Intro

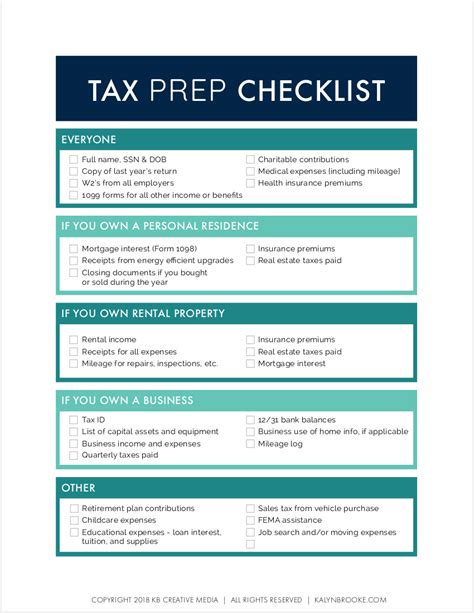

The tax season is upon us, and it's essential to be prepared to ensure a smooth and stress-free experience. A printable tax preparation checklist Excel template can be a valuable tool in helping you organize your finances and gather all the necessary documents. In this article, we will explore the importance of having a tax preparation checklist, how to create one using Excel, and provide tips on how to use it effectively.

Tax preparation can be a daunting task, especially for those who are new to the process. With so many documents to gather and forms to fill out, it's easy to get overwhelmed. However, having a comprehensive checklist can help you stay on track and ensure that you don't miss any critical steps. A printable tax preparation checklist Excel template can be customized to fit your specific needs, making it an essential tool for anyone looking to simplify their tax preparation process.

Using a tax preparation checklist can help you save time and reduce stress. By breaking down the tax preparation process into smaller, manageable tasks, you can focus on one step at a time, making it easier to stay organized. Additionally, having a checklist can help you identify potential issues or discrepancies in your tax return, allowing you to address them before submitting your return.

Benefits of Using a Tax Preparation Checklist

There are several benefits to using a tax preparation checklist, including:

- Reduced stress and anxiety: By breaking down the tax preparation process into smaller tasks, you can focus on one step at a time, making it easier to manage.

- Increased accuracy: A checklist can help you identify potential issues or discrepancies in your tax return, allowing you to address them before submitting your return.

- Time savings: By having all the necessary documents and information organized, you can quickly and easily complete your tax return.

- Improved organization: A checklist can help you keep track of all the documents and information you need to complete your tax return, making it easier to stay organized.

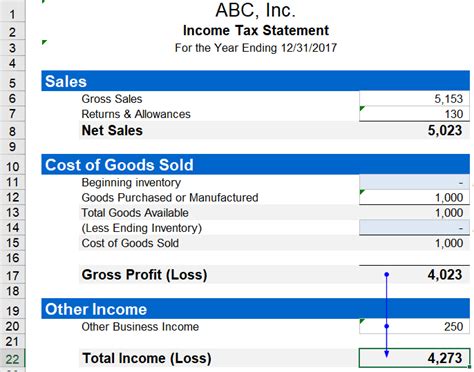

Creating a Tax Preparation Checklist in Excel

Creating a tax preparation checklist in Excel is a straightforward process. Here are the steps to follow:

- Open a new Excel spreadsheet and create a table with the following columns: Task, Description, Due Date, and Status.

- List all the tasks involved in the tax preparation process, such as gathering documents, filling out forms, and submitting your return.

- Add a description for each task, including any relevant details or instructions.

- Set a due date for each task, taking into account the tax filing deadline.

- Use the Status column to track the progress of each task, marking them as completed or pending.

Using a Tax Preparation Checklist Effectively

To get the most out of your tax preparation checklist, follow these tips:

- Review the checklist regularly: Regularly review your checklist to ensure you're on track to meet the tax filing deadline.

- Prioritize tasks: Prioritize tasks based on their urgency and importance, focusing on the most critical tasks first.

- Use reminders: Set reminders for upcoming deadlines and tasks to ensure you stay on track.

- Keep it updated: Keep your checklist updated throughout the tax preparation process, marking tasks as completed and adding new ones as needed.

