Intro

Streamline financial management with printable accounting sheets, featuring balance templates, expense trackers, and budget planners for efficient bookkeeping and fiscal organization.

The world of accounting can be complex and overwhelming, especially for small business owners or individuals who are new to managing their finances. However, with the right tools and resources, it can be much more manageable. One of the most effective ways to simplify accounting is by using printable accounting sheets. These sheets provide a straightforward and organized way to track income, expenses, and other financial transactions, making it easier to stay on top of your finances.

Printable accounting sheets are particularly useful for those who prefer a hands-on approach to accounting or who need to keep track of finances for a small business or personal project. They can be easily customized to fit specific needs and can be used in conjunction with digital accounting tools for a comprehensive financial management system. Whether you're looking to create a budget, track expenses, or manage invoices, printable accounting sheets can be a valuable resource.

In today's digital age, it's easy to get caught up in the idea that everything needs to be done online. However, there's still a lot to be said for the simplicity and tangibility of printable accounting sheets. Not only can they provide a useful backup in case of technical issues, but they can also help to reduce errors and increase accuracy. By having a physical record of financial transactions, individuals and business owners can more easily identify discrepancies and make adjustments as needed.

Benefits of Using Printable Accounting Sheets

The benefits of using printable accounting sheets are numerous. For one, they provide a clear and organized way to track financial transactions, making it easier to identify areas where costs can be cut or where income can be increased. They also provide a useful backup in case of technical issues or data loss, ensuring that financial records are always accessible. Additionally, printable accounting sheets can be easily customized to fit specific needs, whether it's for personal or business use.

Some of the key benefits of using printable accounting sheets include:

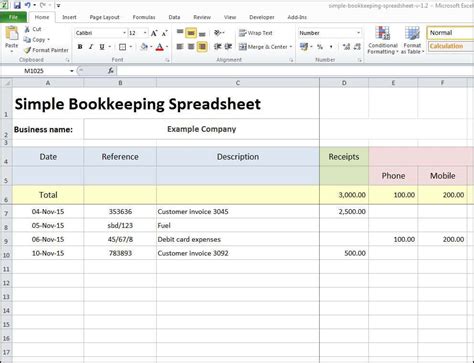

- Simplified financial tracking: Printable accounting sheets provide a straightforward way to track income, expenses, and other financial transactions.

- Increased accuracy: By having a physical record of financial transactions, individuals and business owners can more easily identify discrepancies and make adjustments as needed.

- Customization: Printable accounting sheets can be easily customized to fit specific needs, whether it's for personal or business use.

- Backup: Printable accounting sheets provide a useful backup in case of technical issues or data loss, ensuring that financial records are always accessible.

