Intro

Boost savings with 5 Savings Challenges, featuring budgeting tips, financial planning, and money management strategies to reach goals quickly and efficiently.

Saving money is an essential aspect of personal finance, and it can be challenging for many individuals. However, with the right strategies and mindset, anyone can develop a savings habit and achieve their financial goals. In recent years, various savings challenges have emerged, encouraging people to save money in innovative and engaging ways. These challenges have gained popularity on social media, with many individuals sharing their progress and motivating others to join in.

The concept of savings challenges is not new, but it has evolved over time. Traditionally, people used to save money in piggy banks or envelopes, but now, there are many digital tools and apps available to help individuals track their savings and stay motivated. Savings challenges can be an effective way to save money, as they provide a sense of accountability and community. Many people find it easier to stick to a savings plan when they are part of a group or have a supportive network.

Savings challenges can be tailored to suit individual needs and goals. Some challenges focus on saving a specific amount of money, while others emphasize reducing expenses or increasing income. The key to success lies in finding a challenge that aligns with your financial objectives and lifestyle. With the rise of social media, it has become easier to discover and participate in savings challenges. Many financial experts and influencers share their favorite savings challenges, providing tips and advice on how to get started.

Introduction to Savings Challenges

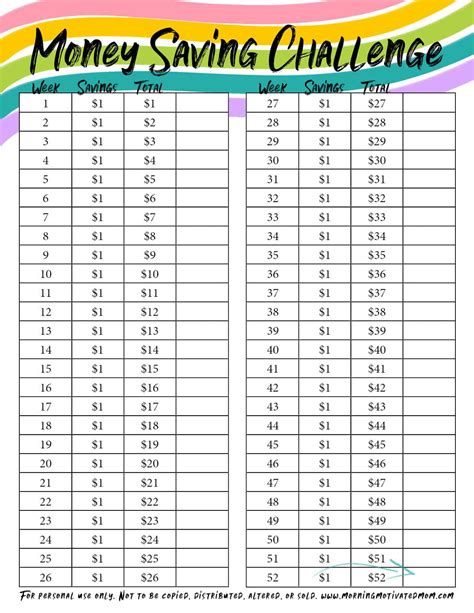

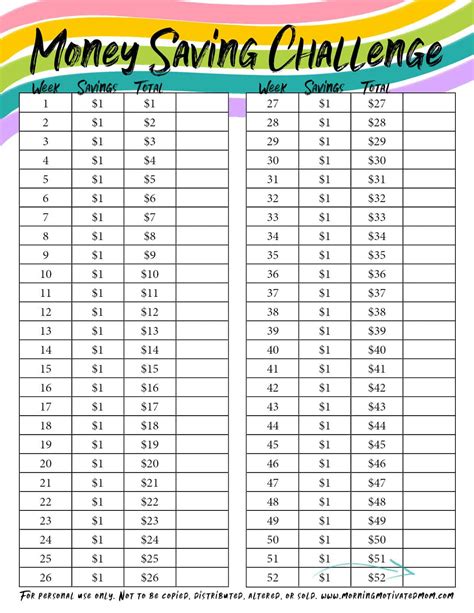

Savings challenges are designed to help individuals develop a savings habit and reach their financial goals. These challenges can be short-term or long-term, depending on the objective. Some popular savings challenges include the 52-week savings challenge, where individuals save an amount equal to the number of the week, and the no-spend challenge, where people avoid making non-essential purchases for a certain period.

Benefits of Savings Challenges

The benefits of savings challenges are numerous. They can help individuals develop a savings habit, reduce expenses, and increase their income. Savings challenges can also provide a sense of community and accountability, as participants often share their progress and support one another. Moreover, savings challenges can be an effective way to save money for specific goals, such as a down payment on a house, a vacation, or a big purchase.Some of the key benefits of savings challenges include:

- Developing a savings habit

- Reducing expenses

- Increasing income

- Providing a sense of community and accountability

- Helping to save money for specific goals

Types of Savings Challenges

There are various types of savings challenges, each with its unique characteristics and objectives. Some popular types of savings challenges include:

