Intro

Explore retail location lease options, including short-term rentals, long-term leases, and pop-up shops, to find the perfect commercial space for your business, considering factors like foot traffic, demographics, and lease agreements.

When it comes to finding the perfect location for a retail business, there are several factors to consider. One of the most important decisions is whether to lease or buy a location. Leasing a retail location can be a great option for many businesses, as it allows for flexibility and can be more cost-effective than buying a property outright. In this article, we will explore the different types of retail location lease options available, the benefits and drawbacks of each, and provide guidance on how to choose the right option for your business.

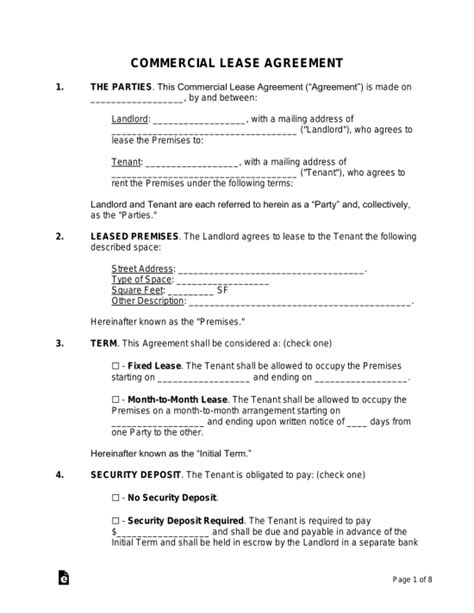

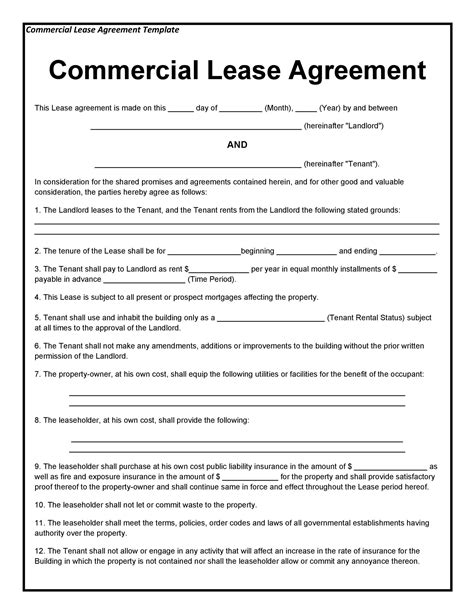

Leasing a retail location can be a complex process, and it's essential to understand the different types of leases available. The most common types of retail leases include gross leases, net leases, and percentage leases. Each type of lease has its own unique characteristics, and it's crucial to choose the one that best suits your business needs. Additionally, lease terms can vary significantly, and it's essential to carefully review and negotiate the terms of your lease to ensure that they align with your business goals.

Retail Location Lease Types

There are several types of retail location leases, each with its own advantages and disadvantages. The most common types of leases include:

- Gross leases: This type of lease requires the tenant to pay a fixed monthly rent, and the landlord is responsible for all expenses, including property taxes, insurance, and maintenance.

- Net leases: This type of lease requires the tenant to pay a fixed monthly rent, as well as a portion of the property's expenses, such as property taxes and insurance.

- Percentage leases: This type of lease requires the tenant to pay a fixed monthly rent, as well as a percentage of their monthly sales.

