Intro

Download W4p printable form for tax withholding, featuring fillable templates and instructions, to simplify pension and annuity payments, ensuring accurate withholding and compliance with IRS regulations.

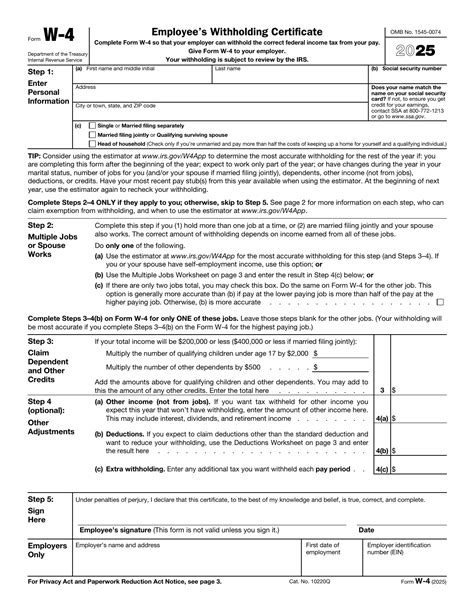

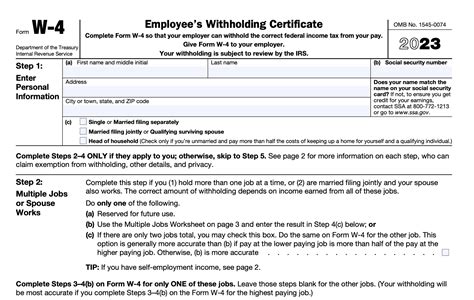

The W-4 form is a crucial document for employees in the United States, as it determines the amount of federal income tax withheld from their wages. The form is used to calculate the correct amount of taxes to be withheld, ensuring that employees do not overpay or underpay their taxes. In this article, we will delve into the world of W-4 printable forms, exploring their importance, benefits, and how to download and fill them out correctly.

The W-4 form is typically provided by employers to their employees, who must fill it out and return it to the employer. However, with the rise of digital technology, it is now possible to download and print W-4 forms from the internet. This has made it easier for employees to access and complete the form, especially for those who are self-employed or have multiple jobs.

One of the primary benefits of using a W-4 printable form is that it allows employees to easily update their tax withholding information. As life circumstances change, such as getting married, having children, or changing jobs, employees may need to adjust their tax withholding. By using a printable W-4 form, employees can quickly and easily make these changes and submit them to their employer.

Another benefit of W-4 printable forms is that they can help reduce errors. When filling out the form by hand, it is easy to make mistakes, such as incorrect calculations or missing information. By using a printable form, employees can ensure that their information is accurate and complete, reducing the risk of errors and potential penalties.

Understanding the W-4 Form

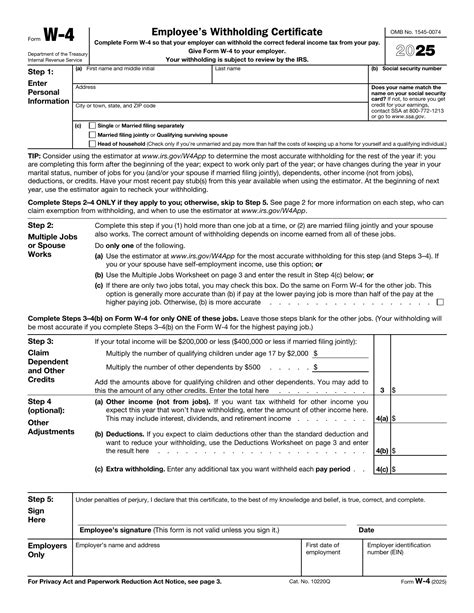

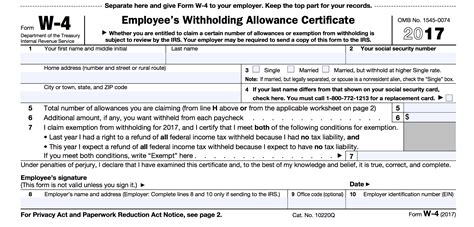

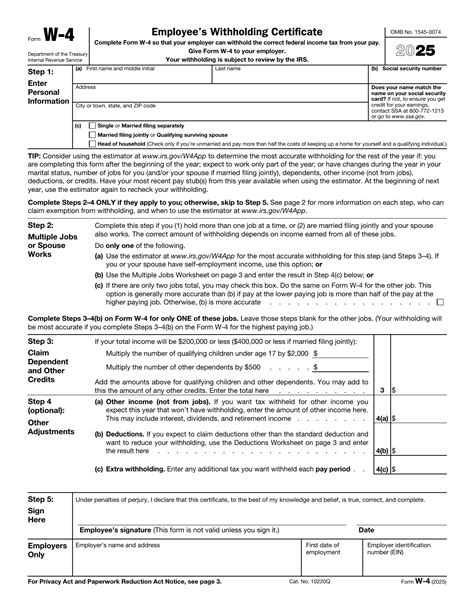

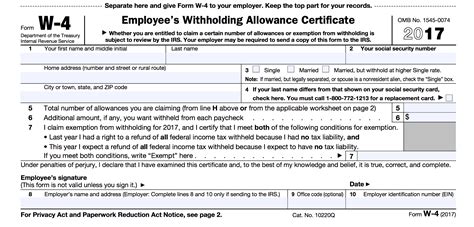

The W-4 form is a simple, one-page document that requires employees to provide basic information, such as their name, address, and Social Security number. The form also asks employees to claim exemptions and deductions, which can affect the amount of taxes withheld. To complete the form, employees will need to calculate their expected tax liability and determine the correct number of allowances to claim.

