Intro

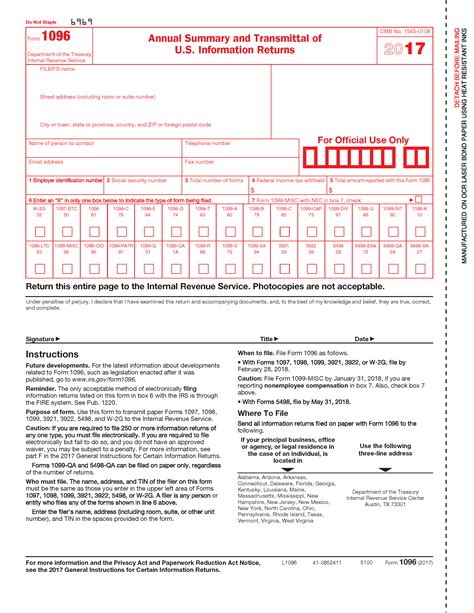

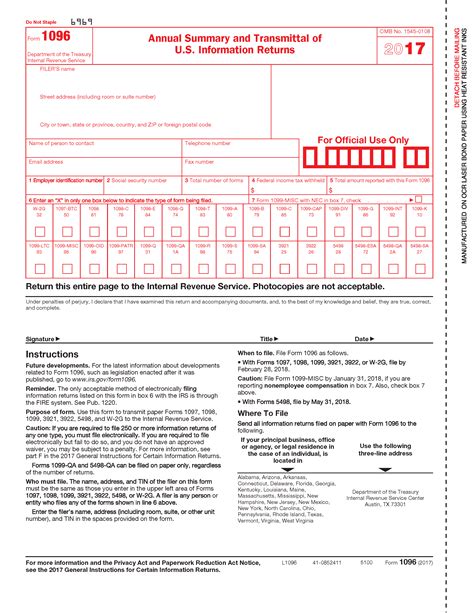

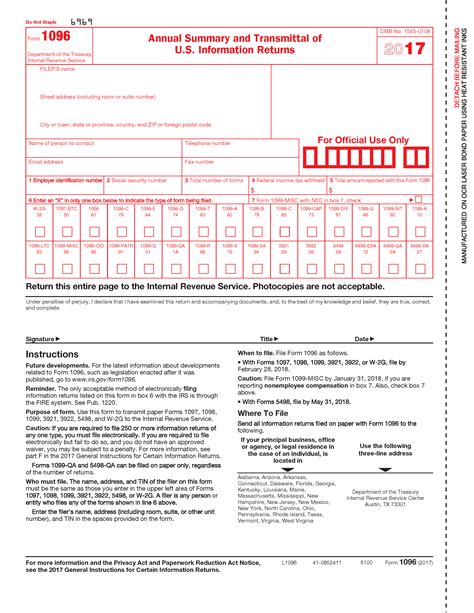

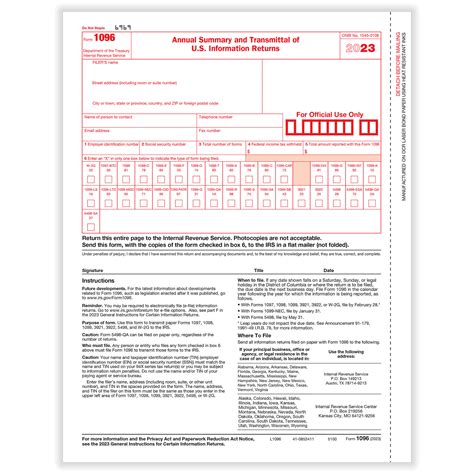

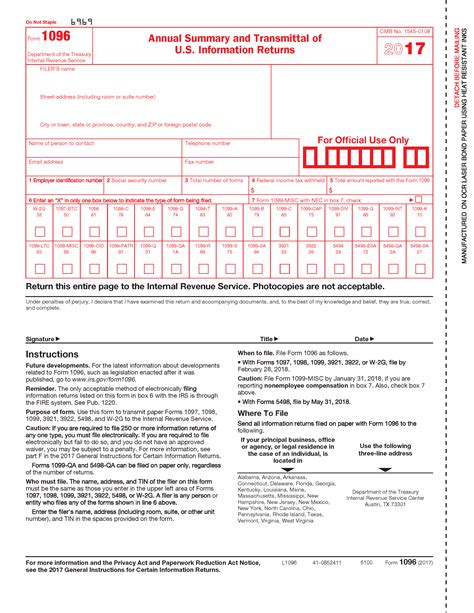

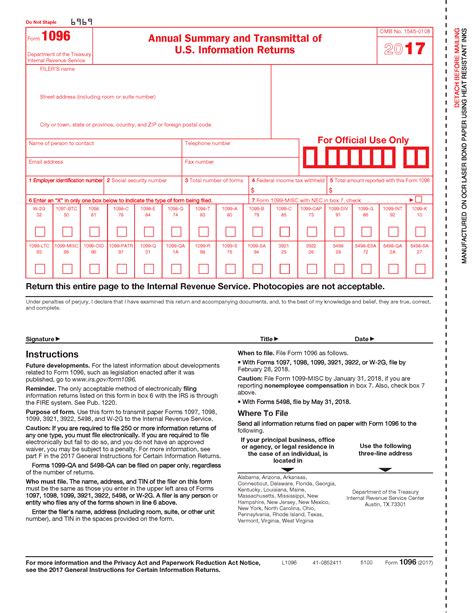

Get the Printable 1096 Annual Summary Form for easy tax reporting, including W-2 and 1099 forms, annual summaries, and IRS filing instructions.

The importance of accurate and timely tax reporting cannot be overstated, especially for businesses and organizations that need to file various forms with the Internal Revenue Service (IRS). One such form is the 1096 Annual Summary Form, which serves as a summary of all the information returns filed by a business during a given tax year. Understanding the purpose and requirements of this form is crucial for ensuring compliance with tax laws and avoiding potential penalties.

The 1096 Annual Summary Form is used by businesses to report the total amount of payments made to recipients during the tax year, as well as the total amount of federal income tax withheld from those payments. This information is typically reported on various information returns, such as the 1099-MISC form, which is used to report miscellaneous income, and the 1099-INT form, which is used to report interest income. The 1096 form provides a summary of all these information returns, making it easier for the IRS to track and verify the accuracy of the reported information.

For businesses and organizations, completing the 1096 Annual Summary Form accurately and filing it on time is essential. The form requires detailed information about the type and amount of payments made, as well as the amount of federal income tax withheld. Failure to file this form or providing inaccurate information can result in penalties and fines, which can be costly and damaging to a business's reputation. Therefore, it is crucial to understand the requirements and instructions for completing the 1096 form to ensure compliance with tax laws and regulations.

