Intro

Master liability forms with 5 expert tips, covering risk management, insurance claims, and legal compliance, to minimize exposure and ensure protection in business transactions and contracts.

Liability forms are an essential part of any business or organization, as they help protect against potential lawsuits and financial losses. A well-crafted liability form can provide peace of mind for both the company and its customers, ensuring that everyone is aware of the risks involved and the terms of the agreement. In this article, we will explore the importance of liability forms and provide valuable tips for creating effective and comprehensive forms.

The use of liability forms has become increasingly common in various industries, including construction, healthcare, and recreation. These forms are designed to release the company from liability in case of accidents or injuries, and to establish clear guidelines for customer behavior. However, creating a liability form that is both effective and fair can be a challenging task. It requires careful consideration of the potential risks, the terms of the agreement, and the language used to convey the information.

One of the primary benefits of liability forms is that they provide a clear understanding of the risks involved in a particular activity or service. By signing a liability form, customers acknowledge that they are aware of the potential dangers and assume responsibility for their own actions. This can help reduce the likelihood of lawsuits and financial losses, as customers are more likely to take necessary precautions and follow established guidelines.

Understanding Liability Forms

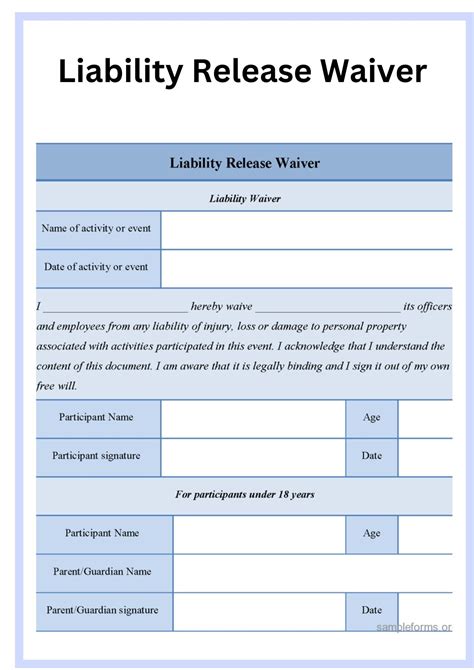

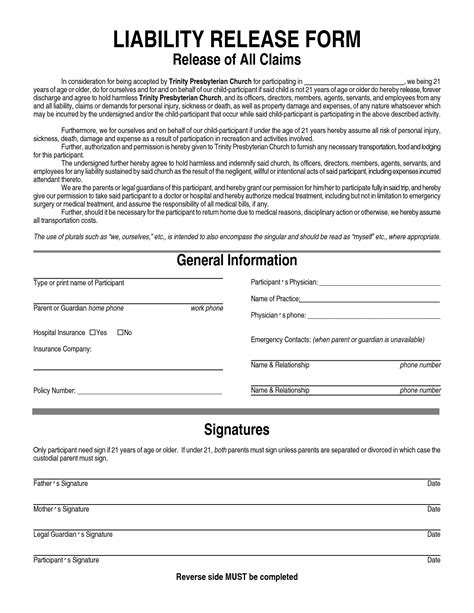

To create an effective liability form, it is essential to understand the different types of liability and the language used to convey the information. There are several key elements that should be included in a liability form, such as a clear description of the activity or service, the potential risks involved, and the terms of the agreement. The form should also include a statement releasing the company from liability in case of accidents or injuries.

Key Elements of Liability Forms

The key elements of liability forms include: * A clear description of the activity or service * The potential risks involved * The terms of the agreement * A statement releasing the company from liability * A signature block for the customer to signCreating Effective Liability Forms

Creating effective liability forms requires careful consideration of the potential risks, the terms of the agreement, and the language used to convey the information. The form should be clear, concise, and easy to understand, with a focus on protecting both the company and its customers. Here are five liability form tips to help you create effective and comprehensive forms:

- Clearly define the scope of the activity or service: The liability form should include a clear description of the activity or service, including the potential risks involved and the terms of the agreement.

- Use simple and concise language: The language used in the liability form should be simple and concise, avoiding technical jargon and complex terminology.

- Include a statement releasing the company from liability: The liability form should include a statement releasing the company from liability in case of accidents or injuries, with a clear explanation of the terms and conditions.

- Provide a signature block for the customer to sign: The liability form should include a signature block for the customer to sign, with a clear statement acknowledging that they have read and understood the terms and conditions.

