Intro

Saving money is a crucial aspect of personal finance, and having a significant amount of money set aside can provide peace of mind and financial security. The 10k savings challenge is a popular trend that encourages individuals to save $10,000 in a specific timeframe, often a year. This challenge can be a great way to build an emergency fund, pay off debt, or work towards a long-term financial goal. In this article, we will explore the importance of saving money, the benefits of the 10k savings challenge, and provide tips and strategies for achieving this goal.

The importance of saving money cannot be overstated. Having a savings cushion can help individuals weather financial storms, such as job loss, medical emergencies, or car repairs. It can also provide the freedom to pursue opportunities, such as starting a business or traveling. Moreover, saving money can help individuals build wealth over time, achieve financial independence, and secure their financial future. With the 10k savings challenge, individuals can take the first step towards building a strong financial foundation and achieving their long-term financial goals.

Saving $10,000 in a year may seem like a daunting task, but it is achievable with discipline, patience, and the right strategies. The benefits of the 10k savings challenge are numerous, including building an emergency fund, paying off high-interest debt, and making progress towards long-term financial goals. Additionally, the challenge can help individuals develop healthy financial habits, such as budgeting, saving, and investing. By completing the 10k savings challenge, individuals can gain a sense of accomplishment, confidence, and control over their finances.

Understanding the 10k Savings Challenge

Benefits of the 10k Savings Challenge

The benefits of the 10k savings challenge are numerous and can have a significant impact on an individual's financial well-being. Some of the benefits include: * Building an emergency fund to cover unexpected expenses * Paying off high-interest debt, such as credit card balances * Making progress towards long-term financial goals, such as buying a house or retirement * Developing healthy financial habits, such as budgeting and saving * Gaining a sense of accomplishment and confidence in managing financesTips for Achieving the 10k Savings Challenge

Strategies for Saving $10,000

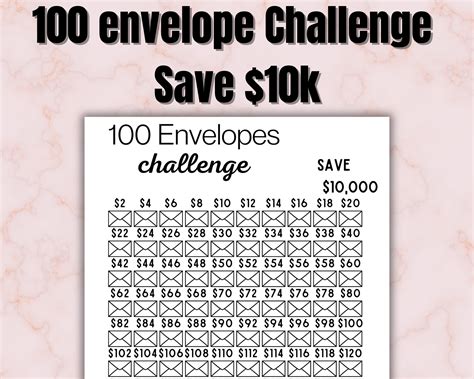

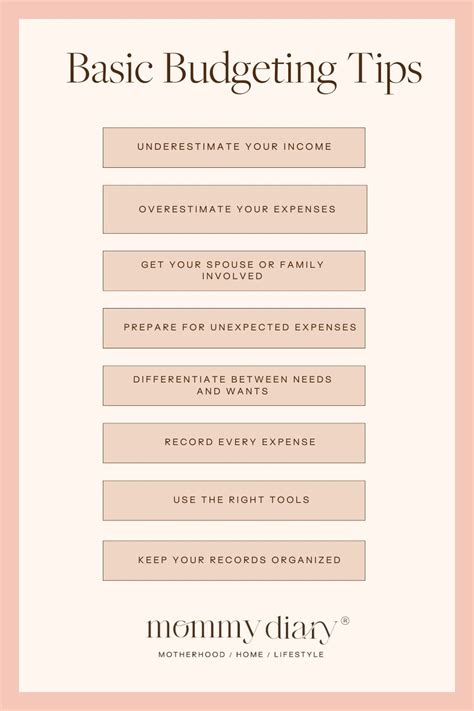

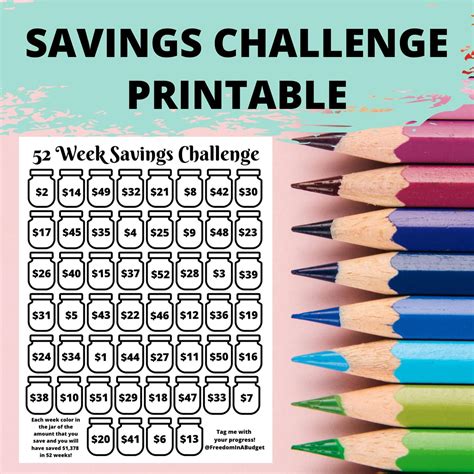

Saving $10,000 in a year requires a solid plan and consistent execution. Here are some strategies to consider: * Break it down into smaller chunks: Divide the goal into smaller, manageable chunks, such as saving $833 per month or $192 per week. * Use the 50/30/20 rule: Allocate 50% of income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment. * Take advantage of tax-advantaged accounts: Utilize tax-advantaged accounts, such as 401(k) or IRA, to save for retirement and other long-term goals. * Consider a savings challenge: Join a savings challenge, such as the 52-week savings challenge, to stay motivated and accountable.Overcoming Obstacles and Staying Motivated

Common Mistakes to Avoid

When working towards the 10k savings challenge, it's essential to avoid common mistakes that can derail progress. Here are some mistakes to avoid: * Not having a clear plan: Failing to create a solid plan and budget can lead to confusion and frustration. * Not tracking progress: Not tracking progress can make it difficult to stay motivated and adjust the plan as needed. * Giving up too soon: Giving up too soon can lead to missed opportunities and a lack of progress towards long-term financial goals.Conclusion and Next Steps

Final Thoughts

Saving $10,000 in a year is a challenging but achievable goal. It requires discipline, patience, and the right strategies. By understanding the benefits of the 10k savings challenge, creating a solid plan, and avoiding common mistakes, individuals can achieve their goal and take the first step towards building a strong financial foundation.10k Savings Challenge Image Gallery

What is the 10k savings challenge?

+The 10k savings challenge is a goal to save $10,000 in a specific timeframe, often a year.

How can I achieve the 10k savings challenge?

+To achieve the 10k savings challenge, create a budget, set up automatic transfers, cut expenses, increase income, and avoid impulse purchases.

What are the benefits of the 10k savings challenge?

+The benefits of the 10k savings challenge include building an emergency fund, paying off debt, making progress towards long-term financial goals, and developing healthy financial habits.

We hope this article has provided you with valuable insights and tips to help you achieve the 10k savings challenge. Remember to stay disciplined, patient, and consistent, and don't be afraid to seek help when needed. Share your thoughts and experiences with the 10k savings challenge in the comments below, and don't forget to share this article with friends and family who may benefit from it.