Intro

Discover 5 SBA loan guidelines, including eligibility, credit scores, and collateral requirements, to navigate small business financing options, loan applications, and funding processes successfully.

The Small Business Administration (SBA) offers various loan programs to support small businesses in the United States. These loans are designed to provide financing for businesses that may not qualify for traditional bank loans. Understanding the 5 SBA loan guidelines is essential for business owners who are considering applying for an SBA loan. In this article, we will delve into the details of these guidelines and explore how they can benefit small businesses.

The SBA loan program is a popular choice among small business owners due to its favorable terms and flexible repayment options. With an SBA loan, businesses can access capital to start or expand their operations, purchase equipment, or refinance existing debt. However, to qualify for an SBA loan, businesses must meet specific requirements and follow the guidelines set by the SBA. In the following sections, we will discuss the 5 SBA loan guidelines and provide examples of how they apply to real-world businesses.

Introduction to SBA Loans

SBA loans are guaranteed by the Small Business Administration, which means that the SBA will repay a portion of the loan if the borrower defaults. This guarantee reduces the risk for lenders, making it easier for small businesses to qualify for loans. The SBA offers several loan programs, including the 7(a) loan program, the 504 loan program, and the Microloan program. Each program has its own set of guidelines and requirements, but they all share the common goal of supporting small businesses.

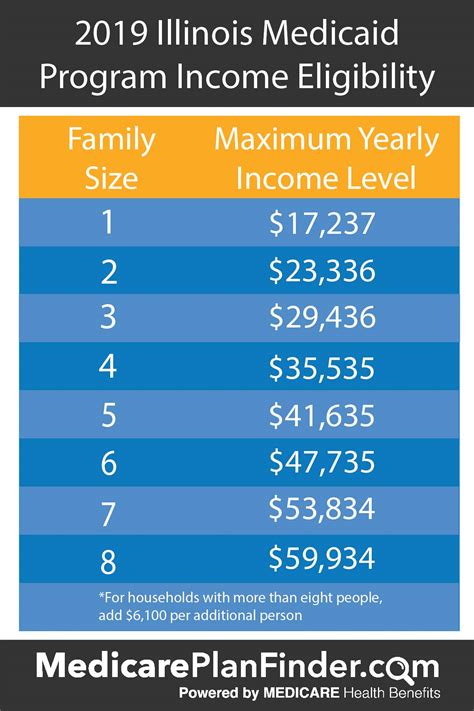

Eligibility Requirements

To qualify for an SBA loan, businesses must meet specific eligibility requirements. These requirements include:

- Being a for-profit business

- Operating in the United States

- Having a reasonable amount of owner equity invested in the business

- Using the loan proceeds for a legitimate business purpose

- Not being able to obtain credit elsewhere

Businesses that meet these requirements can apply for an SBA loan through a participating lender. The lender will review the application and determine whether the business qualifies for an SBA loan.

Loan Amounts and Terms

SBA loans offer flexible loan amounts and terms to meet the needs of small businesses. The loan amounts range from $5,000 to $5 million, depending on the loan program. The repayment terms can range from 5 to 25 years, depending on the loan program and the borrower's creditworthiness. The interest rates on SBA loans are also competitive, with rates ranging from 5% to 10% per annum.

For example, a business that needs to purchase equipment may qualify for a 7(a) loan with a loan amount of $500,000 and a repayment term of 10 years. The interest rate on the loan may be 7% per annum, with a monthly payment of $5,500.

Collateral Requirements

SBA loans require collateral to secure the loan, but the collateral requirements vary depending on the loan program. For example, the 7(a) loan program requires collateral for loans over $25,000, while the Microloan program does not require collateral. The collateral can be in the form of business assets, such as equipment, inventory, or real estate.

Businesses that do not have sufficient collateral may still qualify for an SBA loan through the use of alternative collateral, such as a personal guarantee or a lien on business assets.