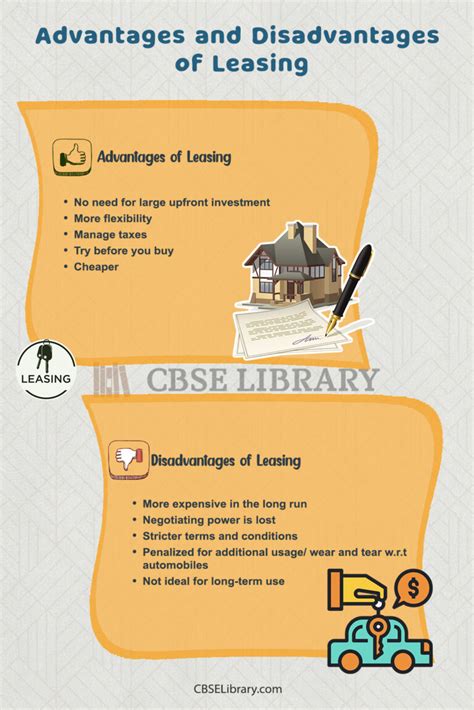

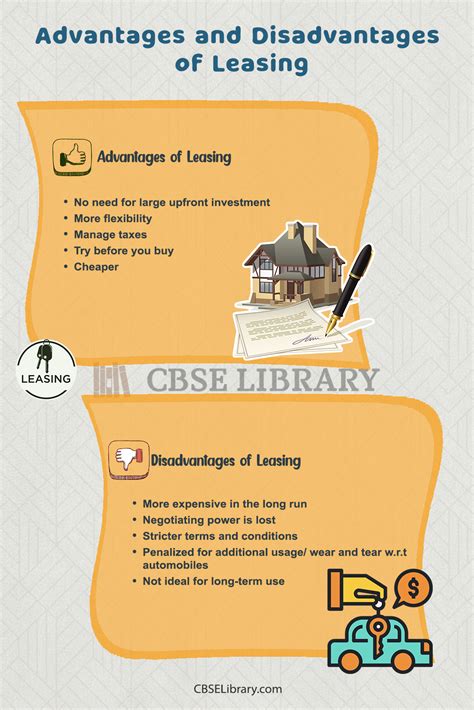

Benefits of Leasing a Retail Location

Leasing a retail location can offer several benefits, including:

- Flexibility: Leasing allows businesses to move to a new location if their needs change or if they outgrow their current space.

- Lower upfront costs: Leasing typically requires a security deposit and first month's rent, which is lower than the down payment required to purchase a property.

- Tax benefits: Lease payments can be tax-deductible, which can help reduce a business's taxable income.

- Access to prime locations: Leasing can provide access to prime locations that may be unaffordable to purchase.

Drawbacks of Leasing a Retail Location

While leasing a retail location can offer several benefits, there are also some drawbacks to consider, including:

- Lack of control: As a tenant, you may have limited control over the property and may be subject to the landlord's rules and regulations.

- Rent increases: Rent can increase over time, which can be a challenge for businesses with limited budgets.

- Lease restrictions: Leases may include restrictions on the use of the property, which can limit a business's ability to operate effectively.

- No equity buildup: At the end of the lease, you will not have any equity in the property, which can be a disadvantage for businesses that plan to stay in the same location for an extended period.

How to Choose the Right Lease Option

Choosing the right lease option requires careful consideration of several factors, including:

- Business needs: Consider the specific needs of your business, including the amount of space required, the location, and the length of the lease.

- Budget: Determine how much you can afford to pay in rent and other expenses.

- Flexibility: Consider whether you need the flexibility to move to a new location if your business needs change.

- Lease terms: Carefully review the terms of the lease, including the length of the lease, rent increases, and any restrictions on the use of the property.

Negotiating a Retail Lease

Negotiating a retail lease requires a thorough understanding of the lease terms and a clear understanding of your business needs. Some tips for negotiating a retail lease include:

- Work with a broker: Consider working with a broker who has experience in retail leasing to help you navigate the process.

- Review the lease carefully: Carefully review the lease to ensure that you understand all of the terms, including the length of the lease, rent increases, and any restrictions on the use of the property.

- Negotiate the terms: Don't be afraid to negotiate the terms of the lease, including the rent, lease length, and any restrictions on the use of the property.

- Consider hiring a lawyer: If you're not experienced in negotiating leases, consider hiring a lawyer to review the lease and provide guidance on the negotiation process.

Retail Lease Renewal and Termination

Retail lease renewal and termination can be complex processes, and it's essential to understand the terms of your lease to ensure that you're prepared. Some tips for renewing or terminating a retail lease include:

- Review the lease: Carefully review the lease to understand the terms of renewal or termination.

- Provide notice: Provide notice to the landlord as required by the lease, which is typically 30 to 60 days prior to the end of the lease.

- Negotiate renewal terms: If you're renewing the lease, negotiate the terms, including the rent, lease length, and any restrictions on the use of the property.

- Consider hiring a lawyer: If you're terminating the lease, consider hiring a lawyer to review the lease and provide guidance on the termination process.

Gallery of Retail Location Lease Options

Retail Location Lease Options Image Gallery

What are the different types of retail location leases?

+The most common types of retail leases include gross leases, net leases, and percentage leases. Each type of lease has its own unique characteristics, and it's crucial to choose the one that best suits your business needs.

What are the benefits of leasing a retail location?

+Leasing a retail location can offer several benefits, including flexibility, lower upfront costs, tax benefits, and access to prime locations.

How do I choose the right lease option for my retail business?

+Choosing the right lease option requires careful consideration of several factors, including business needs, budget, flexibility, and lease terms. It's essential to work with a broker and review the lease carefully to ensure that you understand all of the terms.

In conclusion, leasing a retail location can be a great option for many businesses, offering flexibility, lower upfront costs, and access to prime locations. However, it's essential to carefully review the lease terms and negotiate the best possible deal. By understanding the different types of retail location leases, the benefits and drawbacks of each, and how to choose the right lease option, you can make an informed decision that meets the needs of your business. We encourage you to share your thoughts and experiences with leasing a retail location in the comments below. Whether you're a seasoned business owner or just starting out, we hope that this article has provided valuable insights and guidance to help you navigate the complex world of retail leasing.