Introduction to the 1096 Annual Summary Form

The 1096 Annual Summary Form is a critical component of the tax reporting process for businesses and organizations. The form is used to summarize the information reported on various information returns, such as the 1099-MISC and 1099-INT forms. The 1096 form provides a concise and accurate summary of the total amount of payments made and the total amount of federal income tax withheld during the tax year. This information is essential for the IRS to track and verify the accuracy of the reported information, ensuring compliance with tax laws and regulations.

Benefits of Using the 1096 Annual Summary Form

The 1096 Annual Summary Form offers several benefits to businesses and organizations. Some of the key benefits include: * Simplified tax reporting: The 1096 form provides a concise and accurate summary of the information reported on various information returns, making it easier to track and verify the accuracy of the reported information. * Reduced errors: By using the 1096 form, businesses can reduce the likelihood of errors and inaccuracies in their tax reporting, which can result in penalties and fines. * Improved compliance: The 1096 form helps businesses ensure compliance with tax laws and regulations, reducing the risk of penalties and fines. * Enhanced organization: The 1096 form provides a centralized location for tracking and reporting information returns, making it easier to manage and organize tax-related documents.How to Complete the 1096 Annual Summary Form

Completing the 1096 Annual Summary Form requires careful attention to detail and accuracy. The form consists of several sections, each requiring specific information about the type and amount of payments made, as well as the amount of federal income tax withheld. To complete the form accurately, businesses should follow these steps:

- Gather all information returns: Collect all the information returns filed during the tax year, including the 1099-MISC and 1099-INT forms.

