Intro

Protect your retail business with comprehensive insurance coverage, including liability, property, and workers compensation, to mitigate risks and ensure financial stability.

As a retail business owner, you understand the importance of protecting your investment from unforeseen events that could impact your operations. Retail business insurance coverage is a crucial aspect of managing risk and ensuring the long-term viability of your company. With the right insurance policies in place, you can mitigate potential losses and focus on growing your business. In this article, we will delve into the world of retail business insurance, exploring the various types of coverage available, their benefits, and how to choose the right policies for your business.

The retail industry is a complex and dynamic sector, with businesses facing a wide range of risks, from property damage and liability to employee injuries and cyber attacks. According to a recent study, the average retail business experiences at least one insurance claim per year, with the most common claims related to property damage, theft, and employee injuries. By investing in comprehensive insurance coverage, retail businesses can reduce their financial exposure and ensure they have the necessary resources to recover from unexpected events.

Retail businesses require a unique combination of insurance policies to address their specific risks and exposures. Some of the most common types of retail business insurance coverage include property insurance, liability insurance, workers' compensation insurance, and cyber insurance. Property insurance protects your business against damage to your building, inventory, and equipment, while liability insurance covers you in the event of a lawsuit or claim related to your business operations. Workers' compensation insurance provides financial support to employees who are injured on the job, and cyber insurance protects your business against data breaches and other cyber threats.

Retail Business Insurance Types

When it comes to retail business insurance, there are several types of coverage to consider. These include:

- Property insurance: This type of insurance protects your business against damage to your building, inventory, and equipment.

- Liability insurance: This type of insurance covers you in the event of a lawsuit or claim related to your business operations.

- Workers' compensation insurance: This type of insurance provides financial support to employees who are injured on the job.

- Cyber insurance: This type of insurance protects your business against data breaches and other cyber threats.

- Business interruption insurance: This type of insurance provides financial support to your business in the event of a disruption to your operations.

Benefits of Retail Business Insurance

The benefits of retail business insurance are numerous. Some of the most significant advantages include: * Financial protection: Insurance provides a financial safety net in the event of an unexpected event or claim. * Risk management: Insurance helps you manage risk and reduce your financial exposure. * Compliance: Many states require businesses to carry certain types of insurance, such as workers' compensation insurance. * Reputation protection: Insurance can help protect your business reputation by providing a way to respond to claims and lawsuits. * Employee protection: Workers' compensation insurance provides financial support to employees who are injured on the job.How to Choose the Right Retail Business Insurance

Choosing the right retail business insurance policies can be a complex and overwhelming process. Here are some tips to help you make the right decision:

- Assess your risks: Identify the specific risks and exposures facing your business and choose policies that address these risks.

- Compare quotes: Compare quotes from multiple insurance providers to find the best rates and coverage.

- Read policy terms: Carefully read the terms and conditions of each policy to ensure you understand what is covered and what is not.

- Consider your budget: Choose policies that fit within your budget and provide the necessary coverage.

- Seek professional advice: Consider seeking the advice of an insurance professional or broker to help you navigate the process.

