Intro

Discover 5 ways Square Up costs impact businesses, including payment processing fees, transaction rates, and more, to optimize your financial management and reduce expenses with efficient online payment solutions.

The cost of using Square, a popular payment processing platform, can be a significant factor for businesses and individuals who rely on it for their financial transactions. Understanding the various costs associated with Square and how to minimize them can help users make the most out of this platform. In this article, we will delve into the details of Square's costs, exploring the different fees and charges that users may incur, as well as providing tips and strategies for reducing these expenses.

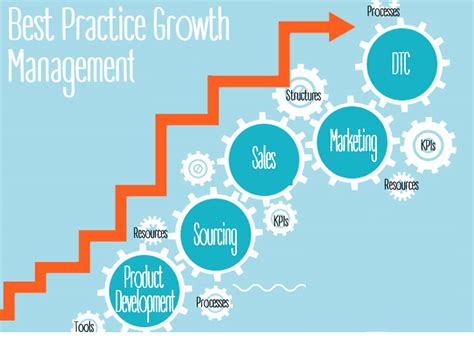

Square is known for its ease of use and versatility, offering a range of tools and services that cater to different types of businesses, from small startups to large enterprises. However, like any other payment processing platform, Square charges fees for its services, which can add up quickly if not managed properly. By understanding the cost structure of Square and implementing effective cost-saving strategies, users can optimize their use of the platform and maximize their profits.

One of the primary advantages of using Square is its simplicity and transparency when it comes to fees. The platform charges a flat rate for most transactions, making it easy for users to calculate their costs and plan their finances accordingly. Nevertheless, there are various types of fees that users should be aware of, including transaction fees, payment processing fees, and other charges that may apply to specific services or features.

Understanding Square's Fee Structure

To minimize the costs associated with using Square, it is essential to have a thorough understanding of the platform's fee structure. Square charges a flat rate of 2.9% + $0.30 per transaction for online transactions, while in-person transactions are charged at a rate of 2.6% + $0.10 per transaction. These fees apply to most types of payments, including credit card transactions, contactless payments, and mobile payments.

In addition to transaction fees, Square also charges payment processing fees, which can vary depending on the type of payment method used. For example, payments made through Apple Pay or Google Pay may incur lower fees compared to traditional credit card transactions. Other charges that users may incur include fees for instant transfers, international transactions, and dispute resolution.

Types of Fees Charged by Square

The types of fees charged by Square can be categorized into several groups, including: * Transaction fees: These are the fees charged for each transaction processed through the platform. * Payment processing fees: These fees apply to the processing of payments, including the verification of payment information and the transfer of funds. * Instant transfer fees: These fees are charged for instant transfers, which allow users to access their funds immediately. * International transaction fees: These fees apply to transactions that involve international payments, including cross-border transactions. * Dispute resolution fees: These fees are charged for resolving disputes related to transactions, including chargebacks and refunds.Strategies for Reducing Square Costs

There are several strategies that users can employ to reduce their Square costs. One of the most effective ways to minimize fees is to use the platform's built-in tools and features, such as the Square Point of Sale app, which allows users to process transactions and manage their sales in a streamlined and efficient manner.

Another strategy for reducing Square costs is to take advantage of the platform's discounts and promotions. Square often offers discounts and promotions for new users, as well as for users who process a high volume of transactions. By taking advantage of these offers, users can reduce their fees and save money on their transactions.

Benefits of Using Square's Built-in Tools and Features

Using Square's built-in tools and features can provide several benefits, including: * Streamlined transaction processing: The Square Point of Sale app allows users to process transactions quickly and efficiently, reducing the risk of errors and disputes. * Enhanced sales management: The app provides users with real-time sales data and analytics, enabling them to make informed decisions about their business. * Improved customer experience: The app allows users to provide their customers with a seamless and convenient payment experience, improving customer satisfaction and loyalty.Best Practices for Managing Square Costs

To manage their Square costs effectively, users should follow best practices such as monitoring their transaction fees regularly, taking advantage of discounts and promotions, and using the platform's built-in tools and features to streamline their transaction processing and sales management.