- Calculate the total amount of payments: Calculate the total amount of payments made to recipients during the tax year, as reported on the information returns.

- Calculate the total amount of federal income tax withheld: Calculate the total amount of federal income tax withheld from the payments made during the tax year.

- Complete the 1096 form: Enter the required information on the 1096 form, including the total amount of payments made and the total amount of federal income tax withheld.

- Review and verify: Review and verify the accuracy of the information reported on the 1096 form to ensure compliance with tax laws and regulations.

Common Mistakes to Avoid When Completing the 1096 Annual Summary Form

When completing the 1096 Annual Summary Form, businesses should avoid common mistakes that can result in penalties and fines. Some of the key mistakes to avoid include: * Inaccurate information: Ensure that the information reported on the 1096 form is accurate and consistent with the information returns. * Missing information: Ensure that all required information is included on the 1096 form, including the total amount of payments made and the total amount of federal income tax withheld. * Late filing: Ensure that the 1096 form is filed on time, as late filing can result in penalties and fines.Importance of Timely Filing of the 1096 Annual Summary Form

Timely filing of the 1096 Annual Summary Form is crucial for businesses and organizations. The IRS requires that the 1096 form be filed by January 31st of each year, and failure to file on time can result in penalties and fines. Some of the key reasons for timely filing include:

- Avoiding penalties: Timely filing helps businesses avoid penalties and fines, which can be costly and damaging to a business's reputation.

- Ensuring compliance: Timely filing ensures compliance with tax laws and regulations, reducing the risk of penalties and fines.

- Simplifying tax reporting: Timely filing simplifies tax reporting, making it easier to track and verify the accuracy of the reported information.

Consequences of Late Filing of the 1096 Annual Summary Form

Late filing of the 1096 Annual Summary Form can have serious consequences for businesses and organizations. Some of the key consequences include: * Penalties: Late filing can result in penalties, which can be costly and damaging to a business's reputation. * Fines: Late filing can result in fines, which can be costly and damaging to a business's reputation. * Loss of credibility: Late filing can damage a business's credibility and reputation, making it harder to attract investors and customers.Best Practices for Managing the 1096 Annual Summary Form

Managing the 1096 Annual Summary Form requires careful attention to detail and accuracy. Some of the best practices for managing the 1096 form include:

- Centralized tracking: Use a centralized system to track and manage information returns, making it easier to complete the 1096 form accurately.

- Automated reporting: Use automated reporting tools to simplify tax reporting and reduce the likelihood of errors.

- Regular review: Regularly review and verify the accuracy of the information reported on the 1096 form to ensure compliance with tax laws and regulations.

Tools and Resources for Completing the 1096 Annual Summary Form

Several tools and resources are available to help businesses complete the 1096 Annual Summary Form accurately and efficiently. Some of the key tools and resources include: * Tax software: Use tax software to simplify tax reporting and reduce the likelihood of errors. * IRS resources: Use IRS resources, such as the IRS website and tax publications, to ensure compliance with tax laws and regulations. * Professional assistance: Seek professional assistance from a tax professional or accountant to ensure accurate and timely completion of the 1096 form.Gallery of 1096 Annual Summary Form