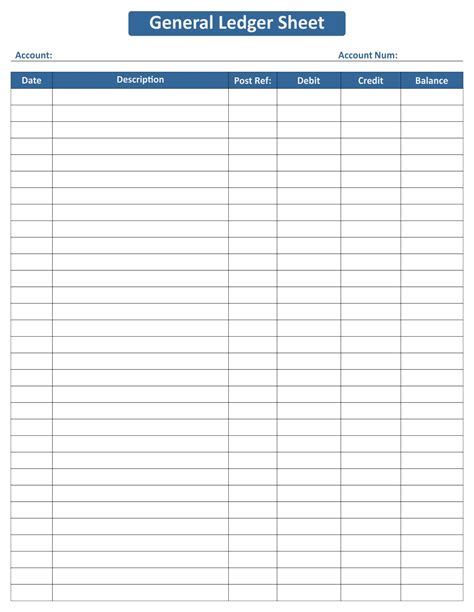

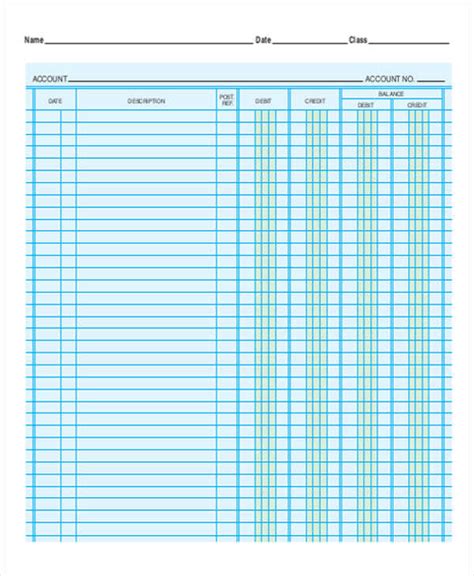

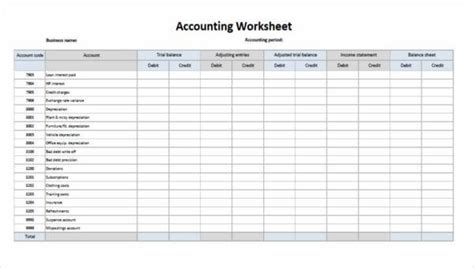

Types of Printable Accounting Sheets

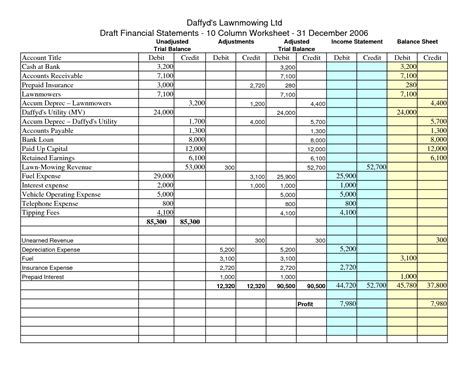

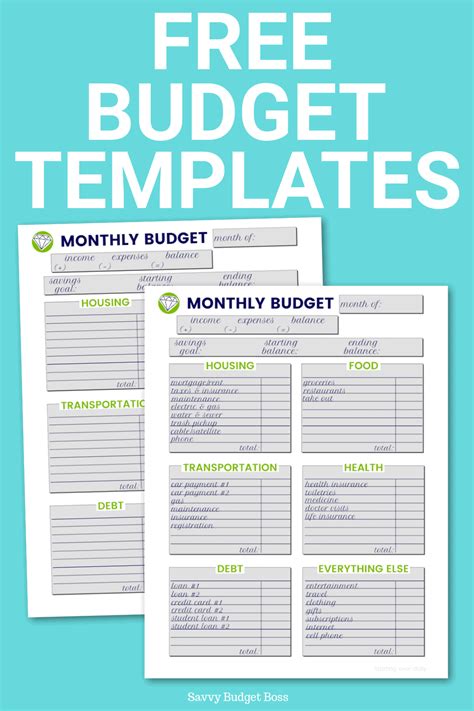

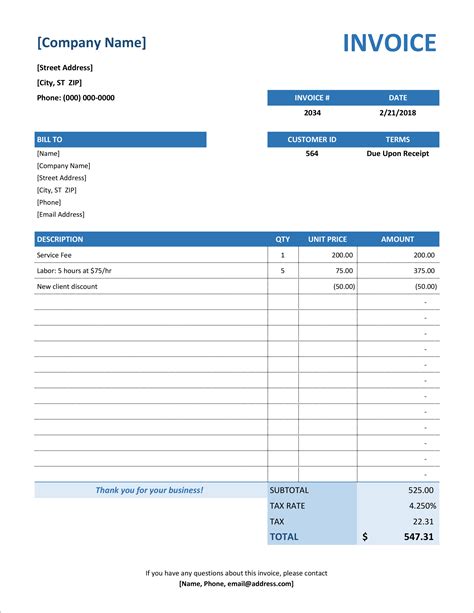

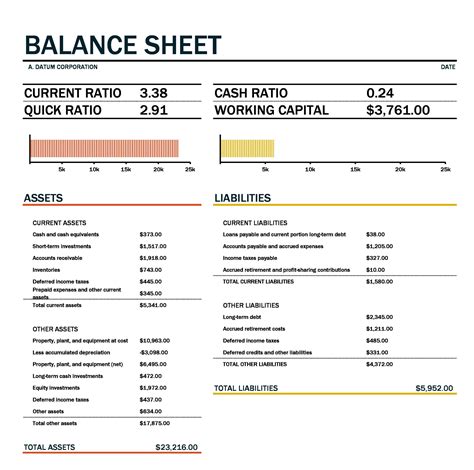

There are many different types of printable accounting sheets available, each designed to meet specific needs. Some of the most common types include:

