Intro

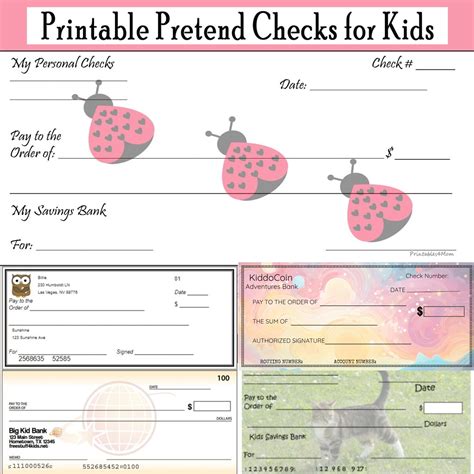

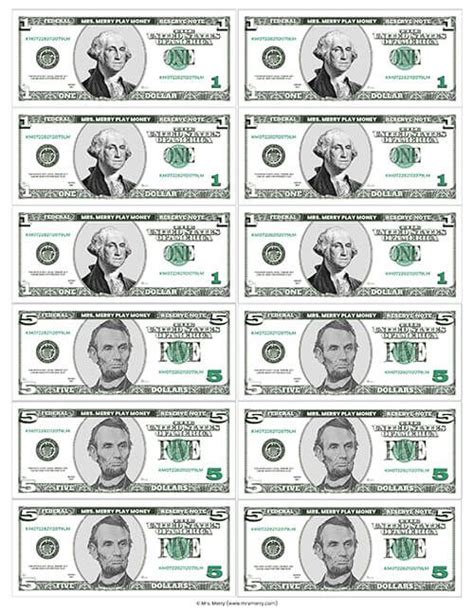

Discover free printable play checks for kids, featuring fun designs and educational templates, teaching money management and banking skills with fake checks and play money.

The concept of printable play checks has gained significant attention in recent years, particularly among parents, educators, and childcare professionals. These innovative tools are designed to help children develop essential life skills, such as money management, responsibility, and financial literacy. In this article, we will delve into the world of printable play checks, exploring their benefits, uses, and advantages.

Printable play checks are an excellent way to introduce children to the concept of money and banking. By using these fake checks, kids can practice writing, balancing, and managing their own finances in a safe and controlled environment. This hands-on approach to learning helps build confidence and familiarity with financial transactions, setting the stage for a lifetime of responsible money management. Moreover, printable play checks can be customized to suit various age groups and learning levels, making them an versatile tool for both homeschooling and traditional educational settings.

The importance of teaching children about money management cannot be overstated. In today's fast-paced, consumer-driven society, it is essential that kids understand the value of money, the importance of saving, and the consequences of overspending. By introducing printable play checks into their daily routine, parents and educators can help children develop healthy financial habits and a strong foundation for future success. Furthermore, these play checks can be used in conjunction with other educational tools, such as piggy banks, wallets, and budgeting worksheets, to create a comprehensive financial literacy program.

Benefits of Printable Play Checks

The benefits of printable play checks are numerous and well-documented. Some of the most significant advantages include:

- Improved financial literacy: By using printable play checks, children can develop a deeper understanding of financial concepts, such as budgeting, saving, and spending.

- Enhanced money management skills: These play checks help kids practice managing their own finances, making smart purchasing decisions, and avoiding debt.

- Increased confidence: Printable play checks provide a safe and supportive environment for children to practice financial transactions, building confidence and self-assurance.

- Customization options: These play checks can be tailored to suit various age groups, learning levels, and educational goals, making them an excellent tool for homeschooling and traditional educational settings.

- Cost-effective: Printable play checks are an affordable alternative to traditional financial education tools, making them an excellent option for parents and educators on a budget.

Using Printable Play Checks in Education

Printable play checks can be used in a variety of educational settings, including homeschooling, traditional classrooms, and after-school programs. These tools can be integrated into existing curricula or used as a standalone financial literacy program. Some popular ways to use printable play checks in education include: * Creating a mock bank or store: Students can practice writing checks, making deposits, and managing their accounts in a simulated environment. * Developing a budget: Kids can use printable play checks to create a personal budget, allocating funds for savings, expenses, and charitable donations. * Role-playing financial scenarios: Students can practice responding to real-life financial situations, such as receiving a paycheck, paying bills, or making purchases.Creating a Comprehensive Financial Literacy Program

To create a comprehensive financial literacy program, parents and educators can combine printable play checks with other educational tools and resources. Some popular options include:

- Piggy banks and clear jars: These visual aids help kids see their savings grow and understand the importance of setting financial goals.

- Budgeting worksheets: These printable worksheets provide a structured approach to budgeting, helping kids allocate funds and prioritize expenses.

- Financial education apps: Interactive apps and games can provide an engaging and immersive learning experience, teaching kids about money management, investing, and entrepreneurship.

- Real-life examples: Using real-life scenarios and case studies can help kids understand the practical applications of financial literacy, making the learning experience more relatable and relevant.

Tips for Parents and Educators

When using printable play checks, parents and educators should keep the following tips in mind: * Start early: Introduce financial literacy concepts at a young age, using simple and engaging language to explain complex ideas. * Make it fun: Incorporate games, activities, and real-life scenarios to make learning about money management enjoyable and interactive. * Be patient: Developing financial literacy skills takes time and practice, so be patient and encouraging as kids learn and grow. * Lead by example: Model healthy financial habits and responsible money management, demonstrating the importance of financial literacy in everyday life.Printable Play Check Templates and Resources

For parents and educators looking to incorporate printable play checks into their financial literacy program, there are numerous templates and resources available online. Some popular options include:

- Printable play check templates: These customizable templates can be downloaded and printed, providing a convenient and affordable way to create play checks.

- Financial education worksheets: These printable worksheets offer a structured approach to teaching financial literacy, covering topics such as budgeting, saving, and investing.

- Online financial education courses: Interactive courses and tutorials can provide a comprehensive and engaging learning experience, teaching kids about money management, entrepreneurship, and personal finance.

Conclusion and Next Steps

In conclusion, printable play checks are a valuable tool for teaching children about money management and financial literacy. By incorporating these play checks into their daily routine, parents and educators can help kids develop essential life skills, such as budgeting, saving, and responsible spending. To get started, simply download and print a printable play check template, and begin exploring the many benefits and advantages of this innovative educational tool.Gallery of Printable Play Checks

Printable Play Checks Image Gallery

What are printable play checks?

+Printable play checks are fake checks that can be used to teach children about money management and financial literacy.

How can I use printable play checks to teach my child about money management?

+You can use printable play checks to create a mock bank or store, practice writing checks, and teach your child about budgeting and saving.

What are the benefits of using printable play checks?

+The benefits of using printable play checks include improved financial literacy, enhanced money management skills, and increased confidence in managing finances.

Can I customize printable play checks to suit my child's needs?

+Yes, you can customize printable play checks to suit your child's needs and learning level.

Where can I find printable play check templates and resources?

+You can find printable play check templates and resources online, including financial education worksheets, online courses, and interactive games.

We hope this article has provided you with a comprehensive understanding of printable play checks and their role in teaching children about money management and financial literacy. If you have any further questions or would like to share your experiences with using printable play checks, please don't hesitate to comment below. Additionally, feel free to share this article with friends and family who may be interested in teaching their children about financial literacy. By working together, we can help the next generation develop the skills and knowledge they need to succeed in today's fast-paced, consumer-driven world.