Users should also be aware of the potential risks and challenges associated with using Square, such as disputes and chargebacks, and take steps to mitigate these risks by providing excellent customer service and resolving disputes in a timely and efficient manner.

Risks and Challenges Associated with Using Square

The risks and challenges associated with using Square include: * Disputes and chargebacks: These can result in significant fees and losses for users, as well as damage to their reputation and customer relationships. * Security risks: The platform's security measures can be compromised if users do not follow best practices for protecting their accounts and transactions. * Technical issues: Technical problems can occur, resulting in downtime and lost sales.Conclusion and Future Outlook

In conclusion, managing Square costs requires a thorough understanding of the platform's fee structure, as well as the implementation of effective cost-saving strategies. By using the platform's built-in tools and features, taking advantage of discounts and promotions, and following best practices for managing transactions and sales, users can minimize their fees and maximize their profits.

As the payment processing landscape continues to evolve, it is likely that Square will introduce new features and services to help users manage their costs and improve their overall experience. By staying up-to-date with the latest developments and trends in the industry, users can ensure that they are getting the most out of the platform and achieving their business goals.

Key Takeaways

The key takeaways from this article include:

- Understanding Square's fee structure is essential for managing costs effectively.

- Using the platform's built-in tools and features can help users streamline their transaction processing and sales management.

- Taking advantage of discounts and promotions can reduce fees and save money on transactions.

- Following best practices for managing transactions and sales can help users mitigate risks and challenges associated with using Square.

Future of Payment Processing

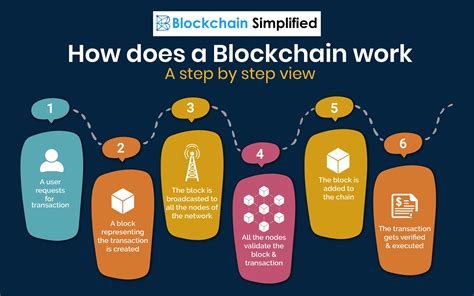

The future of payment processing is likely to be shaped by emerging trends and technologies, such as contactless payments, mobile payments, and blockchain. As these technologies continue to evolve, it is likely that Square will introduce new features and services to help users take advantage of these trends and improve their overall experience.

By staying ahead of the curve and adapting to changing market conditions, users can ensure that they are getting the most out of the platform and achieving their business goals.

Call to Action

We hope that this article has provided you with valuable insights and information about managing Square costs. If you have any questions or comments, please do not hesitate to reach out to us. We would be happy to hear from you and provide further guidance and support.

Gallery of Square Payment Processing

Square Payment Processing Image Gallery

What are the fees associated with using Square?

+The fees associated with using Square include transaction fees, payment processing fees, instant transfer fees, international transaction fees, and dispute resolution fees.

How can I minimize my Square costs?

+You can minimize your Square costs by using the platform's built-in tools and features, taking advantage of discounts and promotions, and following best practices for managing transactions and sales.

What are the benefits of using Square's built-in tools and features?

+The benefits of using Square's built-in tools and features include streamlined transaction processing, enhanced sales management, and improved customer experience.

What are the risks and challenges associated with using Square?

+The risks and challenges associated with using Square include disputes and chargebacks, security risks, and technical issues.

How can I stay up-to-date with the latest developments and trends in the payment processing industry?

+You can stay up-to-date with the latest developments and trends in the payment processing industry by following industry news and blogs, attending conferences and events, and participating in online forums and communities.

We hope that this article has provided you with valuable insights and information about managing Square costs. If you have any questions or comments, please do not hesitate to reach out to us. We would be happy to hear from you and provide further guidance and support. Share this article with your friends and colleagues who may be interested in learning more about Square and its costs.