Intro

Master 5 emergency card tips to avoid financial stress, including credit card, debit card, and cash management strategies for unexpected expenses, overdrafts, and travel emergencies.

Emergency cards are a vital component of our financial lives, offering a safety net during unexpected events or financial setbacks. These cards can provide immediate access to funds, helping us navigate through difficult situations with greater ease. Understanding how to effectively utilize emergency cards is crucial for maximizing their benefits while minimizing potential drawbacks. In this article, we will delve into the importance of emergency cards, their benefits, and most importantly, provide 5 emergency card tips to help you manage your finances more efficiently.

The concept of emergency cards is not new, but their significance has grown over the years as financial uncertainty and the need for immediate financial solutions have become more prevalent. Emergency cards can be a lifeline, offering a quick way to cover unexpected expenses, from car repairs to medical bills. However, like any financial tool, they must be used wisely to avoid falling into debt or experiencing financial strain. It's essential to approach the use of emergency cards with a clear understanding of their terms, benefits, and potential risks.

Effective management of emergency cards requires a combination of financial discipline, awareness of the card's features, and a strategy for repayment. Without a well-thought-out plan, the convenience offered by emergency cards can quickly turn into a financial burden. This is why having the right tips and strategies is indispensable. By adopting smart habits and being mindful of how and when to use emergency cards, individuals can protect their financial health and ensure that these cards serve their intended purpose as a supportive measure during difficult times.

Understanding Emergency Cards

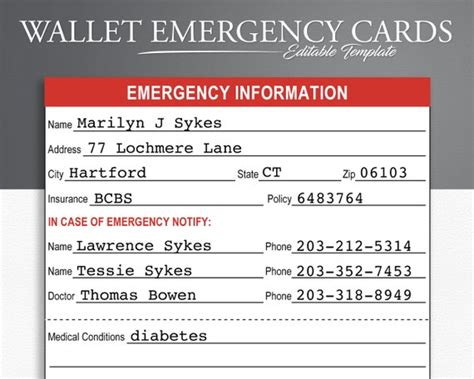

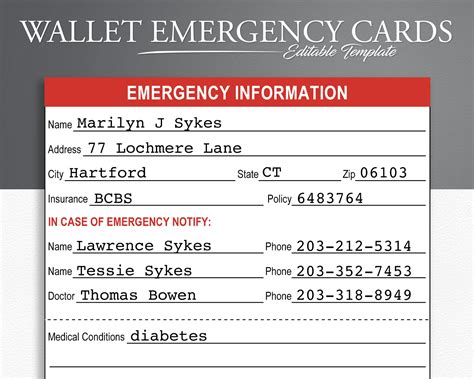

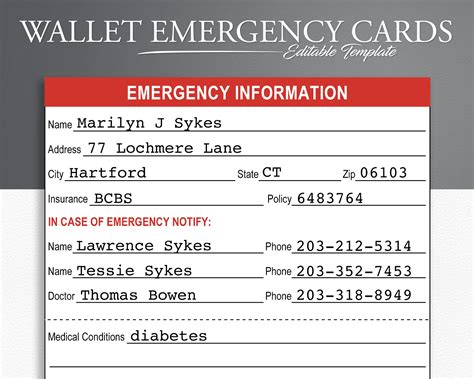

Before diving into the 5 emergency card tips, it's crucial to understand what emergency cards are and how they function. Emergency cards, often referred to as emergency credit cards or emergency loans, are designed to provide immediate financial assistance during unforeseen circumstances. They can be used for a variety of purposes, including covering emergency medical expenses, car repairs, or other unexpected bills. The key feature of emergency cards is their accessibility and the quick approval process, which allows individuals to get the funds they need rapidly.

Benefits of Emergency Cards

The benefits of emergency cards are numerous. They offer a sense of security, knowing that there's a financial safety net available. Additionally, they provide flexibility, as they can be used for various emergency expenses. Emergency cards also offer convenience, with many providers allowing for online applications and quick disbursal of funds. However, it's essential to weigh these benefits against the potential costs and risks associated with emergency cards, such as high interest rates and fees.

