Intro

Effective expense reporting is crucial for businesses to maintain transparency, reduce costs, and ensure compliance with financial regulations. Expense reports provide a detailed account of expenditures incurred by employees during business trips, conferences, or other work-related activities. By implementing a well-structured expense reporting system, companies can streamline their financial management, minimize errors, and maximize reimbursements. In this article, we will discuss five essential tips for creating and managing expense reports efficiently.

Expense reports play a vital role in helping organizations track and control their expenses, making it easier to identify areas where costs can be optimized. Moreover, accurate and timely expense reporting enables businesses to reimburse employees promptly, boosting employee satisfaction and morale. With the advancement of technology, automated expense reporting tools have become increasingly popular, offering a convenient and efficient way to manage expenses. However, regardless of the method used, it is essential to follow best practices to ensure that expense reports are accurate, complete, and compliant with company policies.

The importance of expense reports cannot be overstated, as they provide a clear picture of an organization's financial health. By analyzing expense reports, businesses can identify trends, detect anomalies, and make informed decisions about future investments. Furthermore, expense reports help companies to stay compliant with tax laws and regulations, reducing the risk of audits and penalties. As the business landscape continues to evolve, it is crucial for organizations to adapt their expense reporting processes to meet the changing needs of their employees, customers, and stakeholders. By doing so, companies can maintain a competitive edge, drive growth, and achieve long-term success.

Understanding Expense Reports

Types of Expense Reports

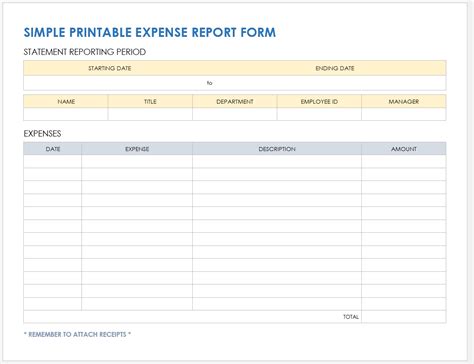

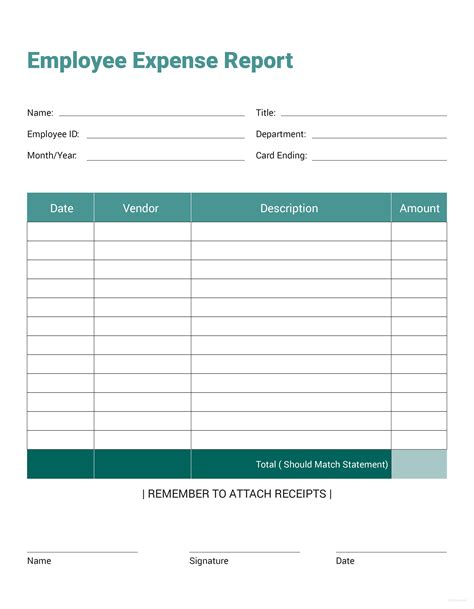

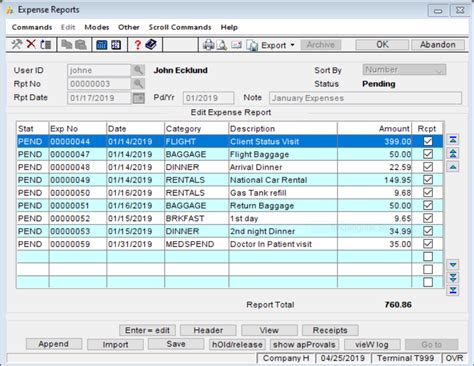

There are several types of expense reports, each designed to capture specific types of expenses. Travel expense reports are used to document expenses incurred during business trips, such as transportation, accommodation, and food. Entertainment expense reports are used to record expenses related to client entertainment, such as meals, events, and gifts. Miscellaneous expense reports are used to capture expenses that do not fit into other categories, such as office supplies, equipment, and software. Understanding the different types of expense reports is crucial to ensure that expenses are properly categorized and reported.Best Practices for Expense Reporting

Expense Reporting Policies and Procedures

Establishing clear expense reporting policies and procedures is crucial to ensure that employees understand what expenses are eligible for reimbursement and how to report them. This includes defining the types of expenses that can be claimed, setting limits on expense amounts, and outlining the documentation required to support expense claims. Businesses should also provide employees with training on expense reporting procedures, ensuring that they understand the importance of accurate and timely reporting. By having clear policies and procedures in place, companies can minimize errors, reduce disputes, and improve employee satisfaction.Automating Expense Reporting

