Intro

Managing finances effectively is crucial for individuals and households to maintain stability and achieve long-term goals. One essential tool in financial management is keeping track of bills and payments. A bill calendar template serves as a personalized planner that helps in organizing and scheduling payments, ensuring that all bills are paid on time. This article delves into the importance of using a free printable bill calendar template, its benefits, and how it can be a valuable asset in maintaining a healthy financial status.

Effective financial planning involves being proactive and organized. A bill calendar template is a simple yet powerful tool that allows users to visualize their financial obligations over a month or year. By having all the bills and their due dates in one place, individuals can plan their expenses better, avoid late fees, and make informed decisions about their financial priorities. Moreover, using a printable template offers the flexibility of being able to update it manually as needed, providing a tactile experience that many find beneficial for memory retention and planning.

In today's digital age, while there are numerous apps and software programs designed for bill tracking and financial management, a printable bill calendar template retains its relevance. It offers a low-tech solution that is accessible to everyone, regardless of their comfort level with technology. Additionally, for those who prefer a more traditional approach or have limited access to digital tools, a printable template is an ideal alternative. It can be hung on a wall, placed on a fridge, or kept in a planner, serving as a constant reminder of upcoming bills and deadlines.

Benefits of Using a Free Printable Bill Calendar Template

The benefits of incorporating a free printable bill calendar template into one's financial routine are multifaceted. Firstly, it enhances organization by providing a centralized location for all bill due dates, making it easier to keep track of payments. This organization leads to reduced stress, as individuals are less likely to miss payments or incur late fees. Secondly, a bill calendar helps in budgeting by giving a clear overview of monthly expenses, allowing for more accurate financial planning and decision-making. It also facilitates communication among household members, ensuring everyone is aware of the financial obligations and can plan accordingly.

Moreover, using a printable bill calendar template can lead to cost savings. By avoiding late fees and potentially negotiating better rates with service providers due to a history of on-time payments, individuals can save money over time. It also encourages a habit of regular saving and investment, contributing to long-term financial health. For those struggling with debt, a bill calendar can be a crucial tool in debt management, helping to prioritize payments and create a plan to become debt-free.

Customizing Your Bill Calendar Template

One of the advantages of a printable bill calendar template is its customizability. Users can tailor it to fit their specific needs, including the type of bills they need to track, the frequency of payments, and any additional financial reminders such as credit card payments or loan installments. This flexibility ensures that the template remains relevant and useful over time, adapting to changes in financial obligations or personal preferences.

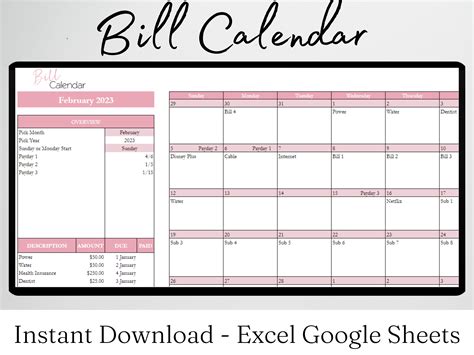

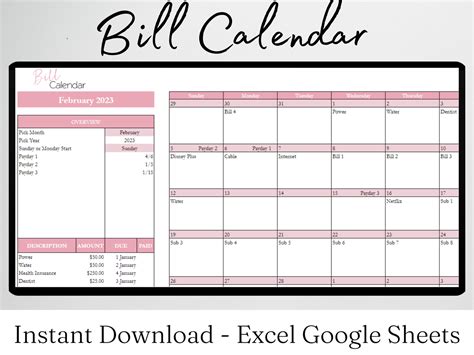

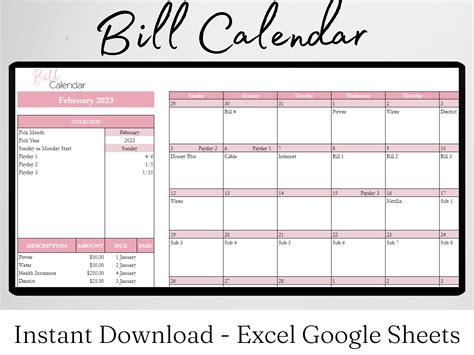

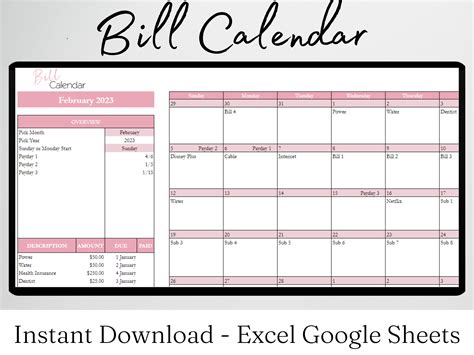

To customize a bill calendar template effectively, start by identifying all the bills and payments that need to be tracked. This includes utilities, rent or mortgage, car payments, insurance, and any subscription services. Next, determine the frequency of each payment, whether it's monthly, quarterly, or annually, and mark the due dates on the calendar. It's also beneficial to include space for notes or comments, where users can jot down payment confirmations, transaction numbers, or any communication with service providers.

