Intro

The world of financial transactions has evolved significantly over the years, with various methods emerging to facilitate secure and efficient payments. One such method is Ach authorization, which has gained popularity due to its convenience and reliability. In this article, we will delve into the world of Ach authorization, exploring its benefits, working mechanisms, and the various ways it can be utilized.

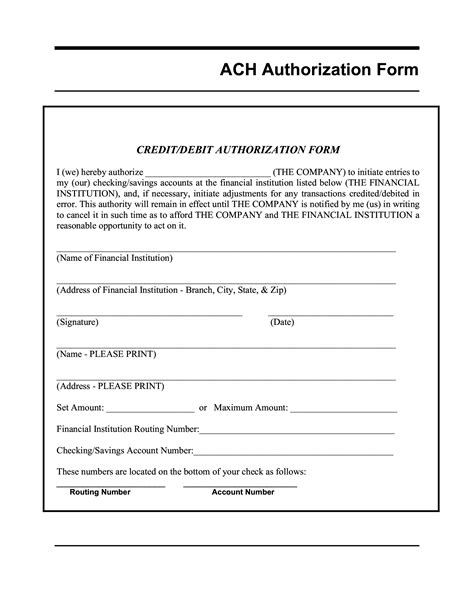

Ach authorization is a type of payment processing that allows individuals and businesses to authorize direct deposits and withdrawals from their bank accounts. This method has become increasingly popular due to its security, speed, and cost-effectiveness. With Ach authorization, users can enjoy a seamless payment experience, eliminating the need for physical checks, credit cards, or other traditional payment methods.

The importance of Ach authorization cannot be overstated, as it has revolutionized the way we conduct financial transactions. Whether you are an individual or a business, Ach authorization offers a convenient and reliable way to manage your finances. In this article, we will explore the various ways Ach authorization can be utilized, highlighting its benefits and advantages.

Ach Authorization Basics

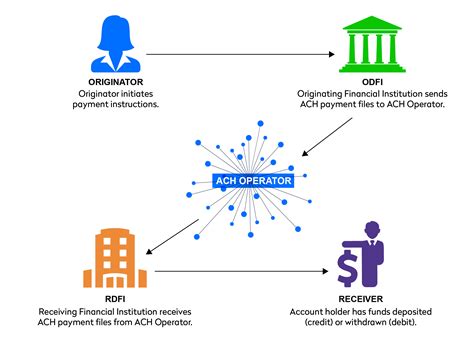

To understand the concept of Ach authorization, it is essential to grasp the basics of how it works. Ach authorization involves a network of financial institutions, payment processors, and banks, which work together to facilitate secure and efficient transactions. When a user initiates an Ach transaction, the payment processor sends a request to the user's bank, which then verifies the account details and authorizes the transaction.

The benefits of Ach authorization are numerous, including reduced transaction costs, increased security, and faster payment processing. With Ach authorization, users can enjoy a seamless payment experience, eliminating the need for physical checks, credit cards, or other traditional payment methods. Additionally, Ach authorization provides a high level of security, as transactions are encrypted and verified through a secure network.

Benefits of Ach Authorization

The benefits of Ach authorization are numerous, making it an attractive option for individuals and businesses alike. Some of the key benefits include:

- Reduced transaction costs: Ach authorization eliminates the need for physical checks, credit cards, or other traditional payment methods, reducing transaction costs.

- Increased security: Ach authorization provides a high level of security, as transactions are encrypted and verified through a secure network.

- Faster payment processing: Ach authorization enables faster payment processing, as transactions are processed electronically.

- Convenience: Ach authorization offers a convenient way to manage finances, eliminating the need for physical checks, credit cards, or other traditional payment methods.

5 Ways to Use Ach Authorization

Ach authorization can be utilized in various ways, making it a versatile payment method. Here are five ways to use Ach authorization:

- Direct Deposit: Ach authorization can be used to set up direct deposits, allowing individuals to receive their salaries, benefits, or other payments directly into their bank accounts.

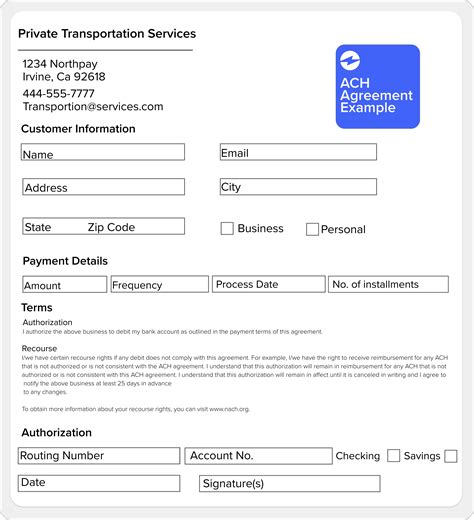

- Bill Payments: Ach authorization can be used to pay bills, such as utility bills, credit card bills, or loan payments, eliminating the need for physical checks or credit cards.

