Intro

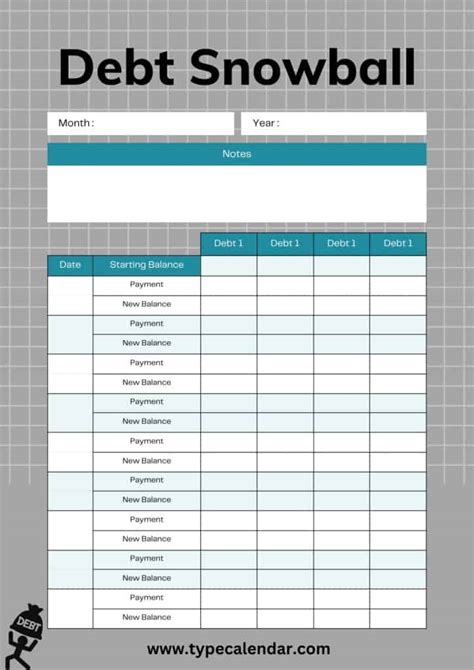

Manage debt with a Snowball Debt Printable Template, using debt snowball method and avalanche approach to track finances, pay off loans, and achieve financial freedom through budgeting and repayment planning.

The snowball debt printable template is a valuable tool for individuals seeking to manage and eliminate their debt. Debt can be overwhelming, affecting not only financial stability but also mental health and overall well-being. The snowball method, popularized by financial expert Dave Ramsey, is a strategy that involves paying off debts one by one, starting with the smallest balance first, while making minimum payments on the rest. This approach provides a psychological boost as you quickly see debts being paid off, motivating you to continue the process.

Managing debt effectively requires a clear understanding of your financial situation, a solid plan, and the discipline to stick to it. The snowball debt printable template is designed to help you organize your debts, prioritize them based on the snowball method, and track your progress. It's a simple yet powerful tool that can be customized to fit your specific financial circumstances. By using this template, you can visualize your debt, create a manageable plan, and work towards becoming debt-free.

The importance of addressing debt cannot be overstated. High levels of debt can lead to increased stress, damaged credit scores, and limited financial flexibility. Moreover, the burden of debt can hinder your ability to achieve long-term financial goals, such as saving for retirement, purchasing a home, or investing in your children's education. By tackling debt head-on with the help of a snowball debt printable template, you can regain control of your finances and pave the way for a more secure and prosperous future.

Understanding the Snowball Debt Method

The snowball debt method is straightforward and focuses on quick wins to build momentum. Here's how it works:

- List all your debts, from the smallest balance to the largest.

- Make minimum payments on all debts except the smallest one.

- Put as much money as possible towards the smallest debt until it's paid off.

- Once the smallest debt is paid off, use the money to attack the next smallest debt, and so on. This method is about behavior modification and quick achievements. It's not necessarily the most efficient mathematically (that would be paying off debts with the highest interest rates first), but it provides a psychological boost that can be crucial for staying motivated throughout the debt repayment process.

Benefits of the Snowball Debt Printable Template

The snowball debt printable template offers several benefits that can enhance your debt repayment journey: - **Organization**: It helps you list and organize your debts in a clear and understandable manner. - **Prioritization**: By sorting your debts from smallest to largest, you can prioritize which ones to pay off first. - **Tracking Progress**: The template allows you to mark off debts as you pay them off, providing a visual representation of your progress. - **Customization**: You can adjust the template to fit your specific needs, including adding more debts or modifying the layout. - **Motivation**: Seeing your debts disappear one by one can be a powerful motivator to continue the debt repayment process.How to Use the Snowball Debt Printable Template

Using the snowball debt printable template is a straightforward process:

- Download and Print: First, download the template and print it out. You can find various versions of the snowball debt template online, so choose one that suits your needs.

- List Your Debts: Write down all your debts, including credit cards, loans, and any other debt you might have. Be sure to include the balance and the minimum payment for each.

- Sort Your Debts: Sort your debts from the smallest balance to the largest. This is the core principle of the snowball method.

- Calculate Your Payments: Determine how much you can afford to pay towards your debts each month. Make the minimum payment on all debts except the smallest one, which you will pay off as aggressively as possible.

- Track Your Progress: As you make payments and debts are paid off, mark them off on your template. This visual progress can be very motivating.

- Review and Adjust: Regularly review your budget and debt repayment plan. As your financial situation changes, you may need to adjust how much you're paying towards your debts or the order in which you're paying them off.

