement is important because it provides a clear picture of an individual's financial situation, helping them to identify areas for improvement and make informed decisions about their financial goals.

How do I create a personal financial statement?

+To create a personal financial statement, gather all financial documents, list all assets and liabilities, calculate net worth, and list all income sources and expenses.

What are some common mistakes to avoid when creating a personal financial statement?

+Common mistakes to avoid include inaccurate information, incomplete information, and failure to review and update the statement regularly.

Where can I find a personal financial statement printable template?

+Personal financial statement printable templates can be found online, including Microsoft Excel templates, Google Sheets templates, and PDF templates.

We invite you to share your thoughts and experiences with creating a personal financial statement. Have you used a personal financial statement printable template? What benefits have you seen from using one? Share your story in the comments below. Additionally, if you found this article helpful, please share it with others who may benefit from learning about personal financial statements.