Intro

Discover how Square Up works with 5 key methods, including payment processing, inventory management, and invoice tracking, to streamline business operations and enhance customer experience with seamless transactions and analytics.

The world of payment processing has undergone significant transformations in recent years, and one of the key players in this revolution is Square. Square Up, the company's flagship product, has been a game-changer for small businesses, entrepreneurs, and individuals looking for a seamless and efficient way to accept payments. In this article, we will delve into the inner workings of Square Up and explore its features, benefits, and applications.

Square Up is an innovative payment processing system that allows users to accept credit card payments using their mobile devices. The system consists of a small, compact card reader that plugs into the audio jack of a smartphone or tablet, and a user-friendly app that facilitates transactions. With Square Up, users can process payments anywhere, anytime, making it an ideal solution for businesses that operate on-the-go.

The importance of Square Up cannot be overstated, as it has democratized access to payment processing and enabled small businesses to compete with larger corporations. By providing a cost-effective and easy-to-use payment solution, Square Up has leveled the playing field and empowered entrepreneurs to focus on what they do best: running their businesses. Whether you're a freelancer, a food truck owner, or a retail store owner, Square Up is an essential tool that can help you streamline your payment processes and improve your bottom line.

How Square Up Works

Square Up works by leveraging the power of mobile technology to facilitate payment transactions. Here's a step-by-step breakdown of how the system operates:

- The user downloads and installs the Square Up app on their mobile device.

- The user orders a Square Up card reader, which is shipped to their location.

- The user plugs the card reader into the audio jack of their mobile device.

- The user launches the Square Up app and sets up their account, including their business information and payment details.

- When a customer is ready to make a payment, the user opens the Square Up app and enters the transaction amount.

- The user swipes the customer's credit card through the card reader, and the app processes the payment in real-time.

- The user can choose to email or text the customer a receipt, which includes the transaction details and a link to leave a review.

Benefits of Using Square Up

The benefits of using Square Up are numerous, and they can be summarized as follows:- Convenience: Square Up allows users to accept payments anywhere, anytime, making it an ideal solution for businesses that operate on-the-go.

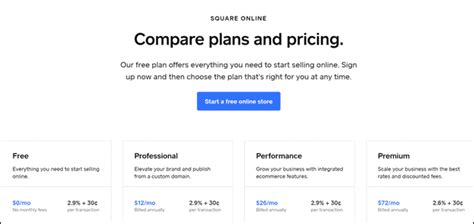

- Cost-effectiveness: Square Up offers competitive pricing and no hidden fees, making it an attractive option for small businesses and entrepreneurs.

- Ease of use: The Square Up app is user-friendly and easy to navigate, even for those who are not tech-savvy.

- Security: Square Up uses advanced encryption and security protocols to protect sensitive customer information.

- Flexibility: Square Up allows users to accept a variety of payment methods, including credit cards, debit cards, and mobile payments.

5 Ways Square Up Can Help Your Business

Square Up can help your business in a variety of ways, including:

- Streamlining payment processes: Square Up allows you to accept payments quickly and efficiently, reducing the time and effort required to process transactions.

- Increasing sales: By accepting a variety of payment methods, including credit cards and mobile payments, you can increase sales and revenue for your business.

- Improving customer satisfaction: Square Up allows you to email or text customers a receipt, which includes the transaction details and a link to leave a review. This can help improve customer satisfaction and encourage repeat business.

- Reducing costs: Square Up offers competitive pricing and no hidden fees, making it a cost-effective solution for small businesses and entrepreneurs.

- Enhancing security: Square Up uses advanced encryption and security protocols to protect sensitive customer information, reducing the risk of data breaches and cyber attacks.

Real-World Applications of Square Up

Square Up has a wide range of real-world applications, including:- Food trucks and restaurants: Square Up is ideal for food trucks and restaurants, as it allows them to accept payments on-the-go.

- Retail stores: Square Up can be used in retail stores to process transactions and manage inventory.

