Intro

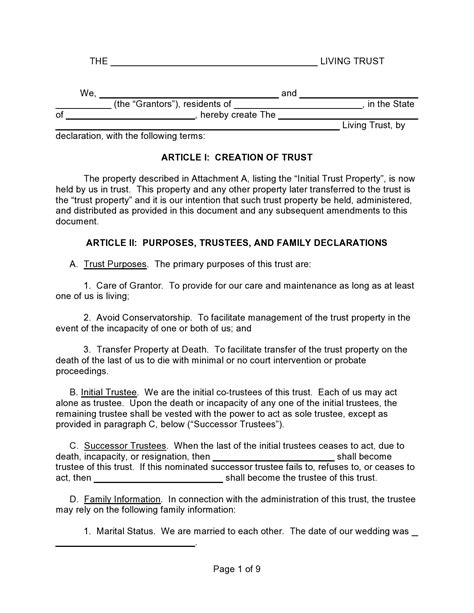

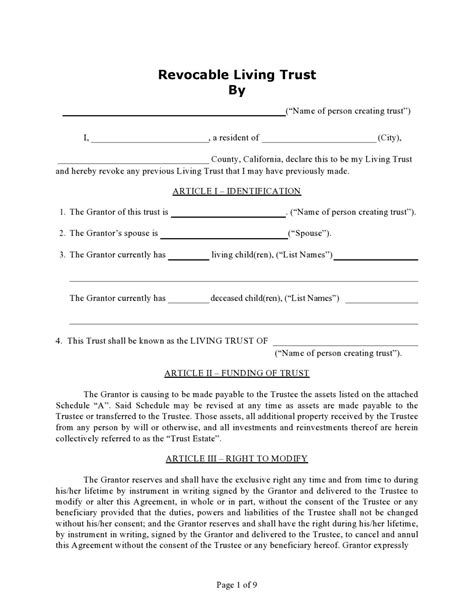

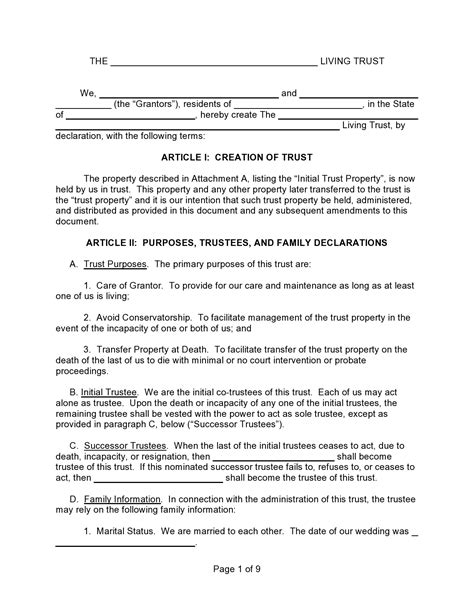

Create a secure estate plan with a free printable living trust form, including revocable trust, asset protection, and inheritance planning, to ensure seamless property transfer and avoid probate.

Creating a living trust can be a complex and costly process, but it is a crucial step in estate planning. A living trust, also known as an inter vivos trust, allows individuals to manage and distribute their assets during their lifetime and after their death. One way to simplify the process is by using a free printable living trust form. However, it is essential to understand the importance and benefits of having a living trust before proceeding.

A living trust provides several benefits, including avoiding probate, reducing estate taxes, and maintaining control over assets. Probate can be a lengthy and expensive process, and by creating a living trust, individuals can ensure that their assets are distributed according to their wishes without the need for court intervention. Additionally, a living trust can help reduce estate taxes by allowing individuals to transfer assets to their beneficiaries during their lifetime.

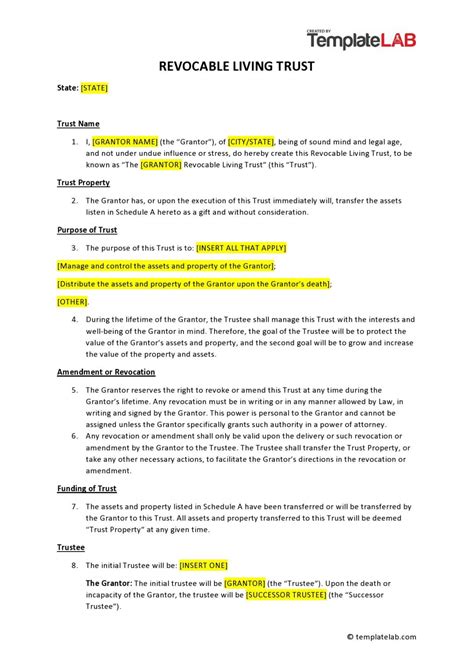

When it comes to creating a living trust, many people are deterred by the cost and complexity of the process. However, using a free printable living trust form can be a cost-effective and straightforward way to establish a living trust. These forms are widely available online and can be customized to fit individual needs. Nevertheless, it is crucial to ensure that the form is valid and compliant with state laws and regulations.

