Intro

Download the Printable Schedule C Form for self-employment tax returns, including business income and expense reporting, deductions, and profit calculations, to simplify your IRS filing process.

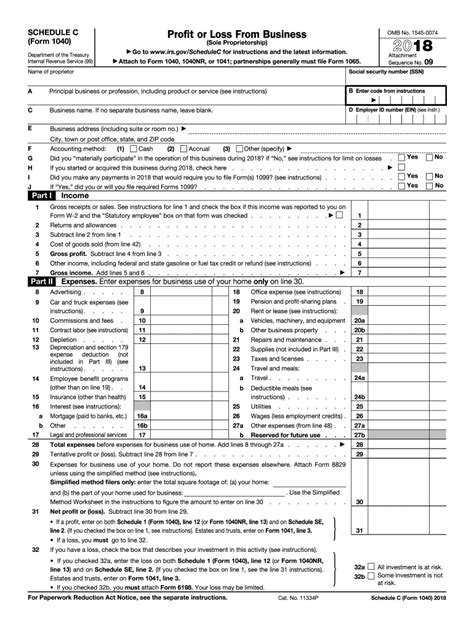

The importance of accurately completing tax forms cannot be overstated, especially for self-employed individuals and small business owners. One crucial form for these entities is the Schedule C form, which is used to report income or loss from a business. Understanding the intricacies of this form is vital to ensure compliance with tax laws and to avoid any potential penalties. In this article, we will delve into the details of the printable Schedule C form, its components, and how to fill it out accurately.

