Intro

Streamline insurance claims with 5 insurance verification tips, including pre-certification, eligibility checks, and benefits validation, to reduce errors and ensure seamless medical billing and reimbursement processes.

The process of insurance verification is a crucial step in ensuring that patients receive the medical care they need while also protecting healthcare providers from financial losses. With the ever-changing landscape of healthcare and insurance policies, it's essential to stay up-to-date on the latest verification techniques. In this article, we will delve into the world of insurance verification, exploring its importance, benefits, and providing valuable tips to streamline the process.

Insurance verification is the process of confirming a patient's insurance coverage and benefits before providing medical services. This step is vital in preventing denied claims, reducing bad debt, and improving patient satisfaction. By verifying insurance coverage, healthcare providers can ensure that they receive timely and accurate payments for their services. Moreover, patients can avoid unexpected medical bills and financial burdens.

The importance of insurance verification cannot be overstated. It helps healthcare providers to navigate the complex world of insurance policies, identify potential issues, and prevent costly mistakes. With the rise of high-deductible health plans and narrow networks, insurance verification has become more critical than ever. By investing time and effort into verifying insurance coverage, healthcare providers can protect their bottom line, improve patient outcomes, and maintain a healthy revenue cycle.

Understanding Insurance Verification

Benefits of Insurance Verification

5 Insurance Verification Tips

Common Insurance Verification Mistakes

Best Practices for Insurance Verification

Technology and Insurance Verification

Future of Insurance Verification

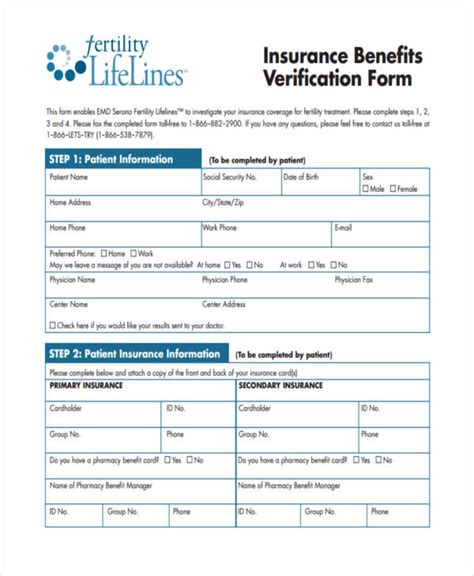

Insurance Verification Image Gallery

What is insurance verification?

+Insurance verification is the process of confirming a patient's insurance coverage and benefits before providing medical services.

Why is insurance verification important?

+Insurance verification is important because it helps healthcare providers prevent denied claims, reduce bad debt, and improve patient satisfaction.

How can healthcare providers verify insurance coverage?

+Healthcare providers can verify insurance coverage using automated systems, online portals, or phone calls to insurance companies.

What are some common mistakes in insurance verification?

+Some common mistakes in insurance verification include failing to verify insurance coverage before providing medical services, not checking for policy changes and updates, and using outdated or incorrect insurance information.

How can healthcare providers improve their insurance verification process?

+Healthcare providers can improve their insurance verification process by using a combination of automated systems and manual verification methods, checking for policy changes and updates regularly, and providing ongoing training and education to staff on insurance verification best practices.

In conclusion, insurance verification is a critical step in ensuring that patients receive the medical care they need while also protecting healthcare providers from financial losses. By following the 5 insurance verification tips outlined in this article, healthcare providers can streamline their verification process, reduce errors, and improve patient satisfaction. As the healthcare landscape continues to evolve, it's essential to stay up-to-date on the latest verification techniques and best practices to ensure accurate and efficient insurance verification. We invite you to share your thoughts and experiences on insurance verification in the comments below and to share this article with your colleagues and peers.