Intro

Boost business efficiency with the 5 ways stock turnover ratio, optimizing inventory management, reducing waste, and improving cash flow through effective supply chain analysis and logistics planning.

The stock turnover ratio is a crucial metric for businesses, particularly those in the retail and manufacturing sectors. It measures the number of times a company sells and replaces its stock of goods within a given period, typically a year. This ratio is essential for evaluating the efficiency of a company's inventory management and its ability to generate sales from its inventory. A high stock turnover ratio indicates that a company is selling its inventory quickly, which can lead to higher profits and lower storage costs. On the other hand, a low stock turnover ratio may indicate that a company is holding onto its inventory for too long, which can result in increased storage costs and lower profits.

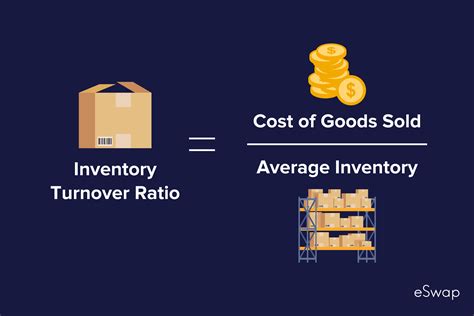

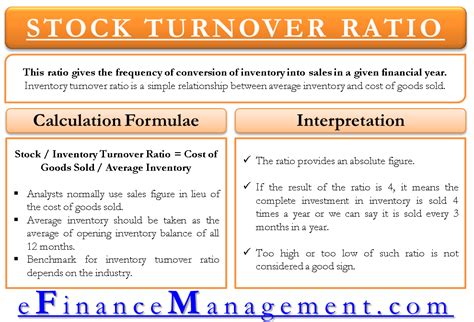

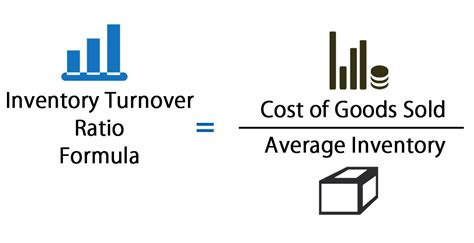

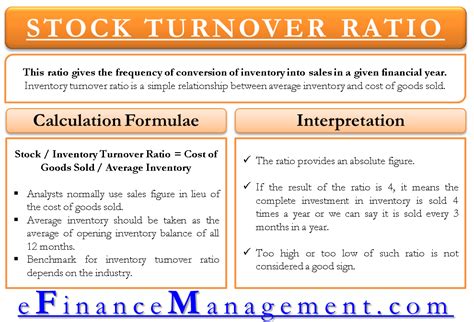

The stock turnover ratio is calculated by dividing the cost of goods sold by the average inventory. The cost of goods sold is the total cost of producing or purchasing the goods sold by a company during a given period, while the average inventory is the average value of the inventory held by a company during the same period. For example, if a company's cost of goods sold is $100,000 and its average inventory is $20,000, its stock turnover ratio would be 5. This means that the company sells and replaces its inventory five times within a year.

Understanding the stock turnover ratio is vital for businesses because it helps them to identify areas for improvement in their inventory management. By analyzing the stock turnover ratio, businesses can determine whether they are holding too much inventory, which can lead to waste and unnecessary costs. They can also identify slow-moving items that are not selling quickly enough and take steps to clear them out. Furthermore, the stock turnover ratio can help businesses to evaluate the effectiveness of their pricing strategies and marketing campaigns. If a company's stock turnover ratio is low, it may indicate that its prices are too high or that its marketing efforts are not effective in driving sales.

In addition to its usefulness in evaluating inventory management, the stock turnover ratio can also be used to compare the performance of different companies within the same industry. By analyzing the stock turnover ratios of its competitors, a company can determine how its inventory management practices stack up against those of its peers. This can help the company to identify areas for improvement and to develop strategies for gaining a competitive advantage. For instance, if a company's stock turnover ratio is lower than that of its competitors, it may indicate that the company needs to improve its inventory management practices in order to remain competitive.

The stock turnover ratio can also be used to evaluate the liquidity of a company's inventory. Liquidity refers to the ability of a company to convert its assets into cash quickly. A high stock turnover ratio indicates that a company's inventory is highly liquid, meaning that it can be converted into cash quickly. On the other hand, a low stock turnover ratio may indicate that a company's inventory is not very liquid, which can make it difficult for the company to meet its financial obligations. By analyzing the stock turnover ratio, businesses can determine whether they have sufficient liquidity to meet their financial obligations and to take advantage of new business opportunities.

