Intro

Boost financial management with 5 essential templates, including budget, invoice, and expense trackers, to streamline accounting, reduce costs, and increase profitability with effective financial planning and analysis tools.

The world of finance can be overwhelming, especially when it comes to managing and tracking financial data. With so many numbers and spreadsheets to keep track of, it's easy to get lost in the sea of financial information. However, with the right tools and templates, anyone can become a financial mastermind. In this article, we'll explore five essential financial templates that can help individuals and businesses alike take control of their finances and make informed decisions.

Financial planning and management are crucial aspects of personal and professional life. Without a clear understanding of financial concepts and tools, it's difficult to achieve long-term goals and stability. The use of financial templates can simplify the process of financial planning, making it more accessible and efficient. By utilizing these templates, individuals can save time, reduce errors, and make more accurate financial projections.

Effective financial management is the backbone of any successful business or personal finance strategy. It involves tracking income and expenses, creating budgets, and making smart investment decisions. Financial templates provide a structured approach to financial management, enabling users to organize their financial data, identify trends, and make data-driven decisions. With the right financial templates, anyone can develop a comprehensive financial plan, achieve financial stability, and secure their financial future.

Introduction to Financial Templates

Benefits of Using Financial Templates

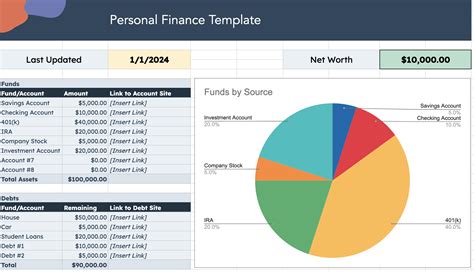

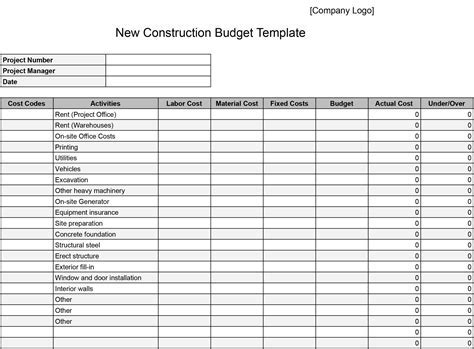

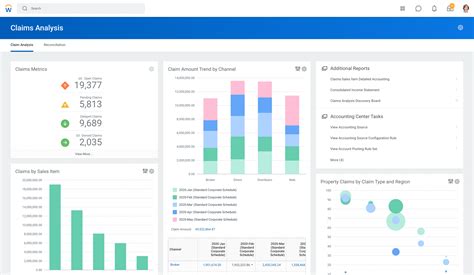

The benefits of using financial templates are numerous. They can help individuals and businesses save time, reduce errors, and make more accurate financial projections. Financial templates can also provide a structured approach to financial management, enabling users to organize their financial data, identify trends, and make data-driven decisions. Additionally, financial templates can be customized to suit individual needs, making them a versatile and effective tool for financial management.Template 1: Budget Template

How to Use a Budget Template

Using a budget template is a straightforward process. First, identify your income and expenses, and then categorize them into different groups. Next, allocate your income to each category, making sure to prioritize essential expenses such as rent, utilities, and food. Finally, review and adjust your budget regularly to ensure you're on track to meet your financial goals.Template 2: Expense Tracker Template

Benefits of Using an Expense Tracker Template

The benefits of using an expense tracker template are numerous. It can help individuals identify areas where they can save money, reduce unnecessary expenses, and make more accurate financial projections. An expense tracker template can also provide a clear picture of spending habits, enabling individuals to make positive changes and achieve financial stability.Template 3: Income Statement Template

