Intro

Learn about processing credit card transactions, including payment gateways, merchant accounts, and secure online payment processing, to streamline transactions and reduce fees with efficient credit card processing systems.

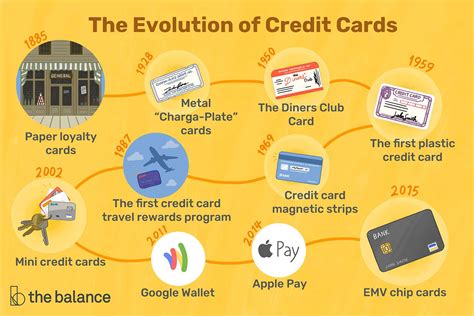

The world of payment processing has evolved significantly over the years, with credit cards becoming a staple in modern commerce. Processing credit card transactions is a complex process that involves multiple parties, including the merchant, the cardholder, the payment processor, and the bank. Understanding how credit card transactions are processed is essential for businesses and individuals alike, as it can help them navigate the often-complex world of payment processing.

The importance of processing credit card transactions cannot be overstated. With the rise of e-commerce and online shopping, credit cards have become the preferred method of payment for many consumers. In fact, according to a recent study, credit cards account for over 40% of all online transactions. As a result, businesses that do not accept credit cards are at a significant disadvantage, as they are missing out on a large portion of potential sales. Furthermore, processing credit card transactions efficiently and securely is crucial for building trust with customers and preventing fraudulent activities.

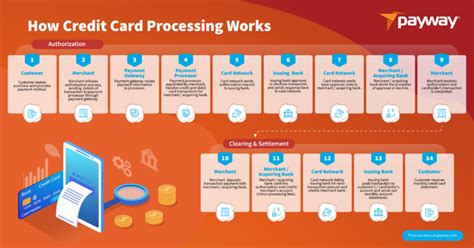

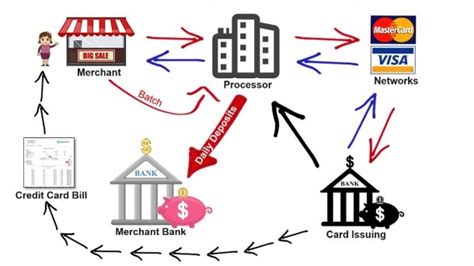

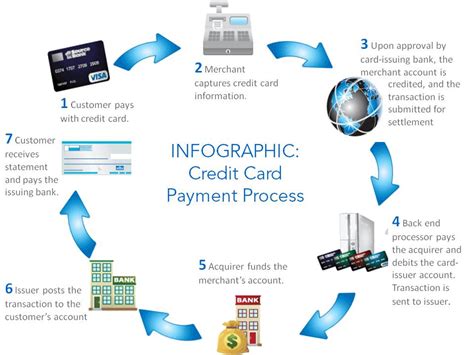

The process of processing credit card transactions begins when a cardholder makes a purchase from a merchant. The merchant then submits the transaction to the payment processor, who forwards it to the card network (such as Visa or Mastercard). The card network then sends the transaction to the issuing bank, which verifies the cardholder's account information and checks for sufficient funds. If the transaction is approved, the issuing bank sends a response back to the card network, which then forwards it to the payment processor. The payment processor then deposits the funds into the merchant's account, and the transaction is complete.

Introduction to Credit Card Processing

Credit card processing involves several key players, including the merchant, the cardholder, the payment processor, and the bank. The merchant is the business or individual that accepts credit cards as a form of payment. The cardholder is the individual who makes the purchase using their credit card. The payment processor is the company that handles the transaction on behalf of the merchant, and the bank is the financial institution that issues the credit card and holds the cardholder's account.

Key Players in Credit Card Processing

The payment processor plays a critical role in credit card processing, as they are responsible for verifying the cardholder's information, checking for sufficient funds, and forwarding the transaction to the card network. The payment processor also handles the settlement of the transaction, which involves depositing the funds into the merchant's account.The Credit Card Processing Cycle

The credit card processing cycle involves several steps, including authorization, capture, and settlement. Authorization occurs when the merchant submits the transaction to the payment processor, who then forwards it to the card network. The card network sends the transaction to the issuing bank, which verifies the cardholder's account information and checks for sufficient funds. If the transaction is approved, the issuing bank sends a response back to the card network, which then forwards it to the payment processor.

Authorization and Capture

Capture occurs when the merchant completes the transaction and submits it to the payment processor for settlement. The payment processor then forwards the transaction to the card network, which sends it to the issuing bank for payment. The issuing bank then transfers the funds to the merchant's account, and the transaction is complete.Security Measures in Credit Card Processing

Security is a critical aspect of credit card processing, as it helps to prevent fraudulent activities and protect sensitive cardholder information. One of the most effective security measures is encryption, which involves converting sensitive data into a code that can only be deciphered by authorized parties. Another security measure is tokenization, which involves replacing sensitive data with a unique token that can be used to identify the cardholder without exposing their actual card information.

