Intro

Boost savings with 5 effective charts, utilizing budgeting tools, expense trackers, and financial planners to optimize money management, achieve frugal living, and secure long-term wealth.

The importance of saving money cannot be overstated. Having a safety net in place can help individuals weather financial storms, achieve long-term goals, and reduce stress. One effective way to track and manage savings is by using savings charts. These visual tools provide a clear picture of progress, helping individuals stay motivated and focused on their financial objectives. In this article, we will delve into the world of savings charts, exploring their benefits, types, and implementation strategies.

Savings charts are essential for anyone looking to take control of their finances. By providing a visual representation of savings goals, these charts help individuals set realistic targets, track progress, and make adjustments as needed. Whether you're saving for a down payment on a house, a dream vacation, or retirement, a savings chart can help you stay on track. Moreover, savings charts can be tailored to suit individual needs, making them an excellent tool for people with varying financial goals and priorities.

The benefits of using savings charts are numerous. For one, they help individuals develop a savings habit, which is essential for long-term financial success. By regularly updating their savings chart, individuals can see their progress, stay motivated, and make adjustments to their spending habits. Additionally, savings charts can help individuals identify areas where they can cut back on unnecessary expenses, freeing up more money for savings. With a savings chart, individuals can also celebrate their achievements, no matter how small, which can help build confidence and reinforce positive financial habits.

Types of Savings Charts

There are several types of savings charts available, each with its unique features and benefits. Some popular types of savings charts include:

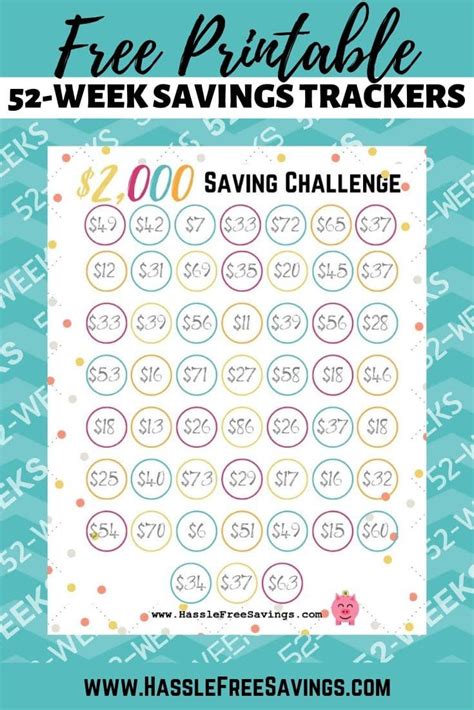

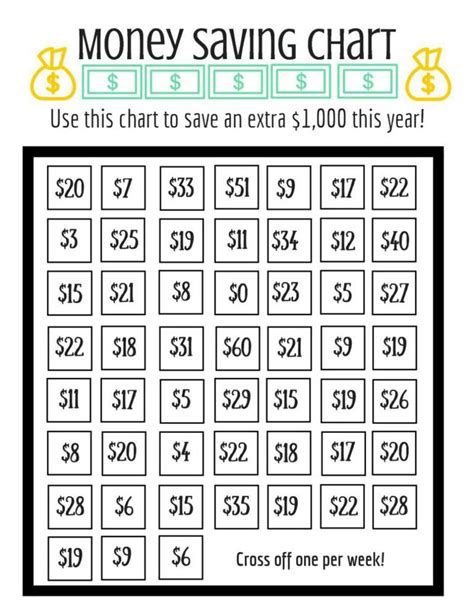

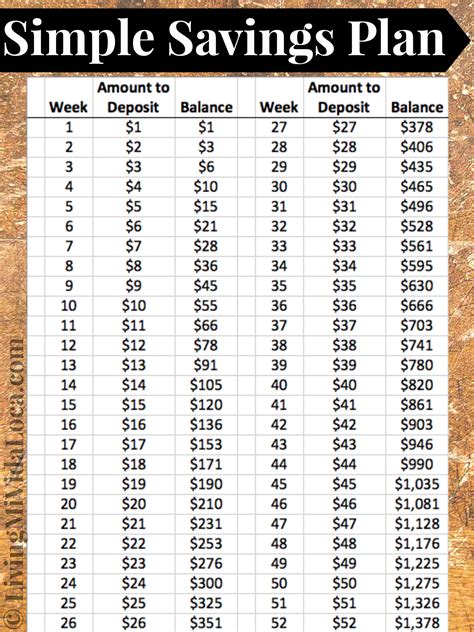

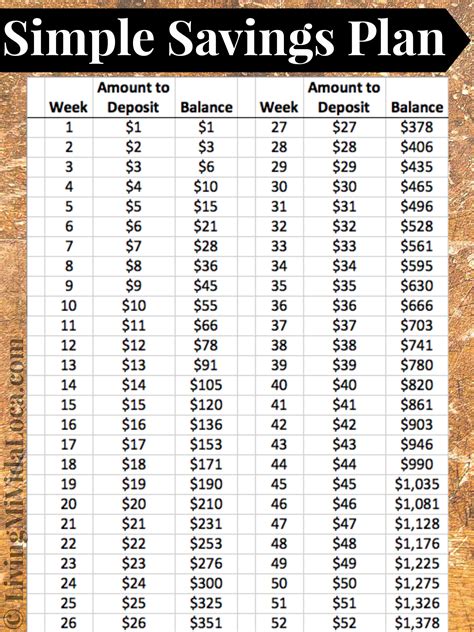

- Savings trackers: These charts help individuals track their daily or weekly savings, providing a clear picture of their progress.

