Intro

Analyze 5 currency charts for insightful forex trading, featuring exchange rates, market trends, and economic indicators for informed investment decisions.

The world of finance is complex and multifaceted, with various factors influencing the value of currencies. Understanding currency charts is crucial for investors, traders, and individuals looking to navigate the global economy. In this article, we will delve into the importance of currency charts, their types, and how to read them.

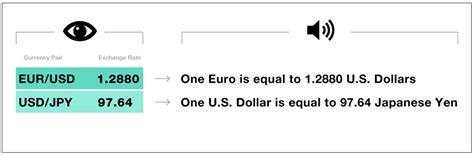

Currency charts are graphical representations of the exchange rates between different currencies over time. They provide valuable insights into market trends, helping users make informed decisions about investments, trades, and financial transactions. With the rise of online trading platforms, accessing and analyzing currency charts has become more convenient than ever.

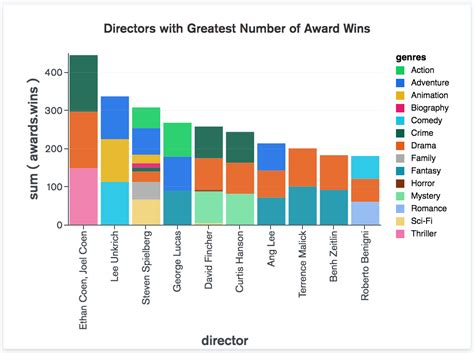

The importance of currency charts lies in their ability to help users identify patterns, trends, and potential areas of support and resistance. By analyzing these charts, traders can develop strategies to maximize profits and minimize losses. Moreover, currency charts are essential for businesses that operate globally, as they need to stay up-to-date with exchange rates to make informed decisions about imports, exports, and investments.

Introduction to Currency Charts

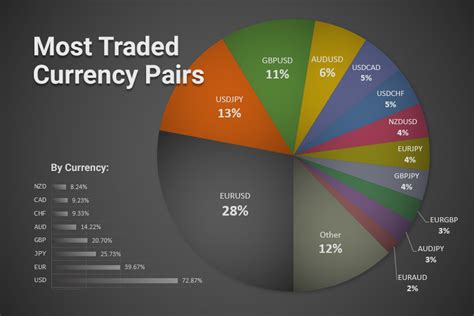

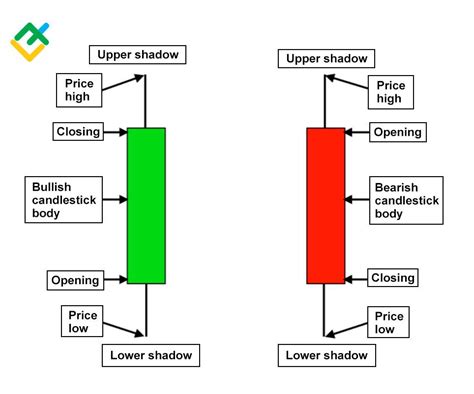

There are several types of currency charts, including line charts, bar charts, and candlestick charts. Each type of chart has its unique characteristics and is used for different purposes. Line charts are the most basic type of chart and are used to show the overall trend of a currency pair over time. Bar charts provide more detailed information, including the high, low, open, and close prices of a currency pair. Candlestick charts are the most popular type of chart among traders, as they provide a clear visual representation of market trends and patterns.

Types of Currency Charts

To read a currency chart, one needs to understand the different components, including the x-axis, y-axis, and the chart pattern itself. The x-axis represents time, while the y-axis represents the exchange rate. The chart pattern is the graphical representation of the exchange rate over time. By analyzing the chart pattern, traders can identify trends, support and resistance levels, and potential areas of breakout.