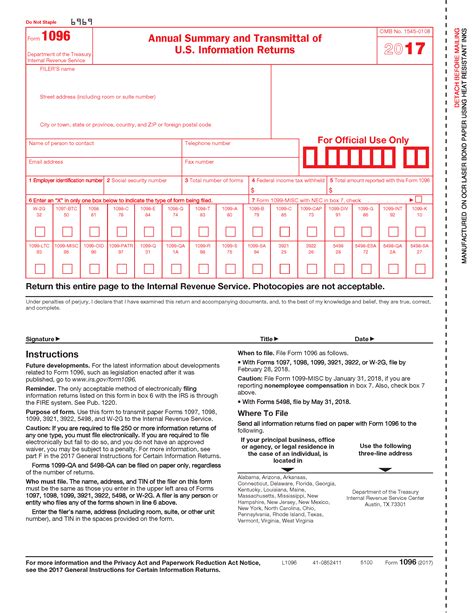

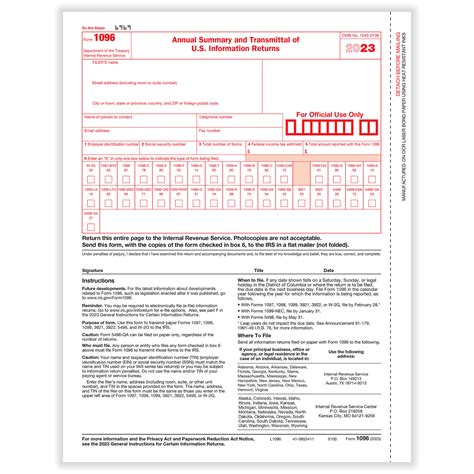

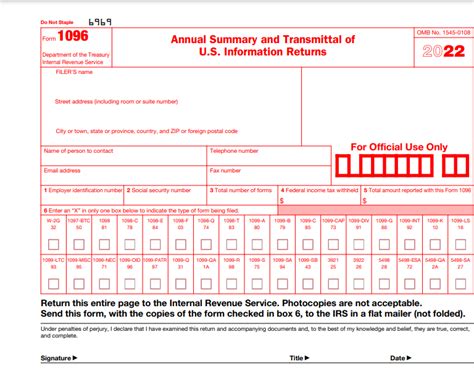

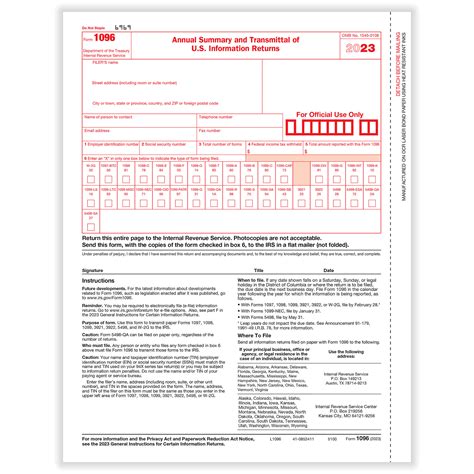

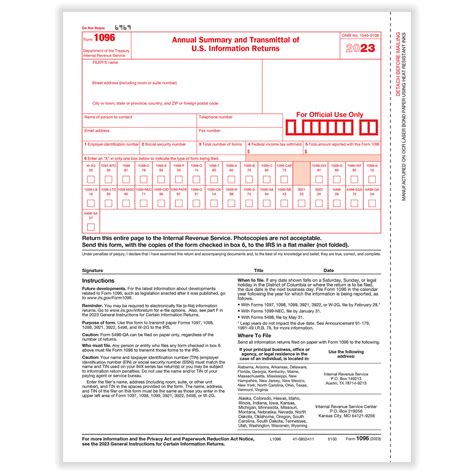

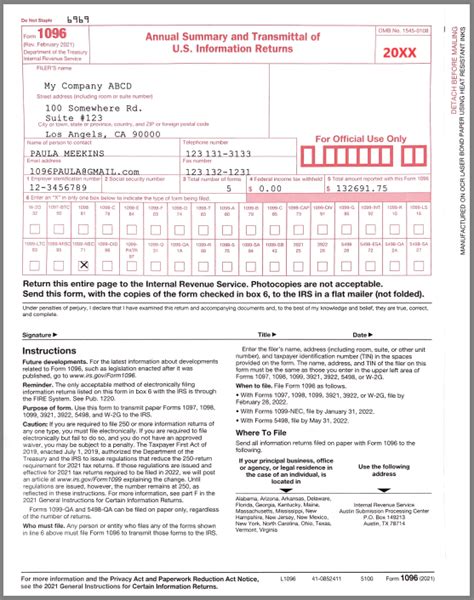

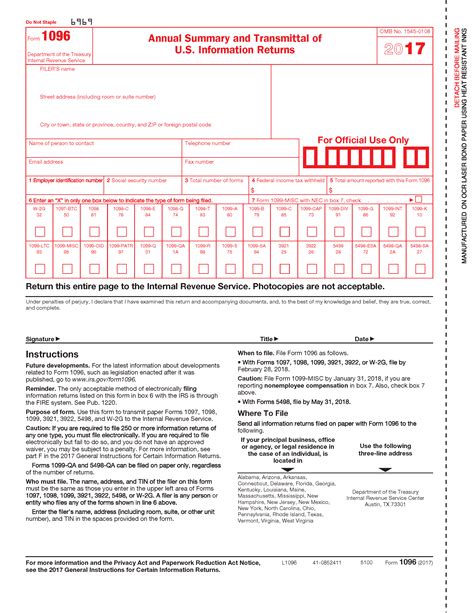

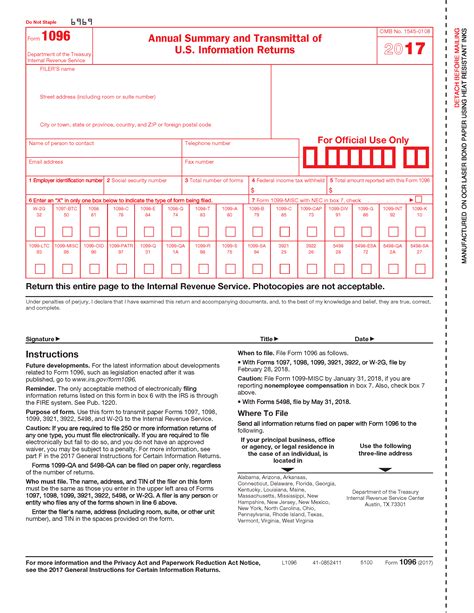

1096 Annual Summary Form Image Gallery

Frequently Asked Questions

What is the purpose of the 1096 Annual Summary Form?

+The 1096 Annual Summary Form is used to summarize the information reported on various information returns, such as the 1099-MISC and 1099-INT forms.

How do I complete the 1096 Annual Summary Form?

+To complete the 1096 form, gather all information returns, calculate the total amount of payments made and the total amount of federal income tax withheld, and enter the required information on the 1096 form.

What are the consequences of late filing of the 1096 Annual Summary Form?

+Late filing of the 1096 form can result in penalties and fines, as well as damage to a business's credibility and reputation.

What tools and resources are available to help complete the 1096 Annual Summary Form?

+Several tools and resources are available, including tax software, IRS resources, and professional assistance from a tax professional or accountant.

How can I ensure accurate and timely completion of the 1096 Annual Summary Form?

+To ensure accurate and timely completion of the 1096 form, use a centralized system to track and manage information returns, automate reporting, and regularly review and verify the accuracy of the information reported.

In conclusion, the 1096 Annual Summary Form is a critical component of the tax reporting process for businesses and organizations. By understanding the purpose and requirements of this form, businesses can ensure compliance with tax laws and regulations, avoid penalties and fines, and simplify tax reporting. To complete the 1096 form accurately and efficiently, businesses should use a centralized system to track and manage information returns, automate reporting, and regularly review and verify the accuracy of the information reported. By following these best practices and using the available tools and resources, businesses can ensure accurate and timely completion of the 1096 Annual Summary Form. We invite you to share your thoughts and experiences with the 1096 Annual Summary Form in the comments section below.