Intro

Learn about processing credit card payments, including secure payment gateways, online transaction processing, and credit card payment systems for merchants and businesses.

The world of e-commerce has revolutionized the way businesses operate, with online transactions becoming the norm. At the heart of these transactions lies the processing of credit card payments, a complex yet crucial aspect of modern commerce. Understanding how credit card payments are processed is essential for businesses and consumers alike, as it helps to ensure secure, efficient, and reliable transactions. The importance of processing credit card payments cannot be overstated, as it directly impacts the bottom line of businesses and the satisfaction of their customers.

In today's digital age, the ability to process credit card payments is no longer a luxury but a necessity. Consumers expect to be able to pay for goods and services online, and businesses that fail to provide this option risk losing sales and falling behind their competitors. Moreover, the rise of mobile commerce has further emphasized the need for seamless and secure credit card payment processing. As the e-commerce landscape continues to evolve, it is crucial for businesses to stay ahead of the curve by adopting the latest payment processing technologies and strategies.

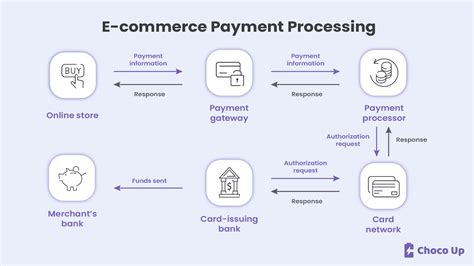

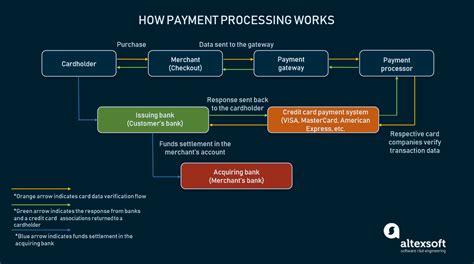

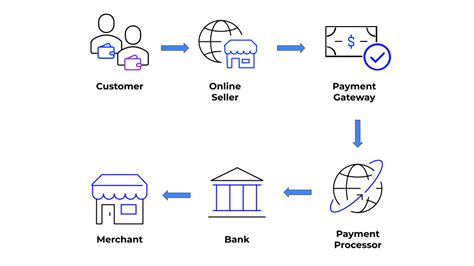

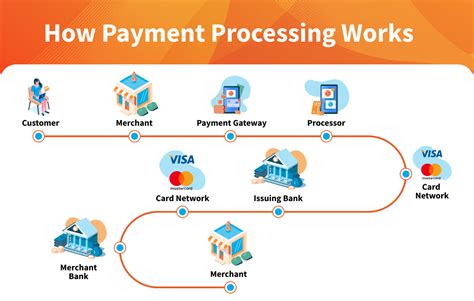

The process of processing credit card payments involves several key players, including the merchant, the payment gateway, the payment processor, and the issuing bank. Each of these entities plays a vital role in ensuring that transactions are processed securely and efficiently. For instance, the payment gateway acts as the intermediary between the merchant and the payment processor, facilitating the transmission of payment information and ensuring that transactions are authorized and settled correctly. Meanwhile, the issuing bank verifies the cardholder's account information and ensures that the transaction is legitimate.

Introduction to Credit Card Payment Processing

Credit card payment processing involves a series of complex steps, from the initial authorization request to the final settlement of the transaction. At its core, the process relies on a network of interconnected systems and entities, each working together to ensure that transactions are processed securely and efficiently. The introduction of new technologies, such as tokenization and encryption, has further enhanced the security of credit card payment processing, protecting sensitive cardholder information from unauthorized access.

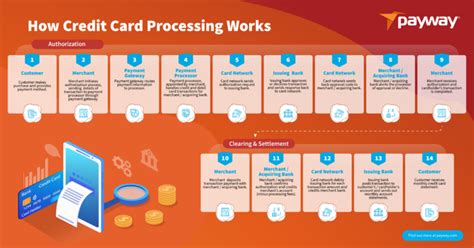

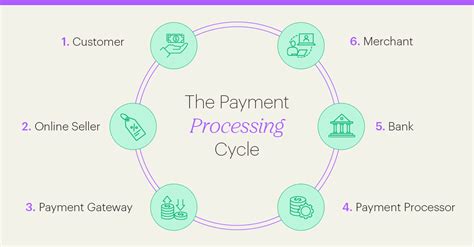

Key Players in Credit Card Payment Processing

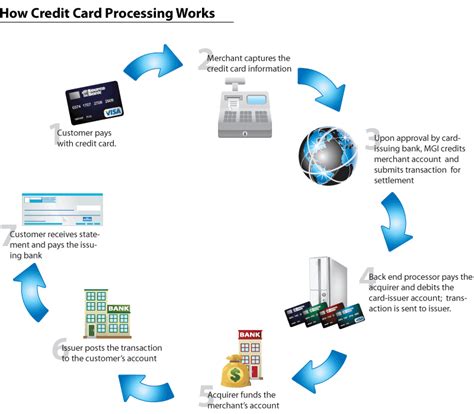

The key players in credit card payment processing include: * Merchants: These are the businesses that accept credit card payments from their customers. * Payment Gateways: These act as intermediaries between the merchant and the payment processor, facilitating the transmission of payment information. * Payment Processors: These handle the processing of credit card transactions, including authorization and settlement. * Issuing Banks: These verify the cardholder's account information and ensure that the transaction is legitimate.The Credit Card Payment Processing Cycle

The credit card payment processing cycle involves several key steps, from the initial authorization request to the final settlement of the transaction. These steps include:

- Authorization: The merchant requests authorization from the issuing bank to verify the cardholder's account information and ensure that the transaction is legitimate.