Benefits of Using a W-4 Printable Form

Using a W-4 printable form can provide several benefits, including: * Easy access to the form, allowing employees to quickly download and print it * Reduced errors, as the form can be completed electronically and checked for accuracy * Increased flexibility, as employees can update their tax withholding information at any time * Improved organization, as the form can be stored electronically and easily retrievedHow to Download and Fill Out a W-4 Printable Form

To download and fill out a W-4 printable form, employees can follow these steps:

- Visit the official website of the Internal Revenue Service (IRS) or a reputable tax preparation website

- Search for the W-4 form and select the correct year

- Download the form and save it to a computer or mobile device

- Open the form and fill it out electronically, using a PDF editor or other software

- Calculate the correct number of allowances to claim, using the IRS's withholding calculator or other resources

- Sign and date the form, and submit it to the employer

Tips for Completing a W-4 Printable Form

When completing a W-4 printable form, employees should keep the following tips in mind: * Use the correct year's form, as tax laws and regulations can change * Calculate the correct number of allowances to claim, to avoid overpaying or underpaying taxes * Keep a copy of the completed form, for record-keeping purposes * Submit the form to the employer promptly, to ensure timely processingCommon Mistakes to Avoid When Using a W-4 Printable Form

When using a W-4 printable form, employees should avoid the following common mistakes:

- Failing to calculate the correct number of allowances to claim

- Not updating the form after changes in life circumstances, such as marriage or the birth of a child

- Not signing and dating the form, which can delay processing

- Not submitting the form to the employer, which can result in incorrect tax withholding

Consequences of Incorrect Tax Withholding

Incorrect tax withholding can have serious consequences, including: * Overpaying taxes, resulting in a large refund at tax time * Underpaying taxes, resulting in a tax bill or penalty * Delayed processing of tax returns, due to errors or missing informationW-4 Printable Form FAQs

Here are some frequently asked questions about W-4 printable forms:

- Q: What is the purpose of the W-4 form? A: The W-4 form is used to determine the correct amount of federal income tax to withhold from an employee's wages.

- Q: How often should I update my W-4 form? A: Employees should update their W-4 form whenever their life circumstances change, such as getting married or having children.

- Q: Can I download and print a W-4 form from the internet? A: Yes, employees can download and print a W-4 form from the IRS website or other reputable tax preparation websites.

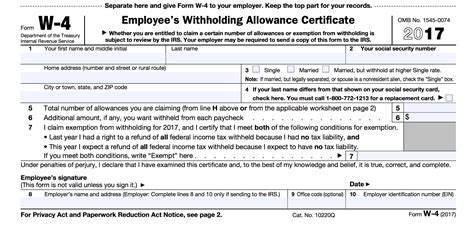

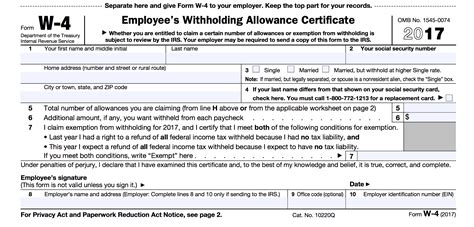

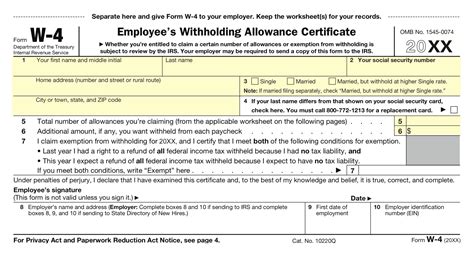

W4 Form Image Gallery

What is the purpose of the W-4 form?

+The W-4 form is used to determine the correct amount of federal income tax to withhold from an employee's wages.

How often should I update my W-4 form?

+Employees should update their W-4 form whenever their life circumstances change, such as getting married or having children.

Can I download and print a W-4 form from the internet?

+Yes, employees can download and print a W-4 form from the IRS website or other reputable tax preparation websites.

What are the consequences of incorrect tax withholding?

+Incorrect tax withholding can result in overpaying or underpaying taxes, delayed processing of tax returns, and potential penalties.

How can I avoid common mistakes when using a W-4 printable form?

+Employees can avoid common mistakes by calculating the correct number of allowances to claim, updating the form after changes in life circumstances, and signing and dating the form.

In conclusion, using a W-4 printable form can provide several benefits, including easy access, reduced errors, and increased flexibility. By understanding the importance of the W-4 form and following the tips outlined in this article, employees can ensure that their tax withholding is accurate and up-to-date. We encourage readers to share their experiences with W-4 printable forms and provide feedback on how to improve the process. Additionally, we invite readers to explore other related topics, such as tax preparation and planning, to further enhance their understanding of personal finance and taxation.