Additional Tips for Debt Repayment

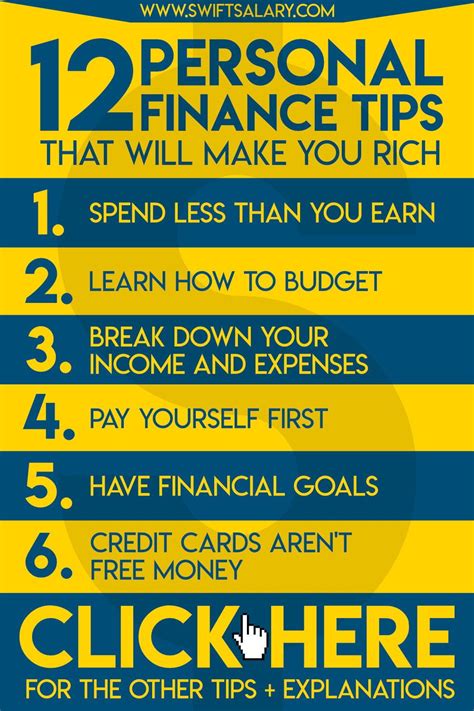

While the snowball debt printable template is a powerful tool, it's also important to consider other strategies and tips that can aid in your debt repayment journey: - **Budgeting**: Creating a budget that accounts for all your income and expenses is crucial. It helps you understand where your money is going and ensures you have enough for debt repayment. - **Emergency Fund**: Building an emergency fund can prevent you from going further into debt when unexpected expenses arise. - **Communication**: If you're struggling to make payments, communicate with your creditors. They may offer temporary hardship programs or other forms of assistance. - **Avoid New Debt**: It's essential to avoid taking on new debt while you're trying to pay off existing debts. This means no new credit cards, loans, or other forms of debt.Common Challenges and Solutions

Despite the best intentions, individuals may face several challenges during the debt repayment process:

- Lack of Motivation: Seeing quick results with the snowball method can help, but it's also important to celebrate small victories along the way.

- Unexpected Expenses: Having an emergency fund in place can help mitigate the impact of unexpected expenses.

- High Interest Rates: Consider consolidating debt into a lower-interest loan or credit card, if possible.

- Lack of Budgeting Skills: Seek out budgeting advice or use budgeting apps to help manage your finances more effectively.

Conclusion and Next Steps

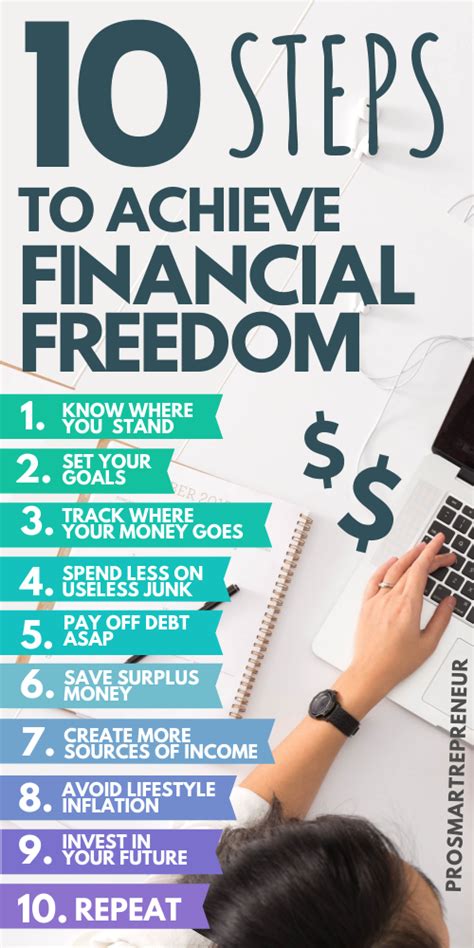

In conclusion, the snowball debt printable template is a valuable resource for anyone looking to manage and eliminate their debt. By providing a clear and organized approach to debt repayment, it helps individuals stay motivated and focused on their financial goals. Remember, becoming debt-free is a journey that requires patience, discipline, and the right tools. With the snowball debt method and a printable template, you're well on your way to achieving financial freedom.Snowball Debt Image Gallery

What is the snowball debt method?

+The snowball debt method is a strategy for paying off debt that involves paying off debts one by one, starting with the smallest balance first, while making minimum payments on the rest.

How do I use a snowball debt printable template?

+First, download and print the template. Then, list all your debts, sort them from smallest to largest, and start making payments according to the snowball method. Use the template to track your progress.

What are the benefits of using a snowball debt printable template?

+The benefits include organization, prioritization of debts, tracking progress, customization, and motivation. It helps you stay focused and motivated throughout the debt repayment process.

We hope this comprehensive guide to the snowball debt printable template has been informative and helpful. If you have any further questions or would like to share your experiences with debt repayment, please don't hesitate to comment below. Your insights can help others who are on their own journey to financial freedom. Remember, becoming debt-free is achievable with the right strategy and tools. Start your journey today and take the first step towards a more secure financial future.