- Review and update the form regularly: The liability form should be reviewed and updated regularly to ensure that it remains effective and comprehensive, with changes made as necessary to reflect new laws, regulations, or industry standards.

Benefits of Liability Forms

The benefits of liability forms include: * Reduced risk of lawsuits and financial losses * Clear understanding of the risks involved * Establishment of clear guidelines for customer behavior * Protection for both the company and its customersLiability Form Examples

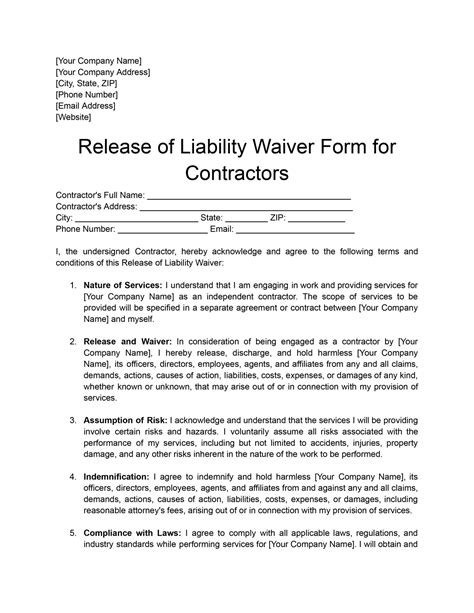

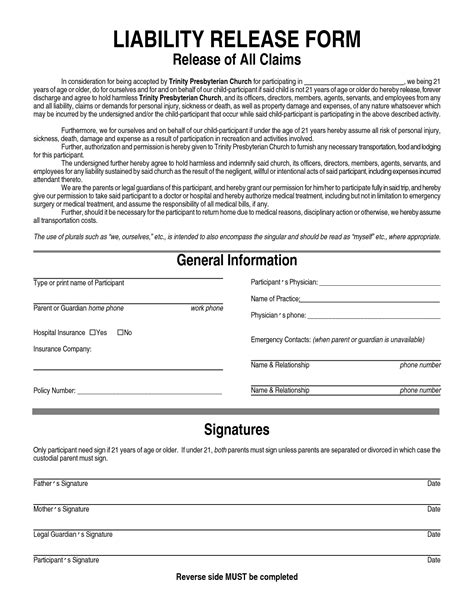

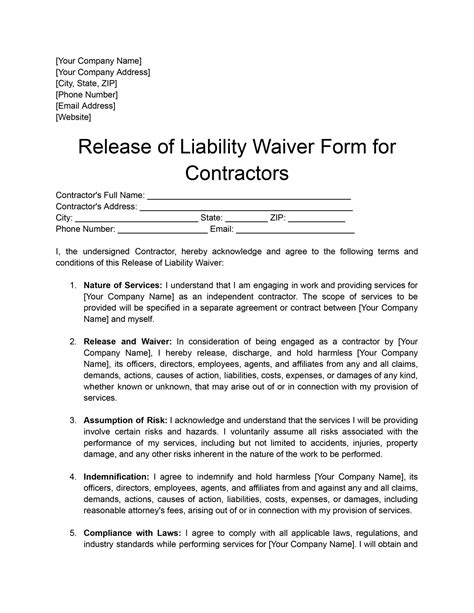

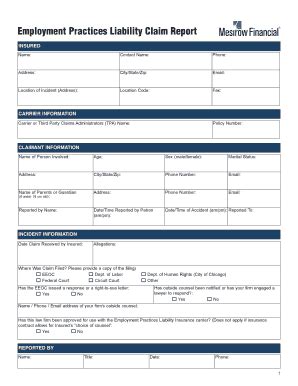

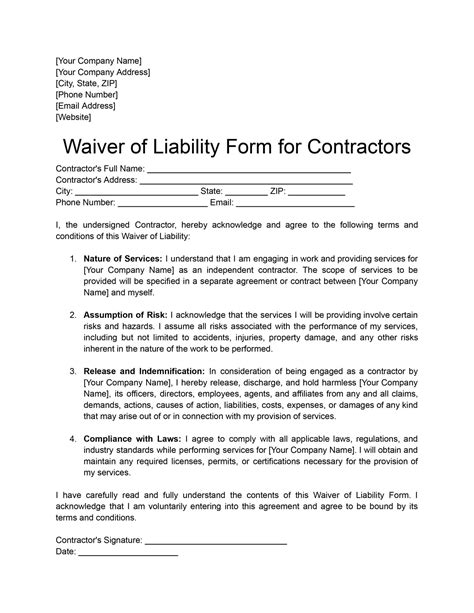

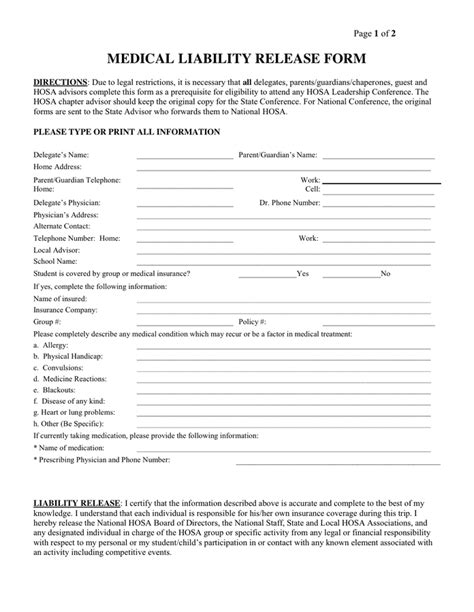

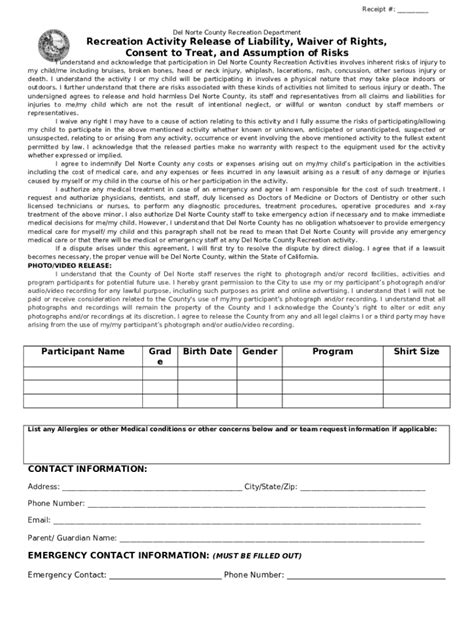

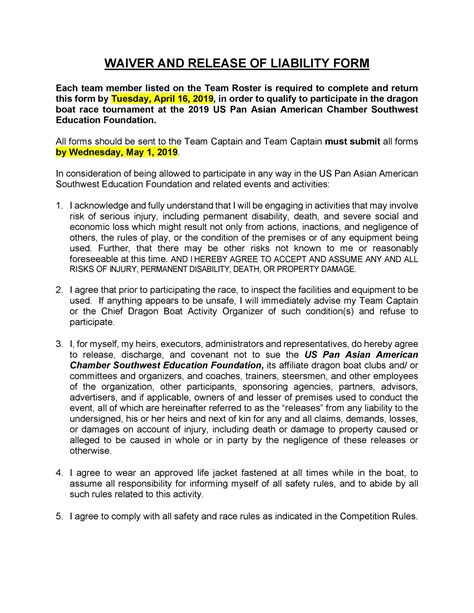

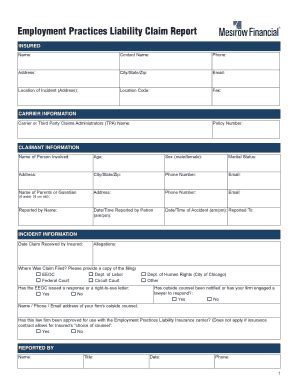

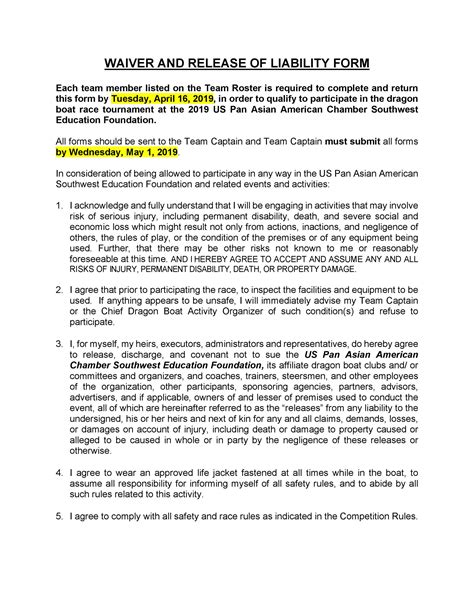

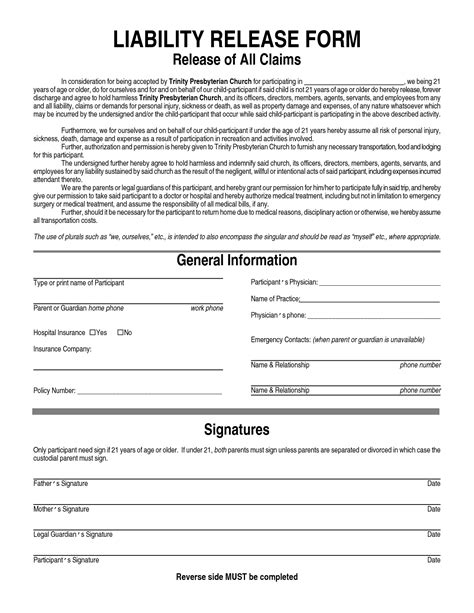

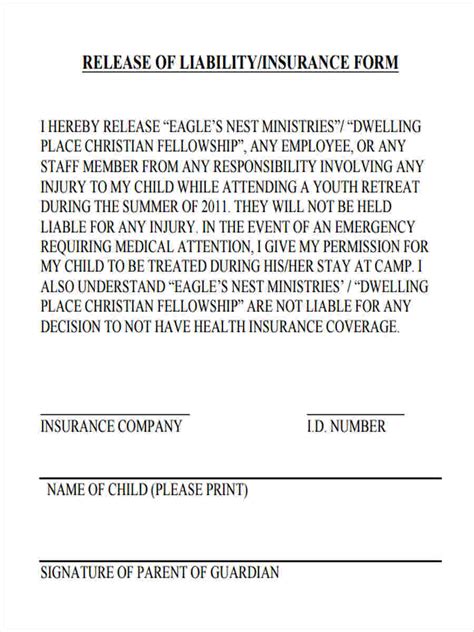

Liability forms can be used in a variety of contexts, including construction, healthcare, and recreation. Here are a few examples of liability forms:

- Construction liability form: This type of form is used to release the construction company from liability in case of accidents or injuries on the job site.

- Healthcare liability form: This type of form is used to release the healthcare provider from liability in case of medical errors or accidents.

- Recreation liability form: This type of form is used to release the recreation provider from liability in case of accidents or injuries during recreational activities.

