Intro

Get the Texas W9 Form Printable and learn about tax withholding, independent contractors, and IRS requirements with our free downloadable template and expert guidance.

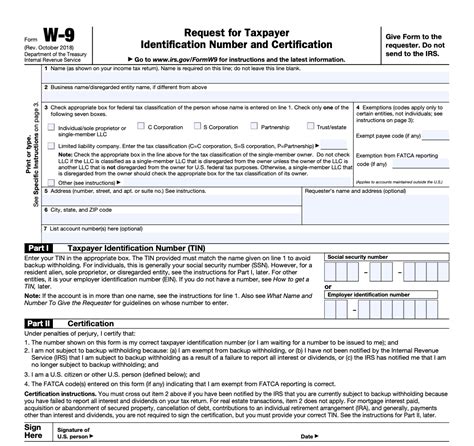

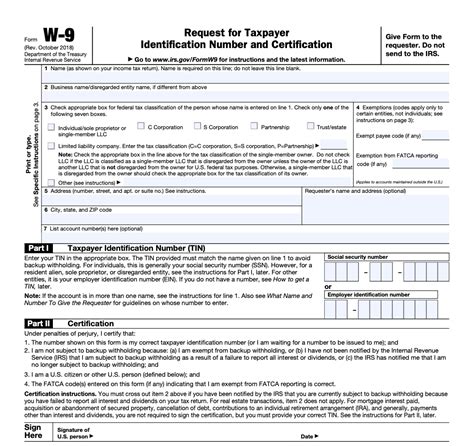

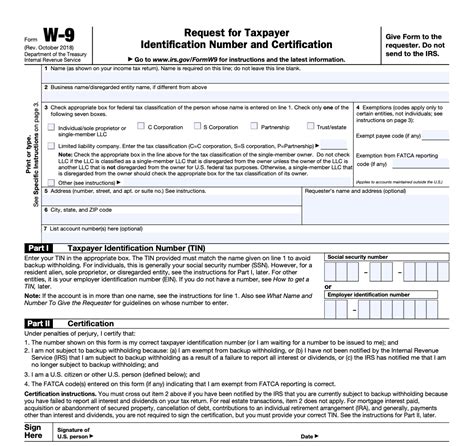

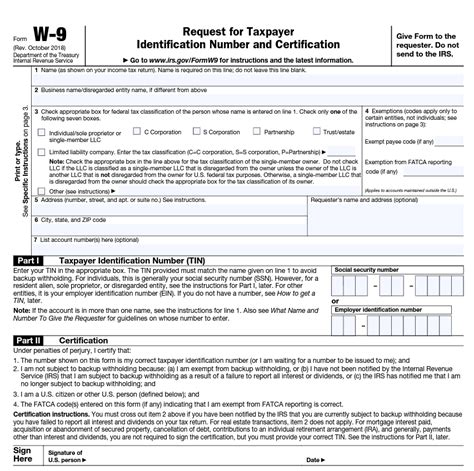

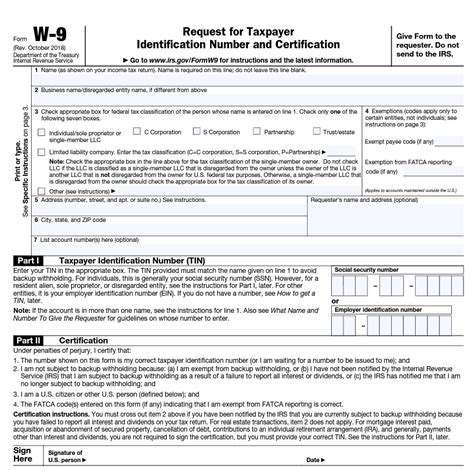

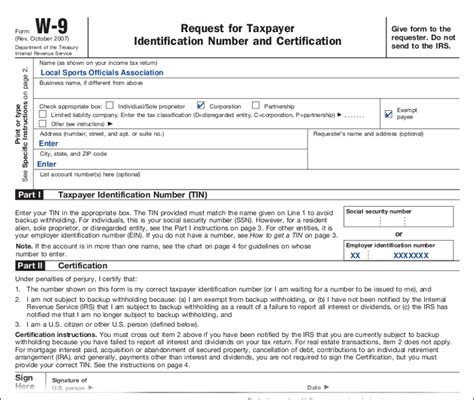

The Texas W9 form, also known as the Request for Taxpayer Identification Number and Certification, is a crucial document for businesses and individuals operating in the state of Texas. This form is used to provide taxpayer identification numbers and certify exempt status for Texas state tax purposes. In this article, we will delve into the importance of the Texas W9 form, its benefits, and how to obtain a printable version.