Understanding Living Trusts

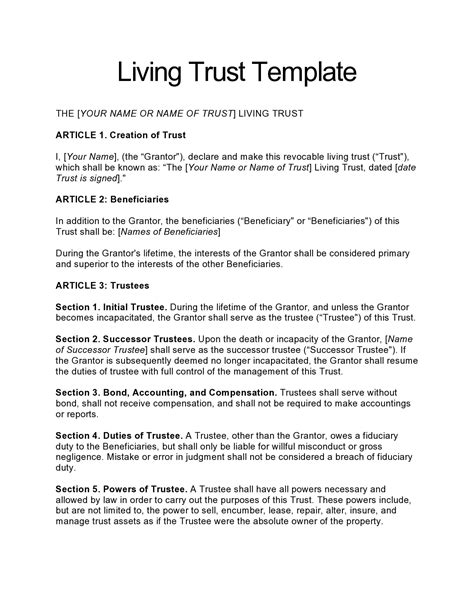

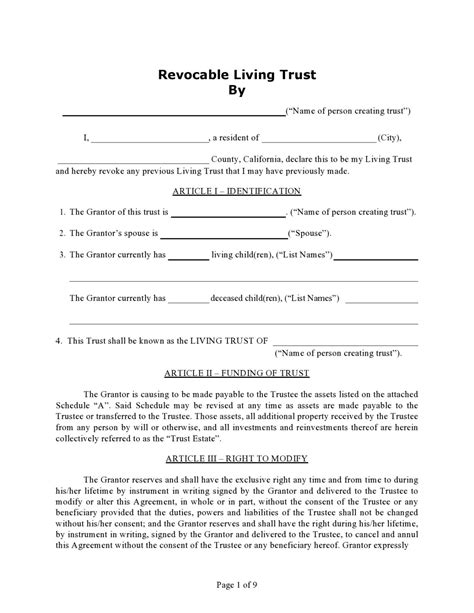

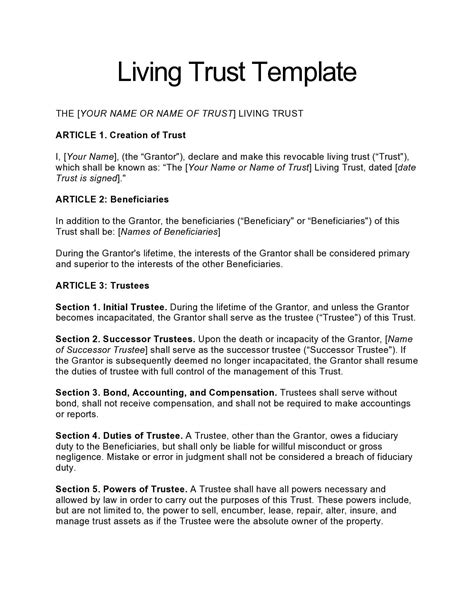

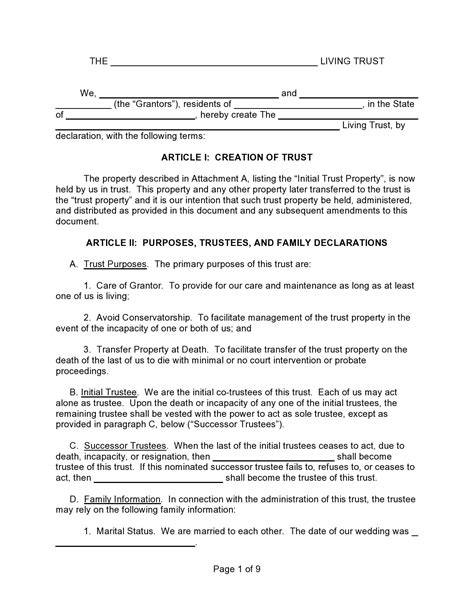

To create a living trust, individuals must first determine the type of trust they need. There are two primary types of living trusts: revocable and irrevocable. A revocable living trust can be modified or terminated during the grantor's lifetime, while an irrevocable living trust cannot be changed once it is established. The choice between a revocable and irrevocable living trust depends on individual circumstances and goals.

Benefits of Living Trusts

Some of the key benefits of living trusts include:

- Avoiding probate: Living trusts allow individuals to distribute their assets without the need for probate.

- Reducing estate taxes: Living trusts can help reduce estate taxes by transferring assets to beneficiaries during the grantor's lifetime.

- Maintaining control: Living trusts enable individuals to maintain control over their assets during their lifetime.

- Protecting assets: Living trusts can help protect assets from creditors and lawsuits.

- Providing for incapacitation: Living trusts can provide for individuals who become incapacitated and unable to manage their assets.

Creating a Living Trust

To create a living trust, individuals must follow these steps:

- Determine the type of trust needed: Individuals must decide whether they need a revocable or irrevocable living trust.

- Choose a trustee: Individuals must select a trustee to manage the trust.

- Identify assets: Individuals must identify the assets they want to include in the trust.

- Draft the trust document: Individuals must draft the trust document, which outlines the terms and conditions of the trust.

- Fund the trust: Individuals must transfer assets into the trust.