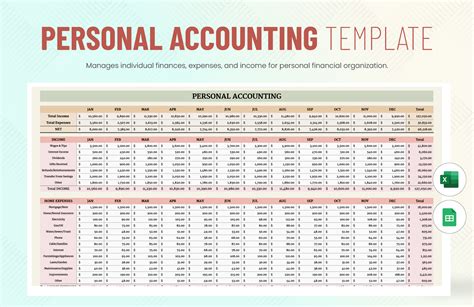

- Budget worksheets: These sheets provide a comprehensive way to track income and expenses, making it easier to create a budget and stick to it.

- Expense trackers: These sheets provide a detailed way to track expenses, including categories and totals.

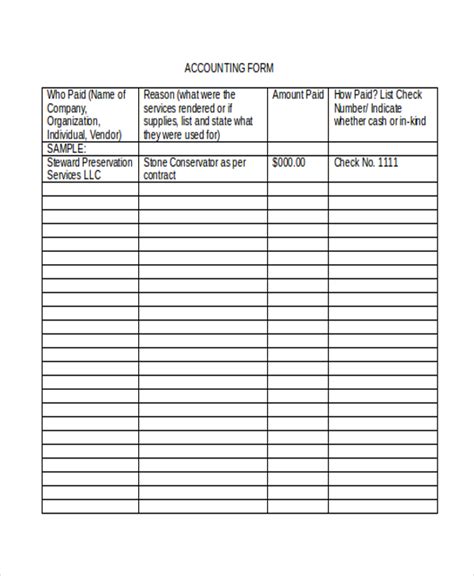

- Invoice templates: These sheets provide a professional way to create and track invoices, including payment terms and totals.

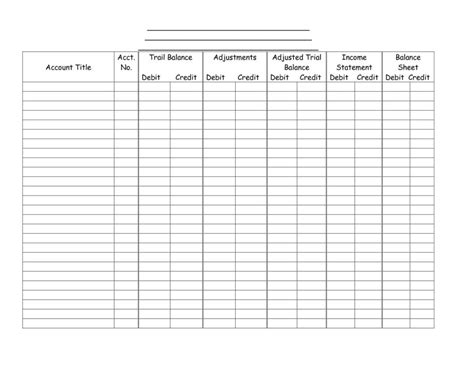

- Balance sheets: These sheets provide a snapshot of financial health, including assets, liabilities, and equity.

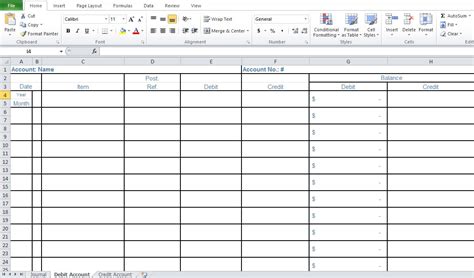

Creating Customizable Printable Accounting Sheets

Creating customizable printable accounting sheets is easier than you might think. With a few simple steps, you can create sheets that meet your specific needs and help you to better manage your finances. Some tips for creating customizable printable accounting sheets include: * Identify your needs: Determine what type of accounting sheet you need and what information you want to track. * Choose a template: Select a template that meets your needs and is easy to use. * Customize the template: Add or remove columns and rows as needed to create a sheet that meets your specific needs. * Test the sheet: Use the sheet for a few weeks to ensure that it's working for you and make any necessary adjustments.Using Printable Accounting Sheets for Small Business

Printable accounting sheets can be particularly useful for small business owners who need to manage finances on a tight budget. By using printable accounting sheets, small business owners can:

- Track income and expenses: Printable accounting sheets provide a clear and organized way to track financial transactions, making it easier to identify areas where costs can be cut or where income can be increased.