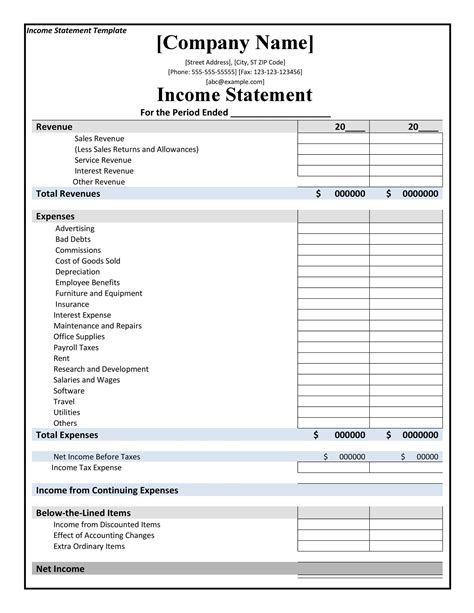

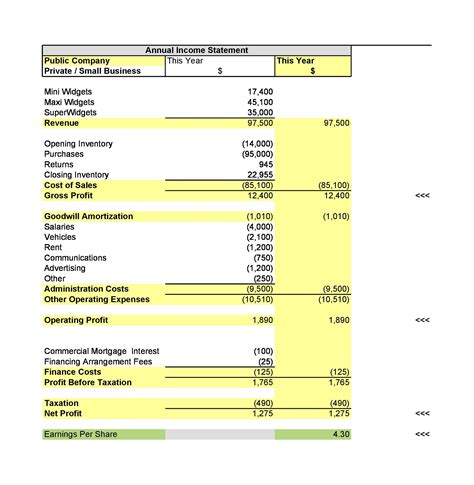

How to Use an Income Statement Template

Using an income statement template is a straightforward process. First, identify your revenues and expenses, and then categorize them into different groups. Next, calculate your gross profit, operating expenses, and net income. Finally, review and analyze your income statement to identify areas where you can improve your financial performance.Template 4: Balance Sheet Template

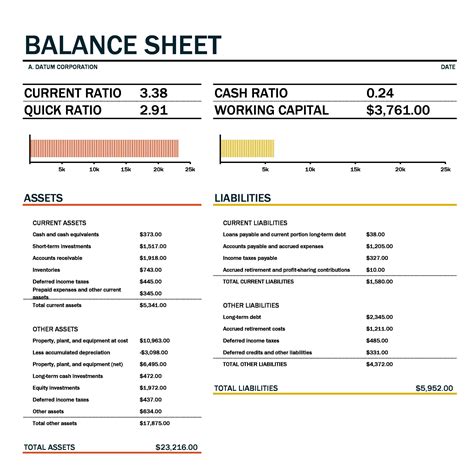

Benefits of Using a Balance Sheet Template

The benefits of using a balance sheet template are numerous. It can help businesses evaluate their financial health, identify areas where they can improve their financial performance, and make informed decisions. A balance sheet template can also provide a clear picture of a company's financial position, enabling stakeholders to make informed decisions.Template 5: Cash Flow Statement Template

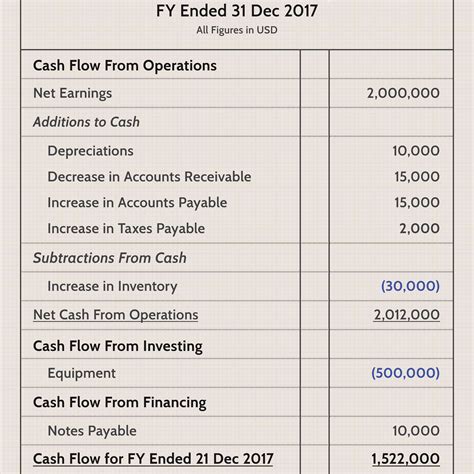

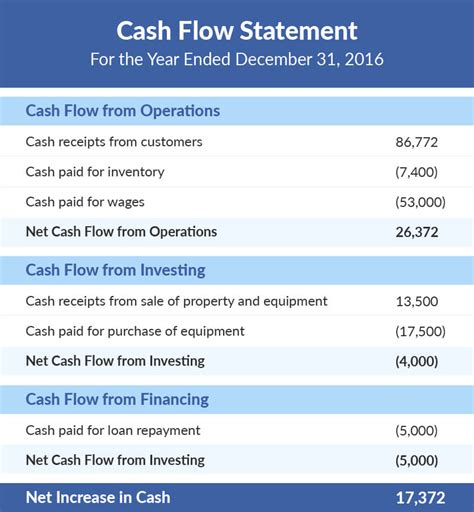

How to Use a Cash Flow Statement Template

Using a cash flow statement template is a straightforward process. First, identify your inflows and outflows of cash, and then categorize them into different groups. Next, calculate your net cash flow, and finally, review and analyze your cash flow statement to identify areas where you can improve your liquidity.Financial Templates Image Gallery

What are financial templates?

+Financial templates are pre-designed spreadsheets or documents that provide a framework for managing and tracking financial data.

Why are financial templates important?

+Financial templates are important because they help individuals and businesses save time, reduce errors, and make more accurate financial projections.

How do I use a budget template?

+To use a budget template, identify your income and expenses, categorize them into different groups, and allocate your income to each category.

What is an expense tracker template?

+An expense tracker template is a tool used to monitor and control expenses, providing a detailed record of all expenses, including dates, amounts, and categories.

How do I use a cash flow statement template?

+To use a cash flow statement template, identify your inflows and outflows of cash, categorize them into different groups, and calculate your net cash flow.

In conclusion, financial templates are essential tools for managing and tracking financial data. By using these templates, individuals and businesses can save time, reduce errors, and make more accurate financial projections. Whether you're a seasoned financial professional or just starting out, financial templates can help you achieve your financial goals and secure your financial future. So why not give them a try? Download a financial template today and start taking control of your finances. We invite you to share your thoughts and experiences with financial templates in the comments section below.