Steps to Create Your Own Bill Calendar Template

Creating a personalized bill calendar template is straightforward and requires minimal materials. Here are the steps to follow:

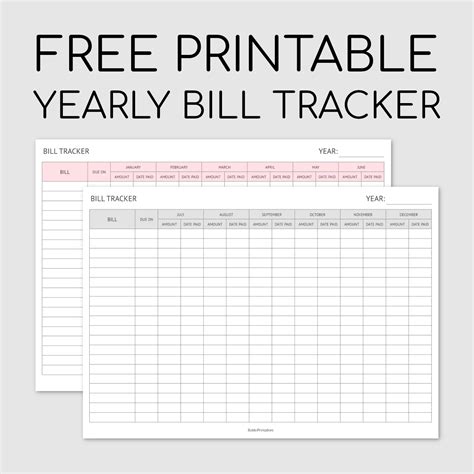

- Determine the Format: Decide whether you prefer a monthly or yearly calendar. A monthly calendar provides a detailed view of upcoming bills, while a yearly calendar gives a broader perspective on financial obligations throughout the year.

- Choose a Design: You can either design your template from scratch using a spreadsheet or word processing software or download a free printable template from the internet. Consider the size, layout, and any additional features you might need, such as space for budgeting or savings goals.

- List All Bills: Compile a list of all the bills you need to pay, including their due dates and frequencies.

- Fill Out the Calendar: Transfer the bill information onto your calendar, marking each due date clearly. Use different colors or symbols to categorize bills by type or priority.

- Review and Update: Regularly review your bill calendar to ensure it remains up-to-date and reflects any changes in your financial obligations.

Tips for Effective Use of a Bill Calendar Template

To maximize the benefits of a bill calendar template, consider the following tips:

- Set Reminders: In addition to marking due dates on the calendar, set reminders on your phone or place sticky notes in strategic locations to ensure you never miss a payment.

- Automate Payments: For bills that remain constant and are paid to the same provider each month, consider setting up automatic payments to simplify the process and reduce the risk of late payments.

- Review and Adjust: Regularly review your financial situation and adjust your bill calendar as needed. This includes updating due dates, adding new bills, or removing paid-off debts.

- Keep It Visible: Place your bill calendar in a location where you will see it frequently, such as on the fridge or near your desk, to keep your financial obligations top of mind.

Conclusion and Next Steps

Incorporating a free printable bill calendar template into your financial management routine can significantly improve your ability to track and pay bills on time. By understanding the benefits, customizing the template to fit your needs, and following tips for effective use, you can enhance your financial organization and stability. Remember, managing finances is an ongoing process that requires regular attention and adjustments. By staying proactive and organized with the help of a bill calendar template, you can achieve your financial goals and secure a healthier financial future.

Bill Calendar Template Image Gallery

What is a bill calendar template?

+A bill calendar template is a tool used to track and organize bill payments and due dates, helping individuals manage their finances more effectively.

Why use a printable bill calendar template?

+Using a printable bill calendar template offers flexibility, accessibility, and a tactile experience, making it easier to manage finances for those who prefer a non-digital approach or need a backup to digital tools.

How do I customize a bill calendar template?

+To customize a bill calendar template, identify all your bills and their due dates, determine the frequency of payments, and mark these on your calendar. You can also add notes or comments as needed.

What are the benefits of using a bill calendar template?

+The benefits include enhanced organization, reduced stress, improved budgeting, cost savings through avoided late fees, and better communication among household members regarding financial obligations.

How often should I review my bill calendar template?

+Regularly review your bill calendar template, ideally monthly, to ensure it remains up-to-date, reflect any changes in financial obligations, and make adjustments as necessary.

In conclusion, a free printable bill calendar template is a versatile and effective tool for managing finances. By understanding its benefits, customizing it to fit individual needs, and using it in conjunction with other financial management strategies, individuals can improve their financial stability and achieve long-term goals. Whether you're looking to simplify your financial routine, avoid late fees, or just stay more organized, a bill calendar template is a valuable resource that can help you take control of your finances. Share your experiences with using bill calendar templates, and let's discuss how they can be tailored to meet different financial needs and preferences.