Tokenization and Encryption

Tokenization and encryption are essential security measures in credit card processing, as they help to protect sensitive cardholder information and prevent fraudulent activities. By using tokenization and encryption, merchants can ensure that their customers' sensitive information is protected, and they can reduce the risk of data breaches and other security threats.Benefits of Credit Card Processing

There are several benefits to credit card processing, including increased sales, improved cash flow, and enhanced customer convenience. By accepting credit cards, businesses can attract more customers and increase their sales, as credit cards are a preferred method of payment for many consumers. Credit card processing also improves cash flow, as it allows businesses to receive payment quickly and efficiently.

Increased Sales and Improved Cash Flow

Credit card processing also enhances customer convenience, as it allows customers to make purchases quickly and easily. With credit card processing, customers can make purchases online, in-store, or over the phone, and they can use their credit cards to pay for goods and services.Common Credit Card Processing Fees

There are several common credit card processing fees, including transaction fees, discount rates, and monthly fees. Transaction fees are charged per transaction, and they can range from 10 cents to 30 cents per transaction. Discount rates are a percentage of the transaction amount, and they can range from 1% to 3% per transaction. Monthly fees are charged on a monthly basis, and they can range from $10 to $50 per month.

Transaction Fees and Discount Rates

Monthly fees are also common in credit card processing, and they can include fees for statement fees, customer service fees, and equipment fees. By understanding the common credit card processing fees, businesses can make informed decisions about their payment processing options and choose the best solution for their needs.Choosing a Credit Card Processor

Choosing a credit card processor is an important decision for businesses, as it can affect their sales, cash flow, and customer convenience. When choosing a credit card processor, businesses should consider several factors, including fees, security, and customer support. They should also consider the types of credit cards accepted, the payment processing methods, and the integration with their existing systems.

Factors to Consider When Choosing a Credit Card Processor

By considering these factors, businesses can choose a credit card processor that meets their needs and provides the best possible solution for their customers. They can also ensure that their payment processing is secure, efficient, and cost-effective.Mobile Credit Card Processing

Mobile credit card processing is a growing trend in the payment processing industry, as it allows businesses to accept credit card payments on-the-go. With mobile credit card processing, businesses can use a mobile device, such as a smartphone or tablet, to accept credit card payments. This can be especially useful for businesses that operate in multiple locations or that need to accept payments remotely.

Mobile Credit Card Processing Solutions

Mobile credit card processing solutions typically involve a mobile app and a card reader, which can be attached to the mobile device. The mobile app allows businesses to manage their transactions, track their sales, and monitor their inventory. The card reader allows businesses to accept credit card payments securely and efficiently.Online Credit Card Processing

Online credit card processing is another growing trend in the payment processing industry, as it allows businesses to accept credit card payments online. With online credit card processing, businesses can use an e-commerce platform or a payment gateway to accept credit card payments. This can be especially useful for businesses that operate online or that need to accept payments from customers remotely.

Online Credit Card Processing Solutions

Online credit card processing solutions typically involve a payment gateway and a merchant account, which can be used to accept credit card payments online. The payment gateway allows businesses to manage their transactions, track their sales, and monitor their inventory. The merchant account allows businesses to receive payment from their customers and to transfer funds to their bank account.Credit Card Processing Image Gallery

What is credit card processing?

+Credit card processing is the process of accepting and processing credit card payments from customers.

How does credit card processing work?

+Credit card processing involves several steps, including authorization, capture, and settlement. The merchant submits the transaction to the payment processor, who forwards it to the card network. The card network sends the transaction to the issuing bank, which verifies the cardholder's account information and checks for sufficient funds.

What are the benefits of credit card processing?

+The benefits of credit card processing include increased sales, improved cash flow, and enhanced customer convenience. By accepting credit cards, businesses can attract more customers and increase their sales, as credit cards are a preferred method of payment for many consumers.

What are the common credit card processing fees?

+The common credit card processing fees include transaction fees, discount rates, and monthly fees. Transaction fees are charged per transaction, and they can range from 10 cents to 30 cents per transaction. Discount rates are a percentage of the transaction amount, and they can range from 1% to 3% per transaction.

How do I choose a credit card processor?

+When choosing a credit card processor, businesses should consider several factors, including fees, security, and customer support. They should also consider the types of credit cards accepted, the payment processing methods, and the integration with their existing systems.

In