Intro

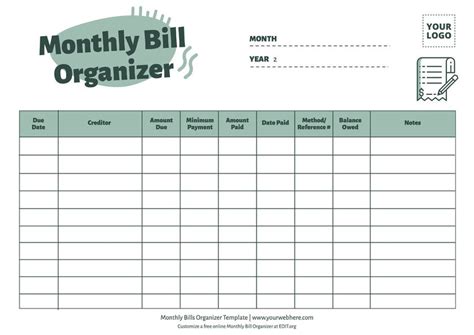

Streamline finances with a Monthly Bill Organizer Printable Template, tracking payments, due dates, and expenses, for efficient budgeting and bill management.

Managing monthly bills can be a daunting task, especially when dealing with multiple payments, due dates, and varying amounts. It's easy to get overwhelmed and miss a payment, which can lead to late fees, penalties, and damage to your credit score. However, with the right tools and strategies, you can take control of your finances and stay on top of your monthly bills. One effective way to do this is by using a monthly bill organizer printable template.

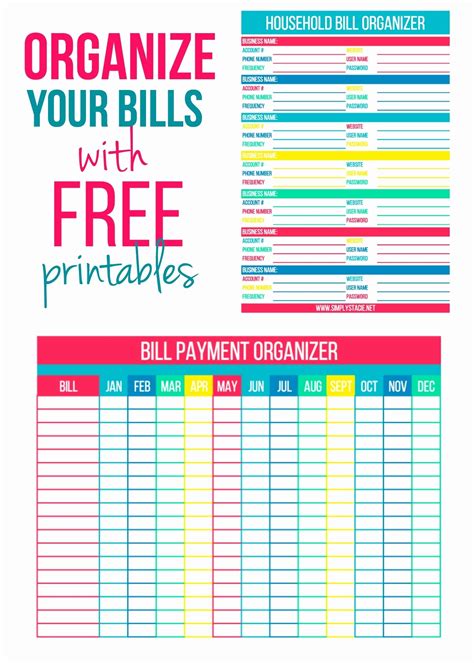

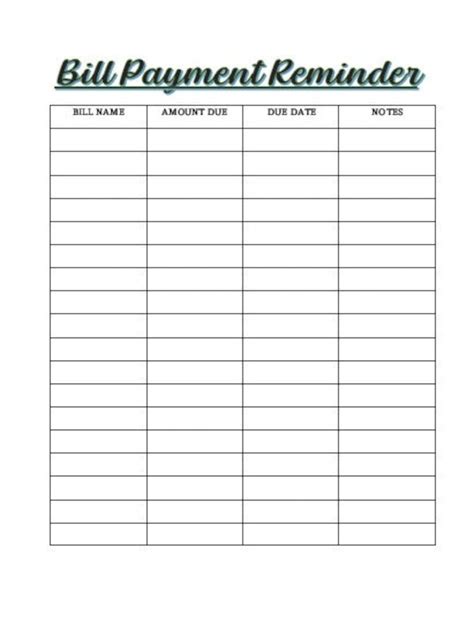

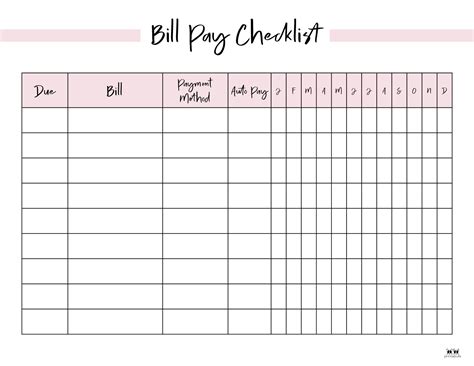

A monthly bill organizer template is a simple yet powerful tool that helps you track and manage your bills, payments, and due dates in one place. It's a customizable template that you can print out and fill in with your own bill information, making it easy to see what's due, when, and how much you need to pay. By using a monthly bill organizer template, you can simplify your bill management process, reduce stress, and save time.

In today's digital age, it's easy to get caught up in online bill payments and automated reminders. However, a physical monthly bill organizer template can be a refreshing change of pace, allowing you to disconnect from screens and focus on your finances in a more tactile way. Plus, it's a great way to keep your bill information private and secure, without relying on online accounts or apps.