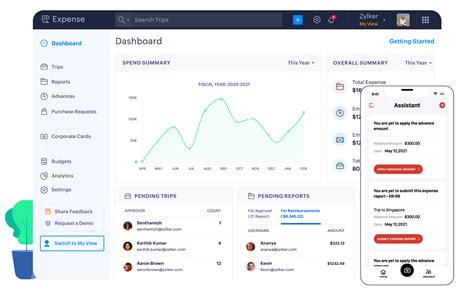

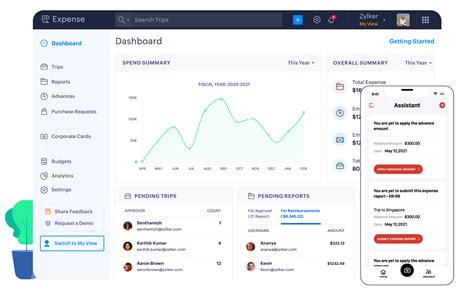

Benefits of Automated Expense Reporting

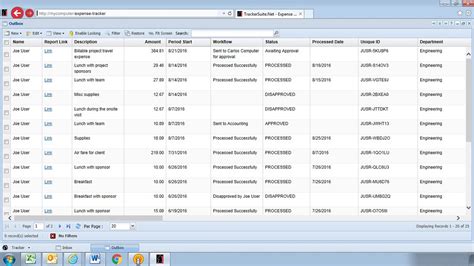

Automated expense reporting offers several benefits, including improved accuracy, increased efficiency, and enhanced compliance. Automated tools can quickly and accurately categorize expenses, reducing the risk of human error and minimizing the time spent on expense reporting. Additionally, automated expense reporting tools can provide real-time insights into expense trends, enabling businesses to make informed decisions about future investments. By automating expense reporting, companies can also improve employee satisfaction, as employees can quickly and easily submit expense reports and receive reimbursements.Expense Report Tips

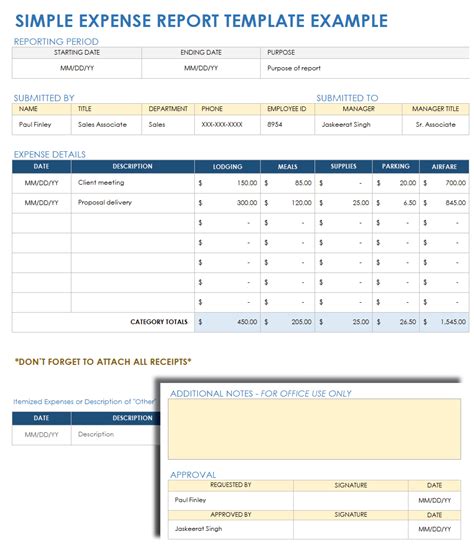

Implementing Expense Report Tips

Implementing these expense report tips can significantly improve the efficiency and accuracy of the expense reporting process. By using a standardized template, ensuring proper documentation and categorization, and submitting reports in a timely manner, businesses can reduce errors, minimize disputes, and improve employee satisfaction. Establishing clear policies and procedures can also help to ensure that employees understand what expenses are eligible for reimbursement and how to report them. By automating expense reporting, companies can take their expense reporting to the next level, improving compliance, reducing costs, and driving growth.Common Expense Reporting Mistakes

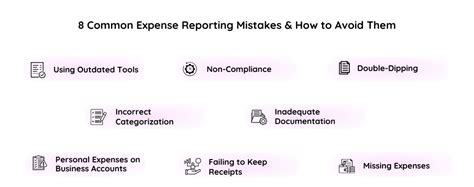

Avoiding Expense Reporting Mistakes

Avoiding expense reporting mistakes requires a combination of clear policies and procedures, employee training, and automated expense reporting tools. By establishing clear guidelines on what expenses are eligible for reimbursement and how to report them, businesses can minimize errors and disputes. Providing employees with training on expense reporting procedures can also help to ensure that employees understand the importance of accurate and timely reporting. By automating expense reporting, companies can reduce manual errors, minimize paperwork, and improve employee productivity.Expense Reporting Tools

Types of Expense Reporting Tools

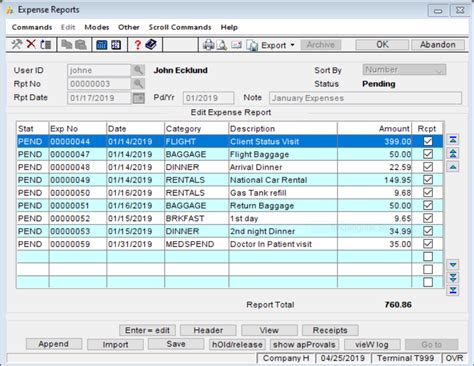

There are various types of expense reporting tools available, including spreadsheet-based tools, cloud-based tools, and mobile apps. Spreadsheet-based tools are simple and easy to use, but can be time-consuming and prone to errors. Cloud-based tools are more advanced, offering real-time tracking and analysis of expenses, as well as integration with accounting systems. Mobile apps are convenient and user-friendly, enabling employees to submit expense reports on-the-go. By choosing the right expense reporting tool, businesses can improve the efficiency and accuracy of their expense reporting process.Expense Report Image Gallery

What is an expense report?

+An expense report is a document that outlines the expenses incurred by employees during business-related activities.

Why is expense reporting important?

+Expense reporting is important because it provides a clear and transparent record of expenditures, enabling businesses to reimburse employees and track expenses accurately.

What are the benefits of automated expense reporting?

+The benefits of automated expense reporting include improved accuracy, increased efficiency, and enhanced compliance.

How can I avoid common expense reporting mistakes?

+To avoid common expense reporting mistakes, establish clear policies and procedures, provide employee training, and consider automating expense reporting.

What are the different types of expense reporting tools?

+The different types of expense reporting tools include spreadsheet-based tools, cloud-based tools, and mobile apps.

In