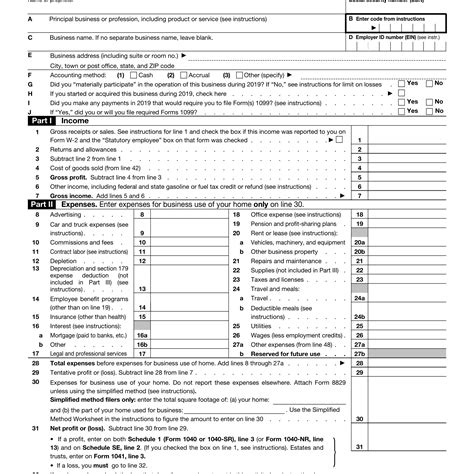

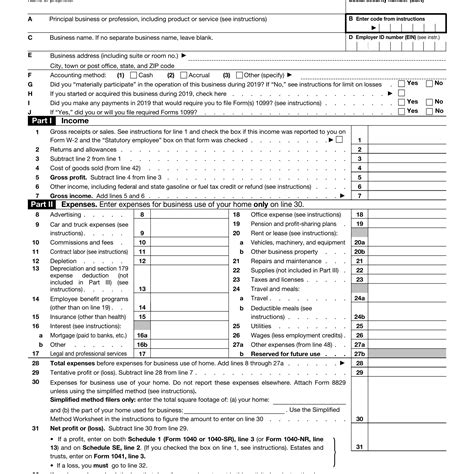

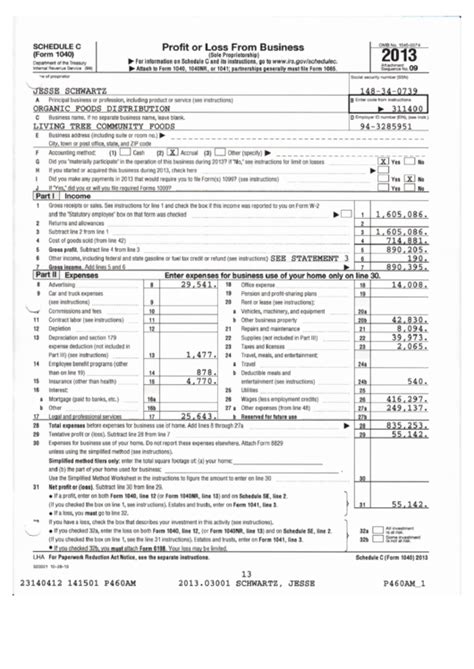

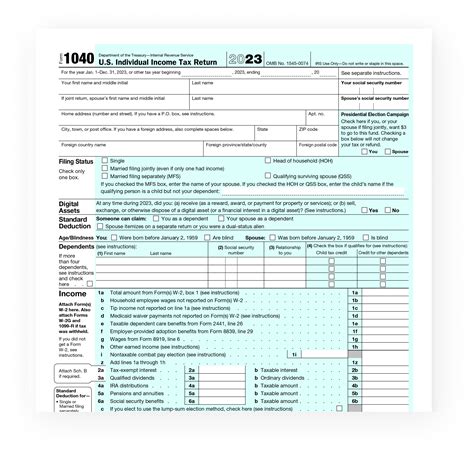

For many entrepreneurs, navigating the world of taxation can be daunting, especially when it comes to understanding the various forms and schedules required by the Internal Revenue Service (IRS). The Schedule C form, also known as Form 1040, Schedule C, is a critical component of the tax return process for sole proprietors and single-member limited liability companies (LLCs). It provides a detailed breakdown of the business's income and expenses, helping to calculate the net profit or loss from the business operation.

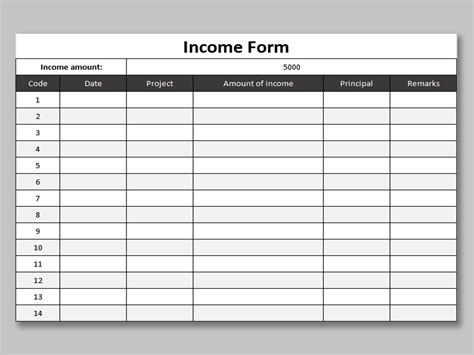

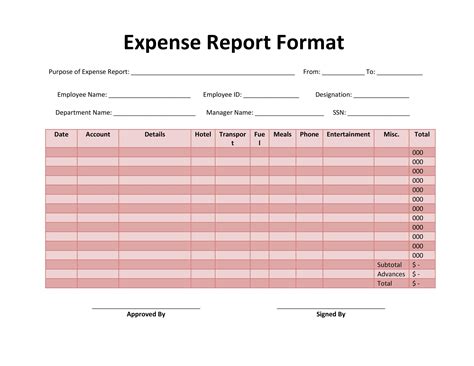

The Schedule C form is divided into several parts, each designed to capture specific information about the business. Part I is dedicated to reporting income, where businesses list their gross receipts or sales, along with any returns and allowances, and their cost of goods sold. This section is crucial as it lays the foundation for calculating the business's gross profit. Following the income section, Part II focuses on expenses, categorizing them into different types such as advertising, car and truck expenses, and utilities, among others. Accurately categorizing and totaling these expenses is vital for determining the business's net profit or loss.

Understanding the Schedule C Form

To complete the Schedule C form accurately, it's essential to maintain meticulous records throughout the year. This includes receipts for all business expenses, invoices for sales, and any other relevant financial documents. The form itself is relatively straightforward, but the preparation and organization required to fill it out correctly can be extensive. For many, seeking the advice of a tax professional or accountant can be beneficial, especially for those new to self-employment or operating a small business.