Understanding the Importance of Stock Turnover Ratio

The stock turnover ratio is a critical metric for businesses because it helps them to evaluate the efficiency of their inventory management practices. By analyzing the stock turnover ratio, businesses can determine whether they are holding too much inventory, which can lead to waste and unnecessary costs. They can also identify slow-moving items that are not selling quickly enough and take steps to clear them out. Furthermore, the stock turnover ratio can help businesses to evaluate the effectiveness of their pricing strategies and marketing campaigns. If a company's stock turnover ratio is low, it may indicate that its prices are too high or that its marketing efforts are not effective in driving sales.

Calculating the Stock Turnover Ratio

The stock turnover ratio is calculated by dividing the cost of goods sold by the average inventory. The cost of goods sold is the total cost of producing or purchasing the goods sold by a company during a given period, while the average inventory is the average value of the inventory held by a company during the same period. For example, if a company's cost of goods sold is $100,000 and its average inventory is $20,000, its stock turnover ratio would be 5. This means that the company sells and replaces its inventory five times within a year.

Interpreting the Stock Turnover Ratio

The stock turnover ratio can be interpreted in different ways, depending on the industry and the company's goals. A high stock turnover ratio indicates that a company is selling its inventory quickly, which can lead to higher profits and lower storage costs. On the other hand, a low stock turnover ratio may indicate that a company is holding onto its inventory for too long, which can result in increased storage costs and lower profits. By analyzing the stock turnover ratio, businesses can determine whether they are holding too much inventory, which can lead to waste and unnecessary costs.

Using the Stock Turnover Ratio to Improve Inventory Management

The stock turnover ratio can be used to improve inventory management in several ways. By analyzing the stock turnover ratio, businesses can determine whether they are holding too much inventory, which can lead to waste and unnecessary costs. They can also identify slow-moving items that are not selling quickly enough and take steps to clear them out. Furthermore, the stock turnover ratio can help businesses to evaluate the effectiveness of their pricing strategies and marketing campaigns. If a company's stock turnover ratio is low, it may indicate that its prices are too high or that its marketing efforts are not effective in driving sales.

Common Mistakes to Avoid When Calculating the Stock Turnover Ratio

There are several common mistakes that businesses can avoid when calculating the stock turnover ratio. One of the most common mistakes is failing to accurately calculate the cost of goods sold. The cost of goods sold should include all the direct costs associated with producing or purchasing the goods sold, such as labor, materials, and overhead. Another common mistake is failing to accurately calculate the average inventory. The average inventory should be calculated based on the inventory levels at the beginning and end of the period, as well as any changes in inventory levels during the period.

Gallery of Stock Turnover Ratio

Stock Turnover Ratio Image Gallery

What is the stock turnover ratio?

+The stock turnover ratio is a metric that measures the number of times a company sells and replaces its stock of goods within a given period.

How is the stock turnover ratio calculated?

+The stock turnover ratio is calculated by dividing the cost of goods sold by the average inventory.

What does a high stock turnover ratio indicate?

+A high stock turnover ratio indicates that a company is selling its inventory quickly, which can lead to higher profits and lower storage costs.

What does a low stock turnover ratio indicate?

+A low stock turnover ratio may indicate that a company is holding onto its inventory for too long, which can result in increased storage costs and lower profits.

Why is the stock turnover ratio important for businesses?

+The stock turnover ratio is important for businesses because it helps them to evaluate the efficiency of their inventory management practices and to identify areas for improvement.

In conclusion, the stock turnover ratio is a crucial metric for businesses, particularly those in the retail and manufacturing sectors. By analyzing the stock turnover ratio, businesses can determine whether they are holding too much inventory, which can lead to waste and unnecessary costs. They can also identify slow-moving items that are not selling quickly enough and take steps to clear them out. Furthermore, the stock turnover ratio can help businesses to evaluate the effectiveness of their pricing strategies and marketing campaigns. If a company's stock turnover ratio is low, it may indicate that its prices are too high or that its marketing efforts are not effective in driving sales. We encourage readers to share their thoughts and experiences with the stock turnover ratio in the comments section below. Additionally, we invite readers to share this article with others who may benefit from learning about the importance of the stock turnover ratio in inventory management.