Intro

Boost retail business with 5 tips on retail insurance, covering risk management, liability coverage, and commercial protection, to ensure a secure and thriving store operation.

As a retailer, you understand the importance of protecting your business from unforeseen risks and losses. Retail insurance is a crucial aspect of any retail business, providing financial protection against various types of risks, including property damage, liability, and business interruption. In this article, we will discuss the importance of retail insurance and provide 5 tips to help you navigate the complex world of retail insurance.

Retail insurance is a type of business insurance that is specifically designed for retail businesses. It provides coverage for a wide range of risks, including damage to property, liability for injuries or damages to customers, and business interruption due to unforeseen events. Having the right retail insurance policy in place can help you protect your business from financial losses and ensure that you can continue to operate even in the face of unexpected events.

The retail industry is a complex and dynamic sector, with many different types of businesses and risks. From small, independent shops to large, multinational retailers, every business faces unique challenges and risks. Retail insurance can help you manage these risks and protect your business from financial losses. Whether you are a small, family-owned business or a large, multinational retailer, having the right retail insurance policy in place is essential for protecting your business and ensuring its long-term success.

What is Retail Insurance?

Benefits of Retail Insurance

5 Tips for Retail Insurance

Types of Retail Insurance

How to Choose the Right Retail Insurance Policy

Gallery of Retail Insurance Images

Retail Insurance Image Gallery

What is retail insurance?

+Retail insurance is a type of business insurance that is specifically designed for retail businesses. It provides coverage for a wide range of risks, including damage to property, liability for injuries or damages to customers, and business interruption due to unforeseen events.

What are the benefits of retail insurance?

+The benefits of retail insurance include financial protection against unforeseen risks and losses, protection for your business assets, including property and inventory, liability coverage for injuries or damages to customers, and business interruption coverage to help you get back on your feet after an unforeseen event.

How do I choose the right retail insurance policy?

+Choosing the right retail insurance policy involves assessing your risks, determining your coverage needs, comparing policies from different insurance providers, and reading the fine print to understand what is covered, what is not covered, and any exclusions or limitations that may apply.

What types of retail insurance are available?

+There are many different types of retail insurance available, including property insurance, liability insurance, business interruption insurance, and workers' compensation insurance.