The Texas W9 form is essential for businesses, including corporations, partnerships, and limited liability companies, as well as for individuals, such as independent contractors and freelancers. This form is used to provide the necessary information to the Texas Comptroller's office, which is responsible for collecting and administering state taxes. By completing the Texas W9 form, businesses and individuals can ensure compliance with Texas state tax laws and regulations.

One of the primary benefits of the Texas W9 form is that it helps to prevent errors and delays in tax processing. By providing accurate and complete information, businesses and individuals can avoid potential penalties and fines associated with incorrect or incomplete tax filings. Additionally, the Texas W9 form helps to ensure that taxpayers receive the correct tax credits and deductions, which can result in significant savings.

For businesses operating in Texas, the W9 form is a critical component of their tax compliance strategy. By completing this form, businesses can demonstrate their commitment to tax compliance and avoid potential audits and penalties. Furthermore, the Texas W9 form helps businesses to establish a paper trail, which can be useful in the event of an audit or tax dispute.

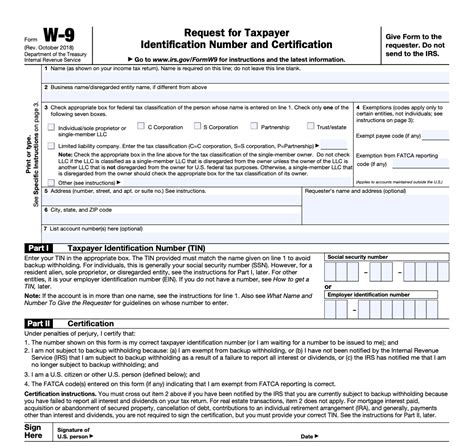

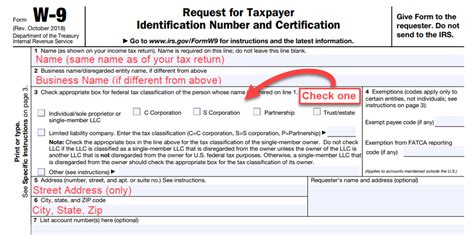

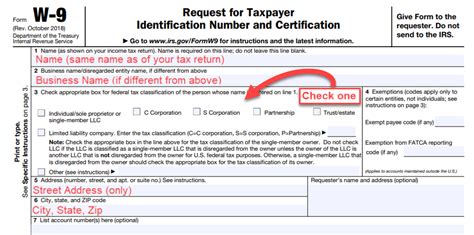

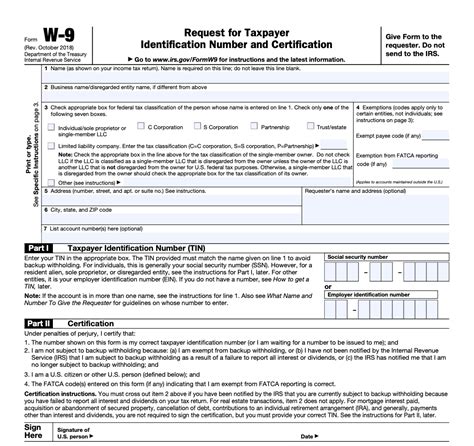

Texas W9 Form Overview

In terms of obtaining a printable version of the Texas W9 form, there are several options available. The Texas Comptroller's office provides a downloadable version of the form on their website, which can be accessed and printed for free. Additionally, many online tax preparation software providers, such as TurboTax and H&R Block, offer printable versions of the Texas W9 form as part of their tax preparation packages.