- Manage invoices: Printable accounting sheets can be used to create and track invoices, including payment terms and totals.

- Create a budget: Printable accounting sheets can be used to create a comprehensive budget, including projected income and expenses.

Some of the key benefits of using printable accounting sheets for small business include:

- Cost savings: Printable accounting sheets can be a cost-effective way to manage finances, eliminating the need for expensive accounting software.

- Simplified financial tracking: Printable accounting sheets provide a straightforward way to track financial transactions, making it easier to identify areas where costs can be cut or where income can be increased.

- Increased accuracy: By having a physical record of financial transactions, small business owners can more easily identify discrepancies and make adjustments as needed.

Best Practices for Using Printable Accounting Sheets

To get the most out of printable accounting sheets, it's essential to follow best practices. Some tips for using printable accounting sheets include:

- Use them consistently: Make sure to use printable accounting sheets on a regular basis to ensure that financial transactions are accurately tracked.

- Keep them organized: Keep printable accounting sheets in a designated area, such as a file folder or binder, to ensure that they're easy to access and use.

- Review them regularly: Regularly review printable accounting sheets to identify areas where costs can be cut or where income can be increased.

- Customize them as needed: Don't be afraid to customize printable accounting sheets as needed to ensure that they're meeting your specific needs.

Common Mistakes to Avoid When Using Printable Accounting Sheets

While printable accounting sheets can be a valuable tool for managing finances, there are some common mistakes to avoid. Some of the most common mistakes include: * Not using them consistently: Failing to use printable accounting sheets on a regular basis can lead to inaccurate financial tracking and a lack of visibility into financial health. * Not keeping them organized: Failing to keep printable accounting sheets in a designated area can lead to lost or misplaced sheets, making it difficult to track financial transactions. * Not reviewing them regularly: Failing to regularly review printable accounting sheets can lead to a lack of visibility into financial health and a failure to identify areas where costs can be cut or where income can be increased.Conclusion and Next Steps

In conclusion, printable accounting sheets can be a valuable tool for managing finances, providing a clear and organized way to track financial transactions and identify areas where costs can be cut or where income can be increased. By following best practices and avoiding common mistakes, individuals and small business owners can get the most out of printable accounting sheets and improve their financial health.

Next steps may include:

- Identifying the type of printable accounting sheet that best meets your needs

- Customizing the sheet to fit your specific needs

- Using the sheet on a regular basis to track financial transactions

- Reviewing the sheet regularly to identify areas where costs can be cut or where income can be increased

Printable Accounting Sheets Image Gallery

What are printable accounting sheets?

+Printable accounting sheets are physical sheets that can be used to track financial transactions, including income, expenses, and invoices.

How can I use printable accounting sheets for my small business?

+Printable accounting sheets can be used to track income and expenses, manage invoices, and create a budget for your small business.

What are the benefits of using printable accounting sheets?

+The benefits of using printable accounting sheets include simplified financial tracking, increased accuracy, and cost savings.

Can I customize printable accounting sheets to fit my specific needs?

+Yes, printable accounting sheets can be customized to fit your specific needs, including adding or removing columns and rows.

How often should I review my printable accounting sheets?

+It's recommended to review your printable accounting sheets on a regular basis, such as weekly or monthly, to ensure that financial transactions are accurately tracked and to identify areas where costs can be cut or where income can be increased.

We hope this article has provided you with a comprehensive understanding of printable accounting sheets and how they can be used to simplify financial tracking and improve financial health. Whether you're an individual or a small business owner, printable accounting sheets can be a valuable tool in managing your finances. We encourage you to share this article with others who may benefit from using printable accounting sheets and to comment below with any questions or feedback you may have.