How to Read Currency Charts

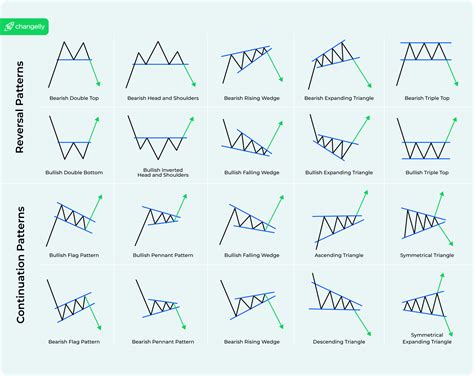

Some of the key concepts to understand when reading currency charts include trend lines, support and resistance levels, and chart patterns. Trend lines are used to identify the overall direction of a currency pair, while support and resistance levels are used to identify areas where the exchange rate may bounce or break. Chart patterns, such as head and shoulders, triangles, and wedges, are used to predict potential breakouts or reversals.

Key Concepts in Currency Charts

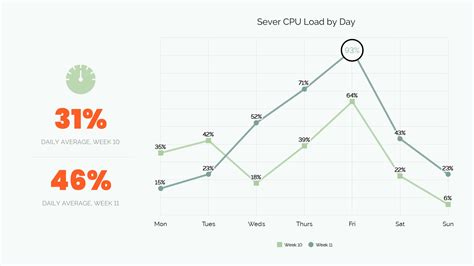

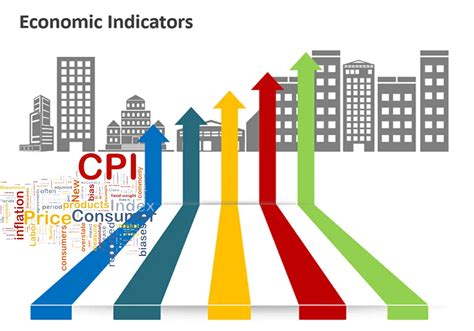

In addition to understanding the different components of a currency chart, it is also essential to stay up-to-date with market news and analysis. Economic indicators, such as GDP, inflation, and employment rates, can have a significant impact on exchange rates. Moreover, geopolitical events, such as elections, trade agreements, and conflicts, can also influence the value of currencies.

Market Analysis and Currency Charts

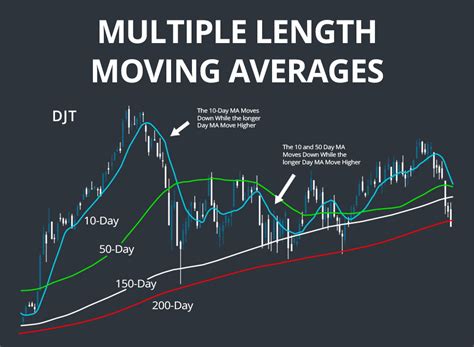

To get the most out of currency charts, it is essential to use them in conjunction with other technical and fundamental analysis tools. Technical indicators, such as moving averages and relative strength index (RSI), can be used to confirm trends and identify potential areas of support and resistance. Fundamental analysis, such as analyzing economic indicators and market news, can be used to understand the underlying factors driving exchange rates.

Using Currency Charts with Other Analysis Tools

In conclusion, currency charts are a powerful tool for navigating the complex world of finance. By understanding the different types of charts, how to read them, and key concepts such as trend lines and chart patterns, traders and investors can make informed decisions about investments and trades. Staying up-to-date with market news and analysis, and using currency charts in conjunction with other technical and fundamental analysis tools, can help maximize profits and minimize losses.

Final Thoughts on Currency Charts

Currency Charts Image Gallery

What is a currency chart?

+A currency chart is a graphical representation of the exchange rate between two currencies over time.

What are the different types of currency charts?

+The different types of currency charts include line charts, bar charts, and candlestick charts.

How do I read a currency chart?

+To read a currency chart, you need to understand the different components, including the x-axis, y-axis, and the chart pattern itself.

We hope this article has provided you with a comprehensive understanding of currency charts and their importance in the world of finance. Whether you are a seasoned trader or just starting out, currency charts are an essential tool for making informed decisions about investments and trades. We invite you to share your thoughts and experiences with currency charts in the comments section below. Additionally, if you have any questions or need further clarification on any of the topics discussed, please do not hesitate to ask.