- Online Payments: Ach authorization can be used to make online payments, such as purchasing products or services from e-commerce websites.

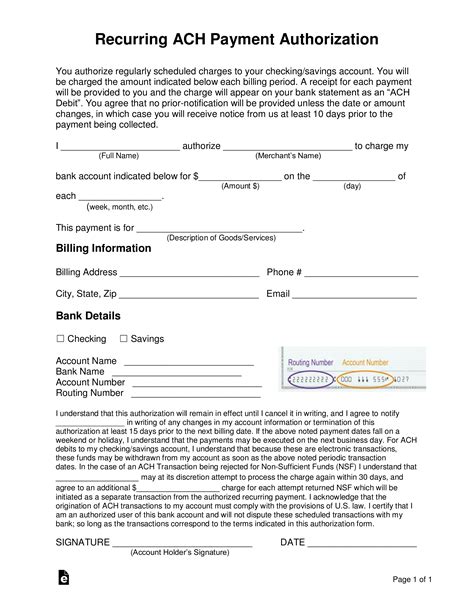

- Recurring Payments: Ach authorization can be used to set up recurring payments, such as subscription services, membership fees, or insurance premiums.

- Business-to-Business Payments: Ach authorization can be used to facilitate business-to-business payments, such as paying suppliers, vendors, or contractors.

Ach Authorization for Businesses

Ach authorization offers numerous benefits for businesses, including reduced transaction costs, increased security, and faster payment processing. Businesses can use Ach authorization to:

- Pay employees through direct deposit

- Pay suppliers, vendors, or contractors

- Receive payments from customers

- Set up recurring payments for subscription services or membership fees

Ach Authorization for Individuals

Ach authorization also offers numerous benefits for individuals, including convenience, security, and faster payment processing. Individuals can use Ach authorization to:

- Receive direct deposits for salaries, benefits, or other payments

- Pay bills, such as utility bills, credit card bills, or loan payments

- Make online payments for products or services

- Set up recurring payments for subscription services or membership fees

Security Measures for Ach Authorization

Ach authorization provides a high level of security, as transactions are encrypted and verified through a secure network. However, it is essential to take additional security measures to protect against potential risks. Some of the security measures include:

- Verifying account details and transaction amounts

- Using strong passwords and two-factor authentication

- Monitoring account activity regularly

- Reporting any suspicious transactions to the bank or payment processor

Common Ach Authorization Errors

While Ach authorization is a reliable payment method, errors can occur. Some of the common Ach authorization errors include:

- Insufficient funds

- Invalid account details

- Transaction limits exceeded

- Verification failures

Best Practices for Ach Authorization

To ensure a seamless Ach authorization experience, it is essential to follow best practices. Some of the best practices include:

- Verifying account details and transaction amounts

- Using strong passwords and two-factor authentication

- Monitoring account activity regularly

- Reporting any suspicious transactions to the bank or payment processor

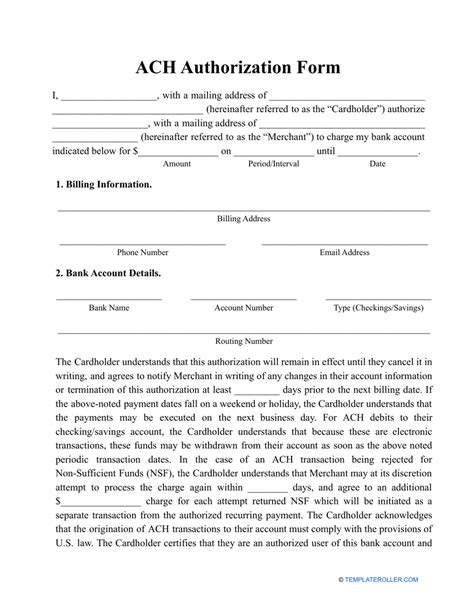

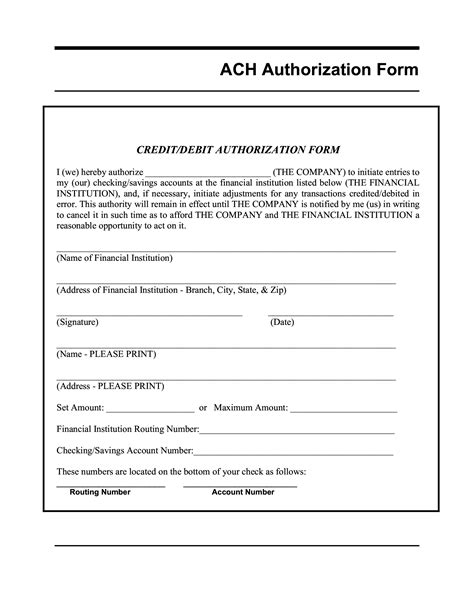

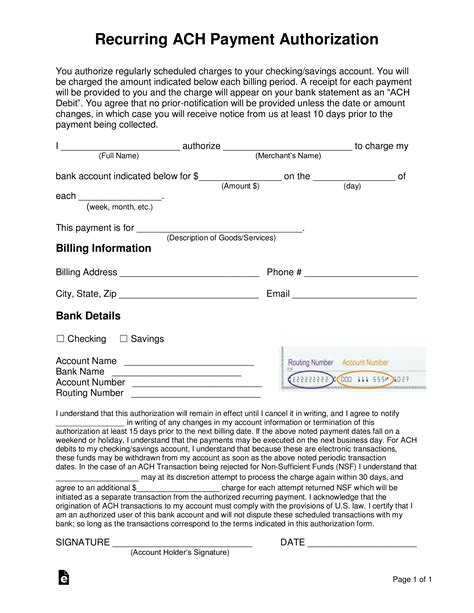

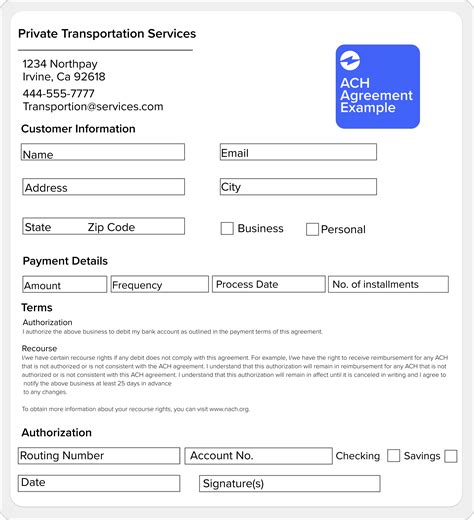

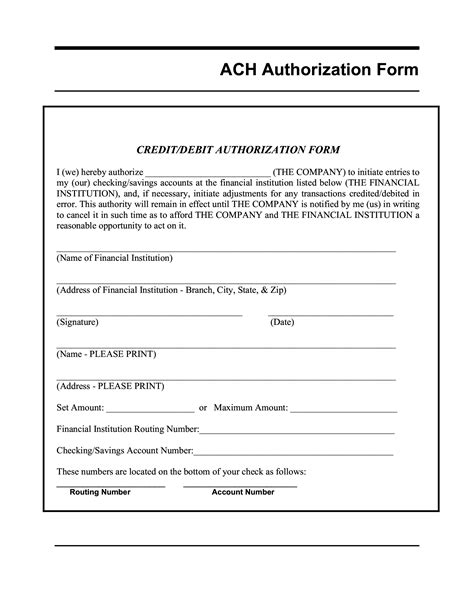

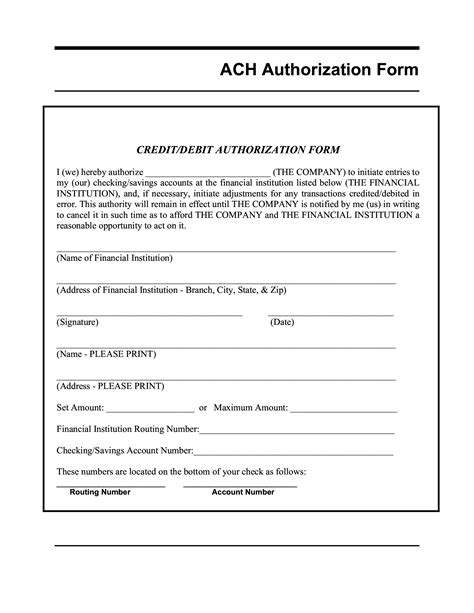

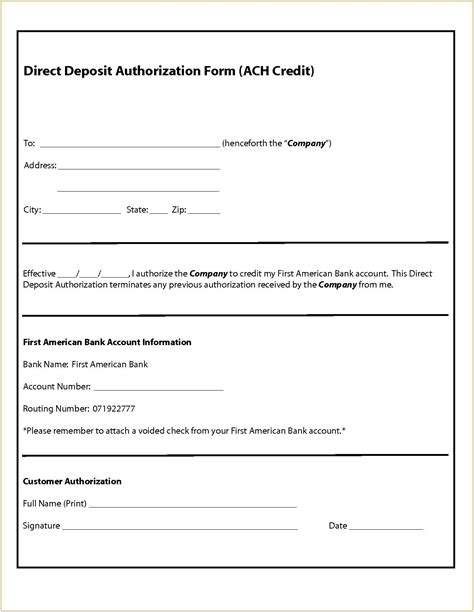

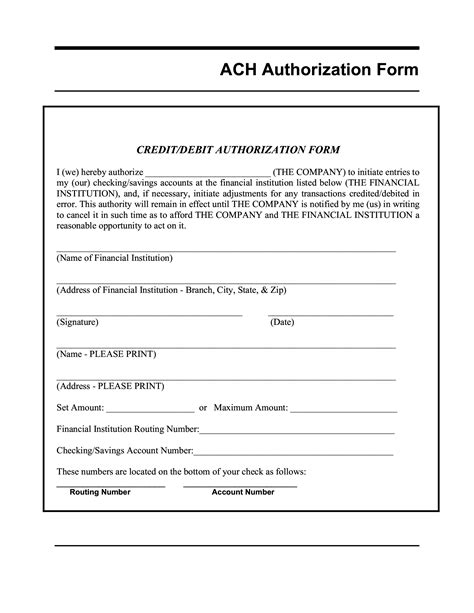

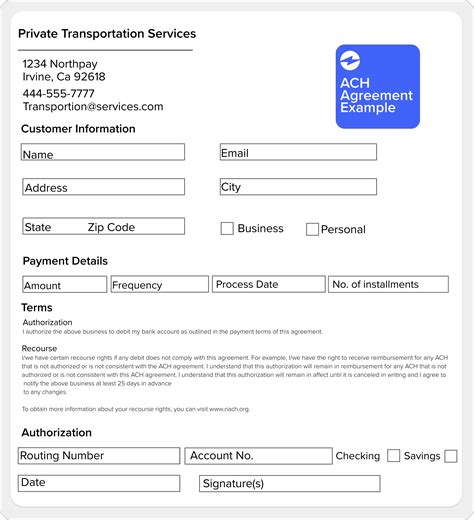

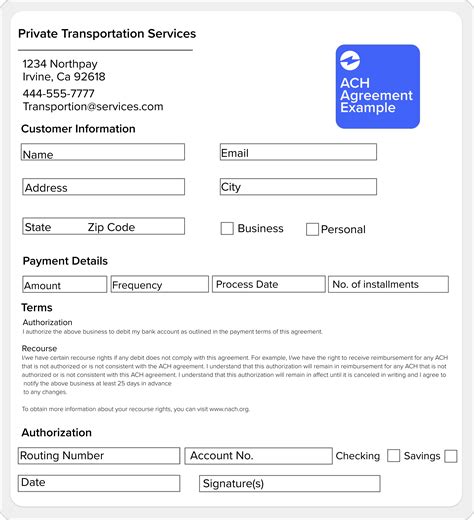

Ach Authorization Image Gallery

What is Ach authorization?

+Ach authorization is a type of payment processing that allows individuals and businesses to authorize direct deposits and withdrawals from their bank accounts.

How does Ach authorization work?

+Ach authorization involves a network of financial institutions, payment processors, and banks, which work together to facilitate secure and efficient transactions.

What are the benefits of Ach authorization?

+The benefits of Ach authorization include reduced transaction costs, increased security, and faster payment processing.

In conclusion, Ach authorization is a reliable and efficient payment method that offers numerous benefits for individuals and businesses. By understanding the basics of Ach authorization, its benefits, and the various ways it can be utilized, users can enjoy a seamless payment experience. Whether you are an individual or a business, Ach authorization is an excellent option for managing your finances. We encourage you to share your thoughts and experiences with Ach authorization in the comments below. Additionally, if you have any questions or need further clarification on any of the topics discussed, please do not hesitate to ask.