5 Emergency Card Tips

-

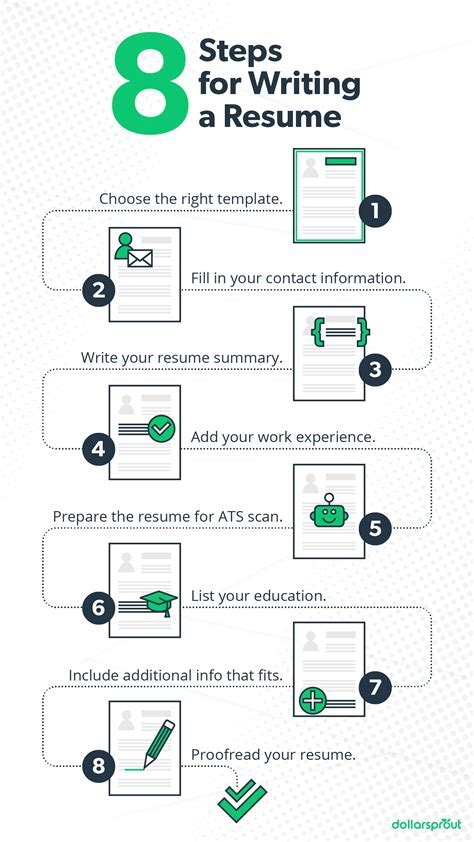

Understand the Terms and Conditions: Before applying for an emergency card, it's vital to read and understand the terms and conditions. This includes the interest rate, fees, repayment terms, and any penalties for late payments. Being informed helps in making the right decision and avoiding potential pitfalls.

-

Create a Repayment Plan: Once you've used an emergency card, creating a repayment plan is crucial. This plan should outline how much you can afford to pay each month and how long it will take to pay off the debt. Sticking to this plan is essential to avoid accumulating interest and falling into debt.

-

Use Emergency Cards Only for Emergencies: It's tempting to use emergency cards for non-essential purchases, but this should be avoided. Emergency cards are designed for unexpected expenses, and using them for other purposes can lead to financial trouble. Discipline is key when it comes to the use of these cards.

-

Monitor Your Credit Score: Applying for and using emergency cards can affect your credit score. It's essential to monitor your credit score regularly and work on improving it. A good credit score can provide better financial opportunities and lower interest rates on future loans or credit cards.

-

Explore Alternative Options: Before opting for an emergency card, consider alternative options. This could include savings, other credit cards with better terms, or even seeking assistance from friends and family. Sometimes, there are more cost-effective and less risky solutions available.

Managing Emergency Card Debt

Managing debt from emergency cards requires a proactive approach. This includes communicating with the lender if you're facing difficulties in making payments, considering debt consolidation options, and prioritizing debt repayment. It's also important to review and adjust your budget to accommodate debt repayment and prevent future financial strain.

Conclusion and Next Steps

In conclusion, emergency cards can be a valuable financial tool when used wisely. By understanding their benefits, being aware of their risks, and following the 5 emergency card tips outlined above, individuals can navigate financial emergencies with greater ease and security. It's also crucial to continuously educate oneself on personal finance and seek professional advice when needed. Remember, the key to benefiting from emergency cards is to use them responsibly and as part of a broader financial strategy.

Gallery of Emergency Card Tips

Emergency Card Tips Image Gallery

What are the key benefits of using emergency cards?

+The key benefits include immediate access to funds, flexibility in use, and convenience in application and disbursal processes.

How can I manage debt from emergency cards effectively?

+Effective management includes creating a repayment plan, communicating with the lender if facing difficulties, and prioritizing debt repayment.

What are some alternative options to emergency cards?

+Alternatives include savings, other credit cards with better terms, seeking assistance from friends and family, and exploring personal loans with favorable conditions.

We hope this comprehensive guide to emergency cards and the 5 emergency card tips have been informative and helpful. Whether you're facing a financial emergency or simply looking to be better prepared for the future, understanding how to use emergency cards wisely is a crucial step in maintaining financial stability. If you have any thoughts, questions, or experiences related to emergency cards, please don't hesitate to share them in the comments below. Your insights can help others navigate their financial challenges more effectively.