Benefits of Using a Printable Texas W9 Form

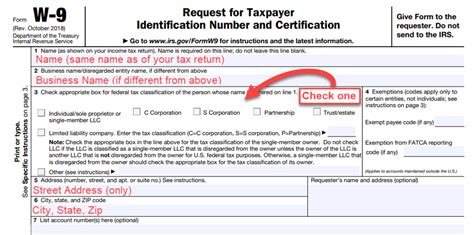

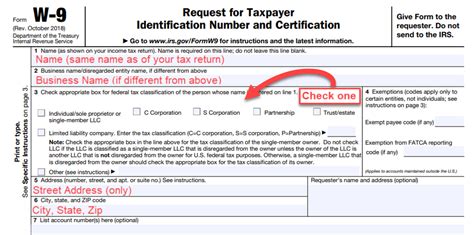

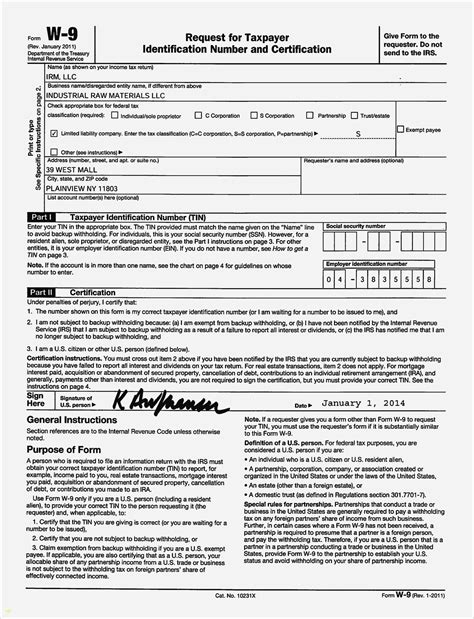

When using a printable Texas W9 form, it is essential to ensure that the form is completed accurately and thoroughly. This includes providing the correct taxpayer identification number, business name, and address, as well as certifying exempt status, if applicable. By taking the time to carefully complete the Texas W9 form, businesses and individuals can avoid potential errors and delays in tax processing.

How to Complete a Texas W9 Form

To complete a Texas W9 form, follow these steps:

- Download and print the form from the Texas Comptroller's website or obtain a copy from a tax preparation software provider.

- Carefully read and follow the instructions provided on the form.

- Provide the correct taxpayer identification number, business name, and address.

- Certify exempt status, if applicable.

- Sign and date the form.

- Submit the completed form to the Texas Comptroller's office or to the requesting party.

Texas W9 Form Requirements

In terms of requirements, the Texas W9 form must be completed and submitted to the Texas Comptroller's office or to the requesting party. The form must be signed and dated, and it must include the correct taxpayer identification number, business name, and address. Additionally, the form must certify exempt status, if applicable.

Texas W9 Form Exempt Status

Exempt status on the Texas W9 form refers to the status of an organization or individual that is exempt from paying certain taxes. To certify exempt status on the Texas W9 form, the following steps must be taken:

- Determine if the organization or individual is eligible for exempt status.

- Obtain the necessary documentation to support the exempt status claim.

- Complete the exempt status section of the Texas W9 form.

- Sign and date the form.

Texas W9 Form Penalties

Failure to complete and submit the Texas W9 form can result in penalties and fines. These penalties can include:

- Late filing penalties

- Late payment penalties

- Interest on unpaid taxes

- Audit and examination penalties

Texas W9 Form Audit

In the event of an audit, the Texas W9 form can serve as a critical piece of documentation. The form provides evidence of taxpayer identification number, business name, and address, as well as exempt status, if applicable. By maintaining accurate and complete records, including the Texas W9 form, businesses and individuals can demonstrate compliance with Texas state tax laws and regulations.

