Intro

Discover Square Payments Processing, a secure payment solution with seamless transaction management, online invoicing, and point-of-sale integration, offering flexible payment options and real-time analytics for businesses.

The world of payments processing has undergone significant transformations in recent years, with the rise of digital payments and the increasing demand for seamless, secure, and efficient transaction experiences. One company that has been at the forefront of this revolution is Square, a leading provider of payments processing solutions for businesses of all sizes. In this article, we will delve into the world of Square payments processing, exploring its benefits, working mechanisms, and key features that have made it a top choice for merchants and consumers alike.

The importance of efficient payments processing cannot be overstated, as it has a direct impact on a business's bottom line, customer satisfaction, and overall competitiveness. With the proliferation of digital payments, businesses need to be able to accept a wide range of payment methods, from credit and debit cards to mobile payments and online transactions. Square payments processing has emerged as a leader in this space, offering a comprehensive suite of solutions that cater to the diverse needs of businesses, from small startups to large enterprises.

Square's payments processing solutions are designed to be easy to use, secure, and scalable, making it an ideal choice for businesses that want to streamline their payment operations and improve customer experiences. With Square, merchants can accept payments in-person, online, or on-the-go, using a range of devices and platforms, including smartphones, tablets, and point-of-sale (POS) systems. The company's payments processing solutions also offer advanced features such as inventory management, employee management, and sales reporting, making it a one-stop-shop for businesses looking to manage their payment operations and grow their sales.

How Square Payments Processing Works

Square payments processing works by using a combination of hardware and software solutions to facilitate secure and efficient transactions. The company's payments processing solutions include a range of devices, such as card readers, POS systems, and mobile apps, that enable merchants to accept payments from customers. When a customer makes a payment, the transaction is processed through Square's secure servers, which use advanced encryption and tokenization to protect sensitive payment information.

The payments processing workflow is straightforward and involves several key steps. First, the merchant sets up their Square account and configures their payment settings, including the types of payments they accept and the fees they pay. When a customer makes a payment, the merchant uses their Square device or platform to process the transaction, which is then sent to Square's servers for authorization and settlement. Once the transaction is approved, the funds are deposited into the merchant's bank account, usually within one to two business days.

Benefits of Square Payments Processing

The benefits of Square payments processing are numerous and significant, making it an attractive option for businesses of all sizes. Some of the key benefits include: * Fast and secure transactions: Square's payments processing solutions use advanced encryption and tokenization to protect sensitive payment information, ensuring that transactions are fast, secure, and reliable. * Easy to use: Square's devices and platforms are designed to be easy to use, with intuitive interfaces and simple setup processes that make it easy for merchants to get started. * Scalable: Square's payments processing solutions are scalable, making it easy for businesses to grow and expand their payment operations as needed. * Affordable: Square's payments processing fees are competitive and transparent, with no hidden fees or surprises. * Integrated solutions: Square's payments processing solutions offer advanced features such as inventory management, employee management, and sales reporting, making it a one-stop-shop for businesses looking to manage their payment operations and grow their sales.Key Features of Square Payments Processing

Square payments processing offers a range of key features that make it an attractive option for businesses. Some of the key features include:

- In-person payments: Square's payments processing solutions enable merchants to accept payments in-person, using a range of devices such as card readers and POS systems.

- Online payments: Square's payments processing solutions also enable merchants to accept payments online, using platforms such as Square Online and Square Market.

- Mobile payments: Square's payments processing solutions enable merchants to accept mobile payments, using platforms such as Apple Pay and Google Pay.

- Inventory management: Square's payments processing solutions offer advanced inventory management features, making it easy for merchants to track and manage their stock levels.

- Employee management: Square's payments processing solutions offer advanced employee management features, making it easy for merchants to manage their staff and track their sales performance.

Security and Compliance

Security and compliance are critical components of any payments processing solution, and Square takes these issues very seriously. The company's payments processing solutions use advanced encryption and tokenization to protect sensitive payment information, ensuring that transactions are fast, secure, and reliable. Square is also compliant with major security standards, including PCI-DSS and EMV, ensuring that merchants and customers can trust the security of their transactions.Getting Started with Square Payments Processing

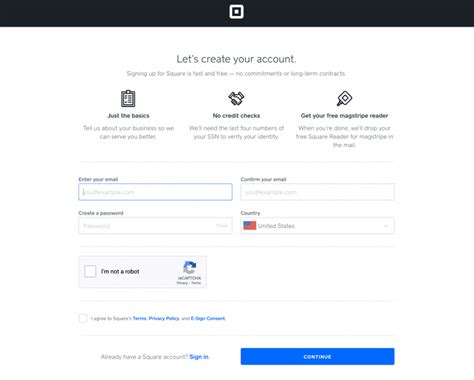

Getting started with Square payments processing is easy and straightforward. Merchants can sign up for a Square account online or through the Square app, and then configure their payment settings and devices. The company offers a range of devices and platforms, including card readers, POS systems, and mobile apps, making it easy for merchants to find the solution that best fits their needs.

To get started, merchants will need to provide some basic information, such as their business name, address, and tax ID number. They will also need to configure their payment settings, including the types of payments they accept and the fees they pay. Once they have completed these steps, they can start accepting payments and managing their sales using Square's intuitive and user-friendly interface.

Tips and Best Practices

To get the most out of Square payments processing, merchants should follow some best practices and tips. These include: * Keeping their software and devices up to date, to ensure they have the latest security patches and features. * Using strong passwords and two-factor authentication, to protect their account and payment information. * Monitoring their transactions and sales performance, to identify trends and areas for improvement. * Providing excellent customer service, to build trust and loyalty with their customers. * Staying compliant with major security standards, such as PCI-DSS and EMV, to protect their customers' payment information.Conclusion and Future Outlook

In conclusion, Square payments processing is a leading provider of payments processing solutions for businesses of all sizes. With its comprehensive suite of solutions, advanced features, and commitment to security and compliance, Square has emerged as a top choice for merchants and consumers alike. As the payments landscape continues to evolve, Square is well-positioned to meet the changing needs of businesses and consumers, with a focus on innovation, security, and customer experience.

Looking to the future, Square is likely to continue to play a major role in shaping the payments landscape, with a focus on emerging technologies such as blockchain, artificial intelligence, and the Internet of Things (IoT). As the company continues to innovate and expand its offerings, it is likely to remain a leader in the payments processing space, providing businesses and consumers with fast, secure, and reliable payment solutions.

Gallery of Square Payments Processing

What is Square payments processing?

+Square payments processing is a comprehensive suite of solutions that enables businesses to accept payments in-person, online, or on-the-go.

How does Square payments processing work?

+Square payments processing works by using a combination of hardware and software solutions to facilitate secure and efficient transactions.

What are the benefits of Square payments processing?

+The benefits of Square payments processing include fast and secure transactions, easy to use, scalable, affordable, and integrated solutions.

How do I get started with Square payments processing?

+To get started with Square payments processing, merchants can sign up for a Square account online or through the Square app, and then configure their payment settings and devices.

Is Square payments processing secure?

+Yes, Square payments processing is secure, using advanced encryption and tokenization to protect sensitive payment information.

We hope this article has provided you with a comprehensive overview of Square payments processing and its benefits, features, and working mechanisms. If you have any further questions or comments, please do not hesitate to reach out to us. We would be delighted to hear from you and provide you with any additional information or support you may need. Thank you for reading!