Intro

Optimize finances with 5 essential money saving charts, featuring budgeting templates, expense trackers, and savings planners to boost financial management and reduce unnecessary spending.

Creating a budget and managing finances effectively can be a daunting task for many individuals. However, with the right tools and strategies, it can become a manageable and even straightforward process. One of the most effective ways to visualize and track your finances is by using money saving charts. These charts provide a clear and concise way to see where your money is going, identify areas for improvement, and make informed decisions about your financial future.

Money saving charts are particularly useful for those who are new to budgeting or struggle with keeping track of their expenses. By using a chart to categorize and record your spending, you can quickly identify areas where you can cut back and make adjustments to achieve your financial goals. Whether you're looking to save for a big purchase, pay off debt, or simply build up your emergency fund, money saving charts can be a valuable tool in your financial toolkit.

In today's digital age, there are many different types of money saving charts available, ranging from simple spreadsheets to complex budgeting apps. However, for those who prefer a more traditional approach, printable money saving charts can be a great option. These charts can be printed out and filled in by hand, providing a tangible and satisfying way to track your progress and stay on top of your finances.

Introduction to Money Saving Charts

Money saving charts are designed to help individuals track and manage their finances more effectively. By categorizing expenses and income, these charts provide a clear picture of where your money is going and help you identify areas for improvement. Whether you're looking to save for a specific goal or simply want to build up your emergency fund, money saving charts can be a valuable tool in your financial toolkit.

There are many different types of money saving charts available, each with its own unique features and benefits. Some charts are designed specifically for tracking expenses, while others focus on income and savings. By choosing the right chart for your needs, you can create a personalized budget that helps you achieve your financial goals.

Benefits of Using Money Saving Charts

The benefits of using money saving charts are numerous. Some of the most significant advantages include: * Improved financial awareness and understanding * Increased ability to track and manage expenses * Enhanced savings and budgeting capabilities * Greater sense of control and confidence in financial decision-making * Ability to identify areas for improvement and make informed decisionsBy using a money saving chart, you can gain a deeper understanding of your financial situation and make positive changes to achieve your goals.

Types of Money Saving Charts

There are several different types of money saving charts available, each with its own unique features and benefits. Some of the most common types include:

- Expense tracking charts: These charts are designed to help you track and manage your expenses, categorizing them into different areas such as housing, transportation, and food.

- Income tracking charts: These charts focus on tracking your income, helping you understand where your money is coming from and how it can be allocated.