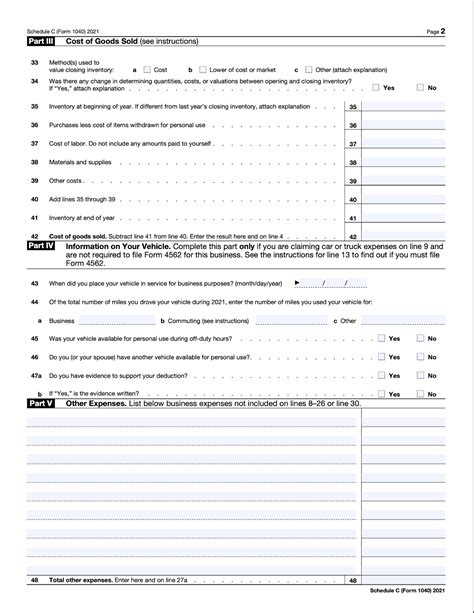

Components of the Schedule C Form

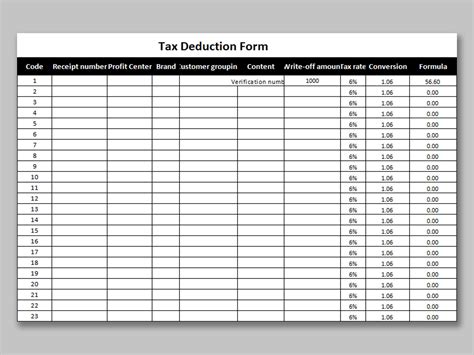

The Schedule C form is comprised of several key components, each serving a specific purpose in the calculation of business income or loss. These include: - **Part I: Income** - This section is where businesses report their gross income from sales, less returns and allowances, and their cost of goods sold. - **Part II: Expenses** - Here, businesses list their various expenses, which are categorized into different types. - **Part III: Cost of Goods Sold** - For businesses that sell products, this section is used to calculate the cost of those goods sold. - **Part IV: Information on Your Vehicle** - If a vehicle is used for business, this section is where the related expenses are calculated. - **Part V: Other Expenses** - Any expenses not listed in Part II are reported here.Filling Out the Schedule C Form

Filling out the Schedule C form requires careful attention to detail and accurate record-keeping. Here are some steps to follow:

- Gather All Necessary Documents - This includes receipts, invoices, bank statements, and any other financial records related to the business.

- Calculate Gross Income - Report all income from sales, minus returns and allowances.

- Deduct Cost of Goods Sold - For businesses that sell products, calculate the cost of those goods sold and deduct it from gross income.

- List Business Expenses - Categorize and total all business expenses, ensuring they are legitimate and documented.

- Calculate Net Profit or Loss - The final step is calculating the net profit or loss from the business operation by subtracting total expenses from gross income.

Tips for Accurate Completion

To ensure the Schedule C form is completed accurately, consider the following tips: - **Maintain Accurate Records** - Throughout the year, keep detailed records of all income and expenses. - **Seek Professional Advice** - If unsure about any part of the form, consider consulting a tax professional. - **Double-Check Calculations** - Ensure all calculations are correct to avoid errors. - **Keep Receipts** - For all business expenses, keep receipts and invoices as proof.Benefits of Using a Printable Schedule C Form

Using a printable Schedule C form can offer several benefits, including:

- Convenience - It can be easily downloaded and printed, allowing for manual completion.

- Cost-Effective - Reduces the need for professional preparation, unless the return is complex.

- Educational - Filling out the form manually can help business owners understand their financial situation better.

Common Mistakes to Avoid

When completing the Schedule C form, there are several common mistakes to avoid, including: - **Inaccurate Income Reporting** - Ensure all income is reported accurately. - **Incorrect Expense Categorization** - Expenses must be categorized correctly to ensure they are deductible. - **Failure to Keep Records** - Always keep detailed records of income and expenses.Gallery of Printable Schedule C Forms and Related Topics

Printable Schedule C Forms Gallery

Frequently Asked Questions

What is the Schedule C form used for?

+The Schedule C form is used to report income or loss from a business operated by a sole proprietor or single-member limited liability company (LLC).

How do I fill out the Schedule C form?

+To fill out the Schedule C form, gather all necessary documents, calculate gross income, deduct the cost of goods sold, list business expenses, and calculate the net profit or loss.

What are the benefits of using a printable Schedule C form?

+The benefits include convenience, cost-effectiveness, and the opportunity to understand the business's financial situation better by manually completing the form.

In conclusion, the printable Schedule C form is a vital tool for self-employed individuals and small business owners, providing a structured way to report business income and expenses to the IRS. By understanding the components of the form, maintaining accurate records, and seeking professional advice when needed, businesses can ensure compliance with tax laws and maximize their deductions. Whether you're a seasoned entrepreneur or just starting out, taking the time to understand and accurately complete the Schedule C form is an investment in the financial health and success of your business. We invite you to share your experiences or ask questions about completing the Schedule C form in the comments below, and don't forget to share this informative article with fellow business owners who might benefit from its insights.