The Small Business Administration (SBA) loan program is a highly sought-after financing option for small business owners in the United States. With its favorable terms and flexible requirements, SBA loans have become a popular choice for entrepreneurs looking to start, grow, or expand their businesses. However, to qualify for an SBA loan, borrowers must meet specific requirements, which can vary depending on the type of loan and the lender. In this article, we will delve into the SBA loan requirements, exploring the eligibility criteria, application process, and benefits of these loans.

SBA loans are designed to provide small businesses with access to capital that might not be available through traditional lending channels. The SBA guarantees a portion of the loan, reducing the risk for lenders and making it more likely for borrowers to qualify. With an SBA loan, small business owners can secure funding for a variety of purposes, including working capital, equipment purchases, real estate acquisition, and debt refinancing. The SBA loan program has been instrumental in helping small businesses thrive, creating jobs, and stimulating economic growth.

To be eligible for an SBA loan, borrowers must meet certain requirements, which include being a for-profit business, having a good credit history, and demonstrating the ability to repay the loan. The business must also be small, as defined by the SBA, with a maximum number of employees and annual revenue. Additionally, the borrower must have a solid business plan, a clear understanding of the loan terms, and a willingness to provide collateral, if required. The SBA loan requirements are in place to ensure that borrowers are able to manage their debt and make timely payments, minimizing the risk of default.

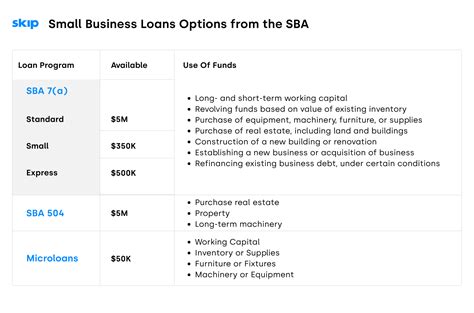

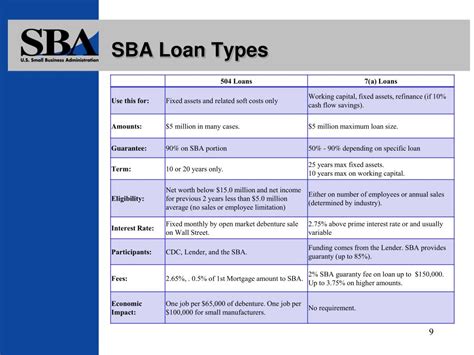

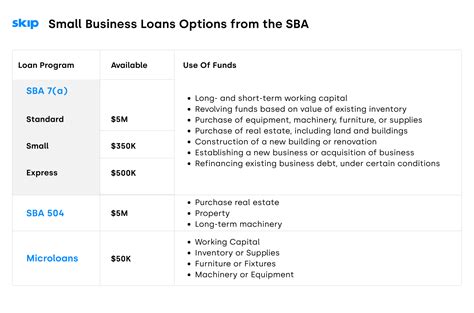

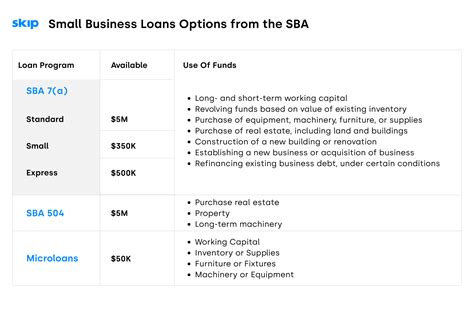

SBA Loan Types

The SBA offers several types of loans, each with its own set of requirements and benefits. The most popular SBA loan programs include the 7(a) loan, the 504 loan, and the Microloan program. The 7(a) loan is the most versatile, providing funding for a wide range of business purposes, including working capital, equipment purchases, and real estate acquisition. The 504 loan is geared towards businesses that need to purchase or improve real estate, such as buying a building or leasing equipment. The Microloan program provides smaller loan amounts, typically up to $50,000, for businesses that need funding for start-up costs, working capital, or equipment purchases.