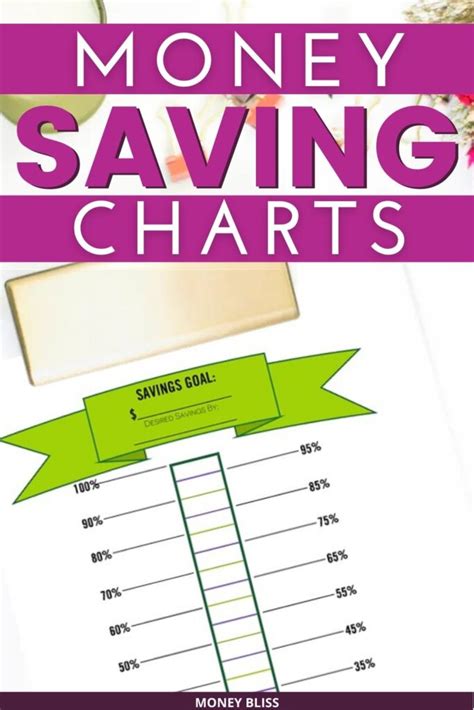

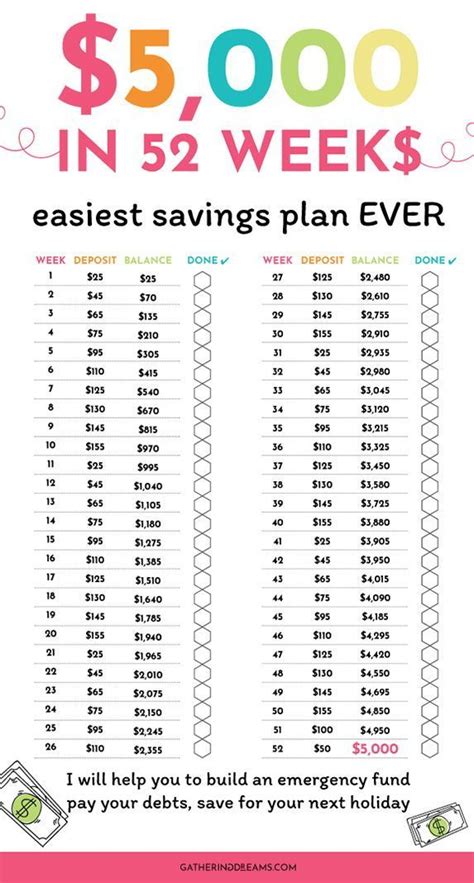

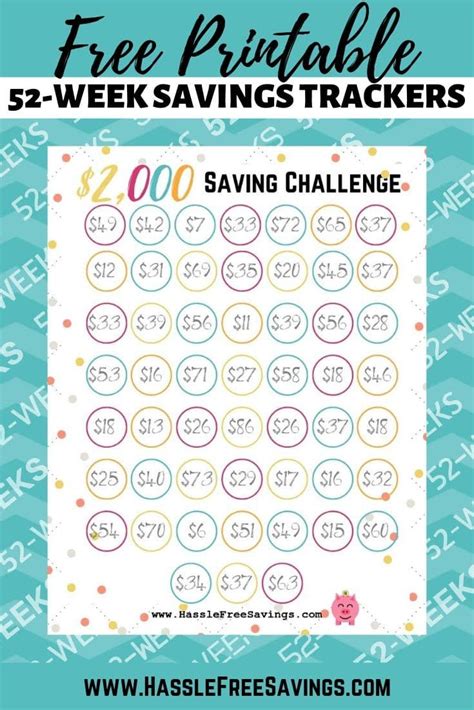

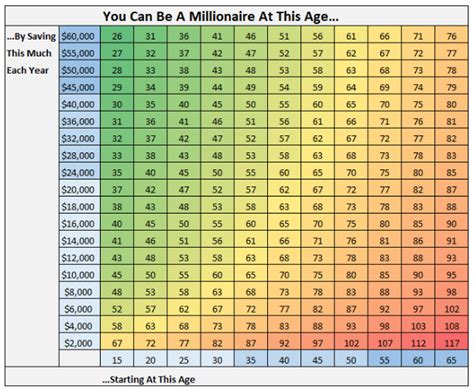

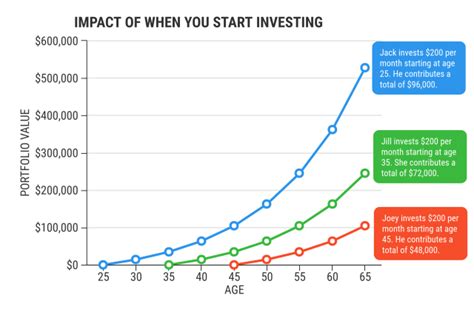

- Savings charts: These charts are designed to help you track and manage your savings, setting goals and monitoring progress over time.

- Budgeting charts: These charts provide a comprehensive overview of your finances, helping you create a personalized budget and make informed decisions about your money.

By choosing the right type of money saving chart for your needs, you can create a tailored approach to managing your finances and achieving your goals.

How to Use Money Saving Charts

Using a money saving chart is a straightforward process that can be adapted to fit your individual needs and financial situation. Here are some steps to get you started: 1. Choose the right chart: Select a chart that aligns with your financial goals and needs. 2. Set up your chart: Fill in the necessary information, including income, expenses, and savings goals. 3. Track your progress: Regularly update your chart to reflect changes in your finances and track your progress over time. 4. Review and adjust: Periodically review your chart to identify areas for improvement and make adjustments as needed.By following these steps and using a money saving chart consistently, you can gain a deeper understanding of your finances and make positive changes to achieve your goals.