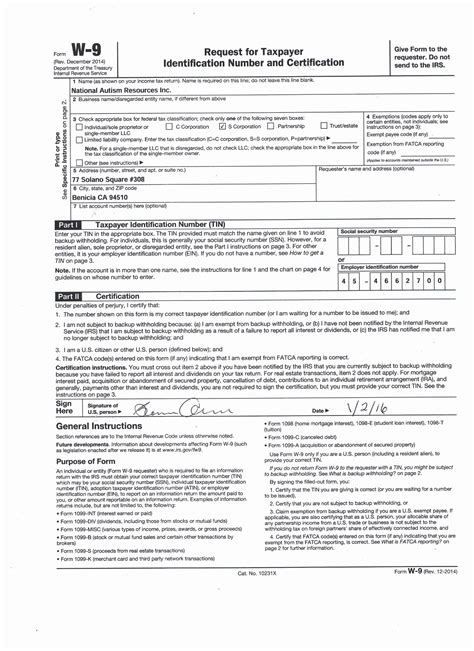

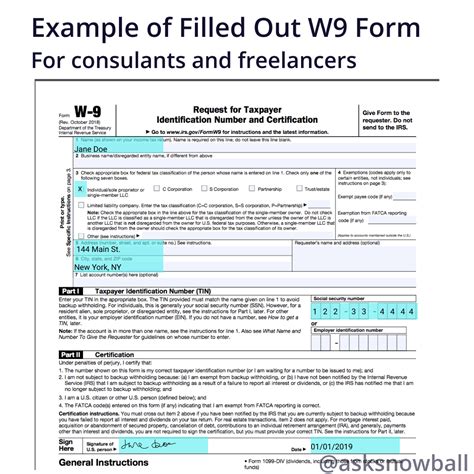

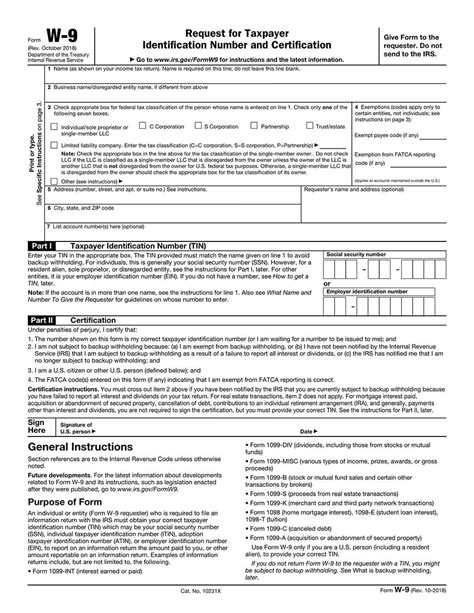

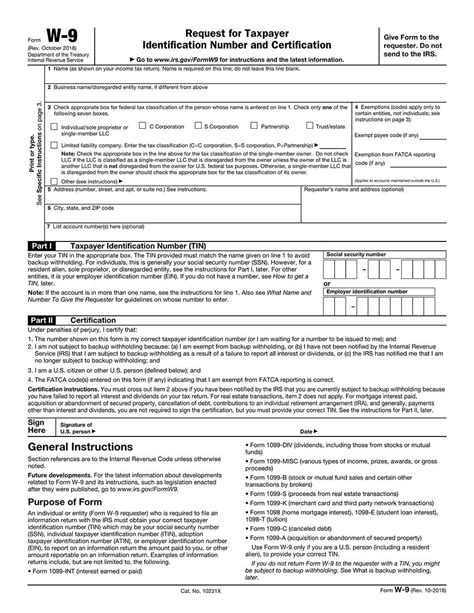

Gallery of Texas W9 Forms

Texas W9 Form Image Gallery

What is the purpose of the Texas W9 form?

+The Texas W9 form is used to provide taxpayer identification numbers and certify exempt status for Texas state tax purposes.

How do I obtain a printable version of the Texas W9 form?

+The Texas Comptroller's office provides a downloadable version of the form on their website, which can be accessed and printed for free. Additionally, many online tax preparation software providers offer printable versions of the Texas W9 form as part of their tax preparation packages.

What are the penalties for not completing and submitting the Texas W9 form?

+Failure to complete and submit the Texas W9 form can result in penalties and fines, including late filing penalties, late payment penalties, interest on unpaid taxes, and audit and examination penalties.

How do I certify exempt status on the Texas W9 form?

+To certify exempt status on the Texas W9 form, determine if the organization or individual is eligible for exempt status, obtain the necessary documentation to support the exempt status claim, complete the exempt status section of the Texas W9 form, and sign and date the form.

What is the importance of maintaining accurate and complete records, including the Texas W9 form?

+Maintaining accurate and complete records, including the Texas W9 form, is essential for demonstrating compliance with Texas state tax laws and regulations. In the event of an audit, the Texas W9 form can serve as a critical piece of documentation, providing evidence of taxpayer identification number, business name, and address, as well as exempt status, if applicable.

In