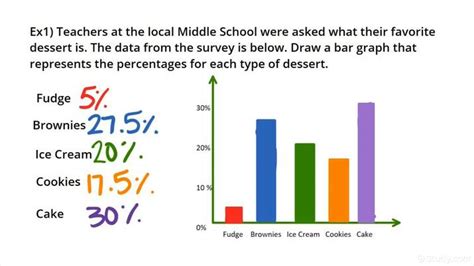

- Budgeting charts: These charts help individuals allocate their income into different categories, such as savings, expenses, and debt repayment.

- Goal-based charts: These charts help individuals set and achieve specific savings goals, such as saving for a down payment on a house or a dream vacation.

- Percentage-based charts: These charts help individuals save a percentage of their income, providing a flexible and adaptable savings strategy.

Benefits of Using Savings Charts

The benefits of using savings charts are numerous. Some of the most significant advantages include:

- Improved financial discipline: Savings charts help individuals develop a savings habit, which is essential for long-term financial success.

- Increased motivation: By tracking progress and celebrating achievements, individuals can stay motivated and focused on their financial goals.

- Better budgeting: Savings charts help individuals allocate their income effectively, reducing unnecessary expenses and freeing up more money for savings.

- Reduced stress: By having a clear picture of their finances, individuals can reduce stress and anxiety related to money management.

How to Create a Savings Chart

Creating a savings chart is a straightforward process that requires minimal time and effort. Here are the steps to follow:

- Determine your savings goal: Identify what you want to save for, whether it's a short-term or long-term goal.

- Choose a chart type: Select a chart type that suits your needs, such as a savings tracker or budgeting chart.

- Set a target amount: Determine how much you need to save to achieve your goal.

- Track your progress: Regularly update your chart to track your progress, making adjustments as needed.

- Celebrate your achievements: Celebrate your achievements, no matter how small, to stay motivated and focused on your financial goals.

Tips for Using Savings Charts Effectively

To get the most out of your savings chart, follow these tips:

- Make it visual: Use colors, symbols, and images to make your chart visually appealing and engaging.

- Make it accessible: Keep your chart in a place where you can easily access it, such as on your fridge or computer desktop.

- Make it a habit: Regularly update your chart to track your progress and stay motivated.

- Be flexible: Don't be too hard on yourself if you miss a savings target. Instead, adjust your chart and move forward.

Common Mistakes to Avoid

When using savings charts, there are several common mistakes to avoid. These include:

- Setting unrealistic targets: Setting targets that are too high or too low can lead to frustration and disappointment.

- Not tracking progress: Failing to regularly update your chart can lead to a lack of motivation and focus.

- Not being flexible: Failing to adjust your chart in response to changes in your financial situation can lead to frustration and disappointment.

Conclusion and Next Steps

In conclusion, savings charts are a powerful tool for managing finances and achieving long-term goals. By providing a clear picture of progress, these charts help individuals stay motivated and focused on their financial objectives. Whether you're saving for a short-term or long-term goal, a savings chart can help you stay on track. Remember to make your chart visual, accessible, and a habit, and don't be too hard on yourself if you miss a savings target. With the right mindset and strategy, you can achieve your financial goals and enjoy a more secure and prosperous future.

Savings Charts Image Gallery

What is a savings chart?

+A savings chart is a visual tool used to track and manage savings, providing a clear picture of progress and helping individuals stay motivated and focused on their financial goals.

What are the benefits of using a savings chart?

+The benefits of using a savings chart include improved financial discipline, increased motivation, better budgeting, and reduced stress.

How do I create a savings chart?

+To create a savings chart, determine your savings goal, choose a chart type, set a target amount, track your progress, and celebrate your achievements.

What are some common mistakes to avoid when using a savings chart?

+Common mistakes to avoid when using a savings chart include setting unrealistic targets, not tracking progress, and not being flexible.

How can I stay motivated when using a savings chart?

+To stay motivated when using a savings chart, make your chart visual, accessible, and a habit, and celebrate your achievements along the way.

We hope this article has provided you with a comprehensive understanding of savings charts and how they can help you achieve your financial goals. Remember to stay motivated, focused, and flexible, and don't hesitate to reach out if you have any further questions or concerns. Share this article with your friends and family, and start building a stronger financial future today!