- Authentication: The cardholder is authenticated to ensure that they are the rightful owner of the credit card.

- Processing: The payment processor handles the processing of the credit card transaction, including the transfer of funds from the cardholder's account to the merchant's account.

- Settlement: The transaction is settled, and the funds are transferred to the merchant's account.

- Reconciliation: The merchant reconciles their transactions to ensure that they have received the correct amount of funds.

Benefits of Credit Card Payment Processing

The benefits of credit card payment processing include: * Convenience: Credit card payment processing allows consumers to make purchases online or in-store, using their credit cards. * Security: Credit card payment processing involves several layers of security, including encryption and tokenization, to protect sensitive cardholder information. * Efficiency: Credit card payment processing is faster and more efficient than traditional payment methods, such as cash or check. * Increased Sales: By accepting credit card payments, businesses can increase their sales and revenue.Security Measures in Credit Card Payment Processing

Security is a top priority in credit card payment processing, with several measures in place to protect sensitive cardholder information. These measures include:

- Encryption: This involves the use of algorithms to scramble sensitive cardholder information, making it unreadable to unauthorized parties.

- Tokenization: This involves the replacement of sensitive cardholder information with tokens, which are unique identifiers that can be used to facilitate transactions without exposing the underlying cardholder information.

- Secure Sockets Layer (SSL): This is a protocol that provides a secure connection between the merchant's website and the payment gateway, protecting sensitive cardholder information from interception.

Common Credit Card Payment Processing Fees

The common credit card payment processing fees include: * Discount Rate: This is a percentage of the transaction amount that is charged by the payment processor. * Transaction Fee: This is a flat fee that is charged by the payment processor for each transaction. * Monthly Fee: This is a flat fee that is charged by the payment processor on a monthly basis. * Gateway Fee: This is a fee that is charged by the payment gateway for each transaction.Choosing a Credit Card Payment Processor

Choosing a credit card payment processor is a critical decision for businesses, as it can impact their bottom line and customer satisfaction. When selecting a credit card payment processor, businesses should consider several factors, including:

- Fees: The payment processor's fees, including the discount rate, transaction fee, and monthly fee.

- Security: The payment processor's security measures, including encryption and tokenization.

- Integration: The payment processor's ability to integrate with the business's existing systems and platforms.

- Customer Support: The payment processor's customer support, including their availability and responsiveness.

Best Practices for Credit Card Payment Processing

The best practices for credit card payment processing include: * Using secure protocols, such as SSL and TLS, to protect sensitive cardholder information. * Implementing tokenization and encryption to protect sensitive cardholder information. * Regularly updating software and systems to ensure that they are secure and compliant with industry standards. * Providing clear and transparent disclosure of credit card payment processing fees and terms.Future of Credit Card Payment Processing

The future of credit card payment processing is exciting and rapidly evolving, with several trends and technologies on the horizon. These include:

- Contactless Payments: These involve the use of near-field communication (NFC) technology to facilitate transactions without the need for physical contact.

- Mobile Payments: These involve the use of mobile devices to facilitate transactions, using technologies such as Apple Pay and Google Pay.

- Blockchain: This is a distributed ledger technology that has the potential to revolutionize credit card payment processing, by providing a secure and transparent way to facilitate transactions.

Impact of Emerging Technologies on Credit Card Payment Processing

The impact of emerging technologies on credit card payment processing is significant, with several benefits and challenges. These include: * Increased Security: Emerging technologies, such as blockchain and artificial intelligence, have the potential to increase the security of credit card payment processing. * Improved Efficiency: Emerging technologies, such as machine learning and automation, have the potential to improve the efficiency of credit card payment processing. * New Business Models: Emerging technologies, such as blockchain and the Internet of Things (IoT), have the potential to enable new business models and revenue streams.Credit Card Payment Processing Image Gallery

What is credit card payment processing?

+Credit card payment processing involves the transfer of funds from a cardholder's account to a merchant's account, using a credit card as the payment method.

How does credit card payment processing work?

+Credit card payment processing involves several key steps, including authorization, authentication, processing, settlement, and reconciliation.

What are the benefits of credit card payment processing?

+The benefits of credit card payment processing include convenience, security, efficiency, and increased sales.

How do I choose a credit card payment processor?

+When choosing a credit card payment processor, consider factors such as fees, security, integration, and customer support.

What is the future of credit card payment processing?

+The future of credit card payment processing is exciting and rapidly evolving, with several trends and technologies on the horizon, including contactless payments, mobile payments, and blockchain.

In conclusion, processing credit card payments is a complex yet crucial aspect of modern commerce. By understanding the key players, benefits, and security measures involved in credit card payment processing, businesses can make informed decisions about their payment processing needs. As the e-commerce landscape continues to evolve, it is crucial for businesses to stay ahead of the curve by adopting the latest payment processing technologies and strategies. We invite you to share your thoughts and experiences with credit card payment processing in the comments below, and to explore our other resources on this topic for further information and insights.