Intro

Discover 5 ways to track bills effectively, including budgeting tools, bill reminders, and expense management, to simplify financial organization and reduce late payments with efficient bill tracking systems and personal finance strategies.

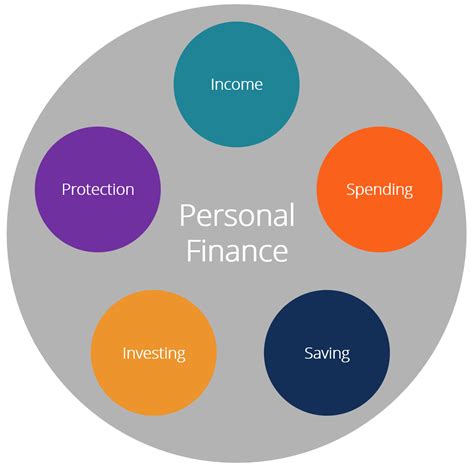

Managing household expenses and tracking bills can be a daunting task, especially with the numerous financial obligations that come with modern life. From rent and utilities to credit card payments and loan repayments, it's easy to lose track of what's due and when. However, staying on top of your bills is crucial for maintaining a good credit score, avoiding late fees, and ensuring a stable financial future. In this article, we will explore five effective ways to track your bills, helping you stay organized and in control of your finances.

Effective bill tracking is essential for avoiding financial pitfalls. It helps you prioritize your payments, make timely payments, and avoid accumulating debt. By implementing a reliable bill tracking system, you can reduce financial stress, improve your credit score, and make the most of your hard-earned money. Whether you're a busy professional or a homeowner with multiple financial obligations, these five methods will help you streamline your bill tracking process and achieve financial stability.

Understanding the Importance of Bill Tracking

1. Using a Budgeting App

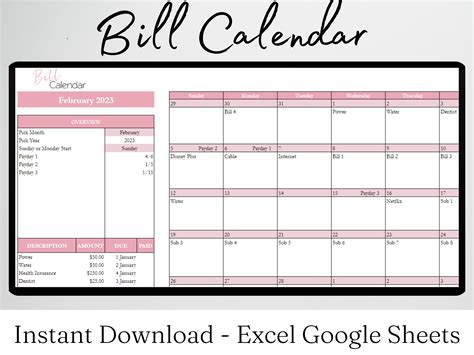

2. Creating a Bill Calendar

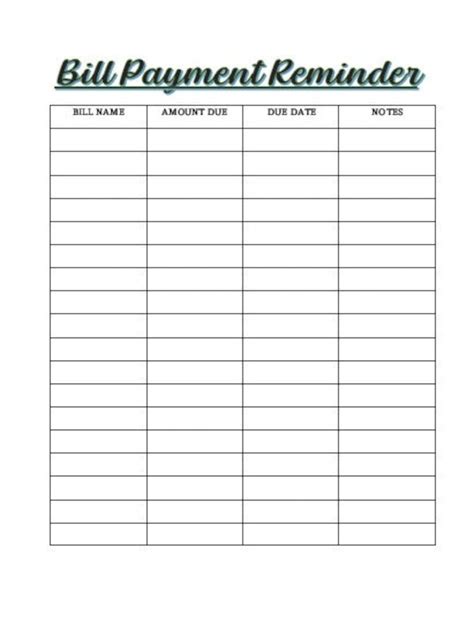

3. Setting Up Automatic Payments

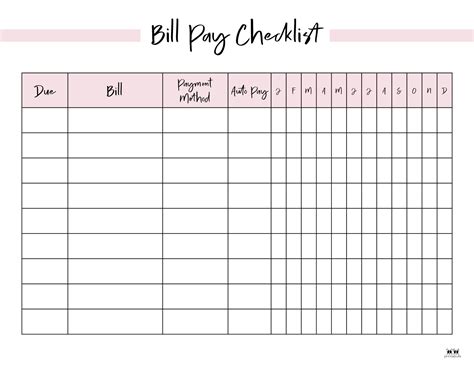

4. Using a Bill Tracking Spreadsheet

5. Implementing a Filing System

Benefits of Bill Tracking

The benefits of bill tracking are numerous, ranging from improved financial stability to reduced stress and anxiety. By implementing a reliable bill tracking system, you can: * Avoid late fees and penalties * Improve your credit score * Reduce financial stress and anxiety * Make informed financial decisions * Identify areas for cost savings * Stay organized and in control of your financesCommon Bill Tracking Mistakes

While bill tracking is essential for financial stability, there are common mistakes to avoid. These include: * Failing to set up reminders and notifications * Not monitoring accounts regularly * Missing payments or paying late * Not keeping track of payment records * Not reviewing and adjusting the bill tracking system regularlyBill Tracking Image Gallery

What is the best way to track bills?

+The best way to track bills is by using a combination of methods, such as budgeting apps, bill calendars, and automatic payments. This approach helps you stay organized, ensures timely payments, and reduces financial stress.

How can I avoid late fees and penalties?

+To avoid late fees and penalties, set up automatic payments, track your bills regularly, and ensure you have sufficient funds to cover your payments. You can also negotiate with your billers to waive late fees or penalties if you've missed a payment.

What are the benefits of using a bill tracking spreadsheet?

+A bill tracking spreadsheet provides a comprehensive overview of your bills, helping you identify patterns, track your expenses, and make informed financial decisions. It also allows you to automate tasks, such as calculating totals and highlighting overdue bills, making it easier to manage your finances.

In conclusion, tracking your bills is essential for maintaining financial stability and avoiding financial pitfalls. By implementing a reliable bill tracking system, you can reduce financial stress, improve your credit score, and make the most of your hard-earned money. Whether you prefer using budgeting apps, creating a bill calendar, or implementing a filing system, there are numerous ways to track your bills effectively. Remember to stay organized, monitor your accounts regularly, and adjust your bill tracking system as needed to ensure you're always in control of your finances. Take the first step towards financial stability today, and start tracking your bills with confidence. Share your favorite bill tracking methods in the comments below, and don't forget to share this article with friends and family who may benefit from these valuable tips.