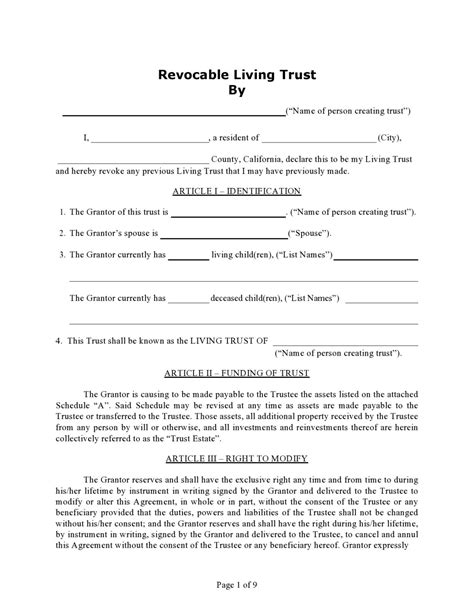

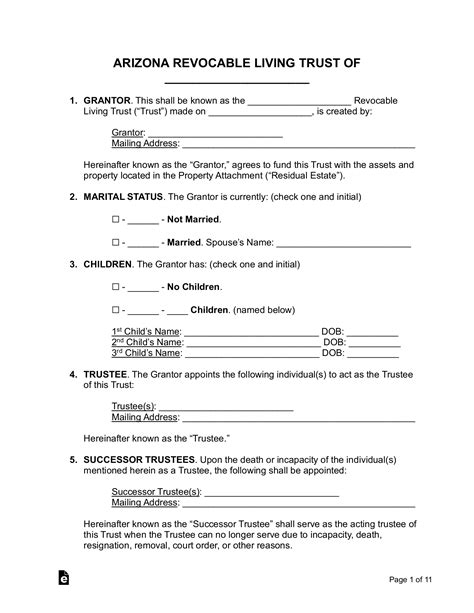

Free Printable Living Trust Forms

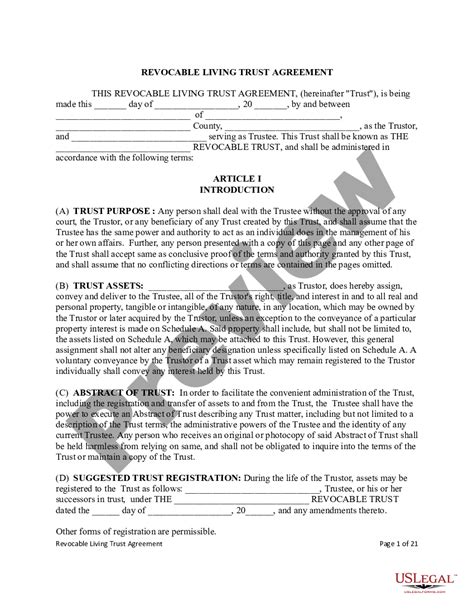

Free printable living trust forms are widely available online. These forms can be customized to fit individual needs and are often valid and compliant with state laws and regulations. However, it is essential to ensure that the form is valid and compliant with state laws and regulations. Some popular websites that offer free printable living trust forms include:

- Nolo

- Rocket Lawyer

- LawDepot

- US Legal Forms

Customizing a Living Trust Form

To customize a living trust form, individuals must:

- Review the form: Individuals must review the form to ensure it meets their needs.

- Modify the form: Individuals must modify the form to fit their specific circumstances.

- Add or remove clauses: Individuals must add or remove clauses as necessary.

- Review and revise: Individuals must review and revise the form to ensure it is accurate and complete.

Validating a Living Trust Form

To validate a living trust form, individuals must:

- Check state laws: Individuals must check state laws and regulations to ensure the form is compliant.

- Review the form: Individuals must review the form to ensure it meets state requirements.

- Consult an attorney: Individuals must consult an attorney to ensure the form is valid and compliant.

Gallery of Living Trust Forms

Living Trust Forms Image Gallery

What is a living trust?

+A living trust is a type of trust that allows individuals to manage and distribute their assets during their lifetime and after their death.

What are the benefits of a living trust?

+The benefits of a living trust include avoiding probate, reducing estate taxes, and maintaining control over assets.

How do I create a living trust?

+To create a living trust, individuals must determine the type of trust they need, choose a trustee, identify assets, draft the trust document, and fund the trust.

What is the difference between a revocable and irrevocable living trust?

+A revocable living trust can be modified or terminated during the grantor's lifetime, while an irrevocable living trust cannot be changed once it is established.

Can I use a free printable living trust form?

+Yes, free printable living trust forms are widely available online and can be customized to fit individual needs. However, it is essential to ensure that the form is valid and compliant with state laws and regulations.

In conclusion, creating a living trust is a crucial step in estate planning, and using a free printable living trust form can be a cost-effective and straightforward way to establish a living trust. However, it is essential to understand the importance and benefits of having a living trust, as well as the process of creating and customizing a living trust form. By following the steps outlined in this article and seeking the advice of an attorney, individuals can ensure that their assets are managed and distributed according to their wishes. We invite you to share your thoughts and experiences with living trusts in the comments below. Additionally, if you found this article informative, please share it with your friends and family who may be interested in learning more about estate planning and living trusts.