Printable Money Saving Charts

For those who prefer a more traditional approach to budgeting, printable money saving charts can be a great option. These charts can be printed out and filled in by hand, providing a tangible and satisfying way to track your progress and stay on top of your finances.

Printable money saving charts are available in a variety of formats, ranging from simple spreadsheets to complex budgeting templates. By choosing a chart that aligns with your needs and financial goals, you can create a personalized approach to managing your finances and achieving your objectives.

Advantages of Printable Money Saving Charts

The advantages of using printable money saving charts are numerous. Some of the most significant benefits include: * Tangible and satisfying way to track progress * Ability to customize and personalize your chart * No need for digital devices or complex software * Easy to use and understand, even for those who are new to budgetingBy using a printable money saving chart, you can create a tailored approach to managing your finances and achieving your goals.

Money Saving Chart Examples

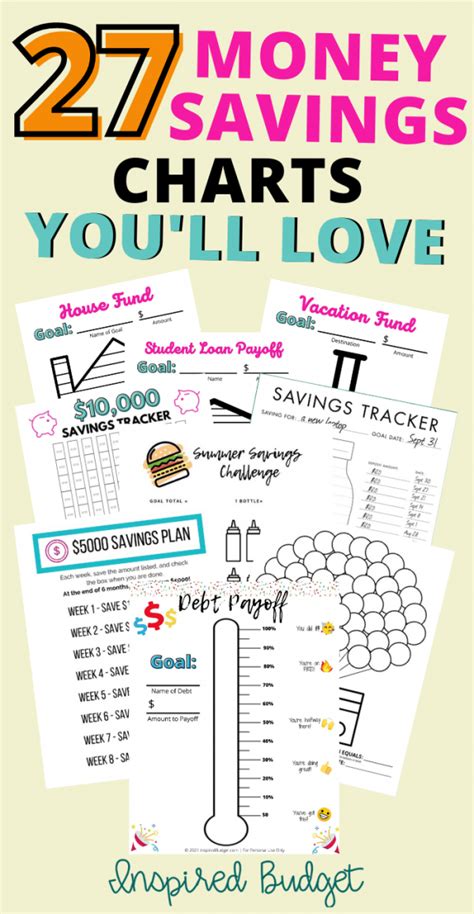

There are many different examples of money saving charts available, each with its own unique features and benefits. Some common examples include:

- 50/30/20 charts: These charts allocate 50% of income towards necessary expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment.

- Envelope charts: These charts use a system of envelopes to categorize and track expenses, helping you stay within budget and avoid overspending.