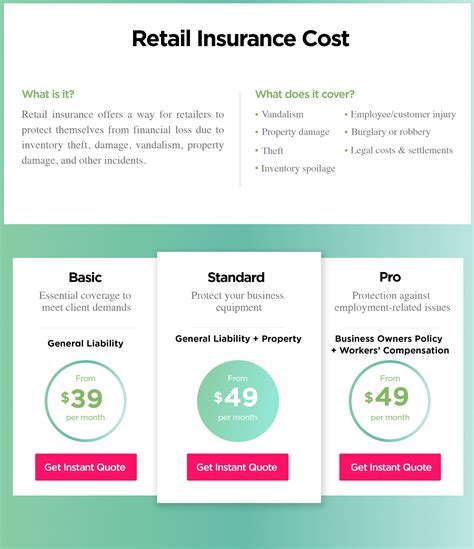

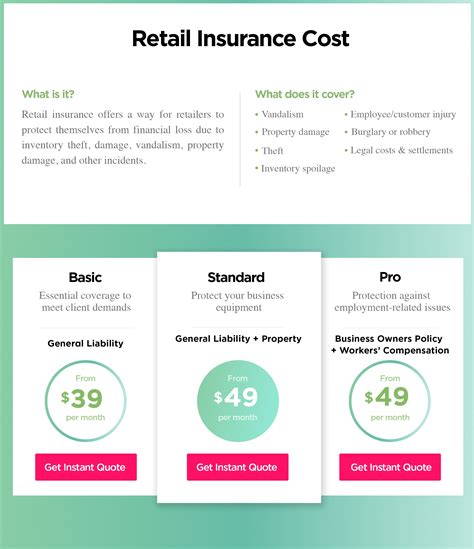

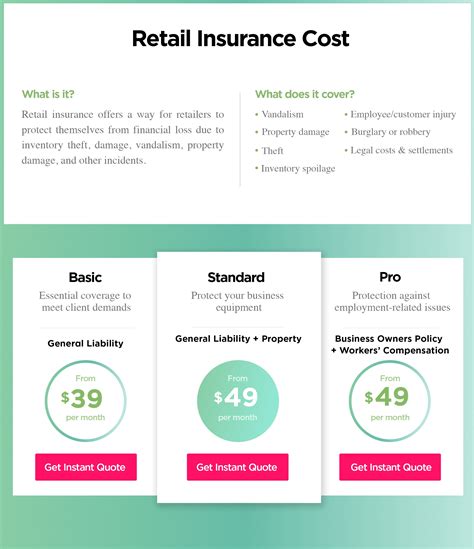

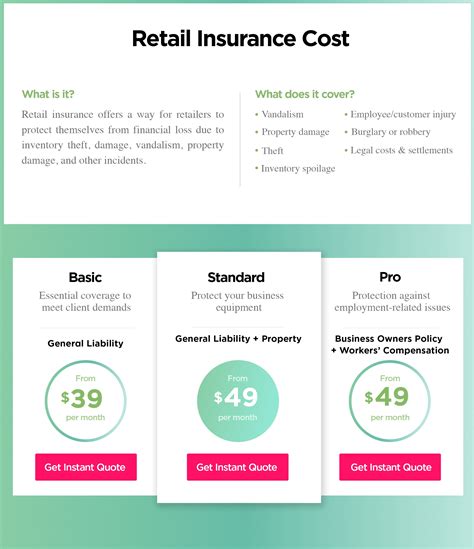

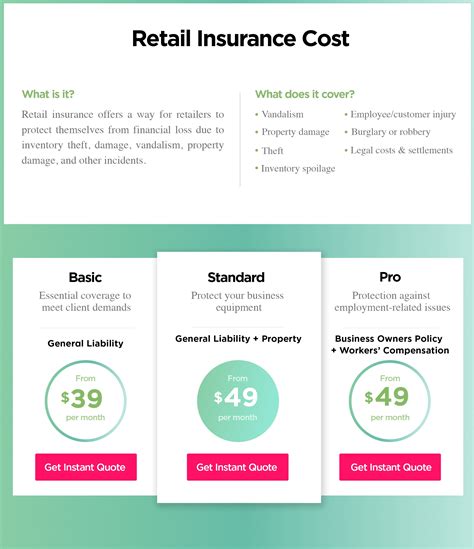

Retail Business Insurance Costs

The cost of retail business insurance varies depending on a number of factors, including the type of business, location, and level of coverage. Some of the factors that can impact the cost of insurance include: * Business size: Larger businesses typically pay more for insurance than smaller businesses. * Location: Businesses located in high-risk areas may pay more for insurance than those located in lower-risk areas. * Level of coverage: The level of coverage you choose can impact the cost of insurance. * Claims history: Businesses with a history of claims may pay more for insurance than those with a clean claims history.Retail Business Insurance Providers

There are many retail business insurance providers to choose from, each offering a range of policies and coverage options. Some of the most well-known providers include:

- State Farm

- Allstate

- Geico

- Progressive

- Liberty Mutual

- Nationwide

- USAA

- Farmers Insurance

- Travelers

- Hartford

Retail Business Insurance Claims

Making a claim on your retail business insurance policy can be a complex and time-consuming process. Here are some tips to help you navigate the process: * Notify your insurer: Notify your insurer as soon as possible after an incident or event. * Gather evidence: Gather evidence to support your claim, including photos, videos, and witness statements. * Complete a claim form: Complete a claim form and submit it to your insurer. * Cooperate with the investigation: Cooperate with the investigation and provide any additional information requested by your insurer. * Keep records: Keep records of all correspondence and communication with your insurer.Retail Business Insurance FAQs

Here are some frequently asked questions about retail business insurance:

- What types of insurance do I need for my retail business?

- How much does retail business insurance cost?

- What is the difference between liability insurance and property insurance?

- Do I need workers' compensation insurance for my retail business?

- How do I make a claim on my retail business insurance policy?

Retail Business Insurance Tips

Here are some tips to help you get the most out of your retail business insurance: * Review your policies regularly: Review your policies regularly to ensure you have the necessary coverage. * Consider bundling policies: Consider bundling policies to save money and simplify your insurance management. * Shop around: Shop around and compare quotes from multiple insurance providers to find the best rates and coverage. * Read policy terms: Carefully read the terms and conditions of each policy to ensure you understand what is covered and what is not. * Seek professional advice: Consider seeking the advice of an insurance professional or broker to help you navigate the process.Retail Business Insurance Image Gallery

What types of insurance do I need for my retail business?

+The types of insurance you need for your retail business depend on several factors, including the size and type of your business, the location, and the level of risk. Some common types of insurance for retail businesses include property insurance, liability insurance, workers' compensation insurance, and cyber insurance.

How much does retail business insurance cost?

+The cost of retail business insurance varies depending on several factors, including the type and size of your business, the location, and the level of risk. On average, retail businesses can expect to pay between $500 and $5,000 per year for insurance, depending on the type and level of coverage.

What is the difference between liability insurance and property insurance?

+Liability insurance protects your business against claims and lawsuits related to your business operations, while property insurance protects your business against damage to your building, inventory, and equipment. Both types of insurance are essential for retail businesses, as they help protect against financial losses and reputational damage.

Do I need workers' compensation insurance for my retail business?

+Yes, if you have employees, you are required by law to carry workers' compensation insurance. This type of insurance provides financial support to employees who are injured on the job and helps protect your business against lawsuits related to workplace injuries.

How do I make a claim on my retail business insurance policy?

+To make a claim on your retail business insurance policy, you should notify your insurer as soon as possible after an incident or event. You will need to provide evidence to support your claim, including photos, videos, and witness statements. Your insurer will then investigate the claim and determine the extent of the coverage.

In conclusion, retail business insurance is a crucial aspect of managing risk and ensuring the long-term viability of your company. By understanding the different types of insurance available, assessing your risks, and choosing the right policies, you can protect your business against unforeseen events and focus on growing your operations. Remember to review your policies regularly, consider bundling policies, and seek professional advice to ensure you have the necessary coverage to protect your business. Share your thoughts and experiences with retail business insurance in the comments below, and don't forget to share this article with your colleagues and friends who may benefit from this information.