Whether you're a busy professional, a student, or a homeowner, a monthly bill organizer template can be a valuable addition to your financial toolkit. It's especially useful for those who struggle with budgeting, have multiple bills to pay, or need help staying organized. By using a monthly bill organizer template, you can take the first step towards financial freedom and start building a stronger, more stable financial future.

Benefits of Using a Monthly Bill Organizer Template

Using a monthly bill organizer template can have a significant impact on your financial management and overall well-being. Here are some of the benefits you can expect:

- Reduced stress and anxiety: By having all your bill information in one place, you can quickly see what's due and when, reducing the likelihood of missed payments and late fees.

- Improved organization: A monthly bill organizer template helps you stay on top of your bills, payments, and due dates, making it easier to manage your finances and avoid clutter.

- Increased savings: By tracking your bills and payments, you can identify areas where you can cut back and save money, helping you build a stronger financial foundation.

- Better budgeting: A monthly bill organizer template can help you create a budget and stick to it, ensuring you have enough money set aside for bills, expenses, and savings.

- Enhanced financial awareness: By regularly reviewing your bill information, you can gain a deeper understanding of your spending habits, income, and expenses, making it easier to make informed financial decisions.

How to Use a Monthly Bill Organizer Template

Using a monthly bill organizer template is straightforward and easy. Here's a step-by-step guide to get you started:

- Download and print the template: Simply download the monthly bill organizer template and print it out on paper.

- Fill in your bill information: Start by filling in your bill information, including the bill name, due date, payment amount, and any relevant notes.

- Track your payments: As you make payments, be sure to track them in the template, including the date, amount, and payment method.

- Review and update regularly: Regularly review your template to ensure you're on track with your bills and payments, and update the information as needed.

- Customize the template: Feel free to customize the template to fit your specific needs, adding or removing columns, rows, or sections as necessary.

Customizing Your Monthly Bill Organizer Template

One of the benefits of using a monthly bill organizer template is that it can be customized to fit your specific needs. Here are some ways you can tailor the template to suit your financial situation:

- Add or remove columns: Depending on your bill information, you may need to add or remove columns to accommodate different types of bills or payments.

- Create separate sections: If you have multiple bills with different due dates or payment amounts, consider creating separate sections to keep them organized.

- Use different colors: Use different colors to highlight important information, such as due dates or payment amounts, making it easier to quickly scan the template.

- Include additional information: Consider including additional information, such as your income, expenses, or savings goals, to get a more comprehensive view of your finances.

Common Challenges and Solutions

While using a monthly bill organizer template can be highly effective, there are some common challenges you may encounter. Here are some solutions to help you overcome them:

- Forgetting to update the template: Set reminders or schedule regular review sessions to ensure you stay on top of your bill information.

- Losing the template: Consider scanning or digitizing the template, or keeping a backup copy in a safe place.

- Struggling to stay organized: Break down larger tasks into smaller, manageable chunks, and focus on one bill or payment at a time.

Additional Tips for Effective Bill Management

In addition to using a monthly bill organizer template, here are some additional tips to help you manage your bills effectively:

- Set up automatic payments: Consider setting up automatic payments for recurring bills, such as utilities or rent.

- Prioritize your bills: Focus on paying essential bills, such as rent or mortgage, before less critical bills, such as credit card debt.

- Communicate with billers: If you're struggling to pay a bill, don't hesitate to reach out to the biller to discuss possible payment arrangements or extensions.

Conclusion and Next Steps

Using a monthly bill organizer template can be a powerful way to take control of your finances and simplify your bill management process. By following the steps outlined in this article, you can create a customized template that meets your specific needs and helps you stay on top of your bills. Remember to review and update your template regularly, and don't hesitate to seek additional resources or support if you need help managing your finances.

Bill Organization Image Gallery

What is a monthly bill organizer template?

+A monthly bill organizer template is a customizable template that helps you track and manage your bills, payments, and due dates in one place.

How do I use a monthly bill organizer template?

+Download and print the template, fill in your bill information, track your payments, and review and update regularly.

What are the benefits of using a monthly bill organizer template?

+The benefits include reduced stress and anxiety, improved organization, increased savings, better budgeting, and enhanced financial awareness.

We hope this article has provided you with valuable insights and practical tips for using a monthly bill organizer template. By taking control of your finances and staying on top of your bills, you can build a stronger, more stable financial future. Share your thoughts and experiences with us in the comments below, and don't forget to share this article with friends and family who may benefit from using a monthly bill organizer template.