- Freelancers and consultants: Square Up is a great solution for freelancers and consultants, as it allows them to accept payments from clients and track expenses.

- Event planners and organizers: Square Up can be used to process ticket sales and donations at events, making it an ideal solution for event planners and organizers.

Setting Up Square Up for Your Business

Setting up Square Up for your business is a straightforward process that can be completed in a few simple steps:

- Download and install the Square Up app: The first step is to download and install the Square Up app on your mobile device.

- Order a Square Up card reader: Once you've installed the app, you'll need to order a Square Up card reader, which will be shipped to your location.

- Set up your account: After you've received your card reader, you'll need to set up your account, including your business information and payment details.

- Start accepting payments: Once you've set up your account, you can start accepting payments using the Square Up app and card reader.

Tips and Tricks for Using Square Up

Here are some tips and tricks for using Square Up:- Use the Square Up app to track sales and inventory: The Square Up app allows you to track sales and inventory, making it easier to manage your business.

- Take advantage of Square Up's customer support: Square Up offers excellent customer support, including online resources and phone support.

- Use Square Up to process refunds and returns: Square Up makes it easy to process refunds and returns, reducing the hassle and stress associated with these transactions.

Security and Compliance with Square Up

Security and compliance are top priorities for Square Up, and the company has implemented a range of measures to protect sensitive customer information. These measures include:

- Advanced encryption: Square Up uses advanced encryption to protect sensitive customer information, including credit card numbers and personal data.

- Compliance with industry standards: Square Up is compliant with industry standards, including PCI-DSS and EMV.

- Regular security updates: Square Up regularly releases security updates and patches to ensure that the system remains secure and up-to-date.

Common Mistakes to Avoid When Using Square Up

Here are some common mistakes to avoid when using Square Up:- Not setting up your account correctly: Failing to set up your account correctly can lead to errors and delays when processing transactions.

- Not using the correct card reader: Using the wrong card reader can result in errors and failed transactions.

- Not keeping your software up-to-date: Failing to keep your software up-to-date can leave you vulnerable to security risks and bugs.

Conclusion and Future Developments

In conclusion, Square Up is a powerful payment processing system that can help businesses of all sizes streamline their payment processes and improve their bottom line. With its user-friendly interface, competitive pricing, and advanced security features, Square Up is an ideal solution for businesses that operate on-the-go. As the payment processing landscape continues to evolve, it will be exciting to see how Square Up adapts and innovates to meet the changing needs of businesses and consumers.

Gallery of Square Up Images

Square Up Image Gallery

What is Square Up and how does it work?

+Square Up is a payment processing system that allows users to accept credit card payments using their mobile devices. The system consists of a small, compact card reader that plugs into the audio jack of a smartphone or tablet, and a user-friendly app that facilitates transactions.

What are the benefits of using Square Up?

+The benefits of using Square Up include convenience, cost-effectiveness, ease of use, security, and flexibility. Square Up allows users to accept payments anywhere, anytime, and offers competitive pricing and no hidden fees.

How do I set up Square Up for my business?

+Setting up Square Up for your business is a straightforward process that can be completed in a few simple steps. You'll need to download and install the Square Up app, order a Square Up card reader, and set up your account, including your business information and payment details.

Is Square Up secure and compliant with industry standards?

+Yes, Square Up is secure and compliant with industry standards. The company uses advanced encryption and security protocols to protect sensitive customer information, and is compliant with PCI-DSS and EMV.

What kind of customer support does Square Up offer?

+Square Up offers excellent customer support, including online resources and phone support. The company also provides regular software updates and patches to ensure that the system remains secure and up-to-date.

We hope this article has provided you with a comprehensive overview of Square Up and its features, benefits, and applications. Whether you're a small business owner, entrepreneur, or individual looking for a seamless and efficient way to accept payments, Square Up is an ideal solution that can help you streamline your payment processes and improve your bottom line. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and colleagues, and let's start a conversation about the future of payment processing.