Eligibility Requirements

To qualify for an SBA loan, borrowers must meet specific eligibility requirements, which include:

* Being a for-profit business

* Having a good credit history

* Demonstrating the ability to repay the loan

* Having a solid business plan

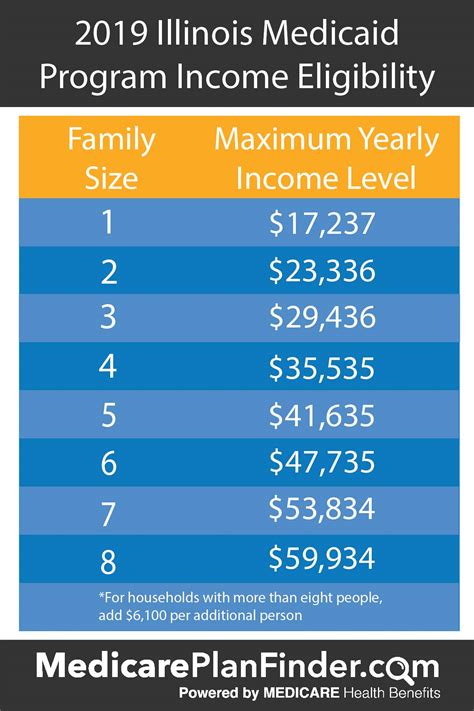

* Being a small business, as defined by the SBA

* Having a maximum number of employees and annual revenue

* Being able to provide collateral, if required

The SBA also considers the borrower's character, experience, and creditworthiness when evaluating loan applications. A strong credit history, a well-written business plan, and a clear understanding of the loan terms can all contribute to a successful loan application.

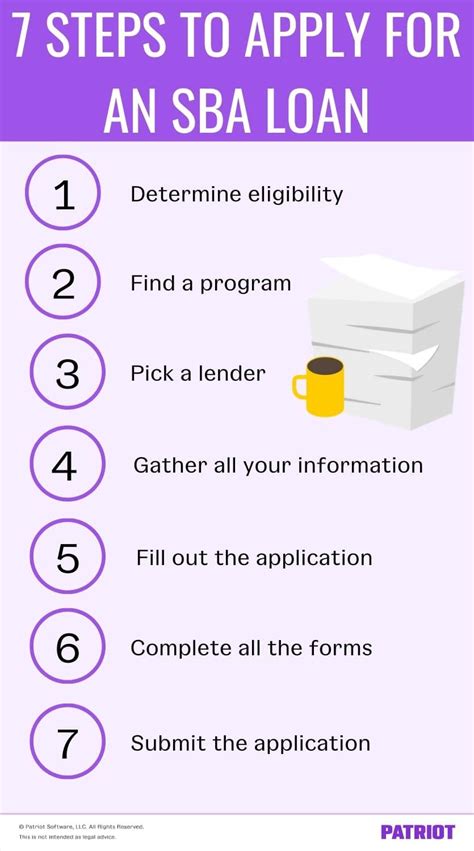

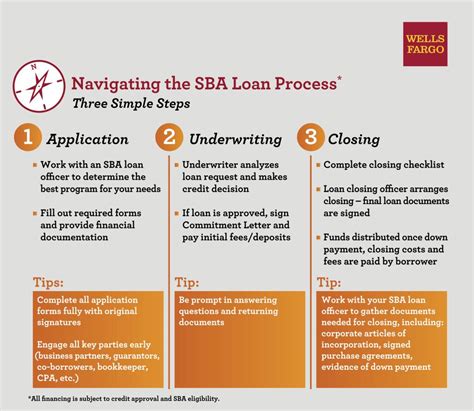

Application Process

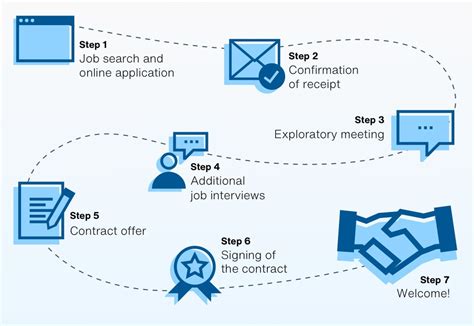

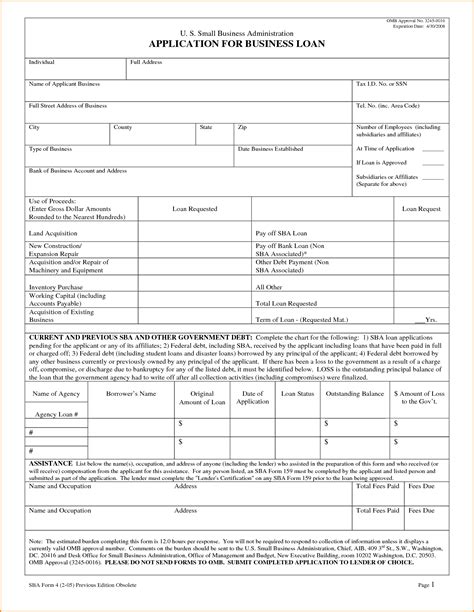

The SBA loan application process can be complex and time-consuming, but it is essential to follow the steps carefully to ensure a successful outcome. The process typically involves:

1. Determining eligibility: Borrowers must meet the SBA's eligibility requirements to qualify for a loan.

2. Choosing a lender: Borrowers can work with an SBA-approved lender, such as a bank or credit union, to apply for a loan.