Tax Preparation Checklist Template

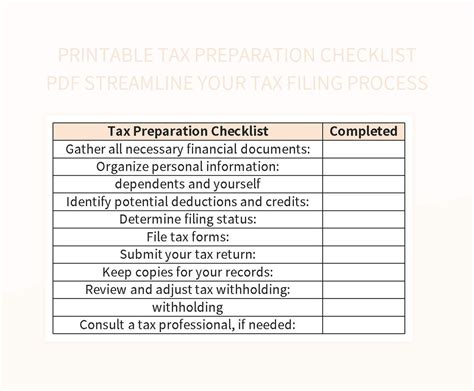

Here is a sample tax preparation checklist template:

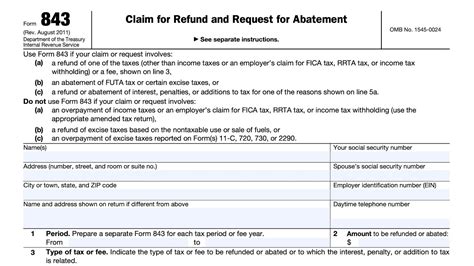

- Gather documents:

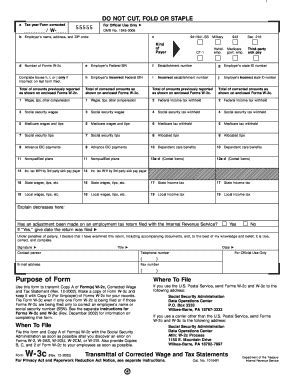

- W-2 forms

- 1099 forms

- Receipts for deductions

- Fill out forms:

- Form 1040

- Schedule A

- Schedule B

- Submit your return:

- Electronically

- By mail

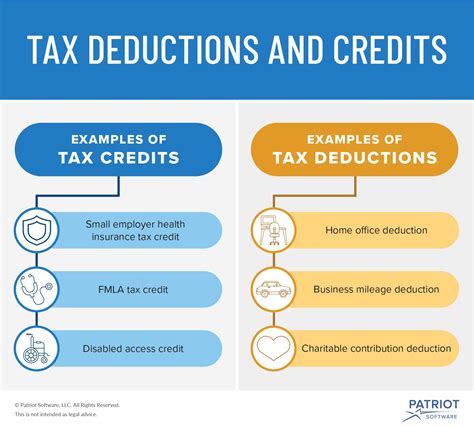

Common Tax Deductions and Credits

There are several common tax deductions and credits that you may be eligible for, including:

- Mortgage interest deduction

- Charitable donations

- Medical expenses

- Child tax credit

- Earned income tax credit

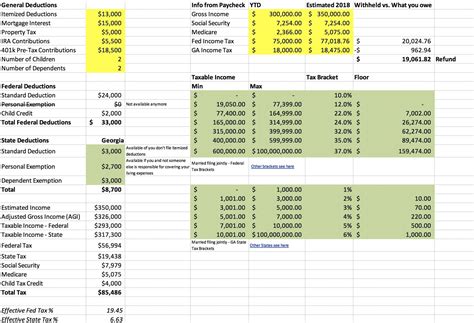

Maximizing Your Tax Refund

To maximize your tax refund, follow these tips:

- Claim all eligible deductions and credits

- Keep accurate records of your expenses and income

- File your return electronically

- Consider hiring a tax professional

Tax Preparation Software

There are several tax preparation software options available, including:

- TurboTax

- H&R Block

- TaxAct

- Credit Karma Tax

Choosing the Right Tax Preparation Software

When choosing a tax preparation software, consider the following factors:

- Ease of use

- Cost

- Features and functionality

- Customer support

Printable Tax Preparation Checklist Excel Image Gallery

What is a tax preparation checklist?

+A tax preparation checklist is a list of tasks and documents needed to prepare and file your tax return.

How do I create a tax preparation checklist in Excel?

+Open a new Excel spreadsheet, create a table with columns for tasks, descriptions, due dates, and status, and list all the tasks involved in the tax preparation process.

What are some common tax deductions and credits?

+Common tax deductions and credits include mortgage interest deduction, charitable donations, medical expenses, child tax credit, and earned income tax credit.

How do I choose the right tax preparation software?

+Consider factors such as ease of use, cost, features and functionality, and customer support when choosing a tax preparation software.

What are some tips for maximizing my tax refund?

+Claim all eligible deductions and credits, keep accurate records of your expenses and income, file your return electronically, and consider hiring a tax professional.

We hope this article has provided you with a comprehensive guide to using a printable tax preparation checklist Excel template. By following the tips and strategies outlined in this article, you can simplify your tax preparation process, reduce stress and anxiety, and maximize your tax refund. Remember to review and update your checklist regularly, and don't hesitate to seek professional help if you need it. Share this article with your friends and family to help them stay organized and prepared for tax season.