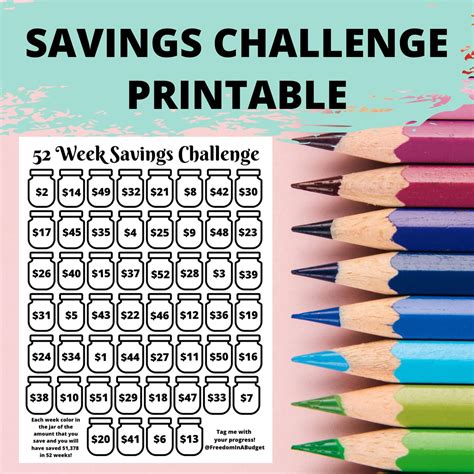

- The 52-week savings challenge

- The no-spend challenge

- The envelope challenge

- The savings jar challenge

- The digital savings challenge

Each type of savings challenge has its advantages and disadvantages. For example, the 52-week savings challenge can be an effective way to save money, but it may not be suitable for individuals with a low income. On the other hand, the no-spend challenge can be a great way to reduce expenses, but it may require significant lifestyle changes.

How to Choose a Savings Challenge

Choosing a savings challenge can be a daunting task, especially for individuals who are new to saving money. Here are some tips to help you choose a savings challenge that suits your needs and goals: * Determine your financial objectives * Assess your income and expenses * Consider your lifestyle and preferences * Research different types of savings challenges * Join a community or find a savings buddyBy following these tips, you can choose a savings challenge that aligns with your financial goals and lifestyle. Remember, the key to success lies in finding a challenge that you enjoy and can stick to in the long term.

Popular Savings Challenges

Some popular savings challenges include:

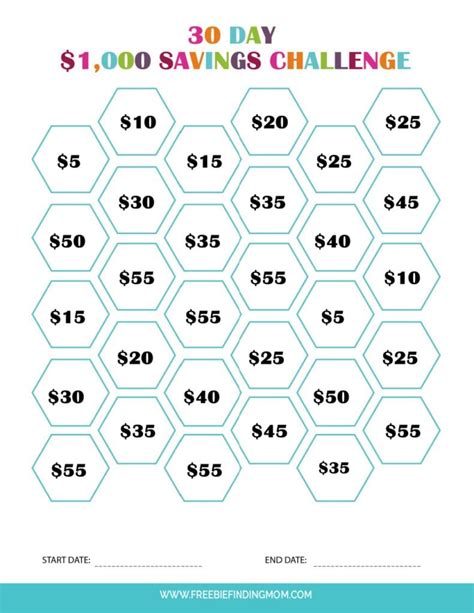

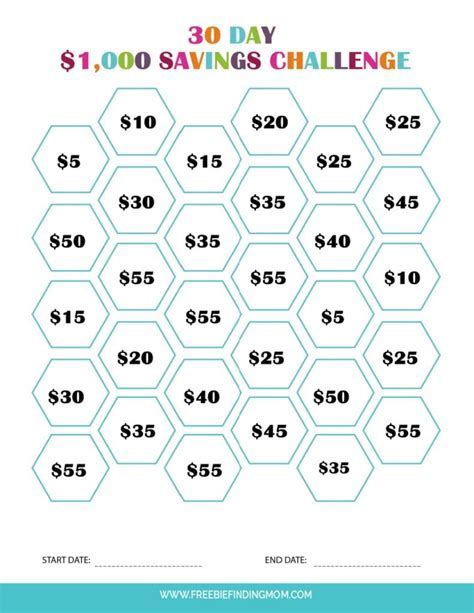

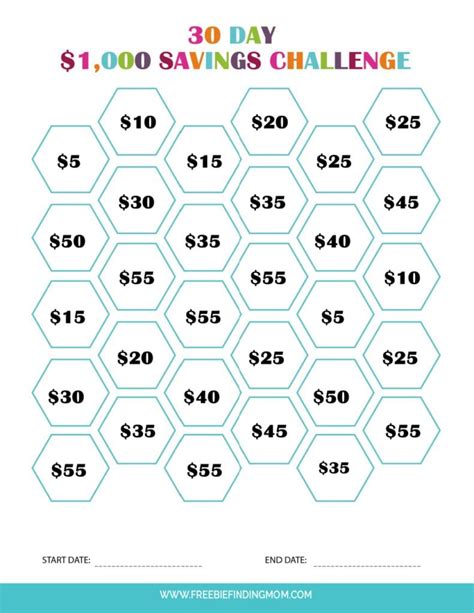

- The 52-week savings challenge: This challenge involves saving an amount equal to the number of the week. For example, in week 1, you would save $1, in week 2, you would save $2, and so on.