3. Gathering documents: Borrowers must provide financial statements, tax returns, and other documents to support their loan application.

4. Submitting the application: The lender will review the application and submit it to the SBA for approval.

5. Receiving approval: The SBA will review the application and provide a loan guarantee, if approved.

The application process can take several weeks to several months, depending on the complexity of the loan and the lender's workload.

Benefits of SBA Loans

SBA loans offer several benefits to small business owners, including:

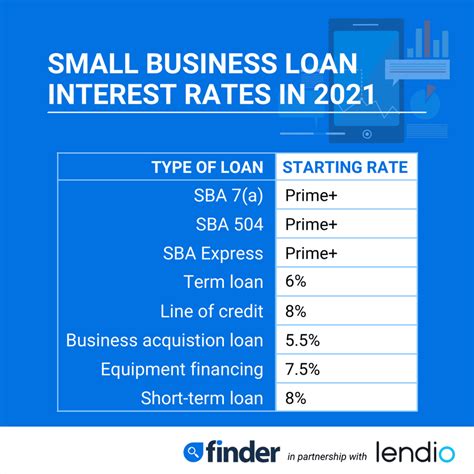

* Favorable interest rates: SBA loans typically have lower interest rates than traditional loans, making them more affordable for small businesses.

* Flexible repayment terms: SBA loans can have longer repayment terms, giving small businesses more time to repay the loan.

* Lower down payments: SBA loans often require lower down payments, making it easier for small businesses to access capital.

* Less collateral: SBA loans may require less collateral than traditional loans, reducing the risk for small businesses.

* Access to capital: SBA loans provide small businesses with access to capital that might not be available through traditional lending channels.

Common Uses of SBA Loans

SBA loans can be used for a variety of purposes, including:

* Working capital: SBA loans can provide small businesses with the funding they need to cover daily expenses, such as payroll, rent, and utilities.

* Equipment purchases: SBA loans can be used to purchase equipment, such as machinery, vehicles, or technology.

* Real estate acquisition: SBA loans can be used to purchase or improve real estate, such as buying a building or leasing a warehouse.

* Debt refinancing: SBA loans can be used to refinance existing debt, reducing interest rates and improving cash flow.

* Business expansion: SBA loans can be used to fund business expansion, such as hiring new employees, opening a new location, or launching a new product.

SBA Loan Requirements for Start-ups

Start-ups can qualify for SBA loans, but they must meet specific requirements, including:

* Having a solid business plan

* Demonstrating a clear understanding of the loan terms

* Providing a detailed financial projection

* Having a good credit history

* Being able to provide collateral, if required

Start-ups can be riskier than established businesses, so lenders may require additional documentation or collateral to secure the loan.

SBA Loan Requirements for Existing Businesses

Existing businesses can qualify for SBA loans, but they must meet specific requirements, including:

* Having a good credit history

* Demonstrating the ability to repay the loan

* Providing financial statements and tax returns

* Having a solid business plan

* Being able to provide collateral, if required

Existing businesses must also demonstrate a clear understanding of the loan terms and be able to provide a detailed financial projection.

Gallery of SBA Loan Images

What are the benefits of SBA loans?

+

SBA loans offer several benefits, including favorable interest rates, flexible repayment terms, and lower down payments. They also provide access to capital that might not be available through traditional lending channels.

How do I apply for an SBA loan?

+

To apply for an SBA loan, you must meet the eligibility requirements and submit an application through an SBA-approved lender. The lender will review your application and submit it to the SBA for approval.

What are the common uses of SBA loans?

+

SBA loans can be used for a variety of purposes, including working capital, equipment purchases, real estate acquisition, debt refinancing, and business expansion.

Can start-ups qualify for SBA loans?

+

Yes, start-ups can qualify for SBA loans, but they must meet specific requirements, including having a solid business plan, demonstrating a clear understanding of the loan terms, and providing a detailed financial projection.

What are the SBA loan requirements for existing businesses?

+

Existing businesses must meet specific requirements, including having a good credit history, demonstrating the ability to repay the loan, providing financial statements and tax returns, and having a solid business plan.

In conclusion, SBA loans are a valuable resource for small business owners, providing access to capital and favorable loan terms. By understanding the SBA loan requirements, application process, and benefits, small businesses can make informed decisions about their financing options. Whether you're a start-up or an established business, SBA loans can help you achieve your goals and grow your business. We invite you to share your thoughts and experiences with SBA loans in the comments below, and don't forget to share this article with your network to help spread the word about the benefits of SBA loans.