Liability Form Templates

Liability form templates can be used to create effective and comprehensive forms, with a focus on protecting both the company and its customers. These templates should include the key elements of liability forms, such as a clear description of the activity or service, the potential risks involved, and the terms of the agreement.Best Practices for Liability Forms

Best practices for liability forms include:

- Using simple and concise language

- Including a statement releasing the company from liability

- Providing a signature block for the customer to sign

- Reviewing and updating the form regularly

- Using liability form templates to create effective and comprehensive forms

Common Mistakes to Avoid

Common mistakes to avoid when creating liability forms include: * Using complex terminology or technical jargon * Failing to include a statement releasing the company from liability * Not providing a signature block for the customer to sign * Not reviewing and updating the form regularlyGallery of Liability Forms

Liability Forms Image Gallery

What is a liability form?

+A liability form is a document that releases a company from liability in case of accidents or injuries, with a clear explanation of the terms and conditions.

Why are liability forms important?

+Liability forms are important because they provide a clear understanding of the risks involved and establish clear guidelines for customer behavior, reducing the likelihood of lawsuits and financial losses.

What should be included in a liability form?

+A liability form should include a clear description of the activity or service, the potential risks involved, and the terms of the agreement, as well as a statement releasing the company from liability and a signature block for the customer to sign.

How often should liability forms be reviewed and updated?

+Liability forms should be reviewed and updated regularly to ensure that they remain effective and comprehensive, with changes made as necessary to reflect new laws, regulations, or industry standards.

Can liability forms be used in any industry?

+Yes, liability forms can be used in any industry, including construction, healthcare, and recreation, to provide a clear understanding of the risks involved and establish clear guidelines for customer behavior.

In conclusion, liability forms are an essential part of any business or organization, providing a clear understanding of the risks involved and establishing clear guidelines for customer behavior. By following the five liability form tips outlined in this article, you can create effective and comprehensive forms that protect both your company and your customers. Remember to review and update your liability forms regularly to ensure that they remain effective and comprehensive, and to use simple and concise language to avoid confusion. With the right liability form in place, you can reduce the likelihood of lawsuits and financial losses, and provide a safe and enjoyable experience for your customers. We invite you to share your thoughts and experiences with liability forms in the comments below, and to explore our website for more information on this topic.