- The no-spend challenge: This challenge involves avoiding non-essential purchases for a certain period. For example, you might avoid buying clothes or dining out for a month.

- The envelope challenge: This challenge involves dividing your expenses into categories and placing the corresponding budgeted amount into an envelope for each category.

- The savings jar challenge: This challenge involves saving a specific amount of money in a jar each day or week.

- The digital savings challenge: This challenge involves using digital tools and apps to track your savings and stay motivated.

These savings challenges can be an effective way to save money and develop a savings habit. However, it's essential to choose a challenge that suits your needs and goals.

Tips for Success

Here are some tips to help you succeed in a savings challenge: * Start small: Don't try to save too much money at once. Start with a small amount and gradually increase it over time. * Be consistent: Make saving a habit by setting aside a specific amount of money each day or week. * Avoid temptation: Try to avoid temptation by removing unnecessary expenses and finding free alternatives. * Stay motivated: Join a community or find a savings buddy to stay motivated and accountable. * Review and adjust: Regularly review your progress and adjust your strategy as needed.By following these tips, you can increase your chances of success in a savings challenge. Remember, saving money is a long-term process, and it's essential to be patient and consistent.

Common Mistakes to Avoid

When participating in a savings challenge, there are several common mistakes to avoid. These include:

- Setting unrealistic goals

- Not tracking progress

- Not having a support system

- Not being consistent

- Not reviewing and adjusting strategy

By avoiding these common mistakes, you can increase your chances of success in a savings challenge. Remember, saving money is a journey, and it's essential to be patient and flexible.

Overcoming Obstacles

When participating in a savings challenge, you may encounter obstacles that can derail your progress. Here are some tips to help you overcome common obstacles: * Identify the obstacle: Recognize the obstacle and understand its cause. * Develop a plan: Create a plan to overcome the obstacle. * Seek support: Join a community or find a savings buddy to stay motivated and accountable. * Stay positive: Focus on the positive aspects of saving money and remind yourself of your goals. * Be flexible: Be willing to adjust your strategy as needed.By following these tips, you can overcome common obstacles and stay on track with your savings challenge. Remember, saving money is a long-term process, and it's essential to be patient and persistent.

Conclusion and Next Steps

In conclusion, savings challenges can be an effective way to save money and develop a savings habit. By choosing a challenge that suits your needs and goals, avoiding common mistakes, and overcoming obstacles, you can increase your chances of success. Remember to stay motivated, be consistent, and review your progress regularly.

If you're ready to start a savings challenge, here are some next steps to take:

- Determine your financial objectives

- Research different types of savings challenges

- Choose a challenge that suits your needs and goals

- Join a community or find a savings buddy

- Start saving and stay motivated

By following these steps, you can start a savings challenge and achieve your financial goals. Remember, saving money is a journey, and it's essential to be patient and persistent.

Savings Challenges Image Gallery

What is a savings challenge?

+A savings challenge is a strategy or plan to save money, often with a specific goal or timeframe in mind.

How do I choose a savings challenge?

+To choose a savings challenge, determine your financial objectives, assess your income and expenses, consider your lifestyle and preferences, research different types of savings challenges, and join a community or find a savings buddy.

What are some popular savings challenges?

+Some popular savings challenges include the 52-week savings challenge, the no-spend challenge, the envelope challenge, the savings jar challenge, and the digital savings challenge.

How can I stay motivated during a savings challenge?

+To stay motivated during a savings challenge, join a community or find a savings buddy, track your progress, celebrate your successes, and remind yourself of your goals.

What if I encounter obstacles during a savings challenge?

+If you encounter obstacles during a savings challenge, identify the obstacle, develop a plan to overcome it, seek support, stay positive, and be flexible.

We hope this article has provided you with valuable insights and tips on how to participate in a savings challenge. Remember to stay motivated, be consistent, and review your progress regularly. If you have any questions or comments, please don't hesitate to share them below. Let's work together to achieve our financial goals and develop a savings habit that will last a lifetime.