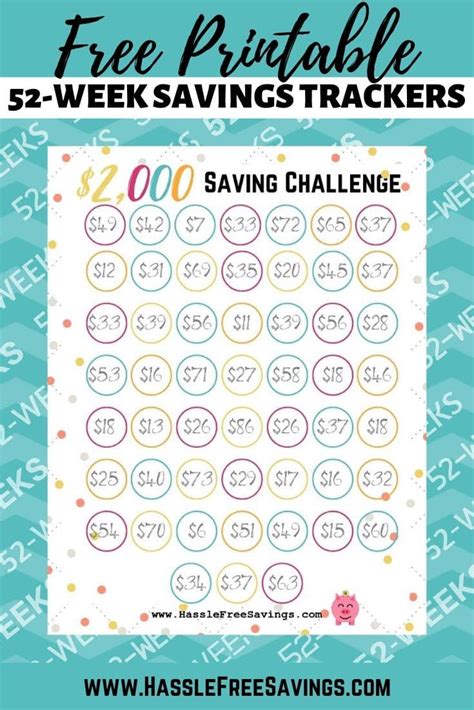

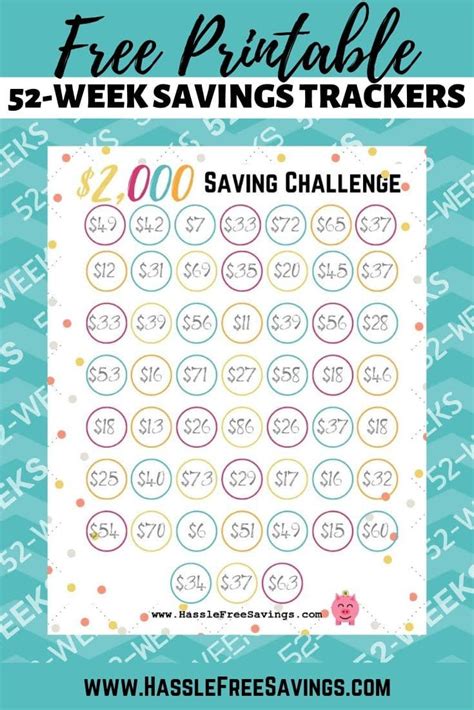

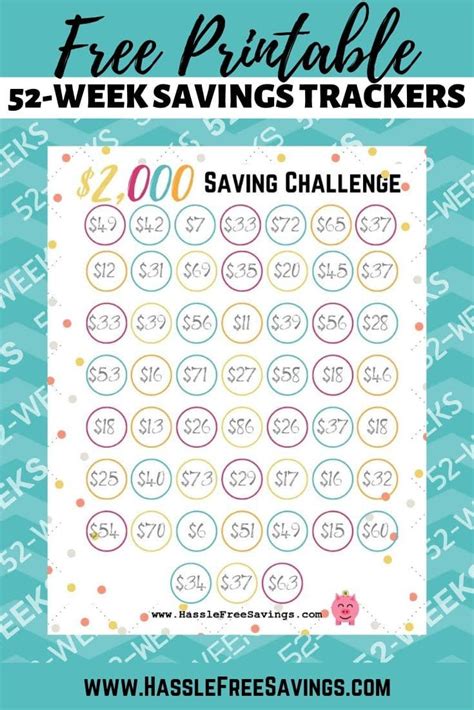

- Savings challenge charts: These charts provide a fun and motivating way to track your savings progress, helping you stay on track and achieve your goals.

By exploring different examples of money saving charts, you can find the one that works best for you and your financial situation.

Creating Your Own Money Saving Chart

Creating your own money saving chart can be a fun and rewarding experience. Here are some steps to get you started: 1. Determine your financial goals: Identify what you want to achieve with your chart, whether it's saving for a specific goal or building up your emergency fund. 2. Choose a format: Decide whether you want to use a digital or printable chart, and select a format that aligns with your needs and preferences. 3. Set up your chart: Fill in the necessary information, including income, expenses, and savings goals. 4. Customize and personalize: Tailor your chart to fit your individual needs and financial situation, adding categories and features as needed.By creating your own money saving chart, you can develop a personalized approach to managing your finances and achieving your goals.

Gallery of Money Saving Charts

Money Saving Charts Image Gallery

Frequently Asked Questions

What is a money saving chart?

+A money saving chart is a tool used to track and manage finances, helping individuals understand where their money is going and make informed decisions about their financial future.

How do I use a money saving chart?

+To use a money saving chart, simply fill in the necessary information, including income, expenses, and savings goals, and regularly update the chart to reflect changes in your finances.

What are the benefits of using a money saving chart?

+The benefits of using a money saving chart include improved financial awareness and understanding, increased ability to track and manage expenses, and enhanced savings and budgeting capabilities.

Can I create my own money saving chart?

+Yes, you can create your own money saving chart by determining your financial goals, choosing a format, setting up your chart, and customizing and personalizing it to fit your individual needs and financial situation.

What types of money saving charts are available?

+There are several types of money saving charts available, including expense tracking charts, income tracking charts, savings charts, and budgeting charts, each with its own unique features and benefits.

In conclusion, money saving charts are a valuable tool for anyone looking to manage their finances more effectively. By providing a clear and concise way to track income, expenses, and savings, these charts can help individuals achieve their financial goals and build a more secure financial future. Whether you're looking to save for a specific goal or simply want to build up your emergency fund, a money saving chart can be a powerful tool in your financial toolkit. So why not give it a try? Start using a money saving chart today and take the first step towards achieving your financial goals. We invite you to share your experiences and tips on using money saving charts in the comments below, and don't forget to share this article with your friends and family who may benefit from using these charts.