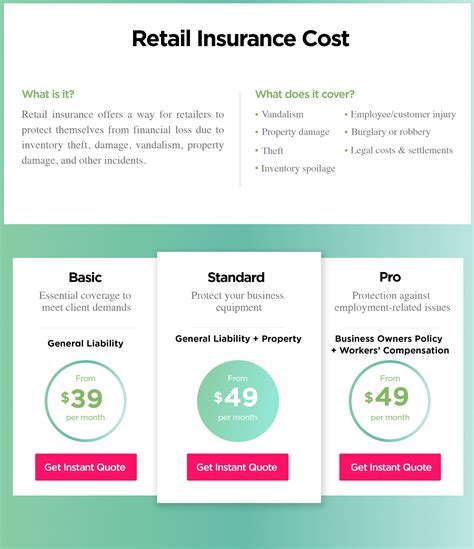

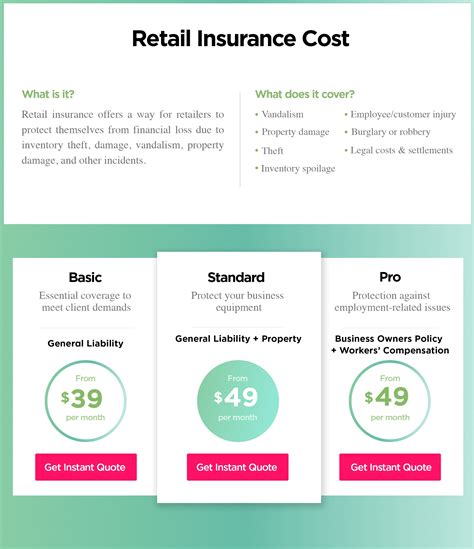

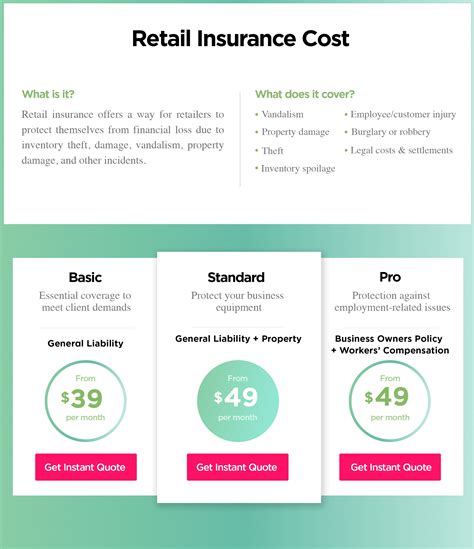

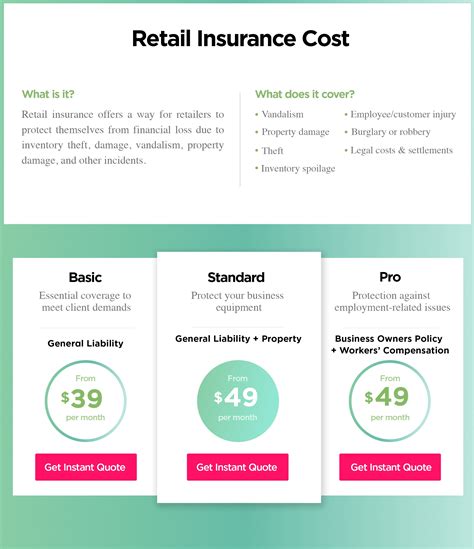

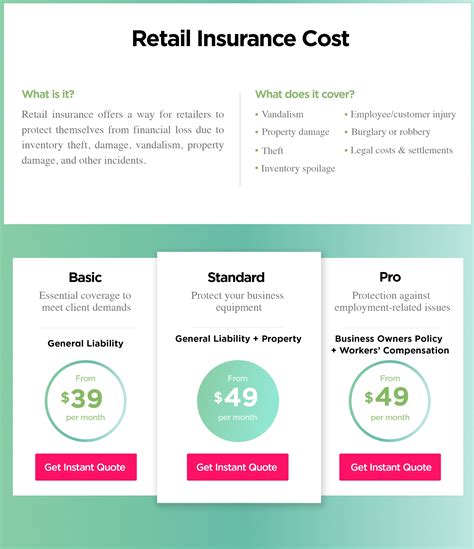

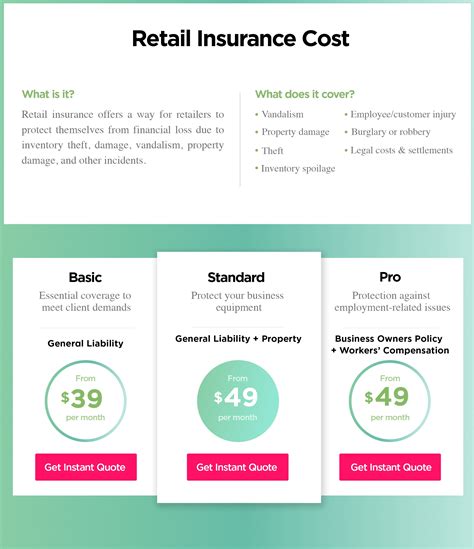

How much does retail insurance cost?

+The cost of retail insurance varies depending on the type of policy, the level of coverage, and the insurance provider. It's essential to shop around and compare policies from different insurance providers to find the best rate for your business.

In conclusion, retail insurance is a crucial aspect of any retail business, providing financial protection against unforeseen risks and losses. By understanding the importance of retail insurance, assessing your risks, and choosing the right policy, you can protect your business and ensure its long-term success. Remember to review and update your policy regularly to ensure it still meets your needs. With the right retail insurance policy in place, you can have peace of mind knowing that your business is protected from financial losses. We encourage you to share your thoughts and experiences with retail insurance in the comments below.