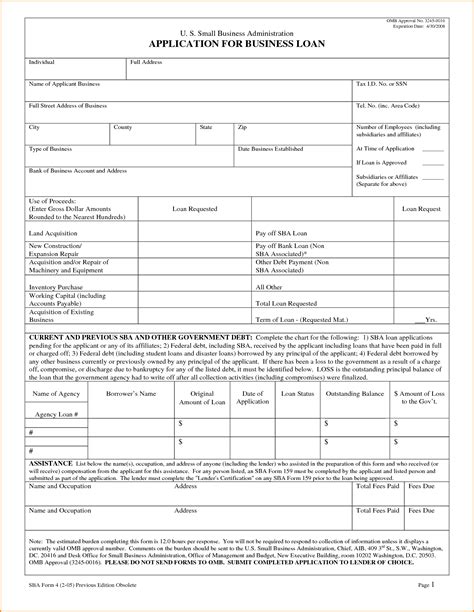

Application Process

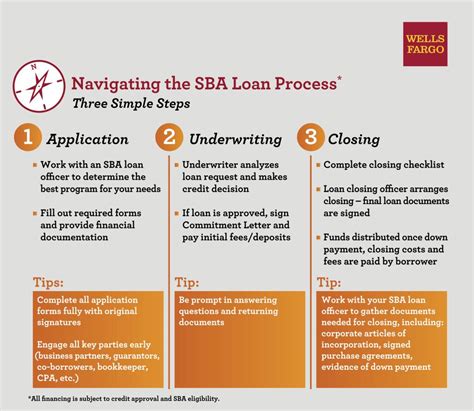

The application process for an SBA loan involves several steps, including:

- Preparing a business plan and financial statements

- Gathering required documents, such as tax returns and bank statements

- Submitting the application to a participating lender

- Reviewing and approving the loan application

- Closing the loan and disbursing the funds

Businesses can apply for an SBA loan through a participating lender, such as a bank or credit union. The lender will review the application and determine whether the business qualifies for an SBA loan.

Benefits of SBA Loans

The benefits of SBA loans include: * Favorable loan terms and interest rates * Flexible repayment options * Access to capital for businesses that may not qualify for traditional bank loans * Support for small businesses and entrepreneurs * Job creation and economic growthSBA loans offer many benefits to small businesses, including access to capital, flexible repayment options, and competitive interest rates. By understanding the 5 SBA loan guidelines, businesses can determine whether they qualify for an SBA loan and take advantage of these benefits.

Common Mistakes to Avoid

When applying for an SBA loan, businesses should avoid common mistakes, such as: * Not meeting the eligibility requirements * Not providing complete and accurate documentation * Not having a solid business plan and financial statements * Not shopping around for the best loan terms and interest rates * Not understanding the loan terms and conditionsBy avoiding these common mistakes, businesses can increase their chances of qualifying for an SBA loan and taking advantage of the benefits that these loans offer.

SBA Loan Image Gallery

What are the eligibility requirements for an SBA loan?

+To qualify for an SBA loan, businesses must meet specific eligibility requirements, including being a for-profit business, operating in the United States, and having a reasonable amount of owner equity invested in the business.

What are the loan amounts and terms for SBA loans?

+SBA loans offer flexible loan amounts and terms, ranging from $5,000 to $5 million, with repayment terms of 5 to 25 years, depending on the loan program and the borrower's creditworthiness.

What are the collateral requirements for SBA loans?

+SBA loans require collateral to secure the loan, but the collateral requirements vary depending on the loan program. Businesses that do not have sufficient collateral may still qualify for an SBA loan through the use of alternative collateral.

How do I apply for an SBA loan?

+To apply for an SBA loan, businesses can prepare a business plan and financial statements, gather required documents, and submit the application to a participating lender. The lender will review the application and determine whether the business qualifies for an SBA loan.

What are the benefits of SBA loans?

+SBA loans offer many benefits to small businesses, including access to capital, flexible repayment options, and competitive interest rates. By understanding the 5 SBA loan guidelines, businesses can determine whether they qualify for an SBA loan and take advantage of these benefits.

In conclusion, the 5 SBA loan guidelines provide a framework for small businesses to qualify for SBA loans and access capital to start or expand their operations. By understanding these guidelines and avoiding common mistakes, businesses can increase their chances of qualifying for an SBA loan and taking advantage of the benefits that these loans offer. If you have any questions or comments about SBA loans, please feel free to share them below. We would be happy to hear from you and provide further guidance on how to navigate the SBA loan application process.